Arizona General and Continuing Guaranty and Indemnification Agreement

Description

How to fill out General And Continuing Guaranty And Indemnification Agreement?

Have you ever found yourself in a circumstance where you require files for either organizational or personal purposes almost daily.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of template documents, including the Arizona General and Continuing Guaranty and Indemnification Agreement, designed to comply with both federal and state regulations.

You can find all the document templates you have purchased in the My documents section. You may download an additional copy of the Arizona General and Continuing Guaranty and Indemnification Agreement at any time, if needed. Just click the desired form to obtain or print the document template.

Make use of US Legal Forms, the largest collection of legal documents, to save time and avoid errors. This service offers professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Arizona General and Continuing Guaranty and Indemnification Agreement template.

- If you do not have an account and wish to use US Legal Forms, follow these instructions.

- Find the document you need and confirm it is for your specific region/area.

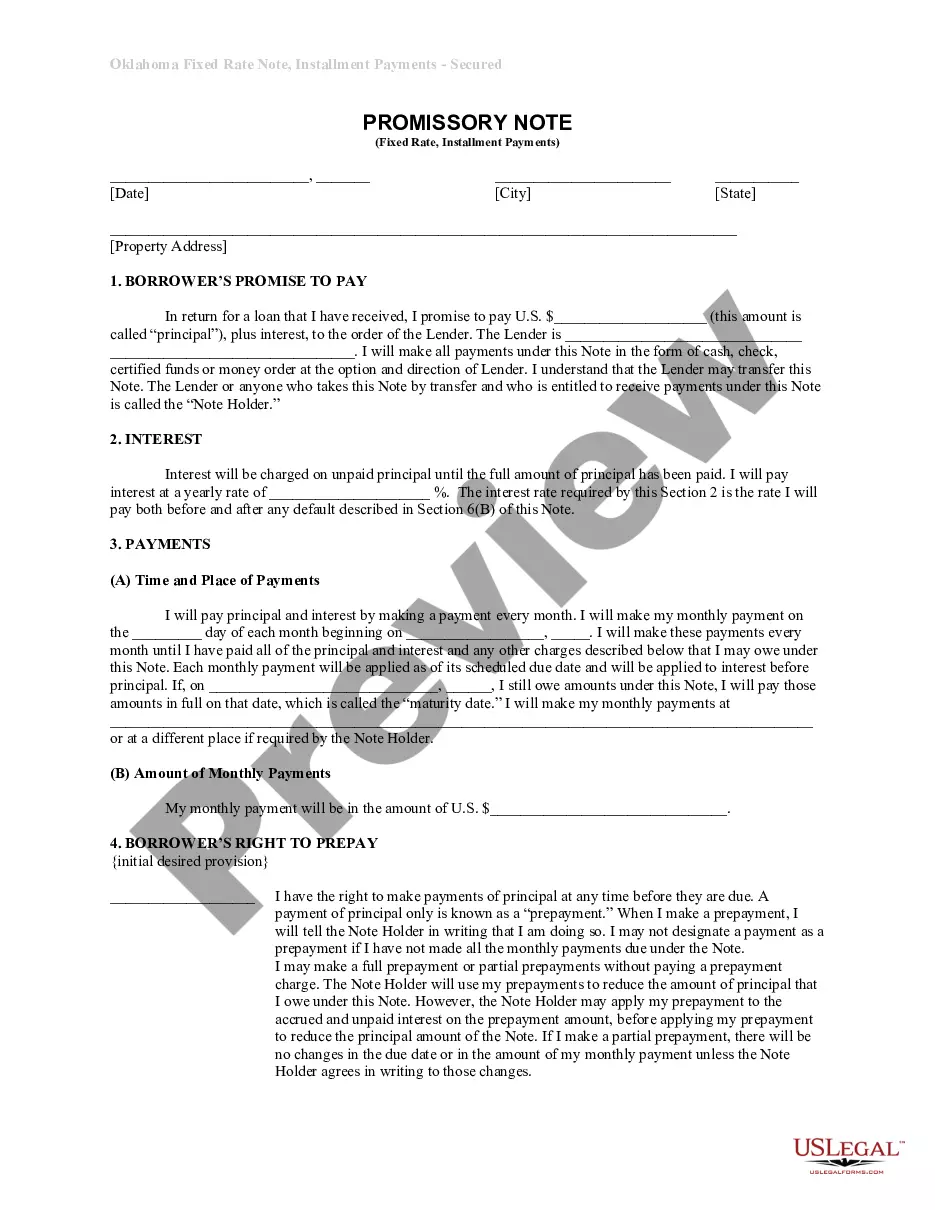

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the right document.

- If the document is not what you are looking for, use the Search field to find a template that suits your needs.

- Once you find the appropriate document, simply click Acquire now.

- Select the pricing plan you want, fill in the required information for account creation, and pay for your order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

A contract of indemnity focuses solely on compensating one party for losses incurred, while a continuing guarantee extends beyond a single transaction to cover ongoing obligations over time. The Arizona General and Continuing Guaranty and Indemnification Agreement combines elements of both, providing comprehensive protection for lenders and ensuring that all parties understand their long-term commitments and liabilities.

An indemnification agreement between guarantors specifies how multiple guarantors may share liabilities in cases of default or unexpected losses. This agreement helps clarify each party's responsibilities and protects individual guarantors from bearing disproportionate financial burdens. In the Arizona General and Continuing Guaranty and Indemnification Agreement, such provisions ensure efficient management of risk among multiple parties.

The indemnity clause in a guarantee lays out the terms under which one party agrees to indemnify another if certain losses occur. This clause provides assurance that the guarantor will cover costs resulting from the primary party’s default or negligence. In the context of the Arizona General and Continuing Guaranty and Indemnification Agreement, this clause is vital for minimizing risk and ensuring financial security between parties.

