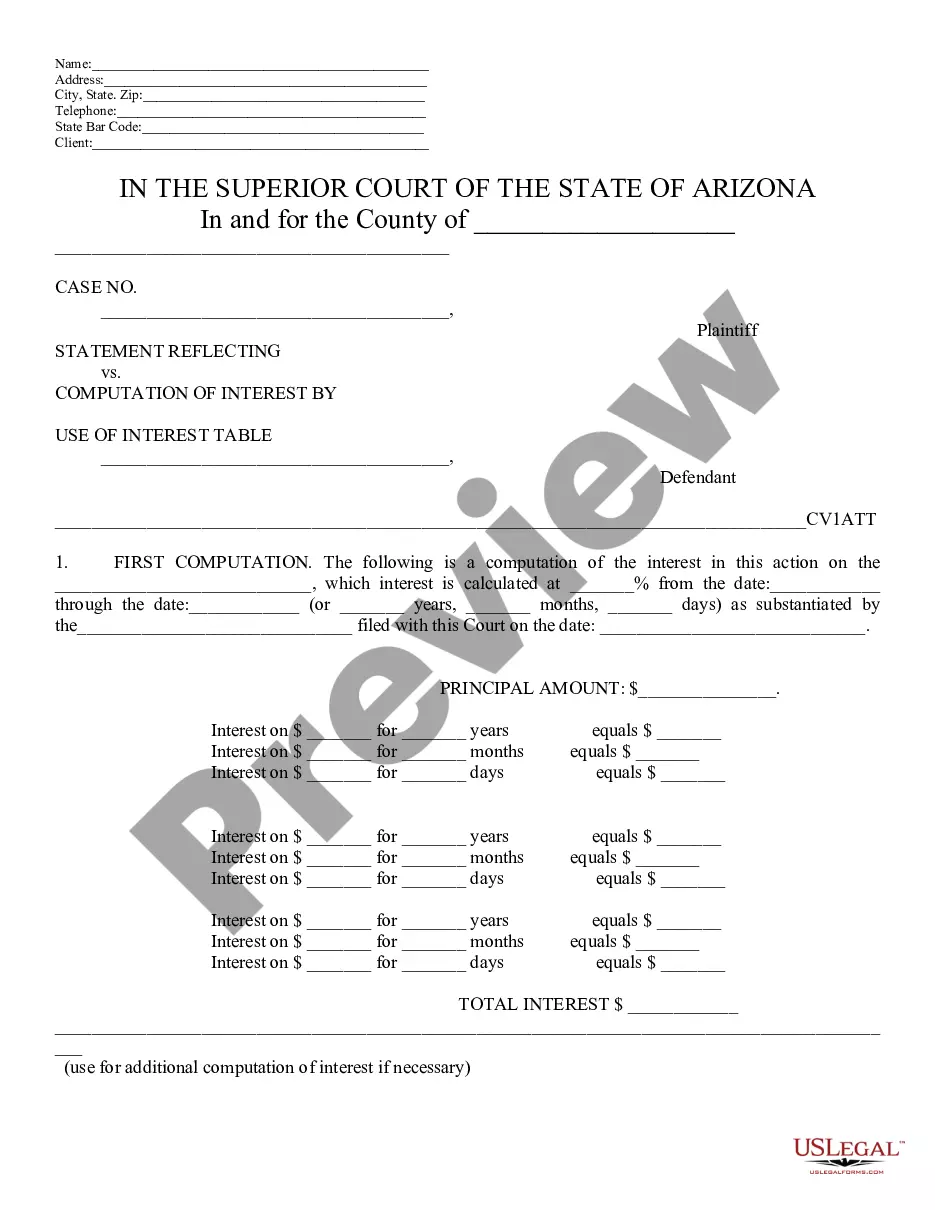

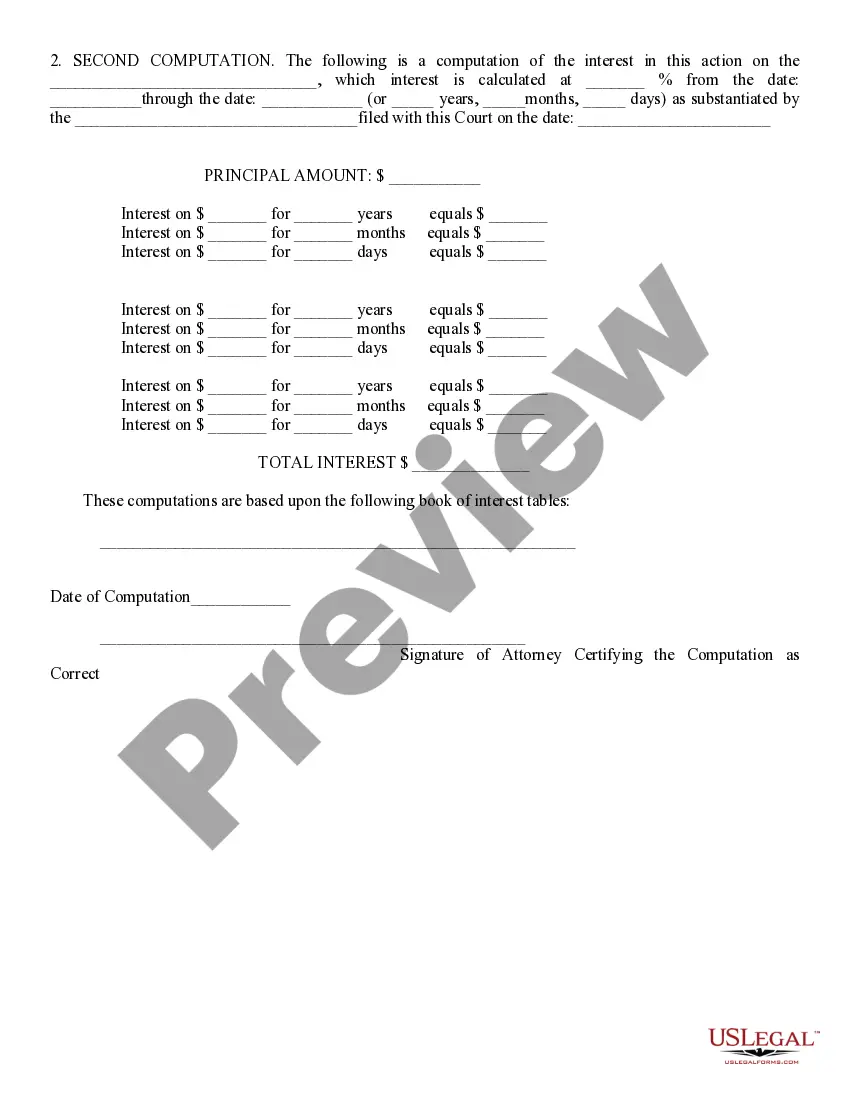

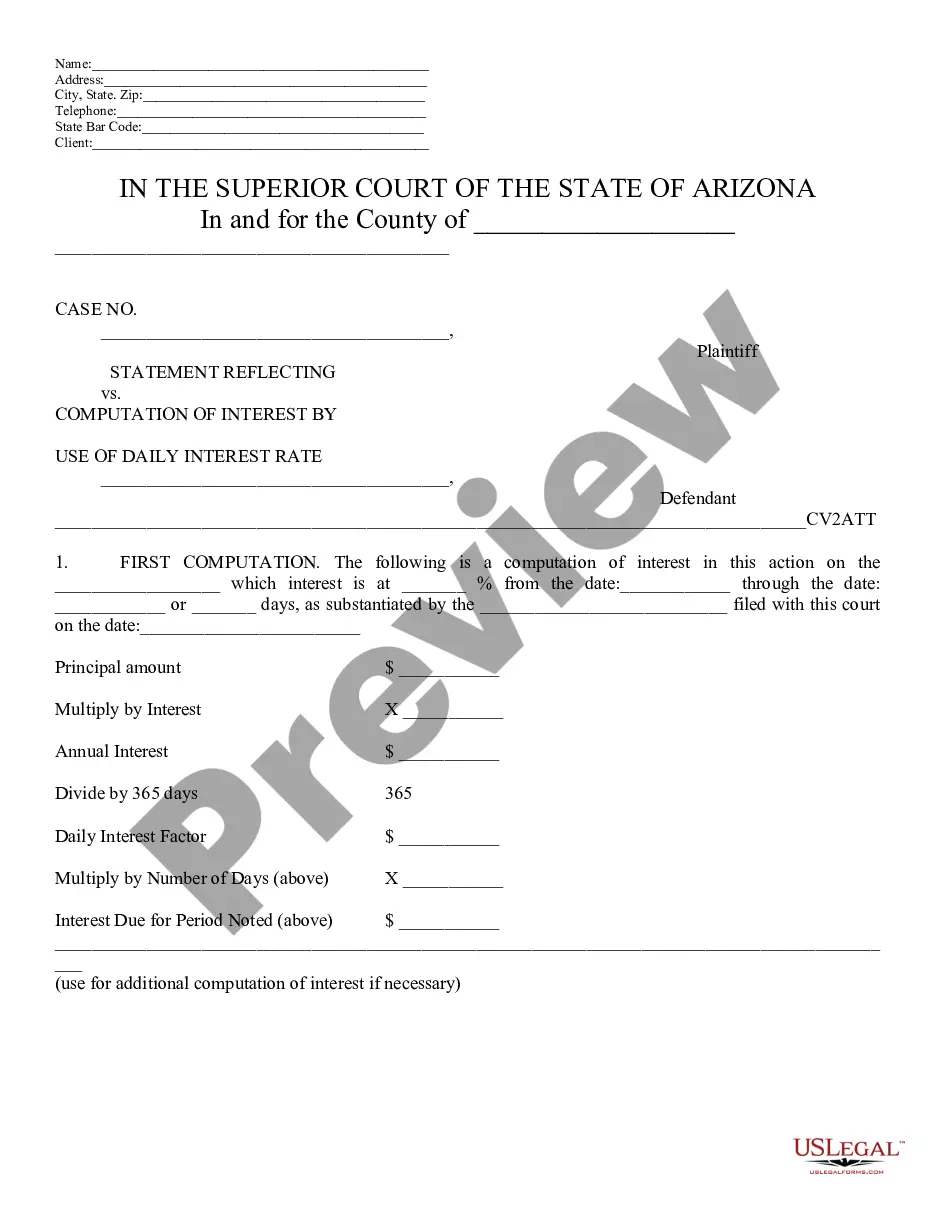

This is a Statement Reflecting Computation of Interest Using Interest Table. It reflects the interest accrued in a particular case. It further displays how the attorney arrived at the computation, by showing the interst table used. It is signed and dated by the presenting attorney.

