In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Arizona Security Agreement with Farm Products as Collateral

Description

How to fill out Security Agreement With Farm Products As Collateral?

Have you found yourself in a situation where you require documentation for either business or personal needs almost every day.

There are numerous official form templates available online, but locating ones you can trust isn't simple.

US Legal Forms offers a vast selection of document templates, including the Arizona Security Agreement with Farm Products as Collateral, which are designed to comply with federal and state regulations.

Once you find the right form, click Buy now.

Select the pricing plan you desire, fill out the necessary information to create your account, and pay for the transaction with your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Arizona Security Agreement with Farm Products as Collateral at any time, if needed. Simply click on the desired form to download or print the document template. Use US Legal Forms, one of the most extensive collections of official forms, to save time and avoid errors. The service provides expertly crafted legal document templates for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Arizona Security Agreement with Farm Products as Collateral template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the form you need and ensure it corresponds to the correct city/state.

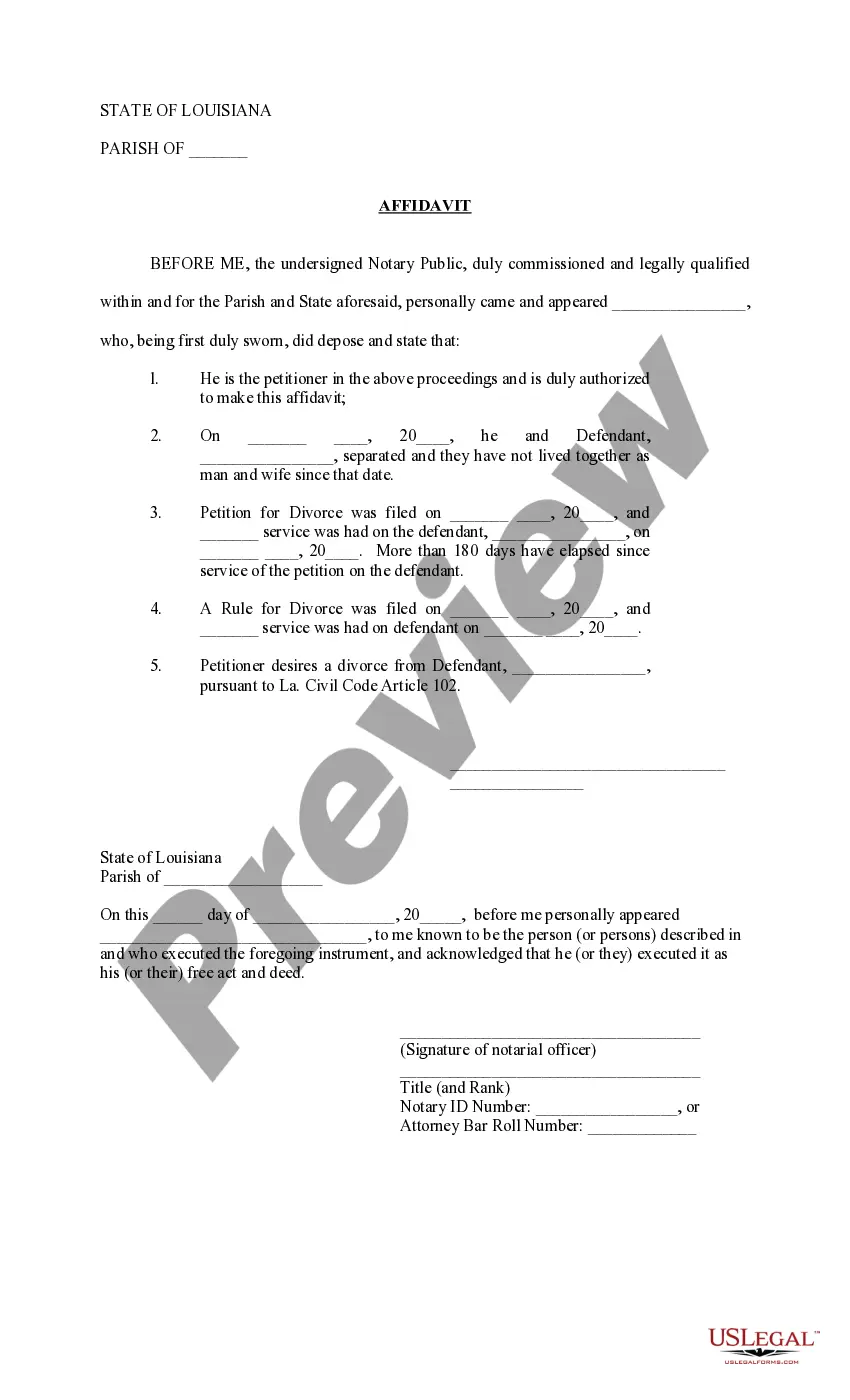

- Use the Review button to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form isn't what you are looking for, utilize the Search field to locate the form that fits your needs and requirements.

Form popularity

FAQ

In the context of the Arizona Security Agreement with Farm Products as Collateral, there are four key methods of perfection. These include filing a UCC financing statement, taking possession of the collateral, obtaining control over the collateral, and utilizing automatic perfection in certain cases. Each method provides a way to establish your rights to the collateral against other creditors, making it vital to choose the right one based on your situation.

To perfect a lien under the Arizona Security Agreement with Farm Products as Collateral, you need to take specific steps. First, file a UCC financing statement in the appropriate Arizona state office. This filing establishes your legal right to claim the farm products as collateral if the borrower defaults on their obligations. You should include essential details, such as the debtor's information and the collateral description, to ensure clarity.

In general, an Arizona Security Agreement with Farm Products as Collateral includes details such as the identification of the collateral, the rights of the lender, and the obligations of the borrower. It also typically outlines the procedures to follow in case of default, ensuring clarity on enforcement actions. Properly drafting these terms is essential for the protection of both parties involved in the transaction.

