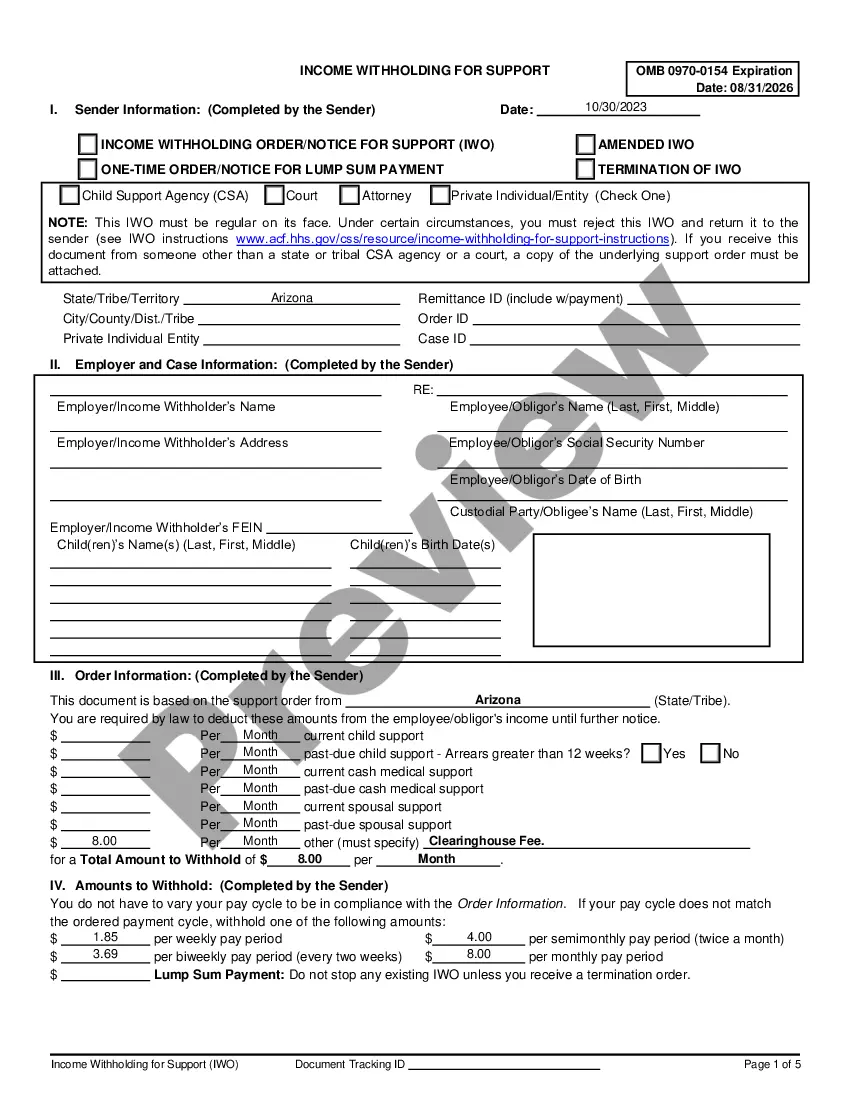

Arizona Income Withholding Data Form is a document used by employers to report wage and tax withholding information to the Arizona Department of Revenue. It includes information such as employer identification number, employee name and address, wages paid, and taxes withheld. There are two types of Arizona Income Withholding Data Forms: Form A-4 for withholding Arizona State Income Tax, and Form A-1 for withholding Arizona City and County Tax. Both forms are used to report wages and taxes for Arizona employees. The information reported on the forms is used to calculate the employee's state and local income tax liability.

Arizona Income Withholding Data Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Income Withholding Data Form?

Drafting legal documents can be quite taxing if you don't have pre-prepared fillable forms readily available. With the US Legal Forms online repository of official records, you can be confident in the templates you acquire, as they all adhere to federal and state laws and have been verified by our experts.

