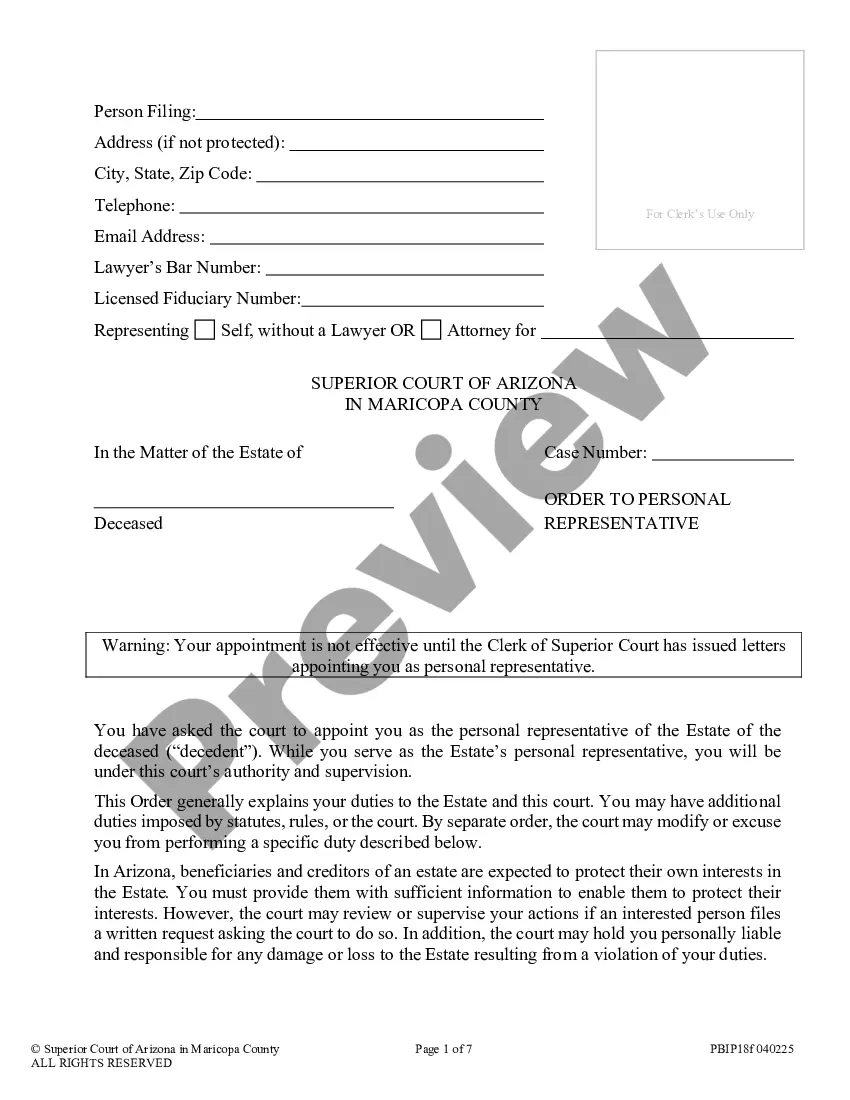

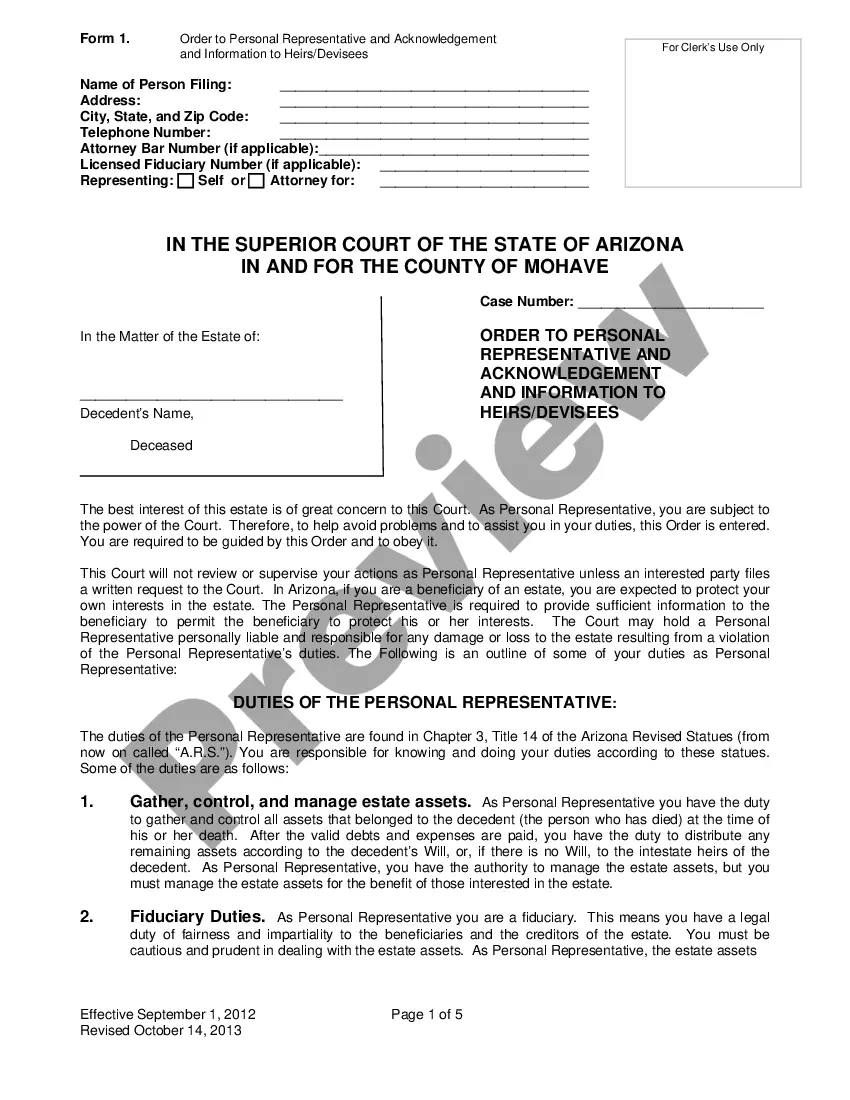

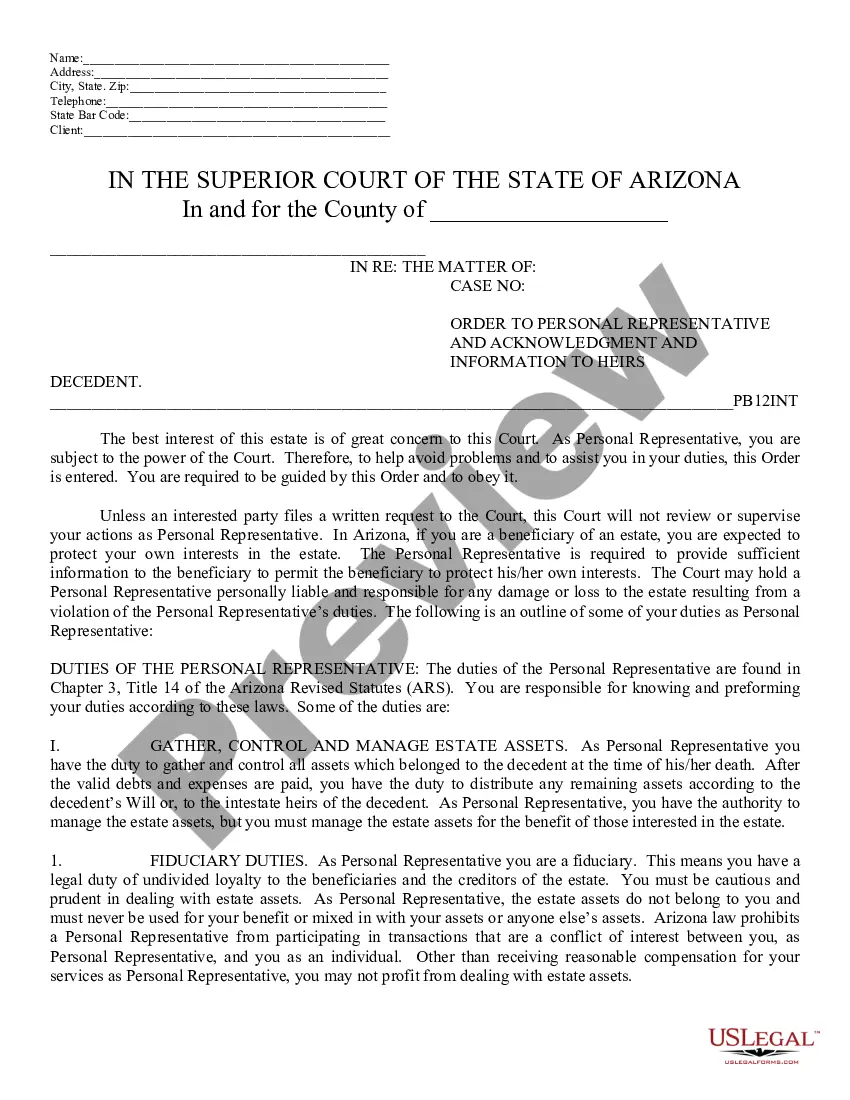

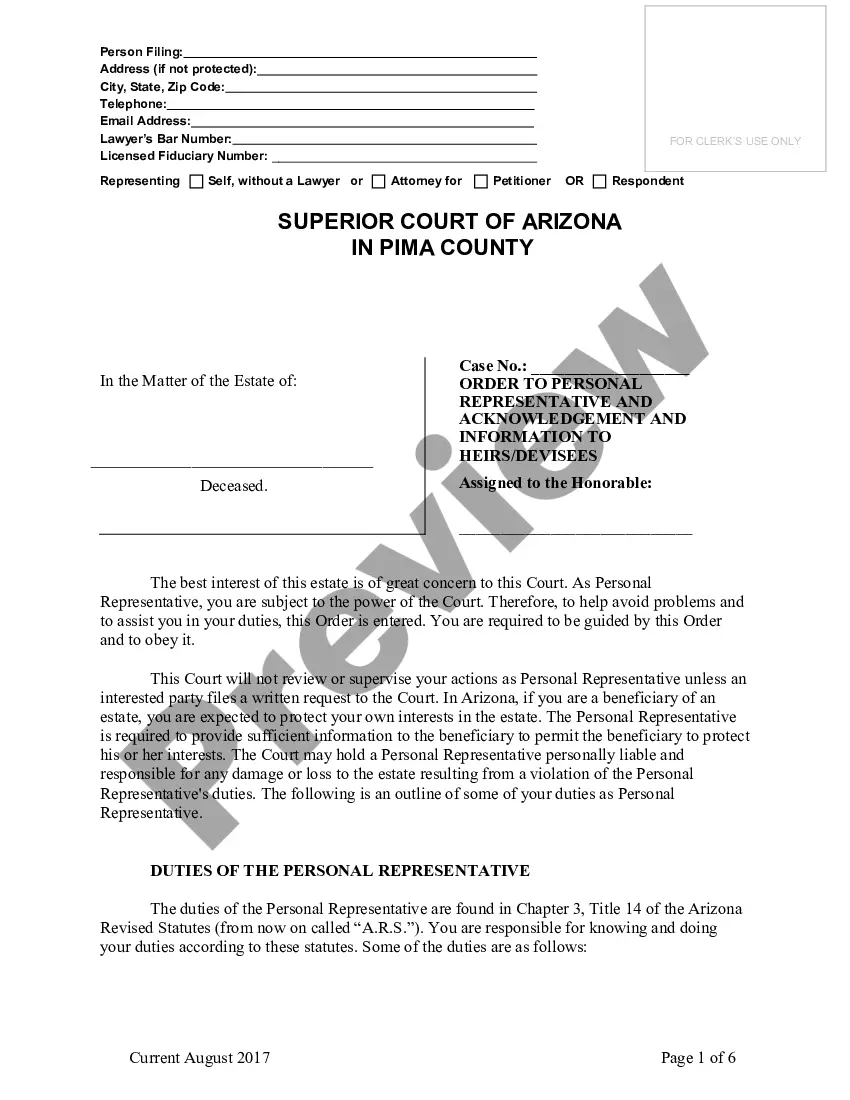

This is an official state court form appointing a personal representative of an estate. This is an official state court form.

Arizona Order To Personal Representative and Acknowledgement and Information to Heirs/Devisees

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Order To Personal Representative And Acknowledgement And Information To Heirs/Devisees?

If you are in search of accurate Arizona Order to Personal Representative and Acknowledgement and Information to Heirs/Devisees templates, US Legal Forms is precisely what you require; find documents crafted and validated by state-certified attorneys.

