Arizona Letter Requesting Transfer of Property to Trust

Description

How to fill out Letter Requesting Transfer Of Property To Trust?

US Legal Forms - one of the most important collections of legal documents in the USA - offers a range of legal form templates that you can download or print.

By using the website, you can find thousands of forms for business and personal needs, organized by categories, states, or keywords. You can access the latest forms like the Arizona Letter Requesting Transfer of Property to Trust within moments.

If you already have a monthly subscription, Log In and download the Arizona Letter Requesting Transfer of Property to Trust from the US Legal Forms library. The Download button will appear on every form you view. You can review all previously saved forms in the My documents section of your account.

Complete the transaction using your credit card or PayPal account.

Select the format and download the form to your device. Edit. Fill, modify, print, and sign the saved Arizona Letter Requesting Transfer of Property to Trust. Each template you add to your account does not have an expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Arizona Letter Requesting Transfer of Property to Trust with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal needs and requirements.

- Make sure you've selected the correct form for your city/county.

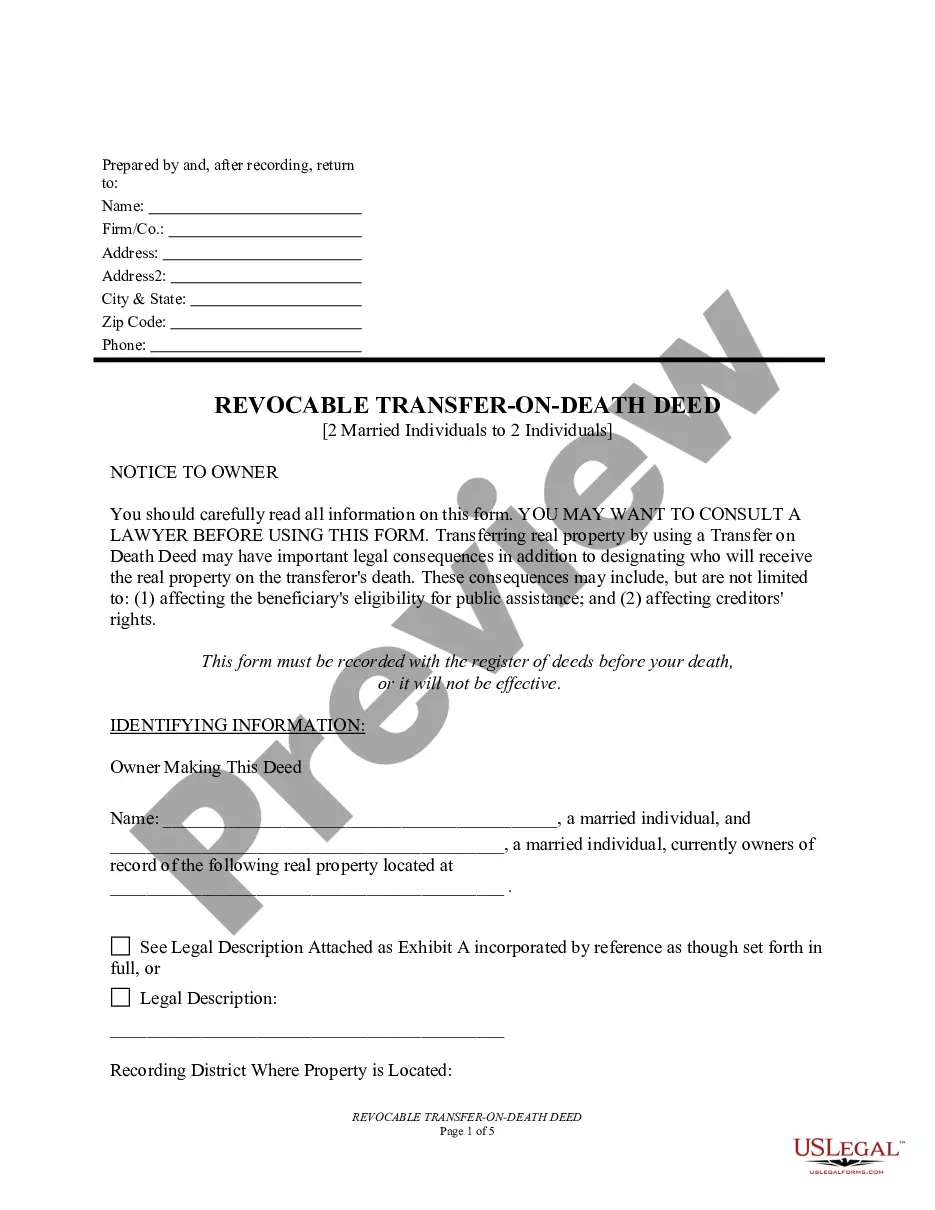

- Click the Preview button to review the form's details.

- Check the form description to confirm you have the right one.

- If the form does not fulfill your requirements, use the Search area at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

To transfer property title to a family member in Arizona, you typically draft a deed that details the transfer. You'll need to sign, notarize, and record this deed in the county where the property is located. For simplicity and clarity in documentation, consider using the Arizona Letter Requesting Transfer of Property to Trust.

Potential DisadvantagesEven modest bank or investment accounts named in a valid trust must go through the probate process. Also, after you die, your estate may face more expense, as the trust must file tax returns and value assets, potentially negating the cost savings of avoiding probate.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

How to Transfer Assets Into an Irrevocable TrustIdentify Your Assets. Review your assets and determine which ones you would like to place in your trust.Obtain a Trust Tax Identification Number.Transfer Ownership of Your Assets.Purchase a Life Insurance Policy.

Property is often transferred into a trust as part of inheritance tax planning however the trust needs to meet certain conditions and to be set up correctly by a solicitor. By putting a property into trust rather than making an outright gift, you are able to control how the property is used after it is given away.

What Assets Should Go Into a Trust?Bank Accounts. You should always check with your bank before attempting to transfer an account or saving certificate.Corporate Stocks.Bonds.Tangible Investment Assets.Partnership Assets.Real Estate.Life Insurance.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

Gifting Property To Family Trust The first option you can choose when transferring the property title is to gift it to the trustee. The trustee and the trust will have to sign a gift deed, which establishes that the ownership of the property is being transferred without payment.

Moving your house or other assets into a trust (specifically an irrevocable trust) can decrease your taxable estate. For a wealthy estate that could otherwise be subject to a state or federal estate tax, putting assets into a trust can help avoid or minimize the estate taxes.