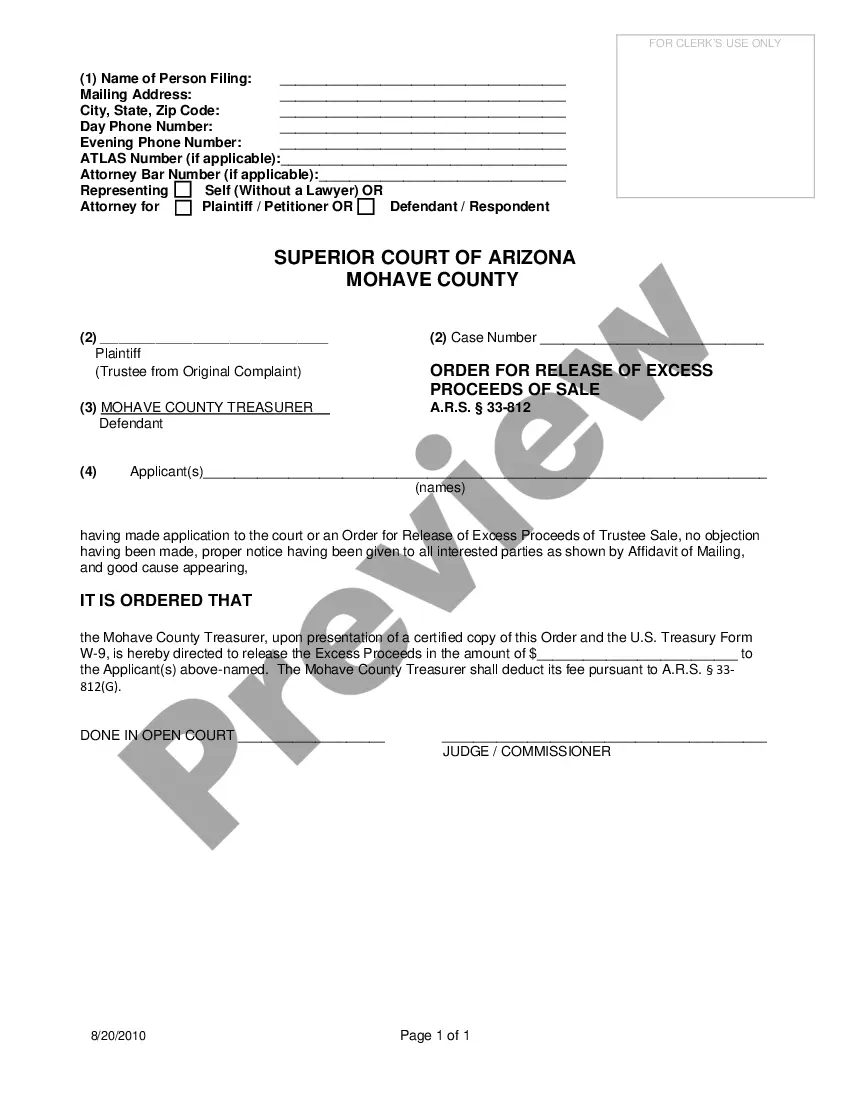

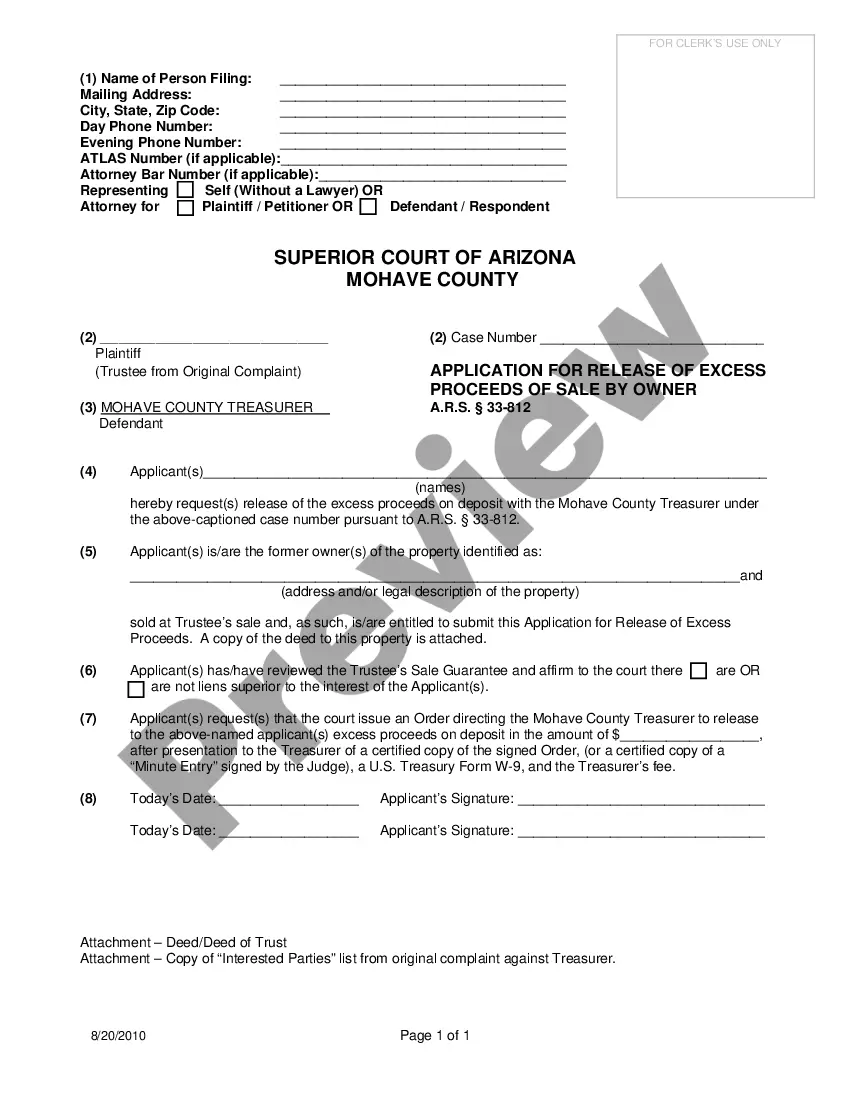

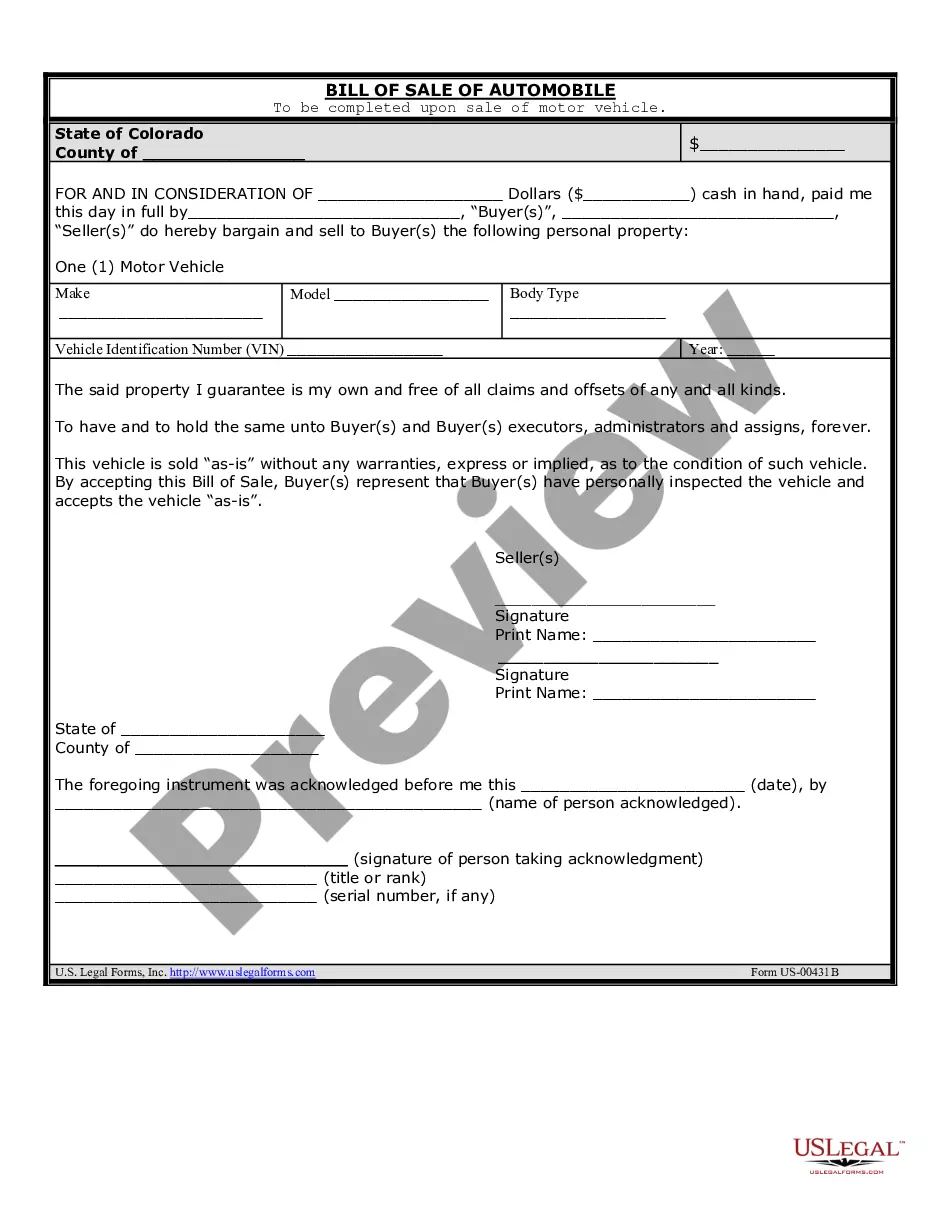

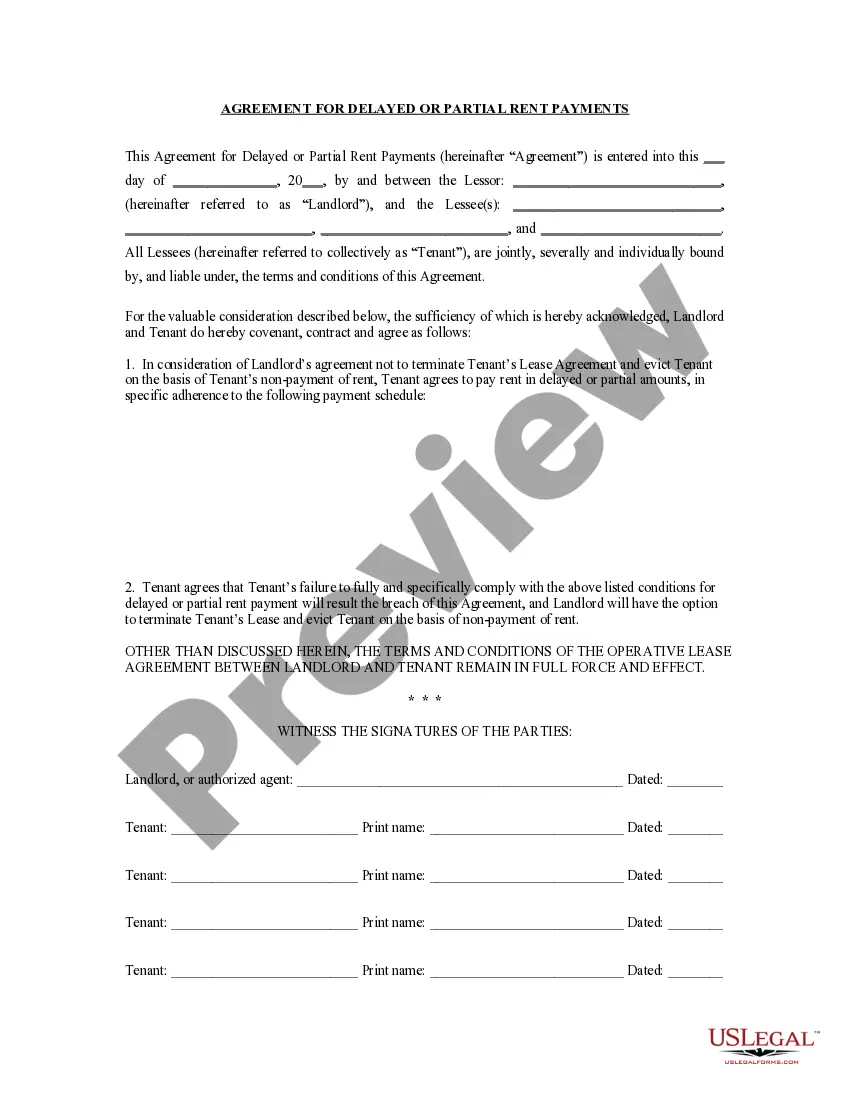

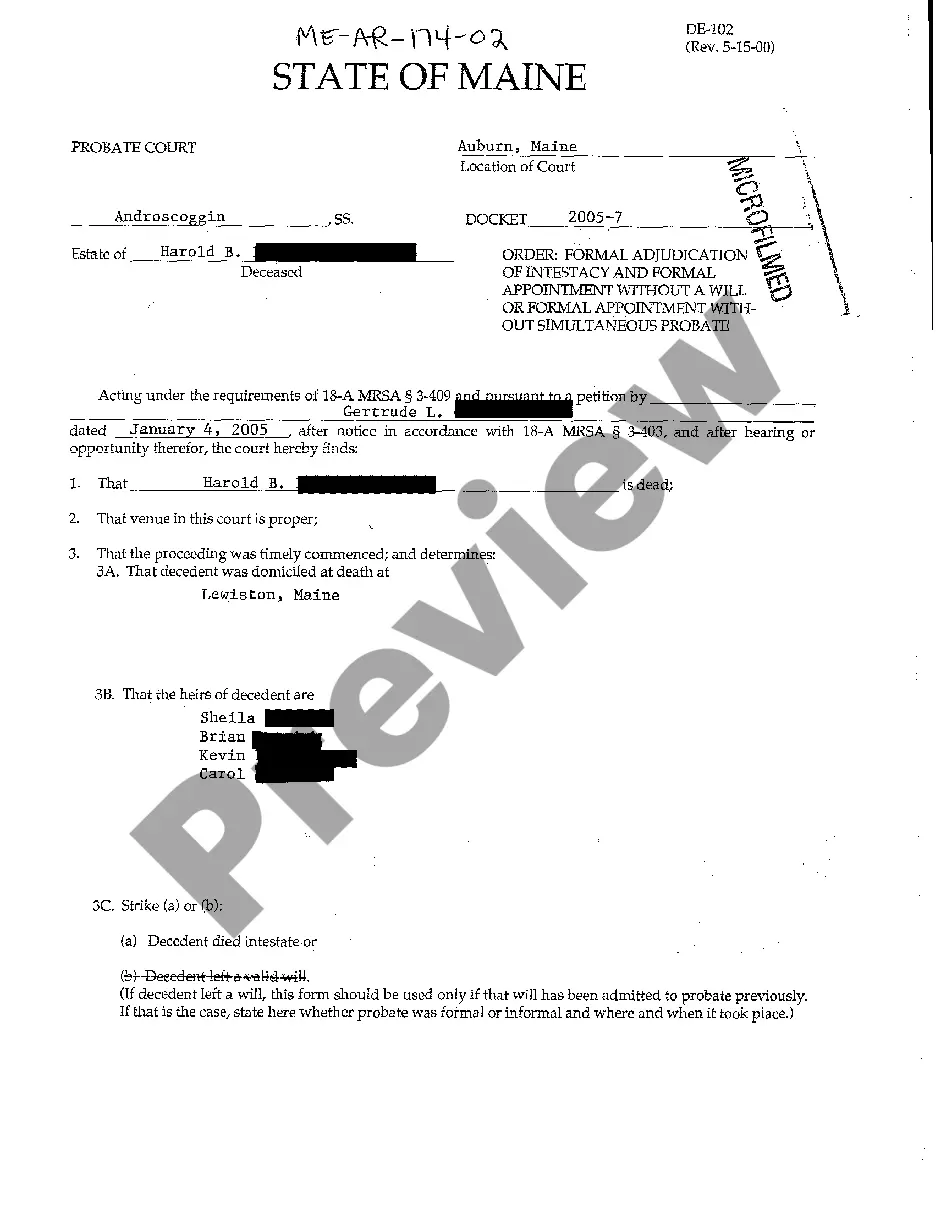

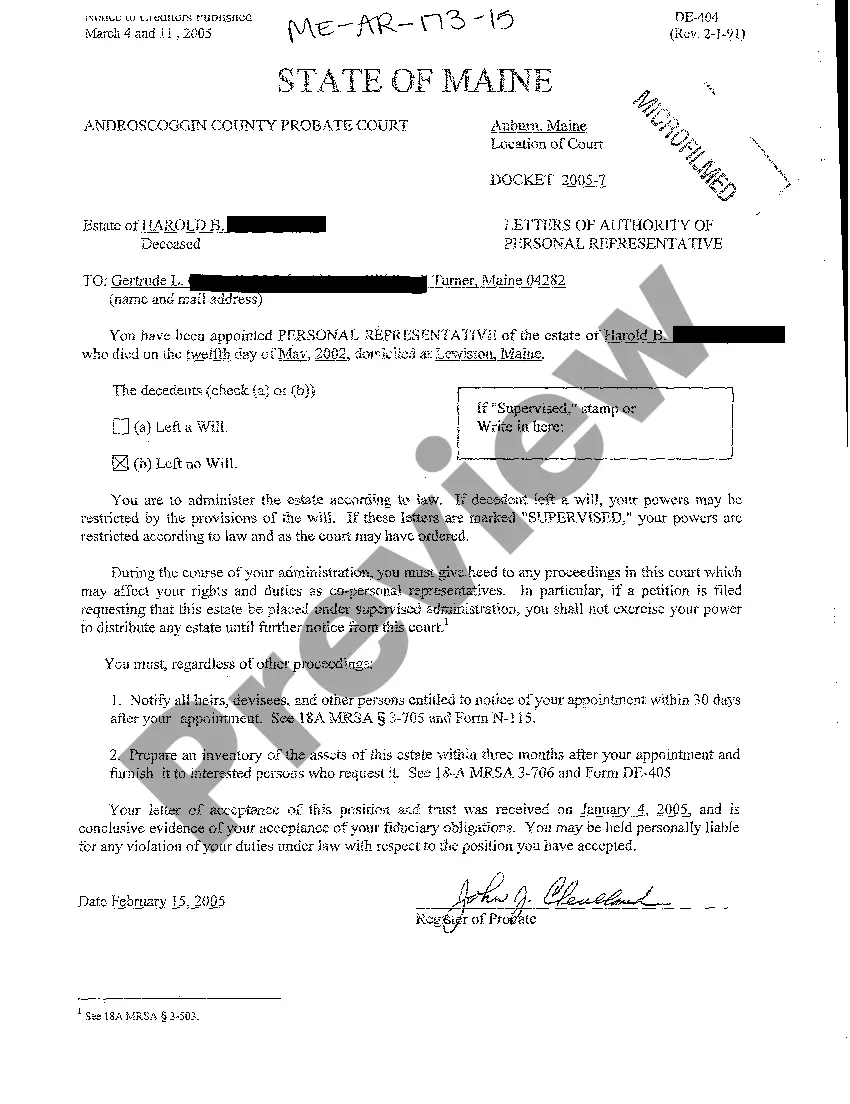

Arizona Application For Release Of Excess Proceeds Of Sale By Owner is a legal document used to release any remaining funds from a sale of real estate in Arizona. It is mostly used in situations where the sale of a home, land, or other property has resulted in excess proceeds, and the seller wishes to have these funds released to them. This form is typically filled out and filed with the county recorder's office and includes information such as the seller's name, the buyer's name, the property address, the amount of excess proceeds, and the seller's signature. There are two types of Arizona Application For Release Of Excess Proceeds Of Sale By Owner: the Single Family Residential and the Commercial Property. The Single Family Residential form is used for the sale of a single-family home, and the Commercial Property form is used for the sale of any other type of real estate.

Arizona Application For Release Of Excess Proceeds Of Sale By Owner

Description

How to fill out Arizona Application For Release Of Excess Proceeds Of Sale By Owner?