Using US Legal Forms not only eliminates worries regarding legal documents; additionally, you conserve time and energy, as well as finances! Downloading, printing, and completing a professional template is significantly more affordable than hiring a lawyer to handle it for you.

And just like that, in a few simple clicks, you possess an editable Arizona Order to Personal Representative and Acknowledgement and Information to Heirs/Devisees. After you set up your account, all subsequent purchases will be processed even more easily. If you maintain a US Legal Forms subscription, simply Log In to your profile and click the Download button on the form’s page. Then, whenever you need to use this template again, you will always be able to find it in the My documents section. Do not waste your time comparing numerous templates on various online sources. Acquire professional templates from a single reliable platform!

- To start, finalize your registration process by entering your email and creating a secure password.

- Follow the instructions below to set up an account and find the Arizona Order to Personal Representative and Acknowledgement and Information to Heirs/Devisees example to solve your issues.

- Utilize the Preview feature or review the document description (if available) to ensure that the template is the correct one you need.

- Verify its relevance in your area.

- Click Buy Now to place an order.

- Select a preferred payment plan.

- Create an account and pay with your credit card or PayPal.

- Choose a suitable format and save the document.

Form popularity

FAQ

In Arizona, creditors have a limited timeframe to collect debts from an estate after a person's passing. Generally, they must file their claims within six months after the personal representative has been appointed. This timeframe is crucial in relation to the Arizona Order To Personal Representative and Acknowledgement and Information to Heirs/Devisees, as it ensures that all debts are addressed timely. By being aware of these deadlines, heirs and devisees can better manage the estate's obligations and prevent potential disputes.

An executor in Arizona typically has up to one year to settle an estate fully, though this can vary based on the estate's specifics. If complications arise, such as will contests or unresolved debts, the process might take longer. Executors should prioritize the settlement to avoid potential legal challenges. By using tools available through uslegalforms, you can access valuable resources to streamline your responsibilities as an executor.

In Arizona, a trustee is expected to distribute assets to the beneficiaries in a reasonable timeframe, usually within a year after the settlor's death. However, the complexity of the trust or any potential disputes among beneficiaries may extend this period. It's essential to communicate regularly with all parties involved to keep everyone informed. The Arizona Order to Personal Representative can facilitate coordination in cases where trust and estate matters overlap.

The time it takes to settle an estate varies, but it often depends on the complexity and nature of the estate. In Arizona, settling an estate generally takes several months to over a year. Factors such as the clarity of the will, the presence of disputes among heirs, and the estate's size all play a role in this timeline. Applying for the Arizona Order to Personal Representative can help initiate the settlement process more efficiently.

To become a personal representative for an estate in Arizona, an interested party must file a petition with the probate court. This process includes submitting the Arizona Order to Personal Representative along with the required documentation. As a representative, you will have responsibilities that include managing the estate's assets and ensuring proper distribution according to the wishes outlined in the will. Utilizing uslegalforms can guide you through the necessary steps and paperwork for a smooth appointment.

A personal representative in Arizona can be a competent adult, which may include a relative, friend, or even a professional fiduciary. According to the Arizona Order To Personal Representative and Acknowledgement and Information to Heirs/Devisees, nominees must not have felony convictions or conflicts of interest. Factors such as residency and relationship to the deceased may also influence eligibility. For more detailed information, uslegalforms can provide helpful guidance to navigate these requirements.

In Arizona, bank accounts with designated beneficiaries generally do not go through probate. The funds will pass directly to the named beneficiaries upon the account holder's death, according to the Arizona Order To Personal Representative and Acknowledgement and Information to Heirs/Devisees protocols. This can significantly simplify the estate settlement process. However, other assets may still require probate, so it’s best to consult with an estate planning advisor.

To become a personal representative for an estate in Arizona, you must file a petition with the probate court. The court will evaluate your eligibility based on the Arizona Order To Personal Representative and Acknowledgement and Information to Heirs/Devisees standards. It typically requires you to be an adult and may need the consent of other heirs. You can also seek assistance from uslegalforms, which offers valuable resources to guide you through this process.

In Arizona, a personal representative typically has one year to settle an estate, but this period may vary depending on the circumstances. It is important to follow the Arizona Order To Personal Representative and Acknowledgement and Information to Heirs/Devisees guidelines to ensure compliance with state laws. Delays may occur due to complexities in the estate or disputes among heirs, so timely action is crucial. Consulting with a legal expert can also help streamline the process.