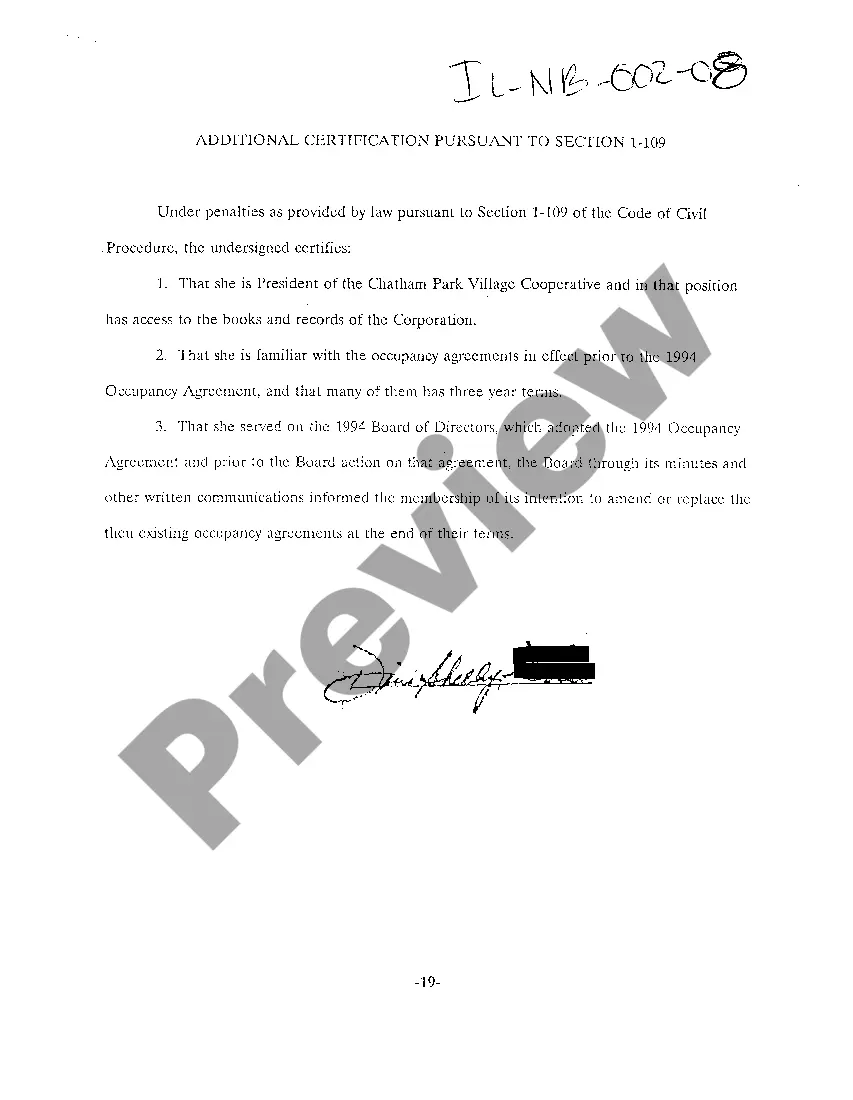

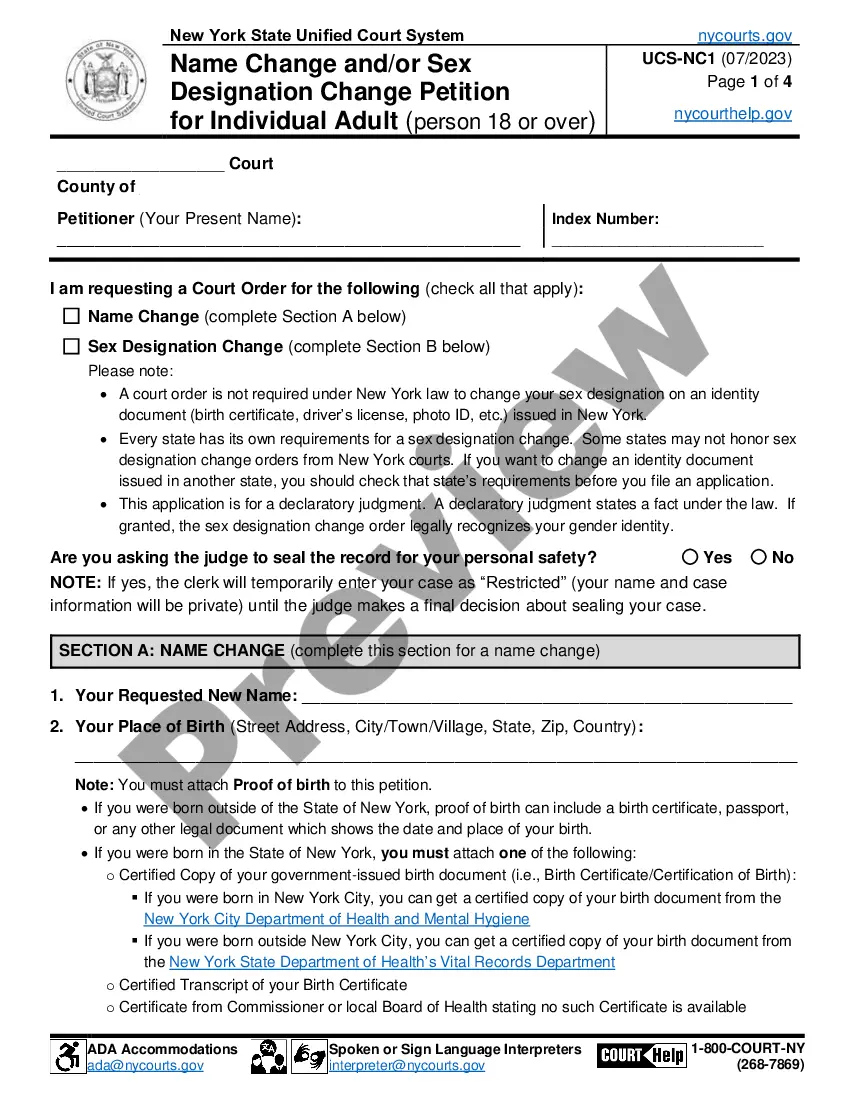

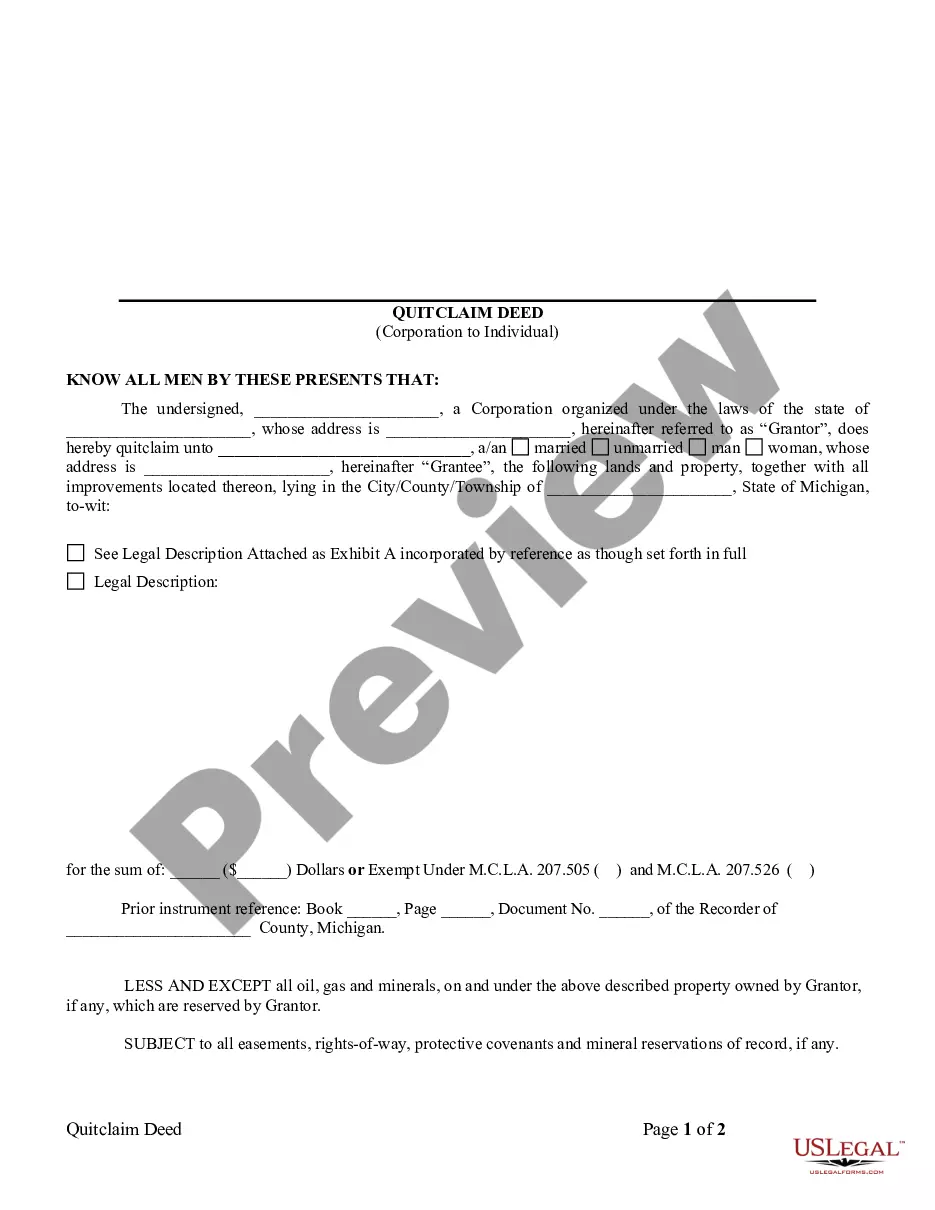

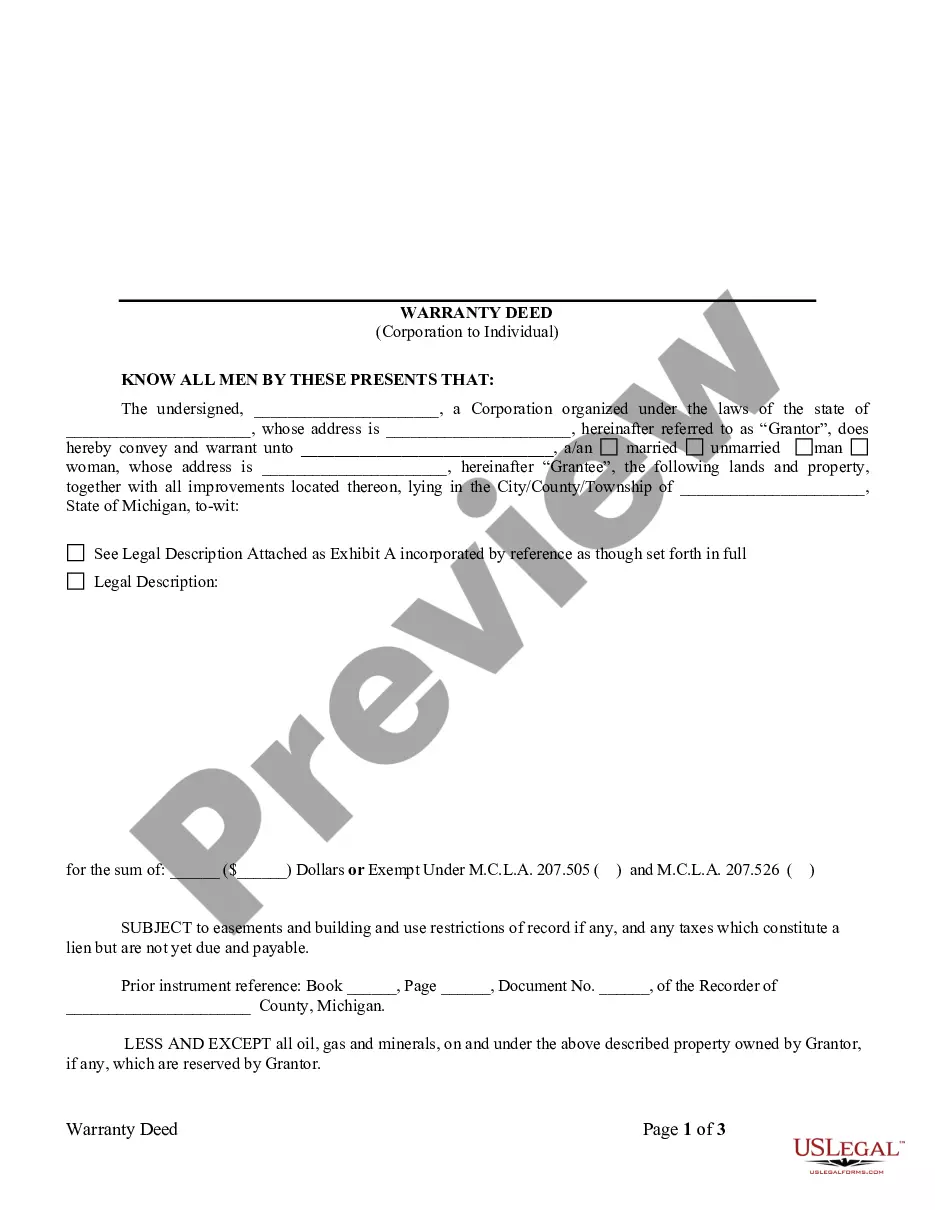

Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devises is a form that is used in Arizona for the appointment of a personal representative for a deceased person’s estate. It is a formal document issued by the court that grants authority to the representative to act on behalf of the estate. The form also acknowledges the rights of the heirs and devises, and provides them with information about the process of claiming their inheritance. There are three types of Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devises: Letters of Administration, Letters of Testamentary, and Final Decree of Distribution. Letters of Administration is issued when the deceased person did not leave a will. Letters of Testamentary is issued when the deceased left a valid will. Final Decree of Distribution is issued after the estate has been settled and the heirs and devises have been identified.

Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devisees

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devisees?

How much time and resources do you typically devote to drafting official documents? There’s a better chance of acquiring such forms than enlisting legal professionals or spending countless hours searching online for an appropriate template.

US Legal Forms is the leading online repository that provides expertly crafted and validated state-specific legal paperwork for any purpose, such as the Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devisees.

Another benefit of our library is that you can retrieve previously downloaded documents that you securely save in your profile within the My documents section. Access them at any time and revise your paperwork as often as necessary.

Conserve time and effort when preparing formal documents with US Legal Forms, one of the most reliable online solutions. Join us today!

- Review the content of the form to ensure it complies with your state's regulations. To do this, examine the form's description or use the Preview option.

- If your legal template does not fulfill your needs, look for another one using the search feature at the top of the page.

- If you possess an account with us, Log In and download the Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devisees. Otherwise, continue with the next steps.

- Click Buy now once you locate the correct blank document. Choose the subscription plan that works best for you to gain access to the full features of our library.

- Create an account and pay for your subscription. Payments can be made with your credit card or via PayPal - our service is completely reliable for this.

- Download your Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devisees onto your device and complete it on a printed version or electronically.

Form popularity

FAQ

Compensation for a personal representative in Arizona varies and is often governed by the Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devisees. Typically, the amount is based on the complexity of the estate, the time spent managing it, and any specific arrangements made in the will. Generally, representatives may receive a percentage of the estate's value or an hourly rate for their services. If you're seeking clarity on compensation, platforms like uslegalforms can provide valuable guidance.

In Arizona, a personal representative holds significant legal authority under the Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devisees. This role includes managing the deceased's estate, settling debts, and distributing assets to heirs and devisees. The personal representative can make crucial decisions regarding the estate, such as selling property or managing financial accounts. By understanding these powers, you can better navigate the responsibilities involved in the probate process.

Probate in Arizona is triggered when a deceased person’s estate includes assets that are not transferred easily, such as solely held property or assets without a designated beneficiary. Additionally, if the deceased person had a valid Will, the probate process is essential to honor their wishes. Understanding these triggers can assist families in managing estate transitions more smoothly. The Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devisees can offer further insight into this process.

The probate threshold in Arizona is primarily based on the total value of the estate. As of current guidelines, estates valued at $75,000 or more in personal property or $100,000 in real property typically require probate. These values can influence how assets are managed after death. Understanding the Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devisees will aid in navigating these requirements.

To become a personal representative in Arizona, you must file a petition with the court and provide the deceased person's Will, if available. If you are nominated in the Will, this simplifies your appointment process. Otherwise, the court will appoint someone based on priority, which includes family members. Utilizing the Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devisees can clarify your responsibilities as a personal representative.

In Arizona, the value of an estate that triggers probate is generally $75,000 or more for personal property and $100,000 for real property. However, it’s important to assess the total value of all assets to determine if probate is necessary. Evaluating your estate’s worth accurately can facilitate the probate process. The Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devisees can assist you in understanding these thresholds.

Certain assets are exempt from probate in Arizona, including life insurance policies, retirement accounts, and property held in a living trust. Additionally, assets with designated beneficiaries typically transfer outside of probate. Identifying these assets can help simplify the estate administration process. The Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devisees may provide further guidance.

Not all estates require probate in Arizona. If the deceased person had assets that were held in joint tenancy, trust, or had named beneficiaries, those assets usually avoid probate. However, other assets may still need to undergo the process to ensure proper distribution. Seeking insight into the Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devisees can help clarify your specific situation.

In Arizona, bank accounts that have designated beneficiaries typically do not go through probate. The funds in these accounts pass directly to the beneficiaries upon the account holder's death. This simplifies the process and can expedite the transfer of assets. Therefore, understanding the Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devisees can provide clarity on managing such accounts.

In Arizona, a personal representative typically has up to one year to settle an estate, though this period can vary based on specific circumstances. This timeline includes tasks such as paying debts, distributing assets, and filing necessary paperwork. Working efficiently can help shorten this period. Understanding the Arizona Order To Personal Representative And Acknowledgment And Information To Heirs Devisees will facilitate smoother estate administration.