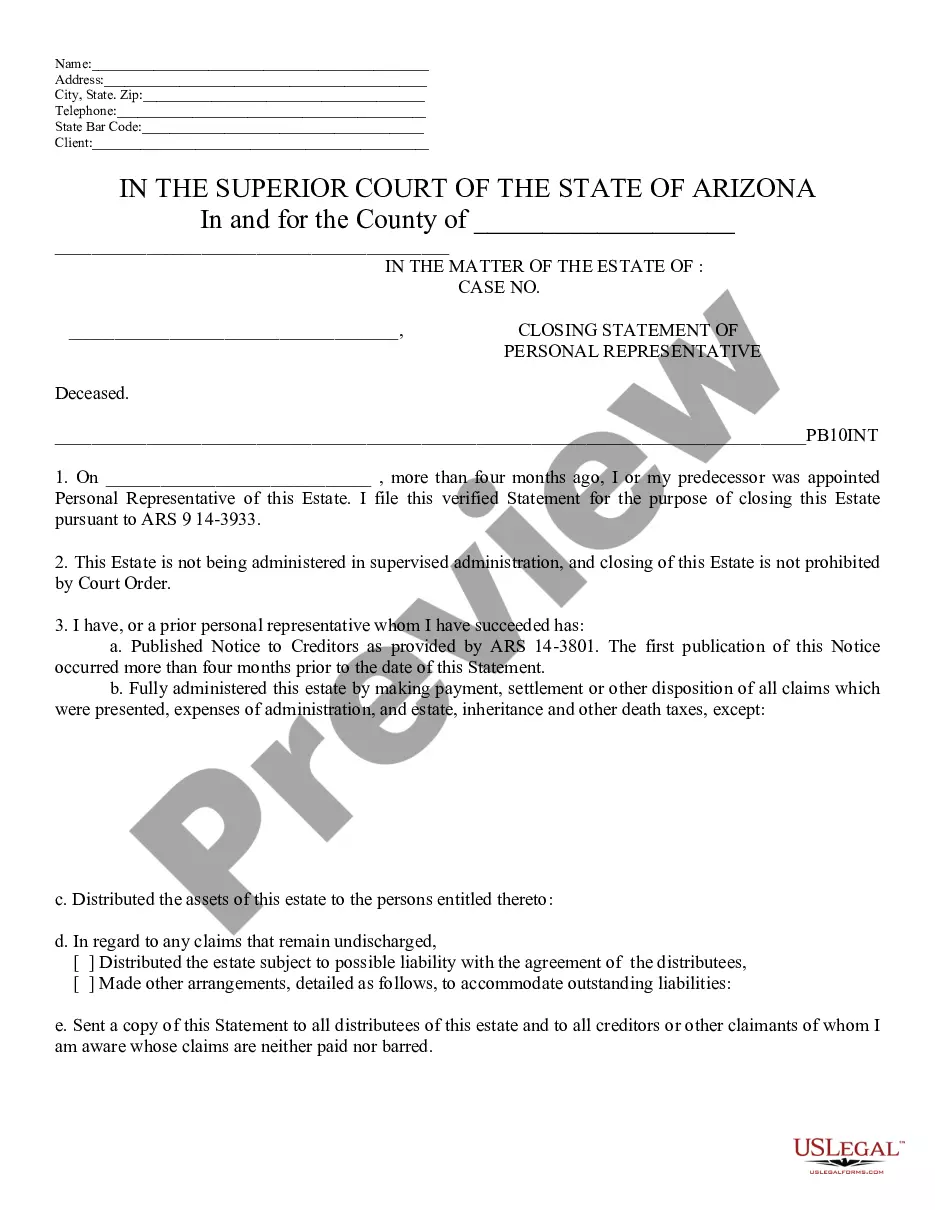

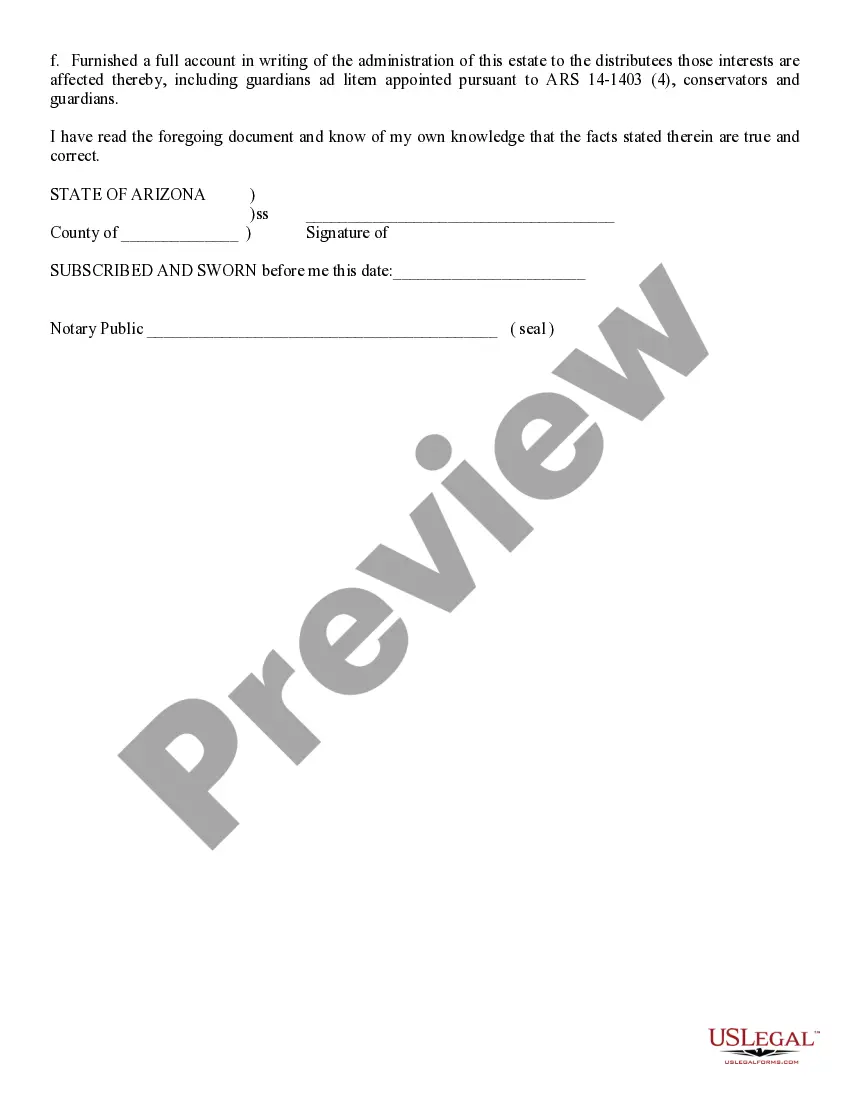

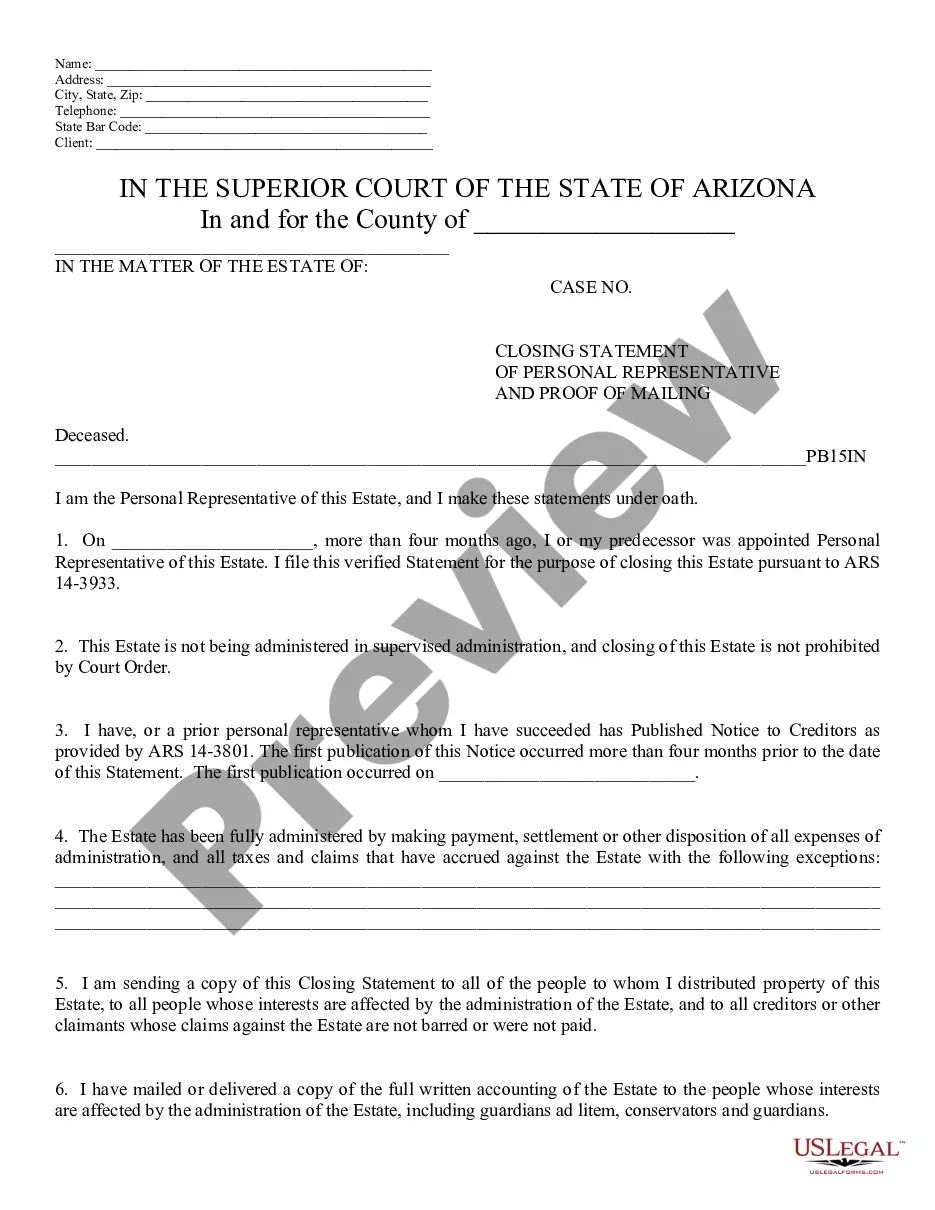

Closing Statement of Personal Rep. - Arizona: A Closing Statement is signed by the administrator of an estate, upon completion of his/her services, which includes distribution of all property in the estate. This form is to be signed in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Arizona Closing Statement of Personal Representative

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Closing Statement Of Personal Representative?

If you're looking for precise Arizona Closing Statement of Personal Representative templates, US Legal Forms is exactly what you require; obtain documents crafted and validated by state-certified attorneys.

Utilizing US Legal Forms not only alleviates concerns regarding legal documents; moreover, you save time, effort, and money!

And there you have it. In just a few simple steps, you possess an editable Arizona Closing Statement of Personal Representative. Once your account is established, all future purchases will be expedited even further. With a US Legal Forms subscription, simply Log In to your account and select the Download option available on the form's page. Consequently, whenever you need to access this template again, you'll always find it in the My documents section. Avoid wasting time sifting through numerous forms across different sites. Obtain accurate templates from a singular, secure platform!

- Initiate by completing your registration process by providing your email and creating a password.

- Follow the instructions outlined below to establish an account and access the Arizona Closing Statement of Personal Representative template to address your needs.

- Utilize the Preview tool or review the document description (if available) to verify that the form is the one you need.

- Confirm its validity in your state.

- Click Buy Now to proceed with your purchase.

- Select a suggested pricing plan.

- Create an account and pay using a credit card or PayPal.

