Arizona Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual

Description

How to fill out Oil, Gas And Mineral Deed - Individual Or Two Individuals To An Individual?

It is possible to invest time on the web looking for the authorized papers template that fits the state and federal specifications you will need. US Legal Forms gives a huge number of authorized kinds which can be reviewed by experts. You can easily obtain or print the Arizona Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual from your services.

If you have a US Legal Forms accounts, it is possible to log in and click the Down load option. Next, it is possible to comprehensive, modify, print, or indication the Arizona Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual. Every authorized papers template you buy is your own for a long time. To obtain yet another backup of any acquired type, visit the My Forms tab and click the corresponding option.

If you work with the US Legal Forms internet site the first time, follow the simple instructions beneath:

- Initial, make certain you have selected the best papers template for your state/metropolis of your choice. Read the type information to ensure you have picked the right type. If available, use the Preview option to check throughout the papers template as well.

- In order to locate yet another edition in the type, use the Research field to discover the template that meets your requirements and specifications.

- After you have found the template you desire, click on Get now to carry on.

- Pick the pricing strategy you desire, type in your qualifications, and sign up for a free account on US Legal Forms.

- Full the deal. You may use your bank card or PayPal accounts to cover the authorized type.

- Pick the structure in the papers and obtain it for your device.

- Make changes for your papers if necessary. It is possible to comprehensive, modify and indication and print Arizona Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual.

Down load and print a huge number of papers layouts while using US Legal Forms site, which offers the most important collection of authorized kinds. Use expert and status-particular layouts to take on your business or specific requirements.

Form popularity

FAQ

If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect. Your basis in mineral rights can affect how much tax you owe when selling mineral rights vs collecting royalties. If you inherited mineral rights, it nearly always makes sense to sell.

Mineral rights ownership information can be found with the register of deeds in the county where the land is located.

The Dormant Minerals Act is a Michigan law that causes severed oil and gas rights to be abandoned (lost) if the owner allows more than 20 years to pass without doing one of the following: Recording at the register of deed's office a sale, lease, mortgage or transfer of the severed interest.

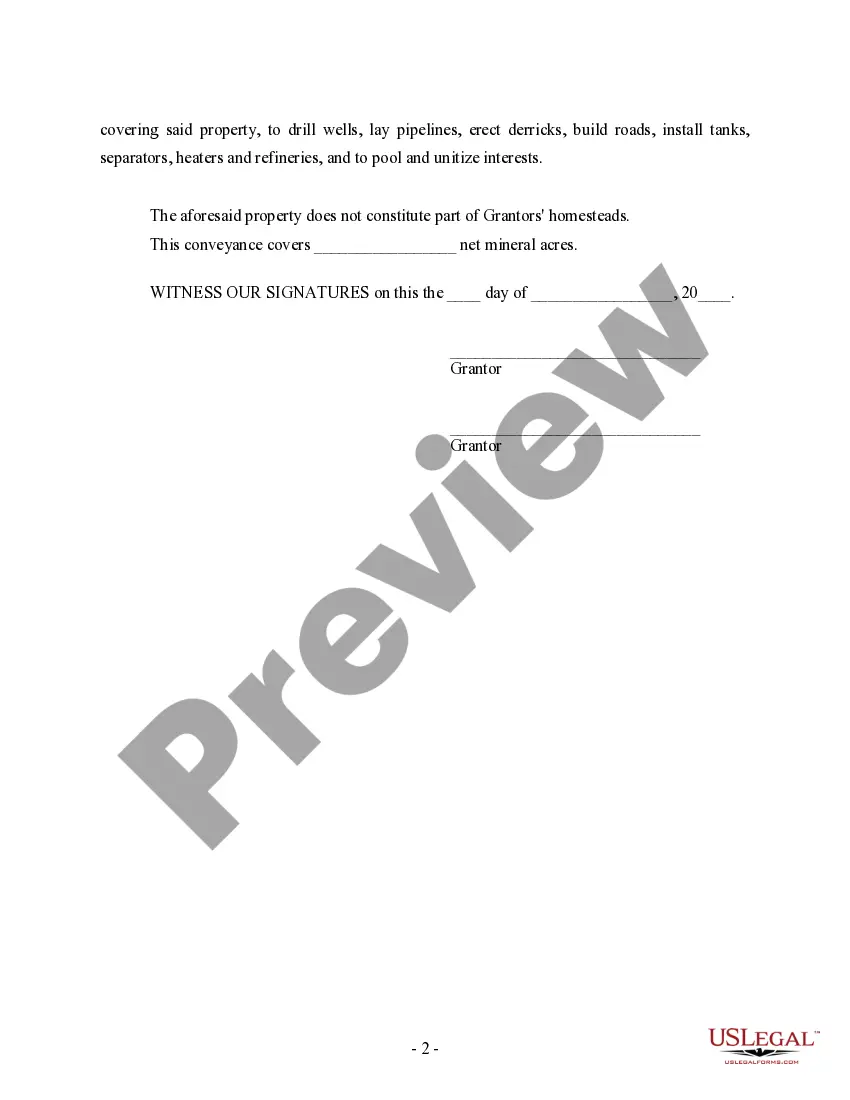

Mineral Deed for Real Estate Located in Arizona The General Mineral Deed in Arizona transfers oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included. The transfer includes the oil, gas and other minerals of every kind and nature.

A person may also own rights to only one kind of mineral, such as oil and gas, or to only one formation or depth interval. The ownership of the mineral rights in a parcel can usually be determined by examining the deed abstract for the property.

Also known as a mineral estate, mineral rights are just what their name implies: The right of the owner to utilize minerals found below the surface of property. Besides minerals, these rights can apply to oil and gas. Interestingly, mineral rights can be separate from actual land ownership.