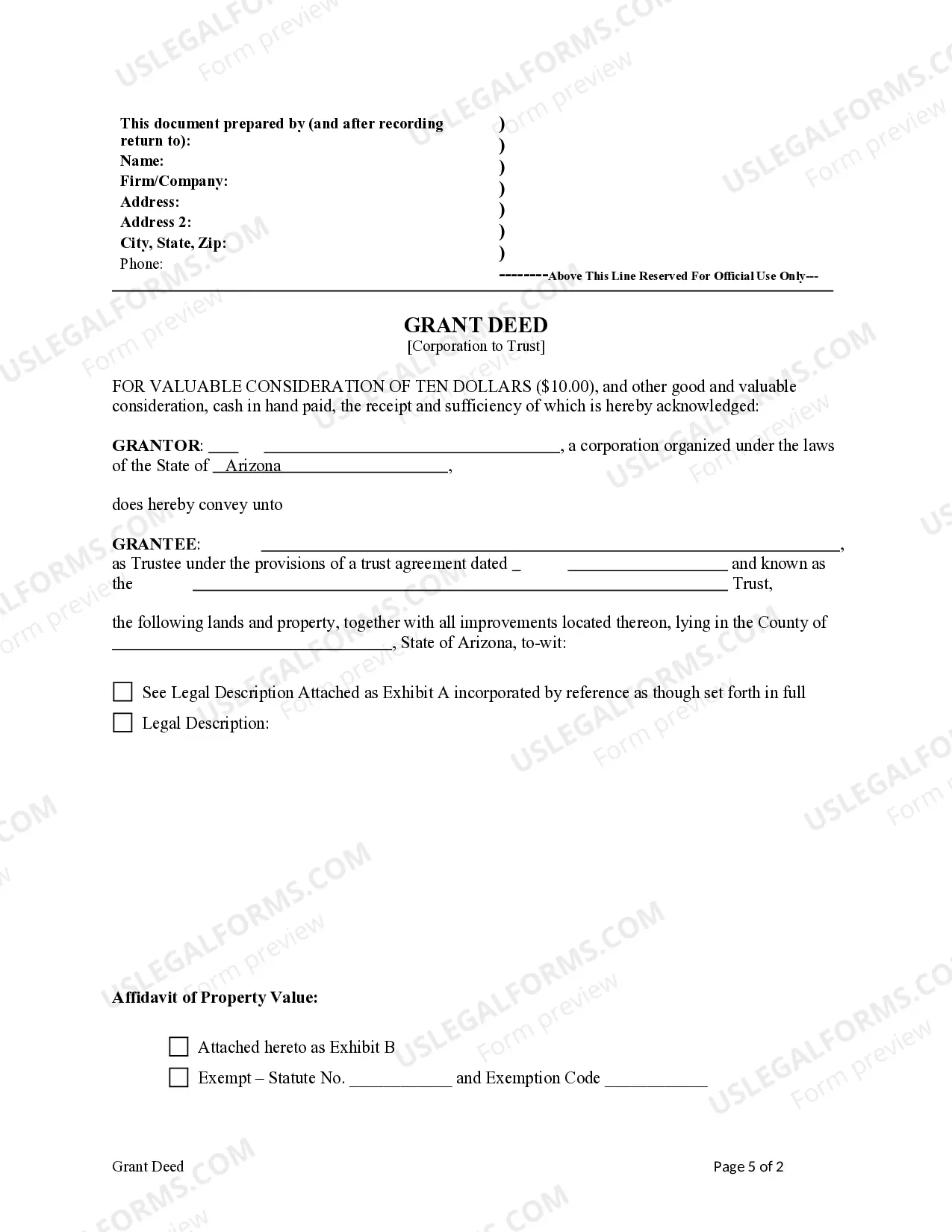

This form is a Warranty Deed where the Grantor is a limited liability company (LLC) and the Grantee is Trust. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Arizona Grant Deed from a Corporation to a Trust

