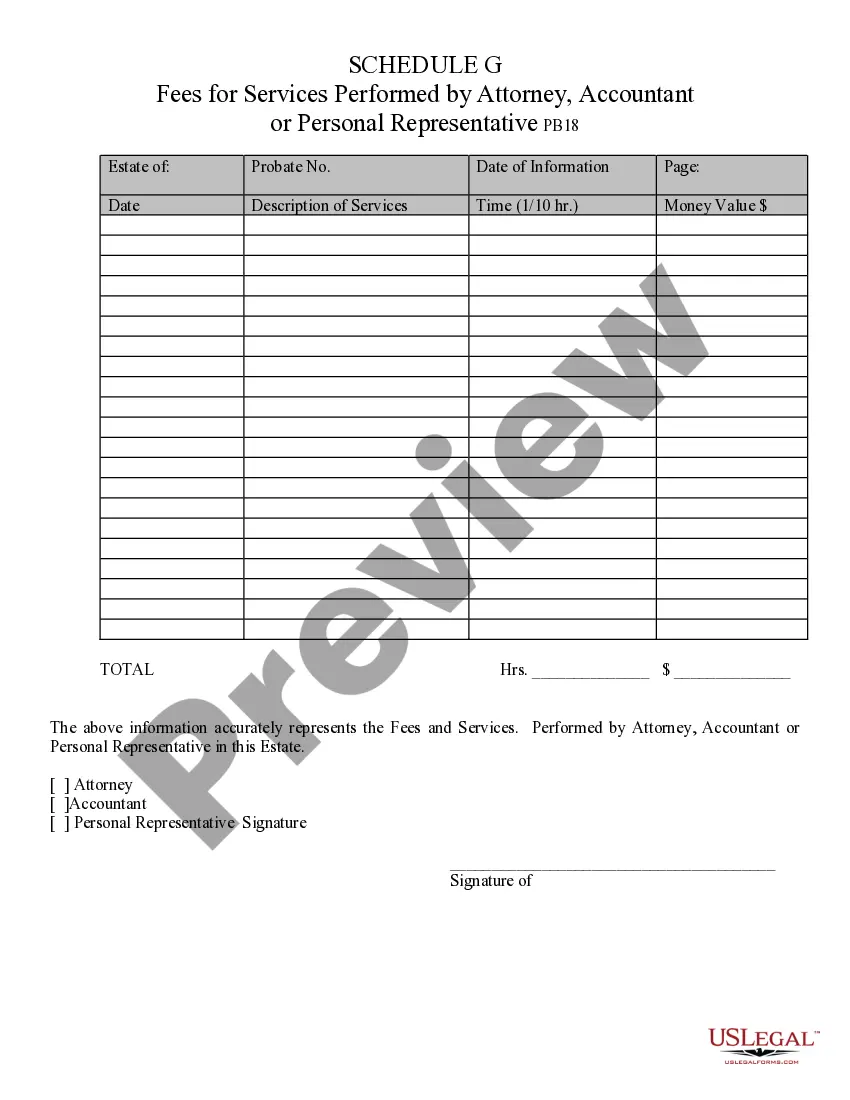

Fees for Services Performed by Attorney, Accountant, or Personal Representative - Arizona: This form is used when an administrator of an estate is called upon to list all the fees of any professional services, such as attorney or accountant fees, paid by the estate. It states the amount of the fee, as well as the duties performed for that amount. It is available for download in both Word and Rich Text formats.

Arizona Fees for Services Performed by Attorney, Accountant, or Personal Representative

Description

How to fill out Arizona Fees For Services Performed By Attorney, Accountant, Or Personal Representative?

If you're looking for accurate Arizona Costs for Services Rendered by Attorney, Accountant, or Personal Representative samples, US Legal Forms is what you require; locate documents crafted and verified by state-authorized lawyers.

Utilizing US Legal Forms not only spares you from difficulties regarding legal paperwork; additionally, you save time, effort, and money! Downloading, printing, and completing a professional template is actually cheaper than having an attorney do it for you.

