Arizona Instructions to Clients - Short

Description

How to fill out Instructions To Clients - Short?

If you wish to finalize, obtain, or print authentic document templates, utilize US Legal Forms, the largest collection of legitimate forms, available online.

Take advantage of the site's straightforward and convenient search to find the documents you require. Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Employ US Legal Forms to acquire the Arizona Instructions to Clients - Short in just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Choose the format of the legitimate form and download it to your device. Step 7. Complete, edit, and print or sign the Arizona Instructions to Clients - Short. Every legitimate document template you obtain is yours forever. You have access to every form you saved in your account. Visit the My documents section and select a form to print or download again. Finalize and obtain, and print the Arizona Instructions to Clients - Short with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to obtain the Arizona Instructions to Clients - Short.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

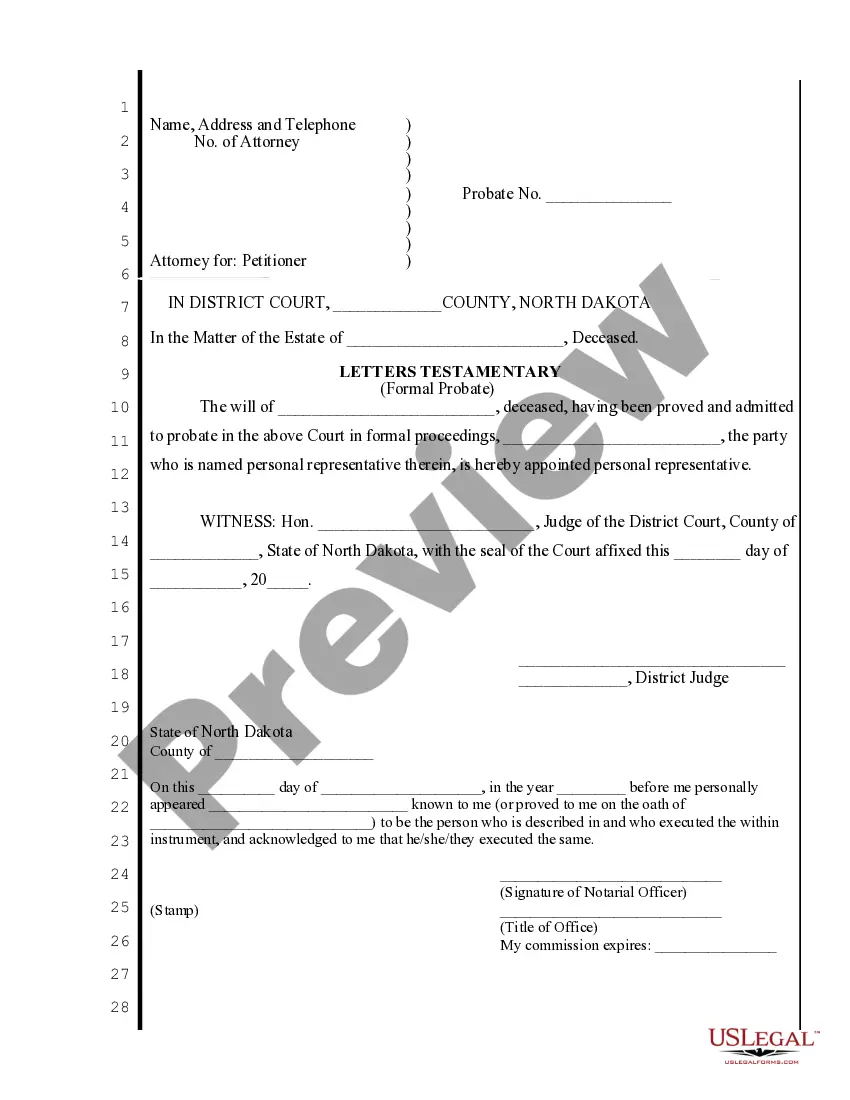

- Step 2. Use the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other versions of the legitimate form template.

- Step 4. Once you have located the form you need, select the Acquire now button. Choose the pricing plan you prefer and provide your details to register for the account.

Form popularity

FAQ

You may file Form 140 only if you (and your spouse, if married filing a joint return) are full year residents of Arizona. You must use Form 140 if any of the following apply: Your Arizona taxable income is $50,000 or more, regardless of filing status. You are making adjustments to income.

Determining Filing Status for Nonresidents and Part-Year Residents. Individuals who move to Arizona or live in the state temporarily also have tax filing requirements. Nonresident individuals must file income tax returns in both Arizona and their home state.

In the state of Arizona, full-year resident or part-year resident individuals must file a tax return if they are: Single or married filing separately and gross income (GI) is greater than $12,950; Head of household and GI is greater than $19,400; or. Married and filing jointly and GI is greater than $25,900.

Purpose of Form Use Arizona Form 140PTC to file an original claim for the property tax credit. If you are claiming the property tax credit, you may also use Form 140PTC to claim a credit for increased excise taxes.

Arizona originally adopted TPT in 1933 when the rate for selling tangible personal property at retail was 2 percent. That rate is currently 5.6 percent. On top of the state TPT, there may be one or more local TPTs, as well as one or more special district taxes, each of which can range between 0 percent and 5.6 percent.

Beginning with tax year 2021, a taxpayer may elect to file a separate small business income tax return (Form 140-SBI, 140NR-SBI or 140PY-SBI) to report the their share of Arizona small business gross income. The SBI tax return must be filed with the regular income tax return to be accepted.

ER 1.18. Rule ER 1.18 - Duties to Prospective Client (a) A person who consults with a lawyer about the possibility of forming a client-lawyer relationship with respect to a matter is a prospective client.

The Arizona Department of Revenue has announced that a revised Form A-4 applies effective January 31, 2023, to take into account the new flat tax of 2.5% effective January 1, 2023 under SB 1828. (See EY Tax Alert 2022-1645.)