Arizona Receipt for Payment of Rent

Description

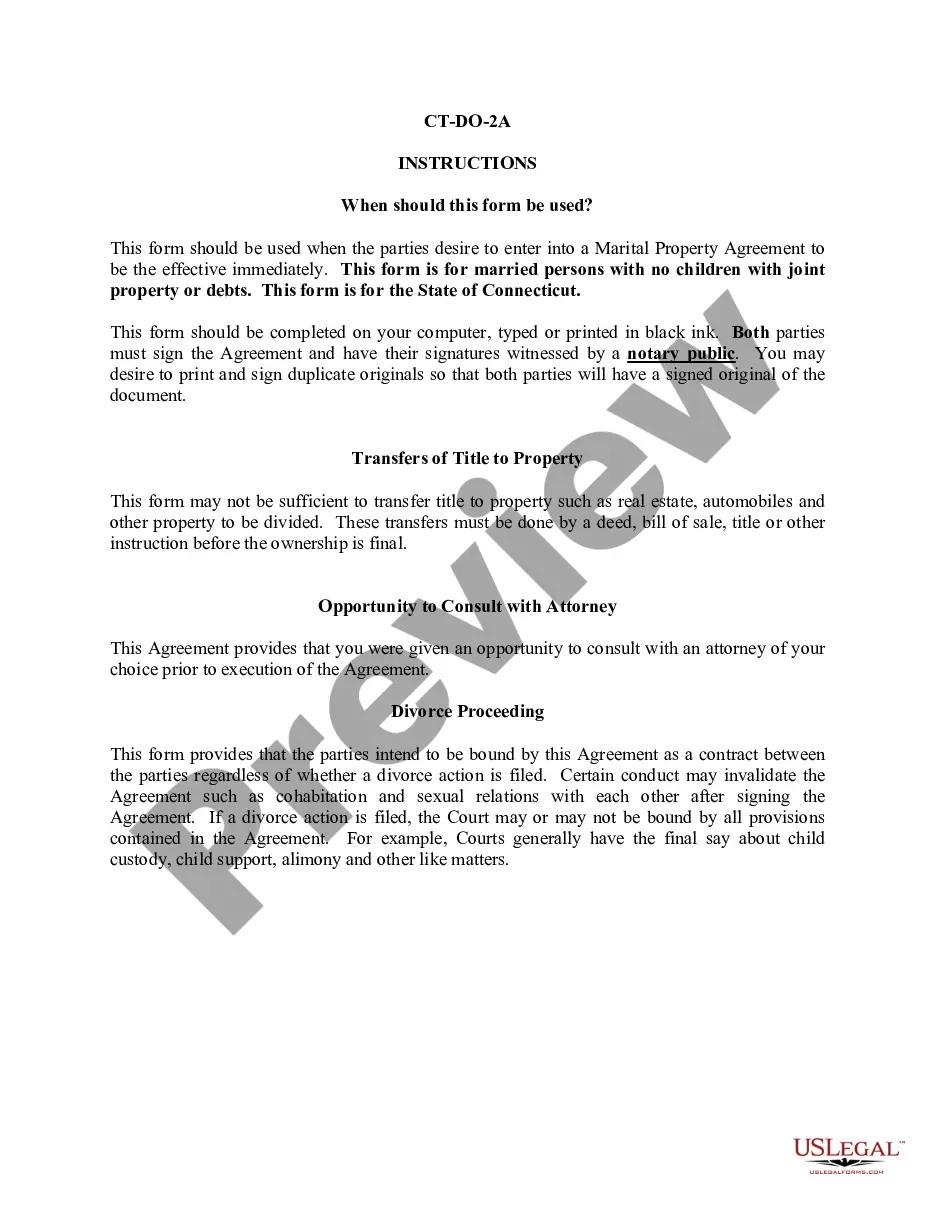

How to fill out Receipt For Payment Of Rent?

You might spend several hours online searching for the official document format that meets the federal and state standards you need.

US Legal Forms provides a vast array of legal templates that have been reviewed by experts.

You can download or print the Arizona Receipt for Payment of Rent from the service.

If available, use the Preview button to view the format as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, edit, print, or sign the Arizona Receipt for Payment of Rent.

- Each legal document format you purchase is yours permanently.

- To obtain another copy of the purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate format for the state/region of your choice.

- Review the form summary to ensure you have chosen the correct document.

Form popularity

FAQ

In Arizona, if you rent out your property, you may need to register it depending on local regulations. Registration can help ensure compliance with local housing laws and make processes smoother. Using an Arizona Receipt for Payment of Rent can also support your registration efforts by providing documented proof of rental transactions.

Arizona's new rental law includes adjustments designed to protect tenants' rights and clarify landlord responsibilities. Recent changes aim to enhance communication between landlords and tenants, promoting a fair rental environment. As a landlord or tenant, having an Arizona Receipt for Payment of Rent can provide proof of transactions that align with the new law.

To fill out a receipt for rent, start by including your name, the tenant's name, and the date of payment. Clearly state the amount received and the rental period it covers. Don’t forget to specify that this is an Arizona Receipt for Payment of Rent, as this detail provides clarity for both parties.

Currently, there are discussions regarding rental tax policies in Arizona, but no official legislation has eliminated these taxes. Tenants and landlords should stay informed about any changes, as the legal landscape can shift. Use the Arizona Receipt for Payment of Rent to keep clear records of any transactions, which can help navigate tax obligations.

In the Philippines, landlords are not legally required to issue rent receipts, but many choose to do so for transparency. If you're dealing with this issue, consider using a similar approach to the Arizona Receipt for Payment of Rent. Platforms like US Legal Forms offer templates to ensure you have proper documentation for any rent payments made.

To review your rent payment history, start by checking with your landlord or property management. They should maintain records and can provide you with an Arizona Receipt for Payment of Rent for past transactions. Additionally, you can create a simple tracker using US Legal Forms templates to keep better track of your payments in the future.

Getting a rental receipt is straightforward. If your landlord issues them, request your Arizona Receipt for Payment of Rent directly. Otherwise, utilize resources from US Legal Forms to design a receipt that meets your needs, making sure to document the necessary information like payment dates and amounts.

Arizona Form 201 is a specific tax form used for reporting income from self-employment within the state. This form helps individuals calculate their tax obligations accurately based on their earnings. Utilizing resources like our US Legal Forms platform can streamline the process of completing Arizona Form 201, ensuring all your information is correct.

To qualify for the Arizona property tax credit, applicants typically must be 65 years or older, have a low-income status, or meet other specific criteria. This credit is designed to help those who significantly bear the burden of property taxes. For more details on the qualifications and application process, visit resources like US Legal Forms, which offer guides tailored to your situation.

An Arizona form of acknowledgment is a legal document that confirms a person's signature on a variety of documents is valid. This form is often used in real estate transactions, including the issuance of an Arizona Receipt for Payment of Rent. Using this form helps protect the interests of both landlords and tenants by providing legal validation.