Arizona Credit Agreement

Description

How to fill out Credit Agreement?

Are you currently in a location where you need documents for either business or personal purposes nearly every day.

There are many legitimate document templates available online, but finding ones you can trust is not easy.

US Legal Forms provides thousands of template options, such as the Arizona Credit Agreement, which can be customized to meet federal and state requirements.

If you find the right form, click Acquire now.

Choose the pricing plan you want, fill in the required information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arizona Credit Agreement template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

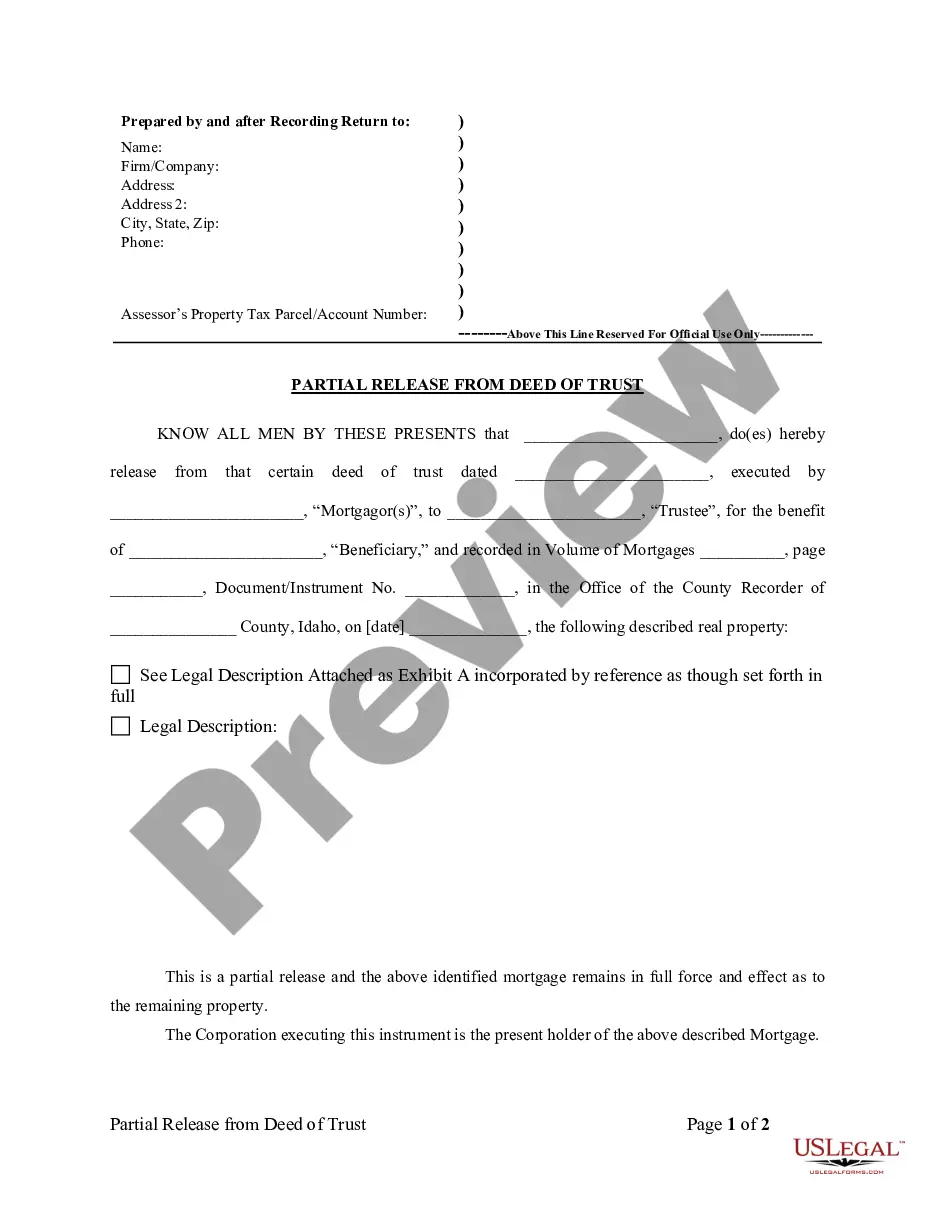

- Utilize the Preview feature to review the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search box to find the form that meets your needs.

Form popularity

FAQ

A loan gives you a lump sum of money that you repay over a period of time. A line of credit lets you borrow money up to a limit, pay it back, and borrow again.

A lending agreement (loan agreement) is a formal contract between a lender and a borrower. Lending agreements spell out all the details of the loan, such as the principal amount, interest rate, amortization period, term, fees, payment terms and any covenants.

How do I find my Credit Agreements? Your reported Credit Agreements will appear on your Credit Report, giving you a detailed list of your current and past lenders, amounts owed, the status of the accounts, and more.

Loans and credits are different finance mechanisms. While a loan provides all the money requested in one go at the time it is issued, in the case of a credit, the bank provides the customer with an amount of money, which can be used as required, using the entire amount borrowed, part of it or none at all.

The NCA does not require that a credit agreement must be in writing and signed by both parties to the agreement, although this is implied throughout the Act. A credit agreement can be (i) a credit facility; (ii) a credit transaction; (iii) a credit guarantee; or (iv) an incidental credit agreement.

A credit agreement is a legal document that outlines the terms of your loan, between you and the lender. Whether you're taking out a mortgage, a personal loan or Car Finance, the creditor is legally required to provide a credit agreement and it must be signed by both parties.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.