To write an Arizona Security Agreement with Farm Products as Collateral, start by identifying the parties and specifying the collateral being used. Next, outline the rights and responsibilities of each party, as well as the terms for repayment and what constitutes default. Utilize clear and concise language to ensure the agreement is easily understood and legally binding.

An Arizona Security Agreement with Farm Products as Collateral should clearly specify the parties involved, the collateral covered, and the obligations of each party. It is important to outline the terms for default and the remedies available to the lender. Additionally, including a detailed description of the farm products involved ensures clarity and legal enforceability.

Agricultural security refers to the legal protections and rights that farmers have regarding their crops and livestock as collateral. Within the scope of an Arizona Security Agreement with Farm Products as Collateral, it helps ensure that farmers can confidently access necessary financing while safeguarding their assets. This security is vital for sustaining agricultural operations and promoting growth in the farming industry.

An agricultural security agreement is a type of security agreement tailored for farmers, allowing them to use their agricultural products as collateral for financing. This agreement, particularly the Arizona Security Agreement with Farm Products as Collateral, provides financial institutions a way to secure loans against the value of seasonal crops or livestock. It supports farmers by enhancing their borrowing capabilities and protecting their financial interests.

A pledge agreement involves the transfer of possession of the asset to the lender until the borrower repays the debt. On the other hand, a security agreement, like an Arizona Security Agreement with Farm Products as Collateral, allows the borrower to retain possession of the asset while providing the lender a security interest. Understanding these differences is crucial for effective financial management in agriculture.

An example of security collateral includes farm products such as corn, wheat, or livestock. In the realm of an Arizona Security Agreement with Farm Products as Collateral, these items can be used to secure loans for agricultural purposes. This not only supports farmers financially but also ensures lenders have a reliable asset backing their loans.

A security agreement collateral refers to the tangible assets specified in a security agreement that are used to secure a debt. The Arizona Security Agreement with Farm Products as Collateral utilizes farm products as this collateral, ensuring that the lender has recourse in case of default. This provides assurance to lenders while giving farmers the necessary capital to operate.