Arizona Promissory Note Assignment and Notice of Assignment

Description

How to fill out Promissory Note Assignment And Notice Of Assignment?

If you want to accumulate, acquire, or print authentic document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search feature to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you've found the form you want, click the Acquire now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

Step 5. Process the purchase. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to locate the Arizona Promissory Note Assignment and Notice of Assignment in just a few clicks.

- If you are already a user of US Legal Forms, Log In to your account and click the Obtain button to find the Arizona Promissory Note Assignment and Notice of Assignment.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for your correct city/state.

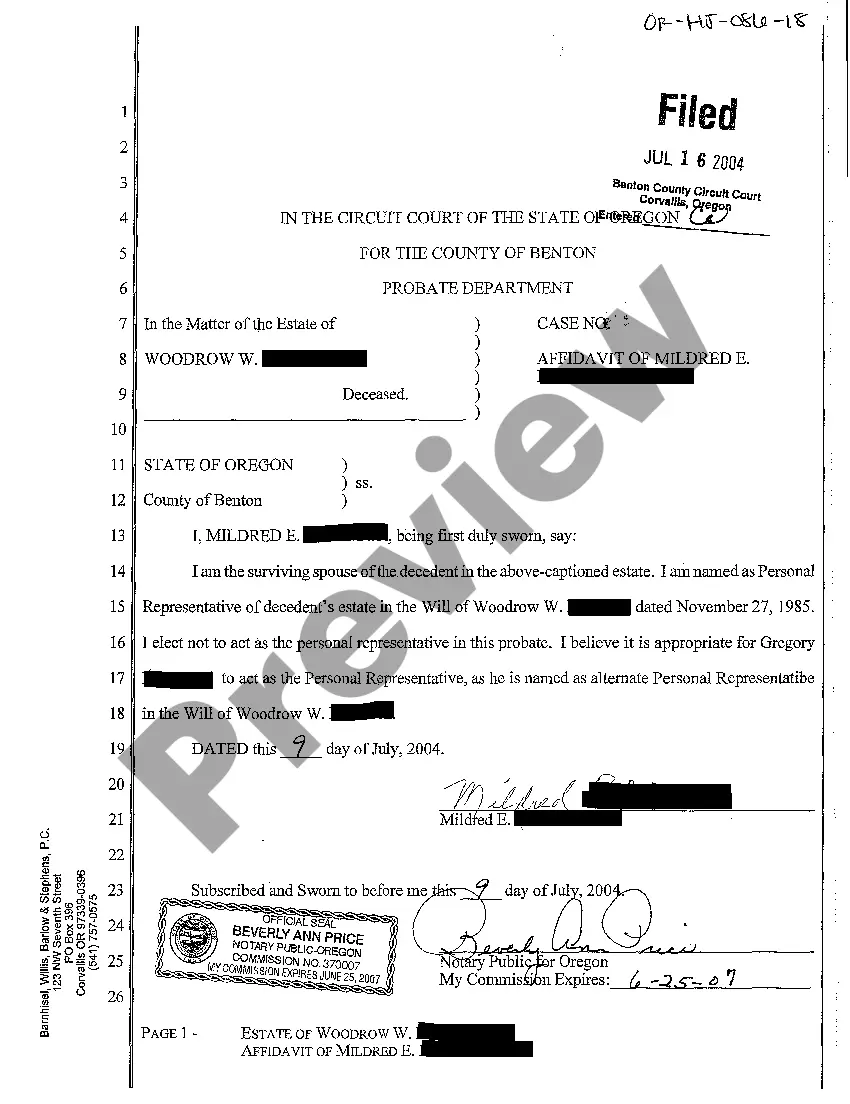

- Step 2. Utilize the Preview option to review the content of the form. Be sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Yes, a promissory note can be assigned to another party through a formal assignment process. This allows the original lender to transfer their rights and obligations to a new lender. During the Arizona Promissory Note Assignment and Notice of Assignment, it is crucial to follow proper procedures to ensure that the assignment is legally recognized.

In Arizona, the statute of limitations for enforcing a promissory note is generally six years. This means that a lender has this timeframe to take legal action if the borrower defaults on the payment terms. Being informed about the statute of limitations helps ensure that your rights are protected under an Arizona Promissory Note Assignment and Notice of Assignment.

A promissory note in Arizona generally remains valid for a specified period, typically six years, depending on the terms outlined within the document. This duration aligns with Arizona's statute of limitations on written contracts. It is essential to include clear expiration terms during the Arizona Promissory Note Assignment and Notice of Assignment to avoid confusion later on.

In Arizona, a promissory note does not necessarily need to be notarized to be enforceable; however, notarization can add an extra layer of security. By having the document notarized, you ensure that the signatures are legitimate and the terms are recognized as official. When dealing with an Arizona Promissory Note Assignment and Notice of Assignment, it is often recommended to consider this step for added protection.

Yes, a promissory note can indeed hold up in court as a legally binding document. Courts typically enforce these notes as long as they are clear and specific regarding the obligations of the parties involved. In cases of disputes, the documentation related to the Arizona Promissory Note Assignment and Notice of Assignment can play a crucial role in determining the outcome.

Promissory notes can be treated as tradable instruments in Arizona. This means that they can be bought and sold, similar to financial securities, under specific conditions. Engaging in an Arizona Promissory Note Assignment and Notice of Assignment allows for smooth transitions of ownership, attracting investors and facilitating liquidity. However, it is essential to follow legal protocols to ensure the validity of each transaction and protect the interests of all parties.

Rules for promissory notes in Arizona include clear identification of the parties involved, the amount owed, and the payment terms. Ensuring that these notes comply with state laws is vital for their enforceability. Engaging in an Arizona Promissory Note Assignment and Notice of Assignment keeps the documentation straightforward and transparent, helping to prevent misunderstandings. A well-structured note promotes trust among parties and provides a reliable foundation for financial agreements.

The Assignment of rights in Arizona refers to the legal process whereby one party transfers their rights to another. In the context of promissory notes, this means the original lender assigns their right to receive payments to a new lender. Utilizing an Arizona Promissory Note Assignment and Notice of Assignment ensures that the new lender is recognized legally and can enforce the terms of the note. This process not only protects the interests of all involved but also enhances financial mobility.

Promissory notes can indeed be transferred. In Arizona, when a promissory note is assigned, the new holder takes over the obligations and rights of the original lender. Therefore, navigating an Arizona Promissory Note Assignment and Notice of Assignment is crucial for making sure all parties are informed and that the transfer is legally binding. It also helps in avoiding potential disputes over payment responsibilities.

Yes, a promissory note is assignable in Arizona. This means that the original lender can transfer their rights to receive payment to another party, allowing for greater flexibility in financial transactions. When you engage in an Arizona Promissory Note Assignment and Notice of Assignment, it ensures that the new holder has the legal authority to enforce the note. Ensuring proper documentation and notification is essential in this process.