Arizona Articles Of Dissolution By Incorporates Or Initial Directors Non Profit or Profit Corporation refers to documents that are filed with the Arizona Corporation Commission to officially dissolve a corporation. The Articles of Dissolution must be signed by either the Incorporates (if the company is brand new) or the initial directors (if the company has already been formed). Depending on the type of corporation, the Articles of Dissolution will be either Non Profit or Profit. Non Profit Articles of Dissolution will include information about the name of the corporation, its purpose, the date of dissolution and the signature of the incorporates or initial directors. Profit Articles of Dissolution will include the same information as Non Profit Articles of Dissolution, plus additional information such as the company’s address, the number of shares of stock issued, the names and addresses of shareholders, and the date of the final meeting of the board of directors.

Arizona Articles Of Dissolution By Incorporators Or Initial Directors Non Profit or Profit Corporation

Description

How to fill out Arizona Articles Of Dissolution By Incorporators Or Initial Directors Non Profit Or Profit Corporation?

If you are looking for a method to accurately finish the Arizona Articles Of Dissolution By Incorporators Or Initial Directors for Non-Profit or Profit Corporations without enlisting a lawyer, then you are in the correct location.

US Legal Forms has established itself as the largest and most trustworthy collection of official templates for every personal and business situation. Every document you discover on our online platform is crafted in line with federal and state laws, so you can be confident that your documents are properly prepared.

Another excellent feature of US Legal Forms is that you will never misplace the documents you have obtained - you can find any of your downloaded templates in the My documents section of your profile whenever necessary.

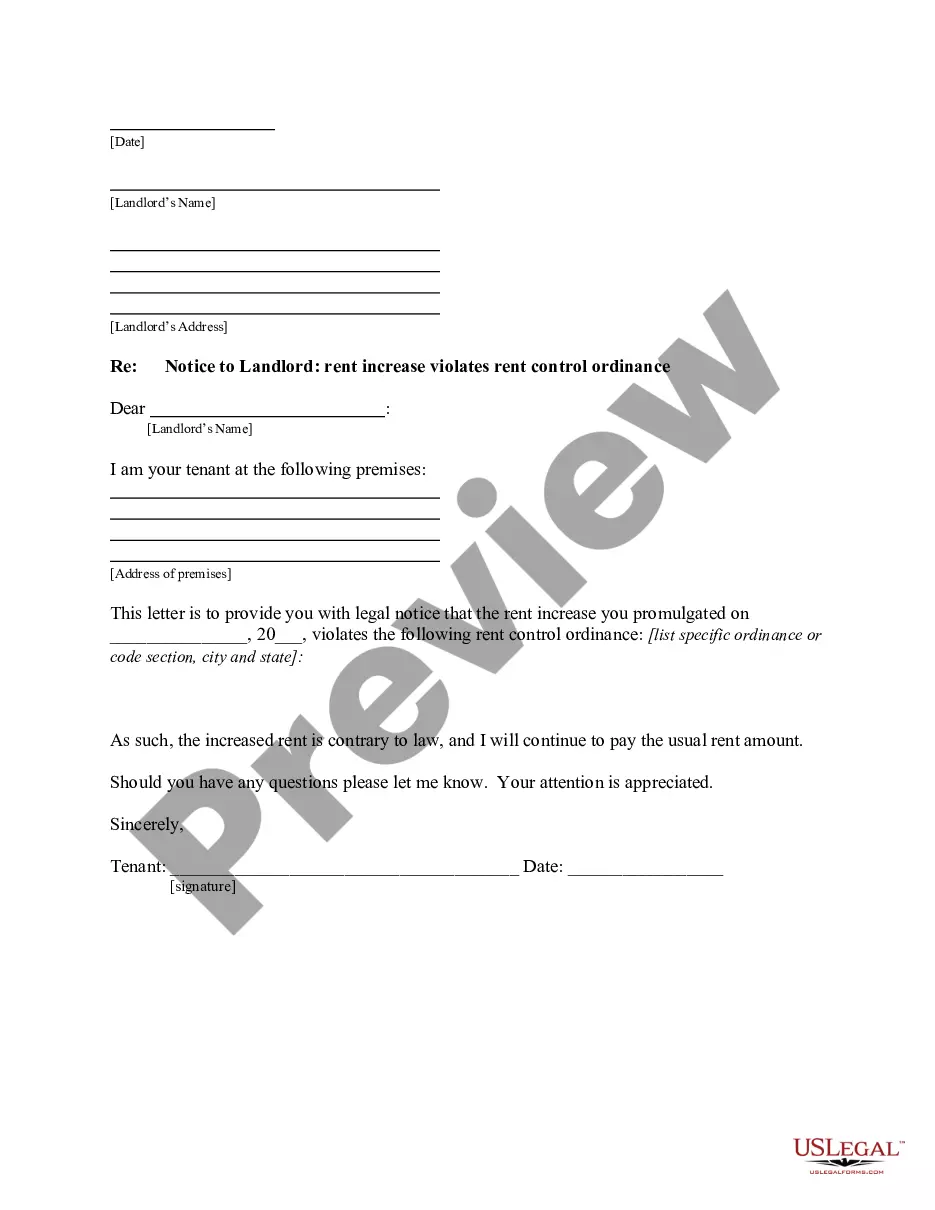

- Ensure that the document displayed on the page aligns with your legal situation and state laws by reviewing its text description or exploring the Preview mode.