Acquiring your Arizona Income Withholding Data Form from our platform is as simple as 1-2-3. Existing users with an active subscription just need to Log In and click the Download button after locating the desired template. Moreover, if needed, users can retrieve the same document from the My documents section of their account.

Haven't you explored US Legal Forms yet? Sign up for our service now to obtain any official document swiftly and effortlessly whenever you require it, and keep your documentation organized!

- Document compliance verification: You should thoroughly assess the form's content to ensure it meets your requirements and adheres to state law. Examining your document and reviewing its overall description will assist you in this process.

- Alternative search (if necessary): If there are any discrepancies, navigate the library using the Search tab above until you discover an appropriate template, and click Buy Now once you identify the one you need.

- Account creation and form acquisition: Register for an account with US Legal Forms. After confirming your account, Log In and select your desired subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template retrieval and subsequent use: Select the file format for your Arizona Income Withholding Data Form and click Download to store it on your device. Print it to finalize your documents manually, or utilize a versatile online editor for quicker and more efficient electronic preparation.

Form popularity

FAQ

AZ form A1 QRT can be filed with the Arizona Department of Revenue as well. This form is crucial for employers reporting their quarterly withholding tax information. Ensure you file it on time to stay compliant with state regulations. For convenience, uslegalforms provides detailed guides that make the filing process straightforward.

Form 285 AZ should be filed with the Arizona Department of Revenue. This form is essential for those establishing withholding accounts. Be sure that your form is complete and accurate to prevent processing delays. If you’re unsure about filling it out, uslegalforms offers helpful resources to guide you.

AZ form 285, which is the Arizona Employer's Tax Withholding Registration Form, should be sent to the Arizona Department of Revenue. For the most precise address, refer to the instructions provided with the form or visit their website. Timely submission ensures that your withholding account is established without delays. Utilizing services like uslegalforms can simplify this process for you.

You can obtain Arizona income tax forms directly from the Arizona Department of Revenue's website. There, you will find downloadable PDF versions and instructions for each form you may need. If you require specific forms related to withholding taxes, such as the Arizona Income Withholding Data Form, they are also available on the site. For quick access, uslegalforms offers a comprehensive collection of these documents.

Yes, you can file Arizona taxes online through the Arizona Department of Revenue's e-file system. This system allows you to submit your tax forms, including any associated with the Arizona Income Withholding Data Form, electronically. Online filing can be more efficient and helps you keep better track of your submissions. Be sure to have all necessary documents ready for a smooth process.

To set up a withholding account in Arizona, you must complete the Arizona Withholding Tax Account Application. This application is available online through the Arizona Department of Revenue's website. Once your application is processed, you will receive your account details. For further guidance on the Arizona Income Withholding Data Form, uslegalforms can help streamline this process.

You can file the Arizona A1-QRT form with the Arizona Department of Revenue. This form is essential for reporting your withholding tax information. Make sure to submit it by the due date to avoid any penalties. If you need assistance, consider using uslegalforms, which provides easy-to-follow instructions.

The percentage to withhold for Arizona taxes primarily depends on your income span and filing details. Consulting the Arizona Income Withholding Data Form is essential to finding the latest withholding rates tailored for your situation. Remember to account for any variations, such as additional deductions or credits. Staying informed about changes throughout the tax year can aid your withholding decisions.

To select the appropriate Arizona withholding percentage, start by reviewing your income situation, family size, and tax deductions. The Arizona Income Withholding Data Form offers useful tools and tables to help determine the correct percentage. Consider future tax liabilities, as selecting the right percentage now can lead to fewer surprises during tax season. Seeking advice from a tax professional can also enhance your decision-making.

The AZ A4 form allows you to specify your Arizona withholding preferences. The amount to withhold depends on your income, family status, and deductions. It’s advisable to refer to the Arizona Income Withholding Data Form for precise calculations. If you are unsure, consulting a tax expert can provide tailored guidance based on your specific financial circumstances.