Arizona Sworn Statement of Identity Theft

Description

1. Obtains, records, or accesses identifying information that would assist in accessing financial resources, obtaining identification documents, or obtaining benefits of the victim.

2. Obtains goods or services through the use of identifying information of the victim.

3. Obtains identification documents in the victim's name.

Identity theft statutes vary by state and usually do not include use of false identification by a minor to obtain liquor, tobacco, or entrance to adult business establishments. The types of information protected from misuse by identity theft statutes includes, among others:

-Name

-Date of birth

-Social Security number

-Driver's license number

-Financial services account numbers, including checking and savings accounts

-Credit or debit card numbers

-Personal identification numbers (PIN)

-Electronic identification codes

-Automated or electronic signatures

-Biometric data

-Fingerprints

-Passwords

-Parent's legal surname prior to marriage

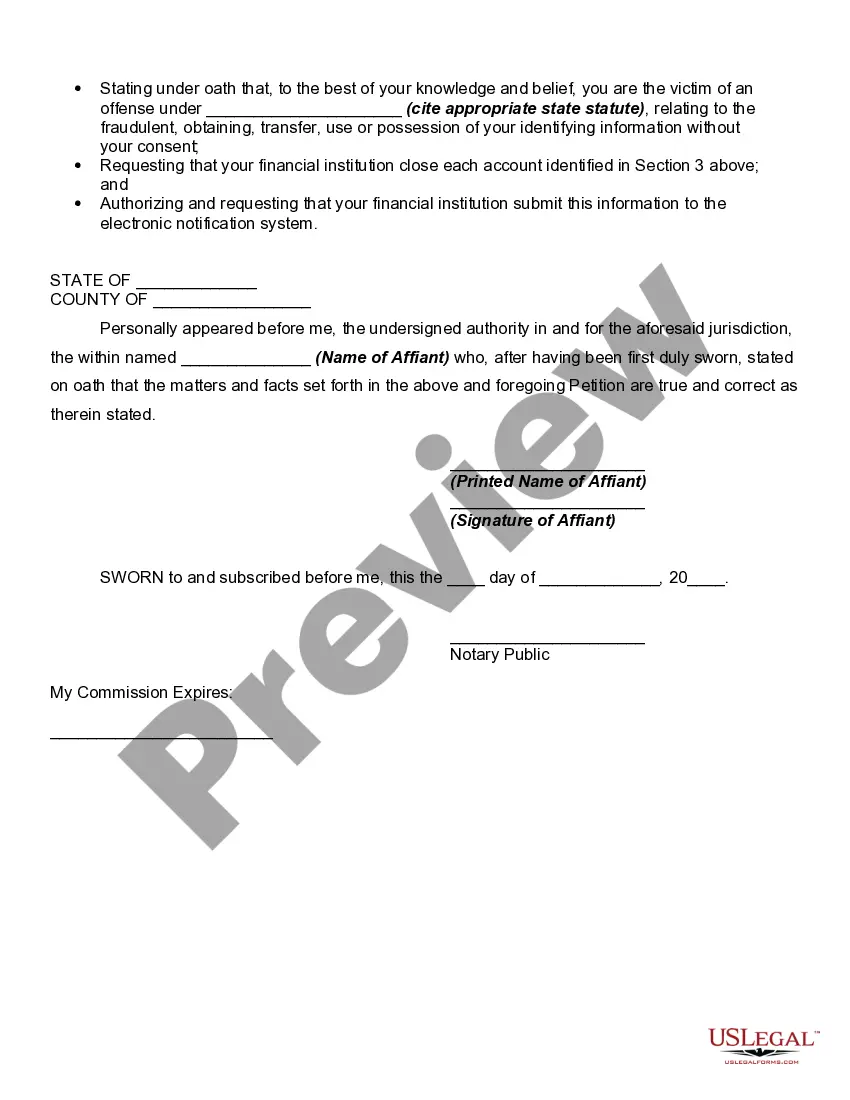

How to fill out Sworn Statement Of Identity Theft?

If you want to comprehensive, obtain, or produce legitimate record themes, use US Legal Forms, the biggest collection of legitimate forms, which can be found online. Make use of the site`s simple and easy hassle-free research to obtain the files you will need. A variety of themes for organization and individual purposes are categorized by types and says, or keywords. Use US Legal Forms to obtain the Arizona Sworn Statement of Identity Theft within a few mouse clicks.

When you are already a US Legal Forms consumer, log in in your account and click on the Acquire switch to obtain the Arizona Sworn Statement of Identity Theft. You can also accessibility forms you previously downloaded inside the My Forms tab of your account.

If you work with US Legal Forms the first time, follow the instructions listed below:

- Step 1. Make sure you have selected the form for the proper city/region.

- Step 2. Use the Review option to look over the form`s articles. Do not forget to read the information.

- Step 3. When you are not happy with all the form, make use of the Look for field at the top of the monitor to find other types of the legitimate form design.

- Step 4. After you have identified the form you will need, go through the Acquire now switch. Select the rates plan you choose and include your credentials to register for the account.

- Step 5. Approach the purchase. You can use your charge card or PayPal account to perform the purchase.

- Step 6. Choose the structure of the legitimate form and obtain it in your gadget.

- Step 7. Complete, modify and produce or signal the Arizona Sworn Statement of Identity Theft.

Every single legitimate record design you buy is yours forever. You have acces to each form you downloaded with your acccount. Go through the My Forms area and decide on a form to produce or obtain yet again.

Compete and obtain, and produce the Arizona Sworn Statement of Identity Theft with US Legal Forms. There are thousands of professional and condition-particular forms you can use for your organization or individual requirements.

Form popularity

FAQ

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

FTC ID Theft Affidavit The FTC provides an ID Theft Affidavit to help victims of identity theft quickly and accurately dispute new unauthorized accounts. It is especially helpful in cases where consumers are unable to file or obtain a police report.

What do I do? After you report the charges to your bank, it is not necessary, but it is a good idea to report the crime to the police. It may take time for the police to investigate. If there are higher priority crimes they may need additional time to investigate your case.

Identity Theft ? A charge of identity theft is a class 4 felony and comes with a minimum jail time of 1.5 years and a maximum jail time of 3 years. If convicted, you could also face a fine of up to $150,000.

In most cases, taxpayers do not need to complete this form. Only victims of tax-related identity theft should submit the Form 14039, and only if they haven't received certain letters from the IRS.

I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.