An affidavit is a written, sworn statement by an individual witnessed and signed by a Notary Public or other official person. The 'affiant' swears to the truth of the written statement. This form, a sample Application and Affidavit for Order for Judgment Without Notice, can be used as an affidavit on the named topic. Adapt the model language to fit your own circumstances and sign in the presence of a Notary. Available for download now in standard format(s).

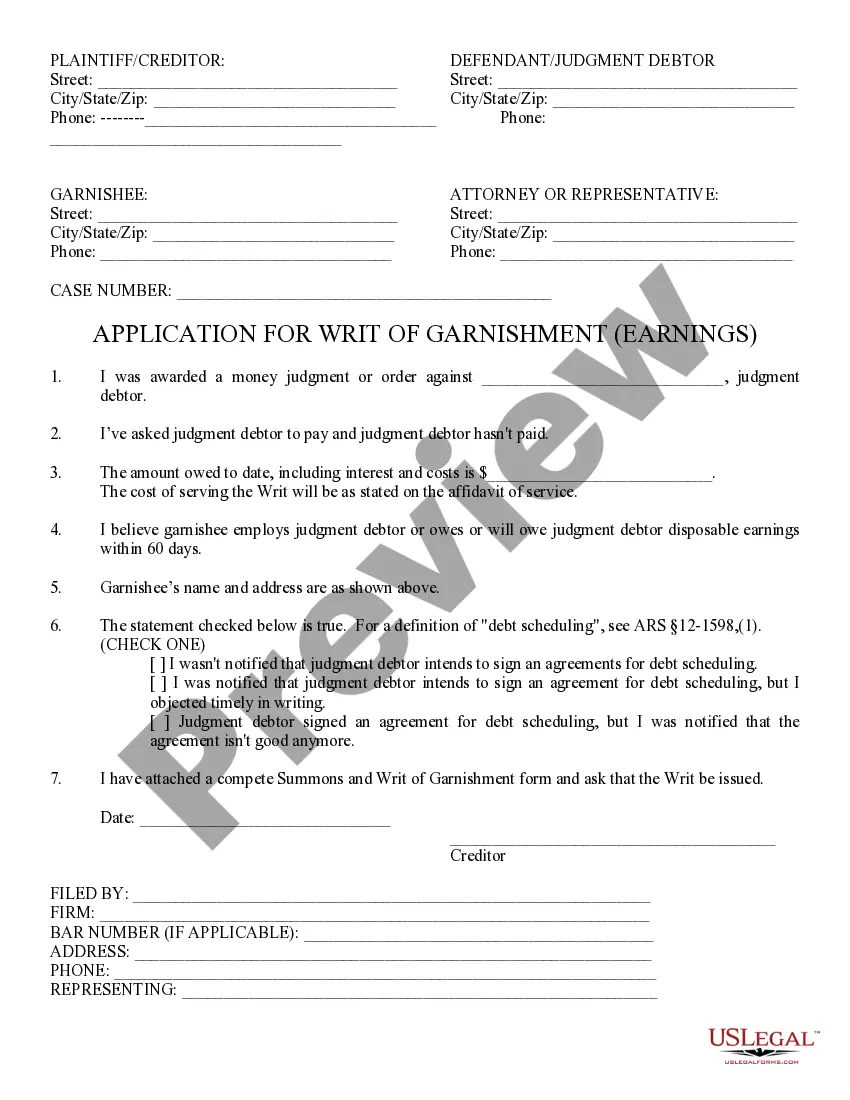

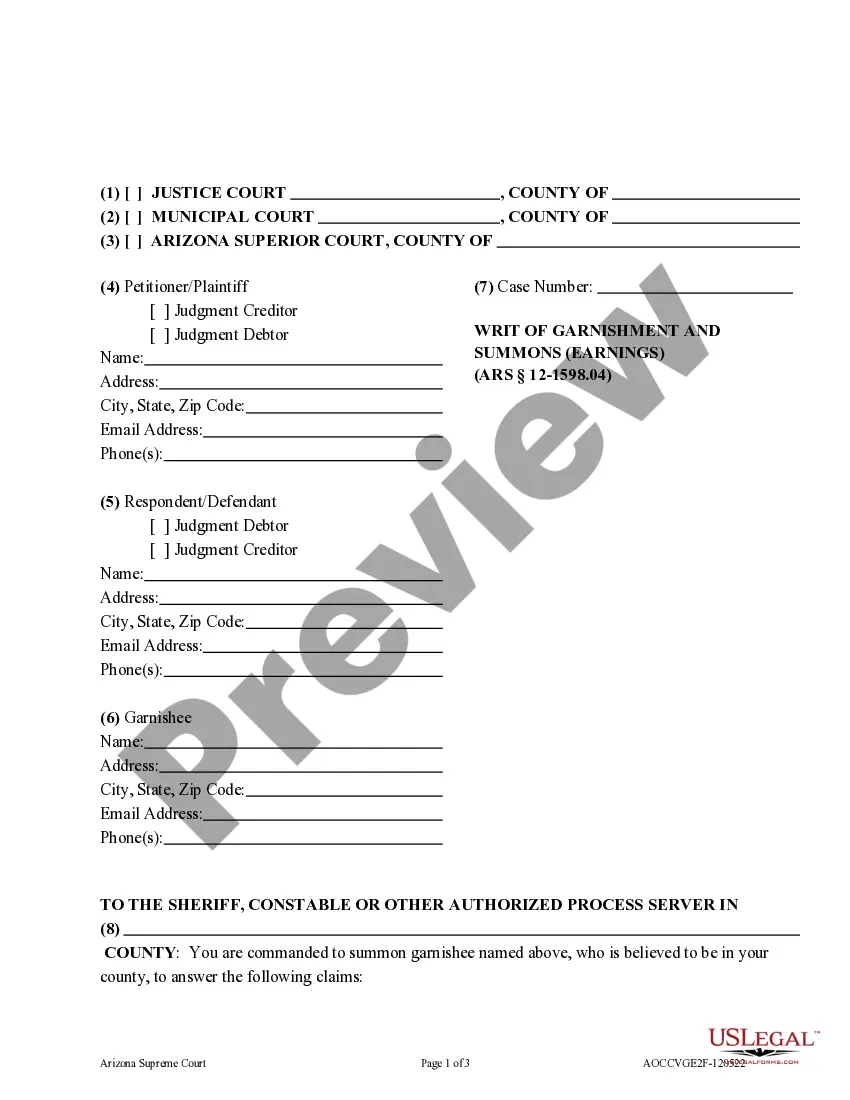

Arizona Application for Writ of Garnishment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Application For Writ Of Garnishment?

If you're looking for specific Arizona Application and Affidavit for Order for Judgment Without Notice forms, US Legal Forms is exactly what you require; access documents crafted and reviewed by state-authorized attorneys.

Utilizing US Legal Forms not only protects you from issues related to legal documents; you also save time, effort, and money! Downloading, printing, and completing a professional template is far less expensive than hiring an attorney to draft it for you.

And that’s it. In just a few simple clicks, you have an editable Arizona Application and Affidavit for Order for Judgment Without Notice. Once your account is set up, all future requests will be even easier. After subscribing to US Legal Forms, just Log In to your profile and click the Download button you can find on the form’s page. Then, when you need to use this template again, you will always be able to locate it in the My documents section. Don't waste your time comparing countless forms across various sites. Order accurate documents from one secure source!

- To initiate, complete your registration by providing your email and creating a password.

- Follow the instructions below to set up your account and obtain the Arizona Application and Affidavit for Order for Judgment Without Notice template for your situation.

- Make use of the Preview option or view the file details (if available) to confirm that the template is what you need.

- Check its validity in your jurisdiction.

- Click Buy Now to place your order.

- Choose a preferred pricing plan.

- Establish your account and pay using your credit card or PayPal.

- Select a suitable format and save the form.

Form popularity

FAQ

In Arizona, a maximum of 25% of your disposable income can be garnished for most debts. However, if you are receiving certain types of benefits or your income is below a particular level, you may be protected from any garnishment. Understanding these rules is vital for anyone facing potential garnishment. The Arizona Application for Writ of Garnishment is an important tool for managing this process effectively.

Stopping a garnishment in Arizona can be achieved by filing a motion with the court or negotiating with the creditor directly. You can present evidence of financial hardship or other valid reasons to stop the garnishment. It’s also beneficial to consult legal resources to understand your rights better. Utilizing the Arizona Application for Writ of Garnishment may simplify your legal filings.