And that's it. With a few simple steps, you obtain an editable Arizona Costs for Services Rendered by Attorney, Accountant, or Personal Representative. Once you establish an account, all subsequent purchases will be processed even more smoothly. After obtaining a US Legal Forms subscription, just sign in and then click the Download button you see on the form's page. Subsequently, when you wish to use this template again, you'll always be able to find it in the My documents section. Don't waste your time searching through multiple forms on various sites. Acquire professional copies from one secure source!

- To begin, complete your registration by entering your email and creating a secure password.

- Follow the instructions below to create an account and locate the Arizona Costs for Services Rendered by Attorney, Accountant, or Personal Representative template to fulfill your requirements.

- Utilize the Preview feature or review the file description (if available) to confirm that the template is the one you seek.

- Verify its validity in your state.

- Click Buy Now to place an order.

- Choose a preferred pricing plan.

- Set up your account and pay using your credit card or PayPal.

- Select a suitable file format and save the documents.

Form popularity

FAQ

The probate process in Arizona typically takes between six months to a year, depending on the complexity of the estate. Factors such as creditor claims, estate disputes, and tax issues can extend this timeframe. Being prepared for potential delays can help you manage expectations. Engaging a professional can streamline the procedures and clarify Arizona fees for services performed by an attorney, accountant, or personal representative.

In Arizona, if an estate is valued at more than $75,000, it generally must go through probate. This process ensures proper distribution of the estate's assets. For lower-value estates, there may be alternative methods to avoid probate. It's crucial to understand the implications of Arizona fees for services performed by an attorney, accountant, or personal representative when navigating this process.

Arizona statute 12-341 pertains to the award of attorney fees in civil cases. This law allows courts to award reasonable attorney fees to the prevailing party in certain actions. Understanding this statute can be beneficial when considering the Arizona fees for services performed by an attorney, accountant, or personal representative in legal disputes.

Hiring a probate lawyer in Arizona can simplify the process of settling an estate. A knowledgeable attorney understands the local laws and can help navigate the legal requirements efficiently. They will ensure that all necessary documents are filed correctly and on time. This support can minimize the stress associated with managing Arizona fees for services performed by an attorney, accountant, or personal representative.

In Arizona, attorney fees may be recoverable depending on the circumstances of the case. Generally, if a statute or contract allows for the recovery of fees, you may claim them. However, it's essential to document these costs properly. For specific situations, consulting an attorney can provide guidance on Arizona fees for services performed by an attorney, accountant, or personal representative.

Start by clearly stating your concerns regarding the lawyer's fees, referencing specific services or charges you believe are unfair. Include documentation that supports your dispute, and express your desire for resolution. Utilizing resources available on platforms like uslegalforms can help you draft an effective letter addressing Arizona fees for services performed by attorneys.

The timeframe for legal separation in Arizona can vary based on court schedules and whether both parties agree on terms. Generally, it takes a few months to finalize the separation once documents are filed. Understanding the Arizona fees for services performed by attorneys may help you prepare for any potential costs involved during this period.

To obtain a legal separation in Arizona, one must file a petition with the court explaining the grounds for separation. Both parties may need to reach an agreement on issues like property division and custody. Legal costs and Arizona fees for services performed by attorneys can vary, so it's wise to seek guidance for this process.

In Arizona, a personal representative has the authority to manage a deceased person's estate, including paying debts, distributing assets, and handling tax matters. They act on behalf of the estate and must follow the instructions in the will or state laws. Understanding the Arizona fees for services performed by personal representatives can clarify their financial responsibilities.

The duty of a personal representative in Arizona includes managing the estate’s assets, paying debts, and distributing property to beneficiaries according to the will or state law. This role is vital in ensuring that all legal obligations are met while also considering the Arizona fees for services performed by attorneys, accountants, or personal representatives. Utilizing platforms like uslegalforms can provide valuable resources and guidance in fulfilling these responsibilities effectively.