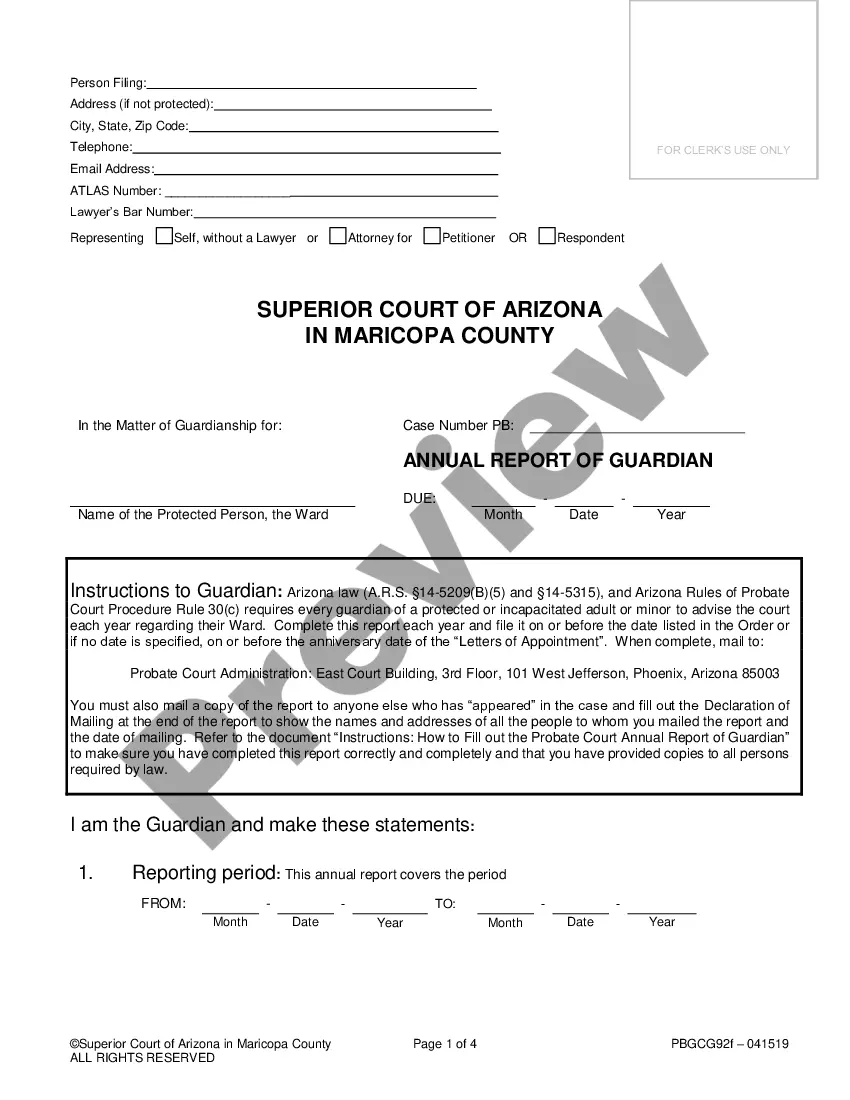

Arizona Annual Report is a document that must be filed each year by corporations, limited liability companies, and limited partnerships in the state of Arizona. This report is required to be filed with the Arizona Corporation Commission and includes information about the company’s current officers, directors, members, partners, and registered agents. It also includes financial information, such as the company’s bank account information, assets, and liabilities. There are three types of Arizona Annual Reports: Initial Report, Annual Report, and Change of Agent Report. The Initial Report must be filed when the business is formed, the Annual Report must be filed by the anniversary of the business formation date each year, and the Change of Agent Report must be filed if there is a change in the designated registered agent.

Arizona Annual Report

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Annual Report?

US Legal Forms is the simplest and most lucrative method to find appropriate official templates.

It boasts the largest online collection of business and personal legal documents prepared and validated by attorneys.

Here, you can discover printable and fillable forms that adhere to national and local regulations - just like your Arizona Annual Report.

Examine the form description or view a preview of the document to ensure you’ve selected the one that meets your needs, or search for another one using the search bar above.

Click Buy now when you are confident of its suitability with all the requirements, and choose the subscription plan that fits you best.

- Acquiring your template involves only a few straightforward steps.

- Users with an existing account and an active subscription merely need to Log In to the site and download the form onto their device.

- Subsequently, they can locate it in their profile under the My documents section.

- And here’s a guide on how to acquire a properly prepared Arizona Annual Report if you are using US Legal Forms for the first time.

Form popularity

FAQ

Preparing a company's annual return requires gathering critical information about the entity's status, including financial statements and operational changes. You will need to be aware of state requirements to ensure compliance. UsLegalForms can assist in this process by providing templates and guidance for your Arizona Annual Report.

Planning an annual report involves outlining key sections and collecting relevant data well in advance. Set a timeline for drafting, reviewing, and finalizing each part of the report. This structured approach ensures that your Arizona Annual Report is comprehensive and allows for timely completion.

An effective annual report format should begin with a title page, followed by a table of contents, and then sections detailing the company overview, financials, and analysis. Ensure to include visuals like charts and graphs for clarity. Crafting your Arizona Annual Report with this structure improves readability and engagement.

When writing an annual report analysis, focus on summarizing key metrics and trends from the report. Evaluate the performance against the previous year, highlighting growth areas and challenges. A well-crafted analysis helps stakeholders understand the significance of the data presented in your Arizona Annual Report.

To complete an Arizona Annual Report, gather your business's financial information, operational highlights, and any relevant changes. Clearly present this information in the report for easy comprehension. If you need assistance, platforms like USLegalForms offer templates to help you structure your annual report effectively.

To file an Arizona Annual Report, you need to visit the Arizona Corporation Commission's website. You'll find the necessary forms and guidelines there. Make sure to complete the form accurately and submit it either online or via mail, adhering to the specified deadlines to maintain your business entity's good standing.

Arizona LLCs do not have to file annual reports, which sets them apart from many other states. Instead, you must submit an annual renewal to ensure your business remains in good standing. This renewal process requires you to confirm or update essential details about your LLC, helping to maintain accurate state records. Understanding this requirement is crucial for any Arizona business owner to avoid penalties.

Yes, you must renew your LLC every year in Arizona. While you are not required to file an annual report, you need to submit an Arizona LLC annual renewal to maintain good standing with the state. This renewal confirms that your business information is up-to-date, and it allows you to continue operations without interruption. Managing this annual obligation is important for compliance and legal protection.

You can obtain a company's annual report in Arizona through the Arizona Corporation Commission's website. Typically, these reports are filed annually and include important financial information and operational updates. If you are looking for a specific company's report, searching by name or entity number can quickly direct you to the right documents. Remember, access to annual reports ensures you stay informed about business performance.

To look up a business in Arizona, you can visit the Arizona Corporation Commission's website. Here, you can search for businesses by name, entity number, or filing date. This tool provides access to important details about the business, including its status and registered agent information. Utilizing this feature can help you find valuable insights regarding annual reports and compliance history.