Arizona Bill of Transfer to a Trust

Description

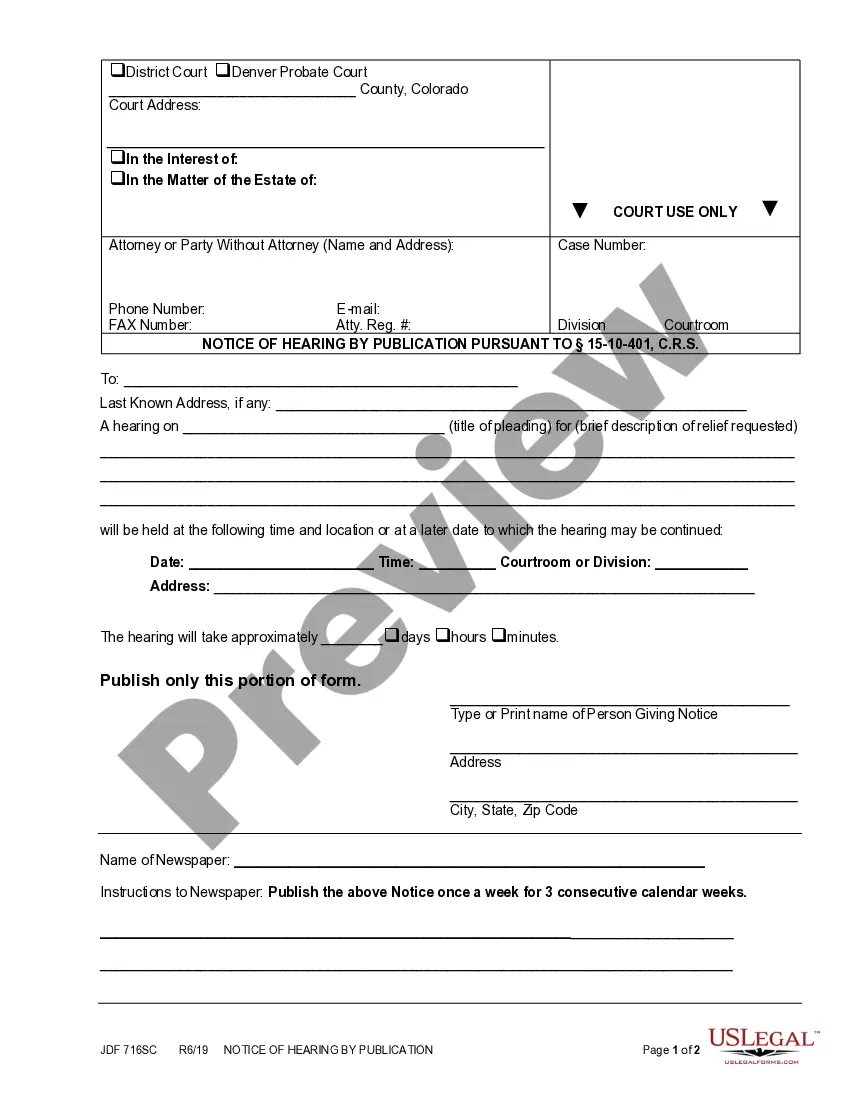

How to fill out Bill Of Transfer To A Trust?

It is feasible to allocate time online looking for the approved documents template that meets the state and federal requirements you need.

US Legal Forms provides a vast array of legal forms that can be reviewed by experts.

You can download or print the Arizona Bill of Transfer to a Trust from this service.

In order to get another version of the form, use the Research field to find the template that meets your needs and requirements.

- If you already have a US Legal Forms account, you may Log In and click on the Obtain button.

- Afterward, you can complete, edit, print, or sign the Arizona Bill of Transfer to a Trust.

- Every legal documents template you acquire is yours permanently.

- To obtain an additional copy of the purchased form, go to the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the appropriate document template for the region/city of your choice.

- Review the form description to confirm you have chosen the correct form.

Form popularity

FAQ

Generally, transfers from a trust are not subject to tax, especially if the assets remain within the trust structure. However, specific tax implications can arise depending on the type of trust and the asset involved. It's crucial to review the details with a tax professional or legal advisor. Understanding these details can help you make informed decisions while utilizing the Arizona Bill of Transfer to a Trust.

Transferring property into a trust in Arizona requires executing an Arizona Bill of Transfer to a Trust. Start by collecting necessary documents and identifying the property. Then, update the title of the property to reflect the trust's name legally. This process is vital to ensure that your property aligns with your estate planning objectives.

Choosing between a transfer on death (TOD) and a trust often depends on your circumstances. An Arizona Bill of Transfer to a Trust offers comprehensive control over assets, allowing you to dictate terms and conditions for beneficiaries. In contrast, a TOD is simpler but grants less flexibility. Evaluating your needs can help you make the right decision for efficient estate planning.

One significant mistake is failing to fund the trust properly. Parents often believe that simply creating a trust is enough, but overlooking the Arizona Bill of Transfer to a Trust can leave the trust empty and ineffective. Regularly reviewing and updating the trust, along with ensuring all intended assets are included, is crucial. By understanding these common pitfalls, you can better secure your children’s financial future.

To transfer assets from one trust to another, you typically need to execute a new Arizona Bill of Transfer to a Trust. This process involves identifying the assets you wish to transfer and ensuring they are correctly retitled in the new trust's name. It helps to consult with a legal expert to comply with state regulations. This approach ensures that your assets remain protected and aligned with your estate planning goals.

The Arizona Bill of Transfer to a Trust is a legal document that allows individuals to move assets into a trust. This bill streamlines the process, ensuring that property is properly titled to avoid probate. By using this bill, you can provide clear instructions and safeguard your estate, making future management easier. It acts as a vital component in preserving your wealth and fulfilling your wishes.

In Arizona, transferring property into a trust requires a few vital steps. First, you must create the trust and draft a Bill of Transfer to a Trust specific to the asset. Next, you should retitle the property in the name of the trust by submitting the appropriate documents to the county recorder’s office. By leveraging uslegalforms, you can obtain the necessary templates and step-by-step assistance, making the process straightforward and efficient.

Transferring assets to a trust after death typically involves a probate process. The executor of the estate must collect and identify all assets, which may include transferring property to the trust as outlined in the deceased's will. The Arizona Bill of Transfer to a Trust can guide executors in this process by providing a formal method to transfer ownership. Utilizing uslegalforms can streamline these requirements and ensure adherence to estate laws.

Certain assets are generally not suitable for a trust, including retirement accounts like IRAs and 401(k)s, as they have specific beneficiary designations. Additionally, personal property that requires keeping title in your name, such as vehicles or savings bonds, may be better left outside the trust. Understanding these distinctions is crucial for effective estate planning, and using the Arizona Bill of Transfer to a Trust can help clarify asset management strategies. Our platform can assist with identifying assets and making informed decisions.

To transfer assets into a trust, you must first create the trust document and identify the assets you wish to include. This process often involves drafting a Bill of Transfer to a Trust, which formalizes the transfer of ownership. You will need to retitle assets such as real estate, bank accounts, and investments in the name of the trust. Using our platform at uslegalforms can simplify this procedure by providing you with the necessary forms and guidance.