- Choose a suitable format and save the document.

Form popularity

FAQ

Closing out an estate in Arizona involves several steps, including settling debts and distributing assets to beneficiaries. Once these tasks are complete, you will need to prepare and file an Arizona Closing Statement of Personal Representative to finalize the process. Using platforms like USLegalForms can help streamline this task, providing you with the correct forms and guidance for a smooth closure.

In Arizona, an executor typically has up to one year to settle an estate, although this timeframe may vary depending on the complexity of the estate. During this period, the executor must manage debts, distribute assets, and complete an Arizona Closing Statement of Personal Representative to document the conclusion. Considering this timeline helps ensure that all tasks are completed efficiently and legally.

When an estate closes, it means that all debts have been settled, assets have been distributed, and the executor has completed their duties. The final step often includes filing an Arizona Closing Statement of Personal Representative. This document signifies that all legal requirements have been met and the estate is officially concluded.

To become a personal representative in Arizona, you need to be appointed by the court during the probate process. This usually requires filing a petition along with the Arizona Closing Statement of Personal Representative. It is advisable to understand your responsibilities fully and possibly consult an attorney to guide you through the appointment process.

Not all estates in Arizona require probate. Generally, if an estate's value is below a specific threshold or consists solely of joint assets or assets with designated beneficiaries, it may bypass probate. However, estates that do not meet these criteria typically need a proper Arizona Closing Statement of Personal Representative to finalize the process.