Arizona Statement Reflecting Computation of Interest Using Interest Table

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Statement Reflecting Computation Of Interest Using Interest Table?

If you're searching for precise Arizona Statement Reflecting Computation of Interest Using Interest Table samples, US Legal Forms is your solution; discover documents crafted and verified by state-accredited lawyers.

Utilizing US Legal Forms not only spares you from concerns regarding legal documents; you also conserve effort and money! Downloading, printing, and filling out a professional form is actually more cost-effective than hiring an attorney to prepare it for you.

And just like that, in just a few simple clicks, you obtain an editable Arizona Statement Reflecting Computation of Interest Using Interest Table. When you create an account, all future orders will be handled even more easily. If you have a US Legal Forms subscription, simply Log In to your profile and click the Download button visible on the form's page. Then, when you need to use this template again, you'll always be able to find it in the My documents section. Don’t waste your time sifting through numerous forms on various online platforms. Purchase accurate documents from a single reliable service!

- To get started, finalize your registration process by entering your email and creating a secure password.

- Follow the instructions below to set up an account and locate the Arizona Statement Reflecting Computation of Interest Using Interest Table template to address your needs.

- Use the Preview function or review the file details (if accessible) to ensure that the form matches your requirements.

- Verify its legality in your jurisdiction.

- Click Buy Now to place an order.

- Choose a suitable pricing plan.

- Create your account and pay using your credit card or PayPal.

- Select a preferred format and save your document.

Form popularity

FAQ

In Arizona, the minimum income requirement to avoid filing a tax return varies based on factors such as filing status and age. Generally, if your income falls below a specific threshold, you may not need to file. It’s wise to refer to the Arizona Statement Reflecting Computation of Interest Using Interest Table for clarity about your specific situation and to ensure you're aware of potential filing requirements.

Arizona mandates a specific interest rate for overdue taxes, which is typically adjusted annually. This rate affects how much interest accumulates on unpaid taxes, and understanding it is crucial for effective tax management. To navigate these figures confidently, utilize the Arizona Statement Reflecting Computation of Interest Using Interest Table for precise interest calculations.

The AZ form 140A is a simplified version of the Arizona individual income tax return designed for residents with straightforward tax situations. This form streamlines the filing process and is ideal for those without complex deductions or credits. If you need help understanding the tax implications, the Arizona Statement Reflecting Computation of Interest Using Interest Table can provide valuable insights.

Line 29a on the Arizona form 140 refers to the addition of certain tax credits or adjustments that affect your overall income tax calculation. This line plays a significant role in your final tax liability and should be filled out accurately. For clarity and precision, consider using the Arizona Statement Reflecting Computation of Interest Using Interest Table to guide you through any uncertainties in your calculations.

The Arizona income tax deduction allows taxpayers to reduce their taxable income, which ultimately lowers their tax liability in Arizona. This deduction can apply to various categories, including medical expenses and certain retirement contributions. When claiming deductions, remember to utilize the Arizona Statement Reflecting Computation of Interest Using Interest Table for accurate calculations and to maximize your tax benefits.

You can mail your Arizona state tax forms to the address provided in the instructions accompanying each form. Typically, the location varies based on whether you are including payment or if you are filing a specific form. Always ensure your Arizona Statement Reflecting Computation of Interest Using Interest Table is submitted to the correct address to avoid delays.

Filing Arizona Form 165 late can result in penalties and interest on the amount due. The penalty generally starts at 4.5% of the unpaid tax for each month it's late, capped at 22.5%. To avoid potential issues, keep track of your due dates and ensure your Arizona Statement Reflecting Computation of Interest Using Interest Table is completed on time.

Yes, Arizona Form 165 accepts a federal extension. If you have filed for an extension with the IRS, you can generally apply that to your Arizona filing as well. This is particularly beneficial when you need additional time to calculate your Arizona Statement Reflecting Computation of Interest Using Interest Table accurately.

You should file Arizona Form 165 with the Arizona Department of Revenue. Specifically, the form can be sent electronically or through the mail, depending on your preference. Always refer to the instructions provided with your Arizona Statement Reflecting Computation of Interest Using Interest Table for any updated filing guidelines.

Arizona Form 165 is required for various entities, including corporations and partnerships, that have taxable income in Arizona. If your business engages in activities generating income within the state, you must file this form. Utilizing the Arizona Statement Reflecting Computation of Interest Using Interest Table can help clarify any interest calculation discrepancies.