Arizona Request for Digital Recording (Free to download as MP3)

Description

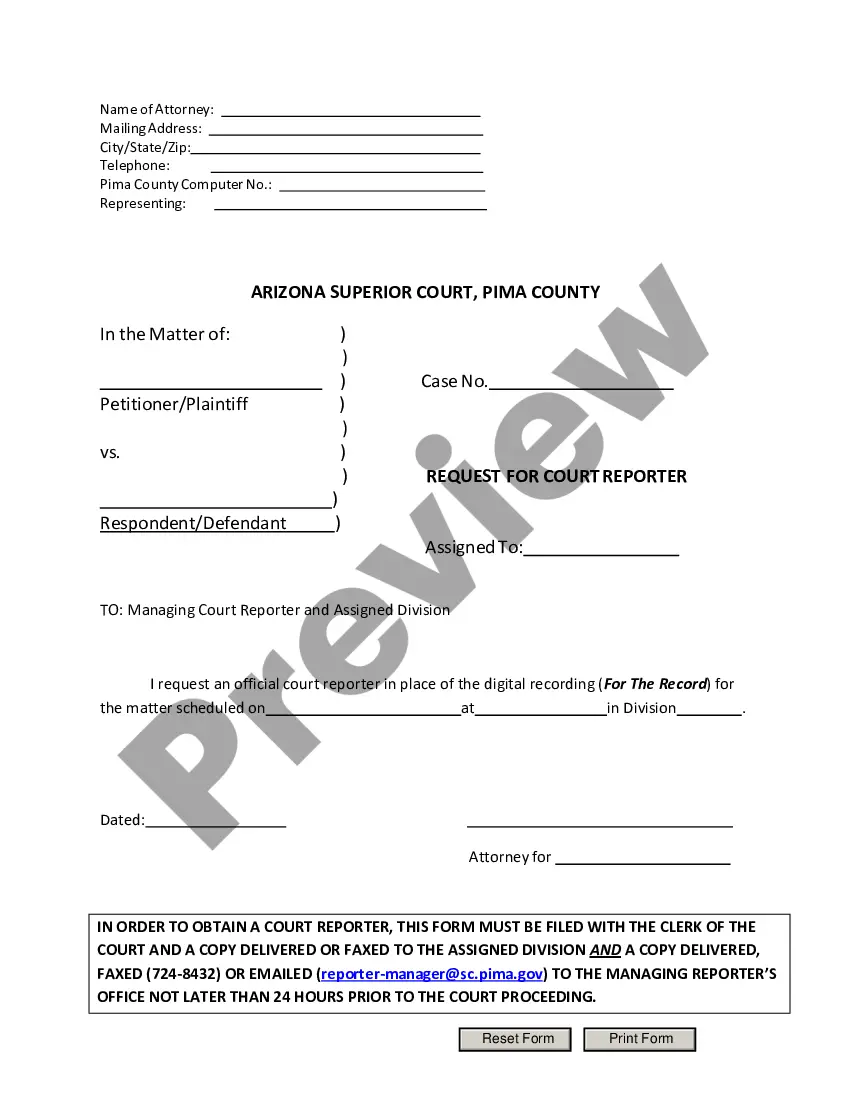

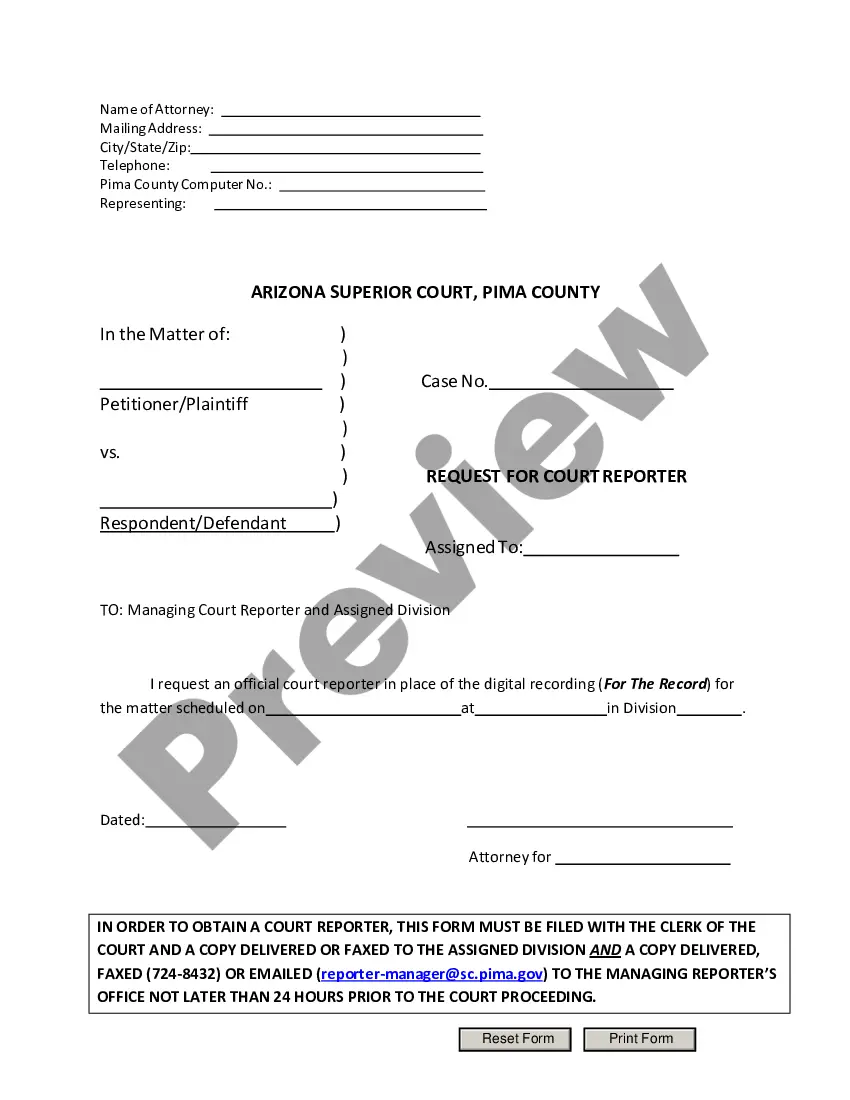

How to fill out Arizona Request For Digital Recording (Free To Download As MP3)?

Managing legal documentation demands focus, precision, and utilizing properly formulated templates. US Legal Forms has been assisting individuals across the country in this regard for 25 years, so when you select your Arizona Request for Digital Recording (Available as a free MP3 download) form from our collection, you can be assured it adheres to federal and state laws.

Using our service is straightforward and quick. To acquire the required document, all you need is an account with an active subscription. Here’s a simple guide to help you locate your Arizona Request for Digital Recording (Available as a free MP3 download) in just a few minutes.

All documents are designed for versatile use, like the Arizona Request for Digital Recording (Available as a free MP3 download) showcased here. If you need to access them again, you can complete them without additional payment – just visit the My documents section in your account and fill out your document whenever necessary. Try US Legal Forms and efficiently manage your business and personal paperwork with full legal compliance!

- Be sure to thoroughly review the form content and its alignment with general and legal requirements by previewing it or reading its overview.

- Look for an alternative official template if the one you initially opened doesn’t fit your needs or state laws (the option for that is located at the top corner of the page).

- Log In to your account and save the Arizona Request for Digital Recording (Available as a free MP3 download) in your preferred format. If it’s your first visit to our website, click Buy now to proceed.

- Establish an account, select your subscription tier, and make a payment using your credit card or PayPal.

- Specify the format in which you wish to receive your form and click Download. Print the template or incorporate it into a professional PDF editor for a paperless preparation.

