Arizona Revocable Trust for Asset Protection

Description

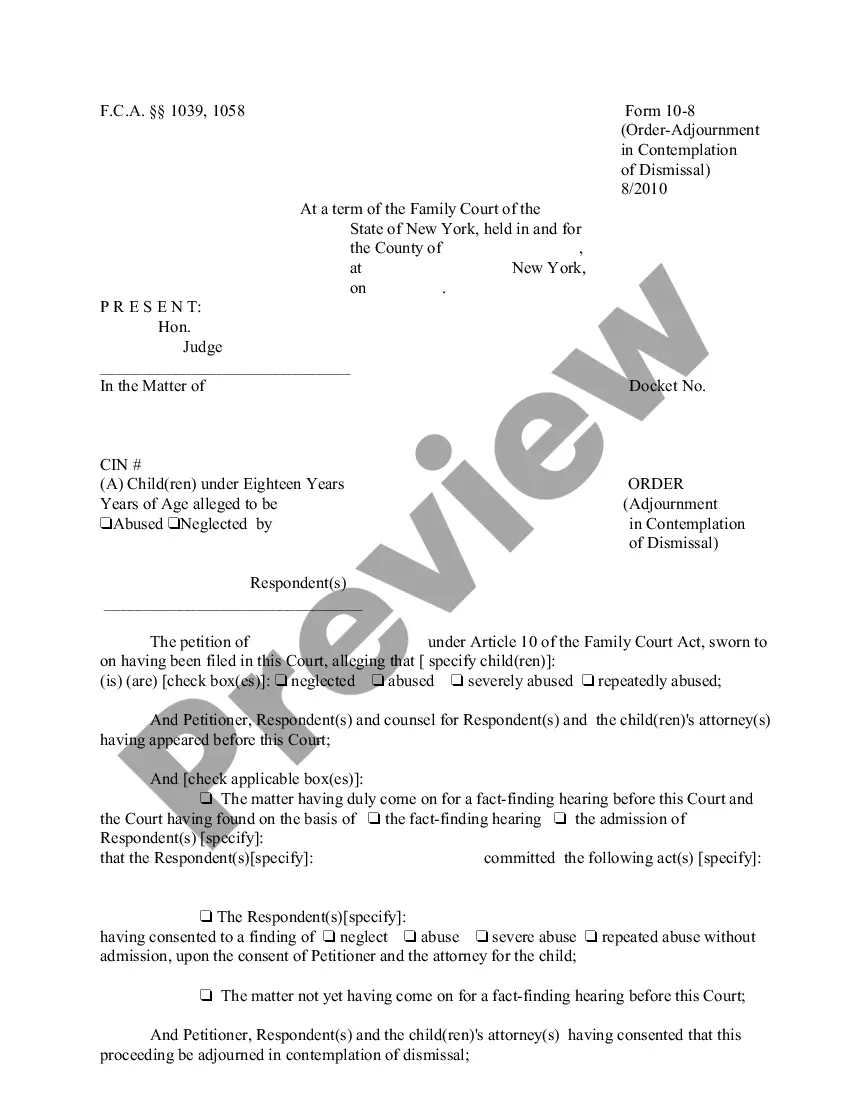

How to fill out Revocable Trust For Asset Protection?

Should you want to finalize, obtain, or print licensed document templates, utilize US Legal Forms, the prime assortment of legal documents available online.

Take advantage of the site’s convenient and efficient search to find the documents you need.

Numerous templates for business and personal applications are categorized by types and jurisdictions, or keywords.

Each legal document template you purchase is yours indefinitely. You have access to every form you saved in your account. Navigate to the My documents section and select a form to print or download again.

Be proactive and download, and print the Arizona Revocable Trust for Asset Protection with US Legal Forms. You will find numerous professional and state-specific forms available for your business or personal requirements.

- Employ US Legal Forms to locate the Arizona Revocable Trust for Asset Protection in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and then click the Download button to acquire the Arizona Revocable Trust for Asset Protection.

- You can also find forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the instructions below.

- Step 1. Ensure you have selected the form for your specific region/territory.

- Step 2. Use the Preview option to review the form’s content. Be sure to read the summary.

- Step 3. If you are unsatisfied with the form, utilize the Search box at the top of the page to find alternative versions of the legal form template.

- Step 4. After locating the form you need, click the Purchase now button. Choose the pricing plan you prefer and input your information to register for an account.

- Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Arizona Revocable Trust for Asset Protection.

Form popularity

FAQ

A primary disadvantage of a family trust, such as an Arizona Revocable Trust for Asset Protection, is the complexity involved in its setup and maintenance. While it can help streamline asset distribution, it may require regular administration and legal oversight. This can be burdensome for some families looking for simple solutions.

Deciding if your parents should establish an Arizona Revocable Trust for Asset Protection depends on their financial situation and long-term goals. A trust can help manage their assets and provide clarity for heirs. However, it's vital to assess their needs and seek legal guidance to make the best choice.

The main downfall of having an Arizona Revocable Trust for Asset Protection is that it does not protect assets from creditors. While it offers flexibility and control for you, it may not safeguard your wealth to the extent you desire. It's crucial to understand these limits when considering asset protection strategies.

One significant drawback of a trust, including an Arizona Revocable Trust for Asset Protection, is the potential for ongoing management fees. This might deter some individuals from establishing a trust. Additionally, if the trust is revocable, you maintain control, which means creditors can still access your assets.

Creating an Arizona Revocable Trust for Asset Protection begins with drafting a trust document that outlines the terms and conditions. It's essential to specify the assets included and appoint a trustee. You may want to consult a legal professional or use a service like USLegalForms to ensure all requirements are met.

You do not necessarily need an attorney to establish an Arizona Revocable Trust for Asset Protection, but having professional guidance can be beneficial. An attorney can help navigate the complexities of trust law and ensure your documents meet state requirements. Additionally, they can provide insights tailored to your specific situation and goals, helping you create a trust that truly protects your assets. US Legal Forms offers resources that can help simplify the process if you choose to go it alone.

While an Arizona Revocable Trust for Asset Protection offers many benefits, there are some downsides to consider. One significant downside is that assets held in a revocable trust are not protected from creditors during your lifetime. Additionally, setting up and maintaining a revocable trust can be more complex compared to a simple will. Therefore, it is crucial to evaluate your financial situation and needs before making a decision.

While revocable trusts offer certain advantages, such as avoiding probate, they do not provide strong asset protection from creditors due to your retained control. The assets within a revocable trust remain part of your taxable estate, making them vulnerable in certain legal situations. However, they can still be an effective tool for managing assets during your lifetime and ensuring your wishes are respected after death. For a higher level of asset protection, consider integrating an Arizona Revocable Trust for Asset Protection as part of a broader estate plan.

The greatest advantage of a revocable trust lies in its flexibility, allowing you to change its terms as your situation evolves. This adaptability is crucial for addressing family dynamics and financial changes over time. Additionally, a revocable trust can streamline the probate process after your passing, providing a smoother transition for your loved ones. An Arizona Revocable Trust for Asset Protection stands out in estate planning, offering peace of mind and control.

Yes, a revocable trust typically becomes irrevocable upon the death of the grantor. This transition solidifies the trust's terms, making it unchangeable and ensuring that assets transfer according to your wishes. It is vital to consider how this transition aligns with your estate planning goals. Creating an Arizona Revocable Trust for Asset Protection can effectively address your long-term planning needs.