An agreement of indemnification is a contract where one party agrees to compensate another for specific losses or damages. This type of agreement protects parties from financial liability arising from the actions of others or certain unforeseen events. Features of the Arizona General and Continuing Guaranty and Indemnification Agreement often include such indemnification provisions, ensuring comprehensive protection for all stakeholders.

The guarantor clause in an agreement outlines the responsibilities of the guarantor regarding the obligations of the primary party. This clause specifies the conditions under which the guarantor will fulfill those obligations if the primary party defaults. Understanding this clause is crucial when reviewing the Arizona General and Continuing Guaranty and Indemnification Agreement, as it clearly sets expectations for all involved parties.

A guarantor is a person or entity that agrees to take responsibility for another's debt or obligation if they fail to fulfill it. In contrast, indemnity refers to a broader legal concept where one party agrees to compensate another for any loss or damage. In the context of an Arizona General and Continuing Guaranty and Indemnification Agreement, these roles define who bears the financial responsibility in various situations.

A continuing guarantee is a type of guarantee that remains in effect over multiple transactions or obligations. It provides ongoing security for the creditor, facilitating smoother business interactions. When you understand the implications of a continuing guarantee within the context of the Arizona General and Continuing Guaranty and Indemnification Agreement, you gain valuable leverage in managing financial risks.

To fill out an indemnity agreement, start by identifying the parties involved and their roles. Clearly specify the obligations and the potential risks covered by the agreement. Review the terms to ensure they align with the Arizona General and Continuing Guaranty and Indemnification Agreement principles, as this agreement can offer added protection.

A contract of indemnity is a mutual agreement where one party agrees to compensate another for losses or damages incurred. This type of contract is essential in risk management, providing assurance that the indemnified party will be made whole after a loss. It is particularly relevant in creating robust frameworks like the Arizona General and Continuing Guaranty and Indemnification Agreement.

Filling out an indemnity form requires you to provide accurate personal and business information of all parties involved. Clearly outline the obligations and the circumstances for which indemnity is being granted. Carefully review the form against established guidelines, especially those relevant to the Arizona General and Continuing Guaranty and Indemnification Agreement, to ensure compliance with legal expectations.