Form popularity

FAQ

In the state of Arizona, the charges for the modification of any sort of prewritten software intended for the use of an individual customer are considered to be exempt so long as the are separately stated on the sales invoice and records. Sales of digital products are subject to sales tax in Arizona.

The ?sale of electronic data products such as software, data, digital books (eBooks), mobile applications and digital images is generally not taxable? (though if you provide some sort of physical copy or physical storage medium then the sale is taxable.)

Yes. All sales of taxable tangible personal property made online are subject to tax when the merchandise is delivered to a customer located in Florida. If the seller is registered as a Florida dealer, the seller should collect Florida sales tax.

Other states have gone further and passed legislation to specifically define digital goods and describe how they are taxed. These states are: Colorado, Idaho, Kentucky, Nebraska, New Jersey, South Dakota, Tennessee, Vermont, Washington, and Wisconsin.

States that generally exempt digital goods and services Alaska (no state sales tax) California (note: local utility users tax may apply to streaming services) Delaware (no state sales tax) Florida (note: video and music streaming are subject to Florida communications services tax, or CST) Georgia.

Generally, all physical art (painting, sculpture, etc) is taxable while about 50% of digital art is taxable, it depends on the state where you reside, ing to TaxJar.

Are electronically delivered products taxable in Florida? In Florida, the sale of digital products is tax-free given that items sold in digital form aren't classified as tangible personal property. In other words, services and products are not taxable if all of the goods are delivered digitally.

States that generally exempt digital goods and services Alaska (no state sales tax) California (note: local utility users tax may apply to streaming services) Delaware (no state sales tax) Florida (note: video and music streaming are subject to Florida communications services tax, or CST) Georgia.