What amount of time and resources do you generally allocate to drafting official documents.

There is a superior alternative to obtaining such forms than engaging legal professionals or investing hours scouring the internet for an appropriate template. US Legal Forms is the premier online repository that provides expertly drafted and validated state-specific legal documents for any purpose, including the Arizona Application For Release Of Excess Proceeds Of Sale By Owner.

Another advantage of our library is that you can retrieve previously acquired documents stored securely in your profile under the My documents section. Access them at any time and redo your documentation as often as necessary.

Conserve time and effort in preparing formal paperwork with US Legal Forms, one of the most dependable online solutions. Join us today!

- Review the form details to ensure it complies with your state regulations. To do this, examine the form description or utilize the Preview option.

- If your legal template does not fulfill your requirements, find another one utilizing the search feature located at the top of the page.

- If you already possess an account with us, Log In and download the Arizona Application For Release Of Excess Proceeds Of Sale By Owner. If not, move on to the subsequent steps.

- Click Buy now once you identify the appropriate template. Choose the subscription plan that best fits your needs to access the complete library’s services.

- Sign up for an account and process your subscription payment. Transactions can be made with your credit card or via PayPal - our service guarantees safety for these transactions.

- Download your Arizona Application For Release Of Excess Proceeds Of Sale By Owner onto your device and fill it out either on a printed form or electronically.

Form popularity

FAQ

In Arizona, you have 12 months from the date of the sale to claim any surplus funds after a foreclosure or tax lien sale. It is essential to act within this timeframe to ensure you receive the funds owed to you. If you are unfamiliar with the claim process, the Arizona Application For Release Of Excess Proceeds Of Sale By Owner can guide you through claiming your excess proceeds efficiently.

Yes, Maricopa County offers a senior property tax freeze program for qualified seniors. This program helps eligible homeowners maintain their property tax amounts, preventing increases as long as they meet certain criteria. To take advantage of this program, you may need to submit an application, and the Arizona Application For Release Of Excess Proceeds Of Sale By Owner can be beneficial if you are dealing with excess funds related to property sales.

Foreclosure payout refers to the distribution of proceeds generated from a property sold at a foreclosure auction. This payout first covers outstanding debts on the property, including the mortgage, legal fees, and taxes. The remaining funds may be available to the previous owner or other lien holders. For assistance with this process, consider platforms like US Legal Forms with resources related to the Arizona Application For Release Of Excess Proceeds Of Sale By Owner to guide you in filing your claim.

In California, excess proceeds from foreclosure sales can be claimed by the former homeowner or other lien holders. The funds are held by the county where the sale took place, and a claim must be filed to access those funds. To simplify the experience, consider using US Legal Forms, especially for the Arizona Application For Release Of Excess Proceeds Of Sale By Owner, to ensure you complete the claim correctly.

The order of proceeds from a foreclosure sale typically starts with paying off the outstanding mortgage and any associated fees. Next, any junior lien holders may receive payment, followed by property taxes. Understanding this sequence is vital, and using a service like US Legal Forms can help you navigate the Arizona Application For Release Of Excess Proceeds Of Sale By Owner effectively.

In Texas, claiming excess proceeds from a foreclosure sale involves submitting a claim to the court. You must properly document your interest in the property and show that there are excess funds available. Utilizing resources like US Legal Forms can streamline your application with tools tailored to the Arizona Application For Release Of Excess Proceeds Of Sale By Owner, making the process simpler and more efficient.

To claim surplus funds from a foreclosure sale in Florida, you need to file a claim in the court where the foreclosure occurred. First, identify the excess amount after the sale and gather your documentation. It is advisable to consult with legal professionals or use platforms like US Legal Forms for guidance through the Arizona Application For Release Of Excess Proceeds Of Sale By Owner process, ensuring you follow all necessary steps.

Arizona does not have a redemption period for non-judicial foreclosures. Once the foreclosure sale is finalized, the homeowner loses the right to reclaim the property. However, homeowners can file for excess proceeds if the sale generates funds beyond what was owed. To access these funds, it is essential to understand the Arizona Application For Release Of Excess Proceeds Of Sale By Owner, which helps former owners reclaim what they may rightfully deserve.