A letter of appointment of personal representative is a legal document issued by a court. This letter officially designates an individual to administer the estate of a deceased person in Arizona. It empowers the personal representative to perform duties such as managing assets and preparing the Arizona Closing Statement of Personal Representative. If you're facing this situation, platforms like UsLegalForms can help simplify the process and provide the necessary templates.

Arizona law typically requires that an estate be settled within 18 months of the personal representative's appointment. However, various factors can affect this timeline, such as the complexity of the estate and any disputes that arise. Timely management of the estate, including preparation of the Arizona Closing Statement of Personal Representative, is vital for a smooth resolution. Staying organized can help you meet legal deadlines and provide closure for all involved.

While it is not legally required to have an attorney for closing on a house in Arizona, it is often beneficial. An attorney can navigate the complexities of the process and ensure that all documents, including the Arizona Closing Statement of Personal Representative, are correctly managed. Without legal guidance, you risk overlooking essential steps. Therefore, consider the advantages an attorney brings to your transaction.

In Arizona, a personal representative holds significant authority in managing an estate. This role includes settling debts, distributing assets, and filing necessary documents, including the Arizona Closing Statement of Personal Representative. A personal representative acts on behalf of the deceased, ensuring that the estate is handled according to the law. Understanding their responsibilities can help streamline the process.

A personal representative in Arizona is an individual appointed by the court to administer an estate after a person's death. This person is responsible for managing estate affairs, including collecting assets, paying debts, and distributing property to heirs. As you prepare the Arizona Closing Statement of Personal Representative, understanding the duties and powers of this role is crucial for a smooth probate process.