The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

Arizona Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property Within One Year Preceding

Description

How to fill out Complaint Objecting To Discharge In Bankruptcy Proceeding For Transfer, Removal, Destruction, Or Concealment Of Property Within One Year Preceding?

US Legal Forms - one of many largest libraries of lawful forms in the States - offers a wide range of lawful file templates you are able to obtain or printing. While using web site, you may get a large number of forms for business and specific reasons, categorized by groups, says, or keywords.You will discover the most recent types of forms much like the Arizona Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property within minutes.

If you currently have a registration, log in and obtain Arizona Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property from the US Legal Forms catalogue. The Download key can look on each develop you see. You have access to all previously acquired forms from the My Forms tab of your respective bank account.

If you would like use US Legal Forms initially, allow me to share simple instructions to help you get began:

- Be sure you have picked out the best develop for your personal metropolis/area. Go through the Review key to review the form`s articles. Look at the develop outline to ensure that you have chosen the correct develop.

- When the develop doesn`t satisfy your demands, utilize the Lookup industry near the top of the display to get the the one that does.

- In case you are satisfied with the shape, verify your choice by simply clicking the Purchase now key. Then, select the prices prepare you like and give your references to register for the bank account.

- Process the transaction. Utilize your charge card or PayPal bank account to accomplish the transaction.

- Select the formatting and obtain the shape on your own product.

- Make adjustments. Fill up, modify and printing and indicator the acquired Arizona Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property.

Every single template you put into your bank account lacks an expiry day which is yours eternally. So, if you wish to obtain or printing another backup, just go to the My Forms area and then click on the develop you require.

Gain access to the Arizona Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property with US Legal Forms, one of the most comprehensive catalogue of lawful file templates. Use a large number of expert and state-distinct templates that meet up with your organization or specific requirements and demands.

Form popularity

FAQ

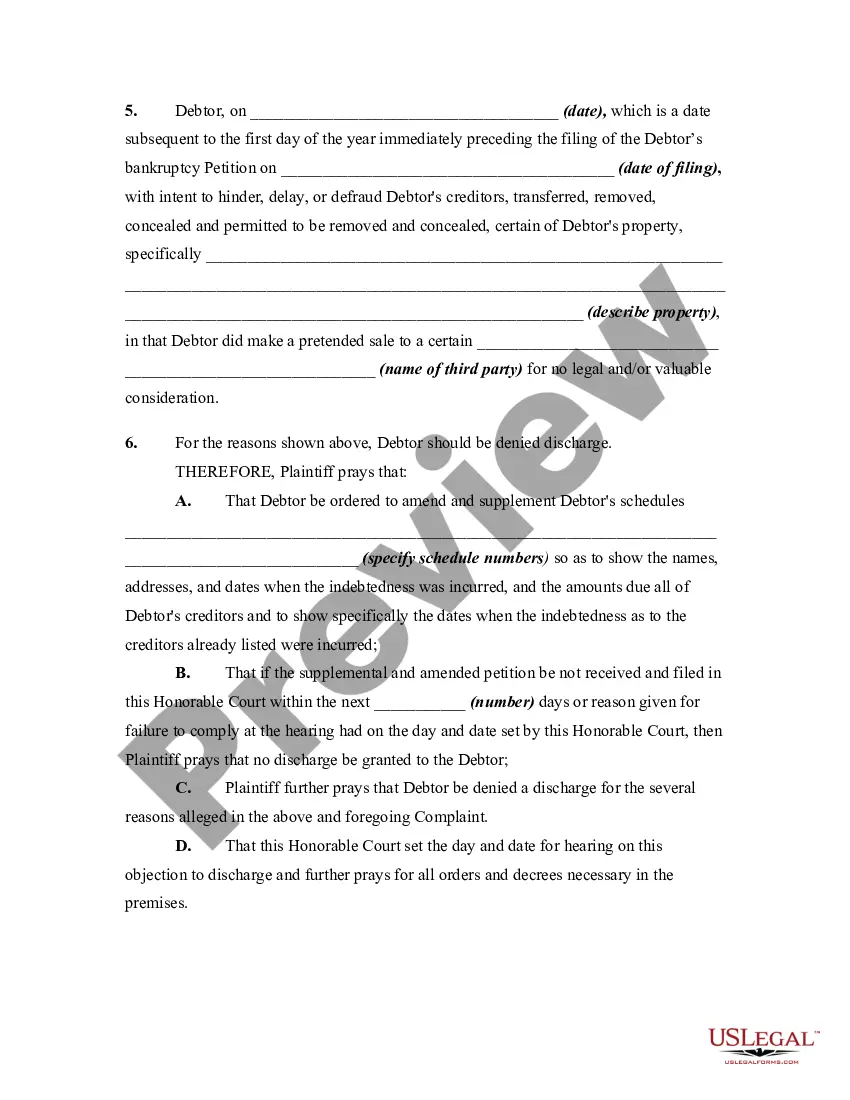

Objecting to a Discharge Generally This might be appropriate when the debtor lied to the bankruptcy judge or trustee, made false statements on the bankruptcy petition, fraudulently transferred title to property, destroyed property, or disregarded a court order.

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

An objection to claim may be filed to object to one claim or multiple claims subject to conditions in Federal Rule of Bankruptcy Procedure 3007(e). When an objection to claim objects to multiple claims, it is called an omnibus objection to claim. An omnibus objection to claim may cause the entry of multiple orders.

Under Federal Rules of Bankruptcy Procedure Rule 4004, a trustee or creditors have sixty (60) days after the first date set for the 341(a) Meeting of Creditors to file a complaint objecting to discharge.

An objection to discharge is a notice lodged with the Official Receiver by a trustee to induce a bankrupt to comply with their obligations. An objection will extend the period of bankruptcy so automatic discharge will not occur three years and one day after the bankrupt filed a statement of affairs.

Among the grounds for denying a discharge to a chapter 7 debtor are that the debtor failed to keep or produce adequate books or financial records; the debtor failed to explain satisfactorily any loss of assets; the debtor committed a bankruptcy crime such as perjury; the debtor failed to obey a lawful order of the ...