- Enter the document title in the Search tab at the top of the page and select your state from the dropdown to locate another template in case of any discrepancies.

- Repeat the content review process and click Buy now when you are assured of the document's adherence to all requirements.

- Log In to your account and hit Download. Register for the service and choose a subscription plan if you haven’t already.

- Utilize your credit card or the PayPal option to settle the payment for your US Legal Forms subscription. The document will be available for download immediately afterward.

- Choose the format in which you wish to receive your Arizona Articles Of Dissolution By Incorporators Or Initial Directors for Non-Profit or Profit Corporations and download it by clicking the corresponding button.

- Incorporate your template into an online editor to fill out and sign it swiftly or print it to prepare a physical copy manually.

Form popularity

FAQ

To acquire articles of dissolution, you must submit the necessary forms to the Arizona Corporation Commission. This can typically be done online, simplifying the process for both nonprofit and profit corporations. Ensure you include all required details regarding your corporation’s closure. By using services like US Legal Forms, you can streamline this process, ultimately assisting you with your Arizona Articles Of Dissolution By Incorporators Or Initial Directors Non Profit or Profit Corporation.

To obtain a copy of your articles of incorporation in Arizona, you can visit the Arizona Corporation Commission's website. They provide a simple online search tool where you can find your corporation's documents. By entering your corporation name or filing number, you can retrieve your articles of incorporation. This process is straightforward and ensures you have access to essential documents, such as Arizona Articles Of Dissolution By Incorporators Or Initial Directors Non Profit or Profit Corporation.

Filing articles of dissolution in Arizona requires submitting the appropriate form to the Arizona Corporation Commission. You can fill out the dissolution form online or via mail, ensuring you provide necessary details such as the corporation's name and the reason for dissolution. Using resources like US Legal Forms can simplify this process, guiding you through the steps to ensure compliance with Arizona Articles Of Dissolution By Incorporators Or Initial Directors Non Profit or Profit Corporation guidelines.

For a corporation to be voluntarily dissolved in Arizona, the board of directors must adopt a resolution recommending the dissolution. Following the resolution, the shareholders must approve this decision at a meeting, based on a majority vote. This process is important to follow carefully, particularly when considering future Arizona Articles Of Dissolution By Incorporators Or Initial Directors Non Profit or Profit Corporation documentation.

To prepare articles of incorporation in Arizona, you need to include the corporation's name, its duration, the address of the principal office, and the name and address of the statutory agent. Additionally, you must specify the purpose of your corporation, whether it is a non-profit or profit corporation. Essential information like the names and addresses of initial directors should also be detailed, making it critical to ensure accuracy for Arizona Articles Of Dissolution By Incorporators Or Initial Directors Non Profit or Profit Corporation.

Yes, you can close a nonprofit, but it requires following legal procedures to ensure compliance with Arizona laws. The process involves settling any remaining debts, notifying stakeholders, and filing the Arizona Articles Of Dissolution By Incorporators Or Initial Directors Non Profit or Profit Corporation. Using resources like US Legal Forms can simplify this process and ensure you complete all necessary steps effectively.

To dissolve a nonprofit in Arizona, you must follow specific procedures set by the state. Start by ensuring that all debts and obligations of the nonprofit are settled. Next, you will need to file the Arizona Articles Of Dissolution By Incorporators Or Initial Directors Non Profit or Profit Corporation with the Arizona Corporation Commission. This document officially ends the nonprofit’s existence and protects you from ongoing liabilities.

Filing with the Arizona Corporation Commission is a straightforward process. You need to complete the Arizona Articles Of Dissolution By Incorporators Or Initial Directors Non Profit or Profit Corporation form. After filling it out, you can submit it online, by mail, or in person at the commission's office, along with the required fees. This ensures that your filing is completed accurately and efficiently.

In Arizona, dissolution can be voluntary, involuntary, or administrative. Voluntary dissolution occurs when the incorporators or initial directors decide to end the corporation. Involuntary dissolution happens when the state acts to dissolve a business for various reasons, such as not filing required paperwork. Administrative dissolution is when the Arizona Corporation Commission dissolves a corporation for failure to comply with state laws, making the Arizona Articles Of Dissolution By Incorporators Or Initial Directors Non Profit or Profit Corporation essential.

You can look up LLCs in Arizona by using the Arizona Corporation Commission's online search tool. By entering the name of the LLC, you can access detailed information about its status, registered agent, and filing history. This can help you find any relevant documents related to Arizona Articles Of Dissolution By Incorporators Or Initial Directors Non Profit or Profit Corporation if necessary.