In Arizona, the amount a creditor can legally garnish from your wages is typically limited to 25% of your disposable earnings. However, if your earning capacity falls below a specific income threshold, you might be exempt from garnishment altogether. It is essential to be informed about these limits, especially when dealing with an Arizona Application for Writ of Garnishment.

To stop wage garnishment in Arizona, you can file a motion to the court that authorized the garnishment. This motion should include reasons such as excessive hardship or successful debt settlement. You might also pursue a negotiation with the creditor to arrive at a mutually agreeable resolution. Understanding the Arizona Application for Writ of Garnishment can guide you through this process efficiently.

Filing a garnishee answer in Arizona requires you to complete specific forms provided by the court. These forms typically include details about the garnished funds and your relationship to the debtor. You must file your answer within the timeframe specified in the garnishment order to avoid penalties. This process is crucial for responding appropriately to an Arizona Application for Writ of Garnishment.

To quickly stop a wage garnishment, the best approach is to file a motion with the court that issued the garnishment. You can argue your case based on exemptions or the failure to follow legal procedures. Additionally, communicating directly with your creditor might also lead to a negotiated settlement. Using the Arizona Application for Writ of Garnishment can facilitate your filing process.

The new law for garnishment in Arizona strengthens consumer protections against wage garnishment. It outlines the procedures creditors must follow when seeking to garnish wages. Changes include limits on the amount that can be garnished and enhancements in notifying debtors about the garnishment process. Understanding these updates is important, especially if you are considering an Arizona Application for Writ of Garnishment.

Yes, creditors can garnish your bank account in Arizona. They typically obtain a court judgment before accessing your account funds. To prevent this, you should take proactive steps, such as responding to any legal notifications and understanding your rights under the Arizona Application for Writ of Garnishment. The US Legal Forms platform offers helpful resources to navigate this situation effectively.

To stop a wage garnishment in Arizona, you need to file a motion with the court and present valid reasons to halt the garnishment. You might also negotiate directly with your creditor to reach a mutually acceptable agreement. Utilizing the Arizona Application for Writ of Garnishment can clarify the necessary steps and benefits of legal consultation. Platforms like US Legal Forms can streamline this process and provide the essential forms.

The maximum wage garnishment in Arizona is typically capped at 25% of your disposable earnings. However, there are special circumstances, like child support or tax debts, that may alter this limit. If you have concerns about wage garnishments, it is helpful to refer to the Arizona Application for Writ of Garnishment. Resources available on platforms like US Legal Forms can provide additional clarity and assistance.