Arizona General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

How to fill out General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

Selecting the most suitable legitimate document template can be a challenge.

Of course, a multitude of templates can be found online, but how do you find the exact document you need.

Utilize the US Legal Forms website.

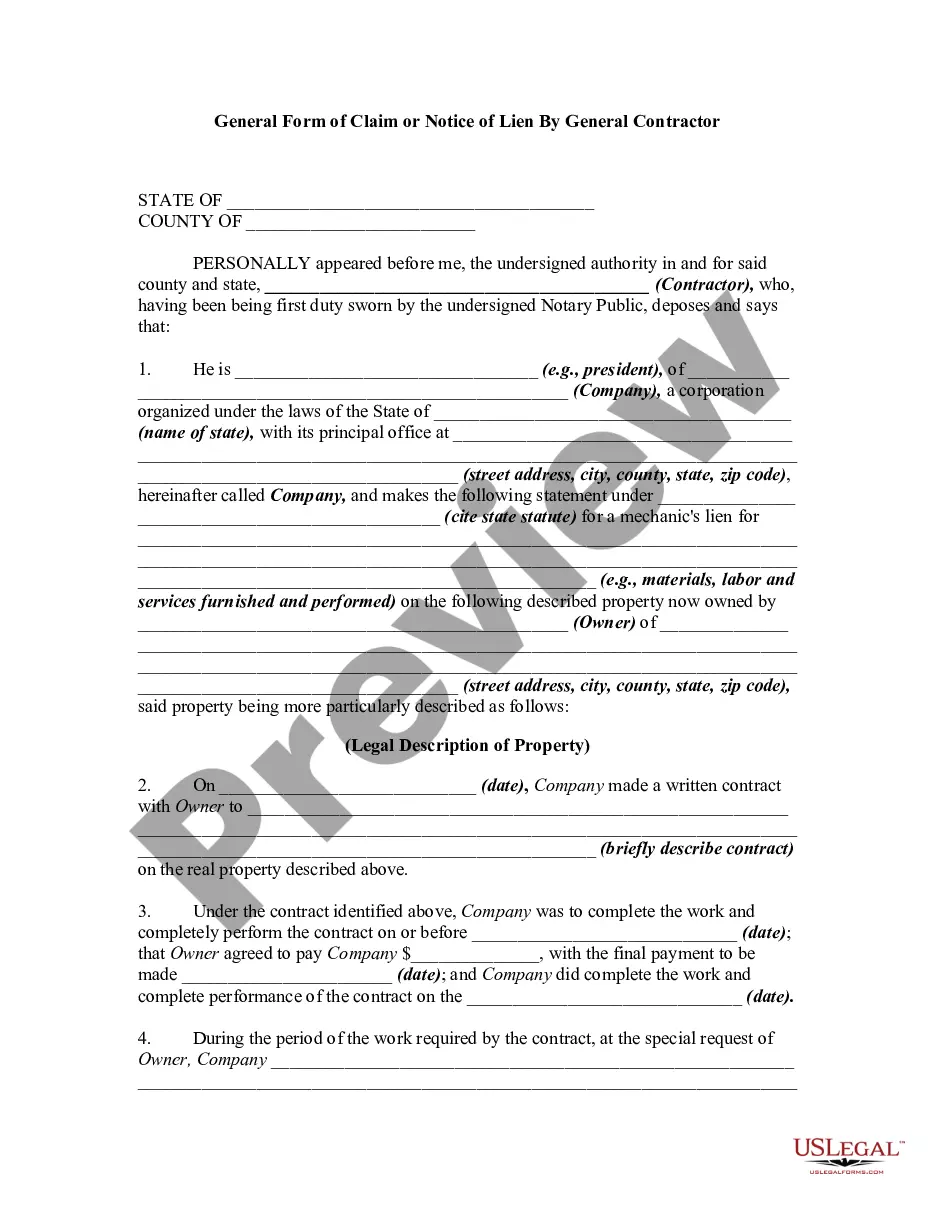

If you are a new user of US Legal Forms, here are simple steps you can follow: First, ensure you have selected the correct document for your specific city/county. You can preview the form using the Preview button and read its description to confirm it meets your needs.

- This service offers thousands of templates, including the Arizona General Form of Factoring Agreement - Assignment of Accounts Receivable.

- These can be utilized for both business and personal purposes.

- All documents are vetted by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Acquire button to download the Arizona General Form of Factoring Agreement - Assignment of Accounts Receivable.

- Use your account to browse through the legal documents you have previously purchased.

- Navigate to the My documents tab in your account to obtain an additional copy of the document you desire.

Form popularity

FAQ

A Noa in factoring is a formal notice issued to notify stakeholders that an account receivable has been transferred to a factoring company. This is aligned with the Arizona General Form of Factoring Agreement - Assignment of Accounts Receivable, ensuring all parties are aware of the new arrangements. This helps prevent confusion regarding payments and secures funding for businesses.

A notice of assignment can typically be obtained directly from your factoring company once you enter into an agreement with them. If you’re utilizing the Arizona General Form of Factoring Agreement - Assignment of Accounts Receivable from US Legal Forms, you can easily generate this document within the platform. This ensures you have all necessary paperwork to maintain clarity and legality in your financial transactions.

A Noa, or Notice of Assignment, is a document that informs all relevant parties that an account receivable has been assigned to a third party. In the context of the Arizona General Form of Factoring Agreement - Assignment of Accounts Receivable, the Noa ensures proper notification and helps secure the rights of the assignee. Thus, it plays a crucial role in making financing processes smooth and transparent.

The notice of assignment (NOA) informs your customer that a third party (bank, financing company, or factoring company) will manage and collect your accounts receivable (AR) going forward.

The NOA is a simple letter that the factoring company sends to the debtors. It is used to inform them that the financial rights to invoices issued by the original lender (the factoring client) are sold to and adapted by the factoring company.

How to Factor InvoicesYour business invoices a customer and sends a copy to the factoring company.The factor then funds your business with an advance typically between 70% to 90% of the invoice amount.Your business gets the remaining invoice amount, minus a small fee, once the customer pays the invoice.

(3) Any assignment of receivables which constitute security for repayment of any loan advanced by any Bank or other creditor and if the assignor has given notice of such encumbrance to the assignee, then on accepting assignment of such receivable, the assignee shall pay the consideration for such assignment to the Bank

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

A Notice of Assignment is used to inform debtors that a third party has 'purchased' their debt. The new company (assignee) takes over collection procedures, but can sometimes hire a debt collection agency to recover the money on their behalf. There are two types of debt assignment: Legal Assignment. Equitable

Factoring can be done either on a notification basis, where the seller's customers remit directly to the factor, or on a non-notification basis, where the seller handles the collections and remits to the factor.