Description

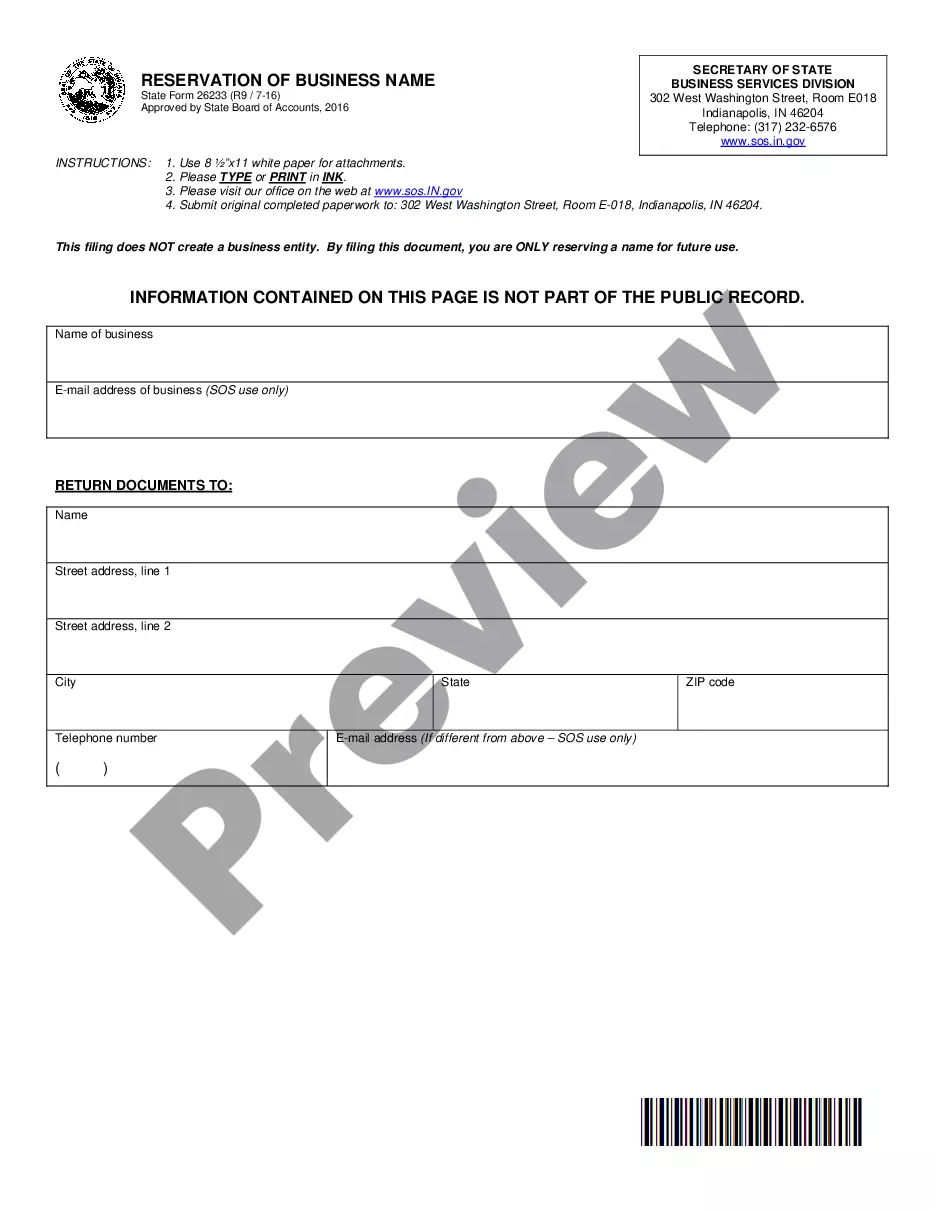

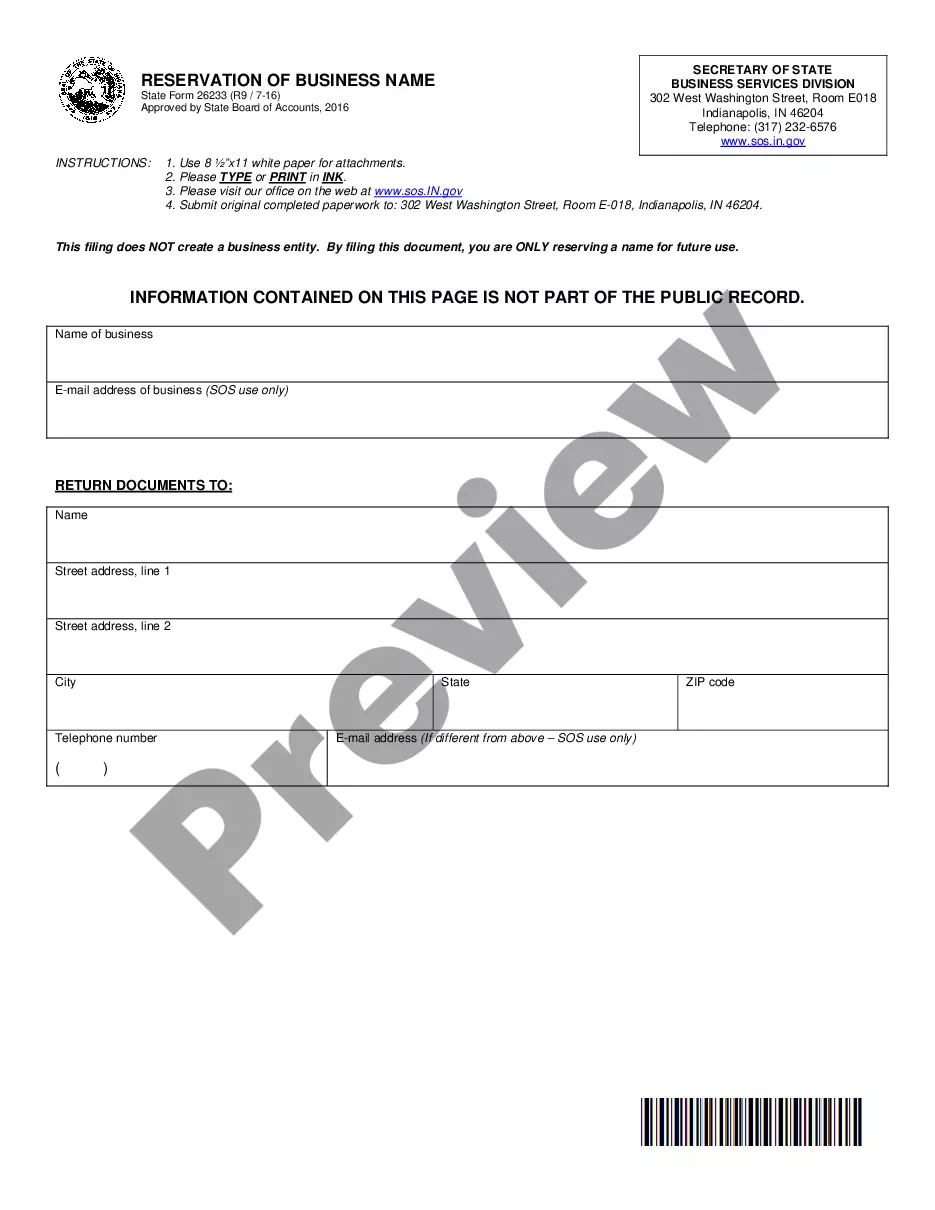

How to fill out Arizona Grant Deed From A Corporation To A Trust?

If you're in search of proper Arizona Grant Deed from a Corporation to a Trust samples, US Legal Forms is exactly what you require; access documents provided and examined by state-certified legal professionals.

Using US Legal Forms not only helps save you from concerns regarding legal documentation; furthermore, you do not expend time, effort, or money!

And that’s it. In just a few simple steps, you obtain an editable Arizona Grant Deed from a Corporation to a Trust. Once you create an account, all future purchases will be processed even more efficiently. After obtaining a US Legal Forms subscription, simply Log In to your account and click the Download button you see on the form's page. Then, when you need to use this template again, you can always find it in the My documents section. Don’t waste your time comparing numerous forms across various websites. Order professional templates from one reliable platform!

- Downloading, printing, and completing a professional form is considerably less expensive than hiring an attorney to do it for you.

- To begin, complete your registration process by entering your email and creating a secure password.

- Follow the instructions below to set up an account and locate the Arizona Grant Deed from a Corporation to a Trust template to fulfill your needs.

- Utilize the Preview tool or read the document details (if available) to confirm that the form you select is the one you desire.

- Check its relevance in your area.

- Click Buy Now to place your order.

- Select a preferred pricing option.

- Establish an account and pay using a credit card or PayPal.

- Choose an appropriate format and save the document.

Form popularity

FAQ

Generally, assets such as retirement accounts and certain insurance policies cannot be placed directly in a trust due to their specific designation and rules. However, an Arizona Grant Deed from a Corporation to a Trust can facilitate the transfer of real estate assets. For a clearer understanding of what you can and cannot place in a trust, US Legal Forms provides valuable resources and expert advice tailored to your needs.

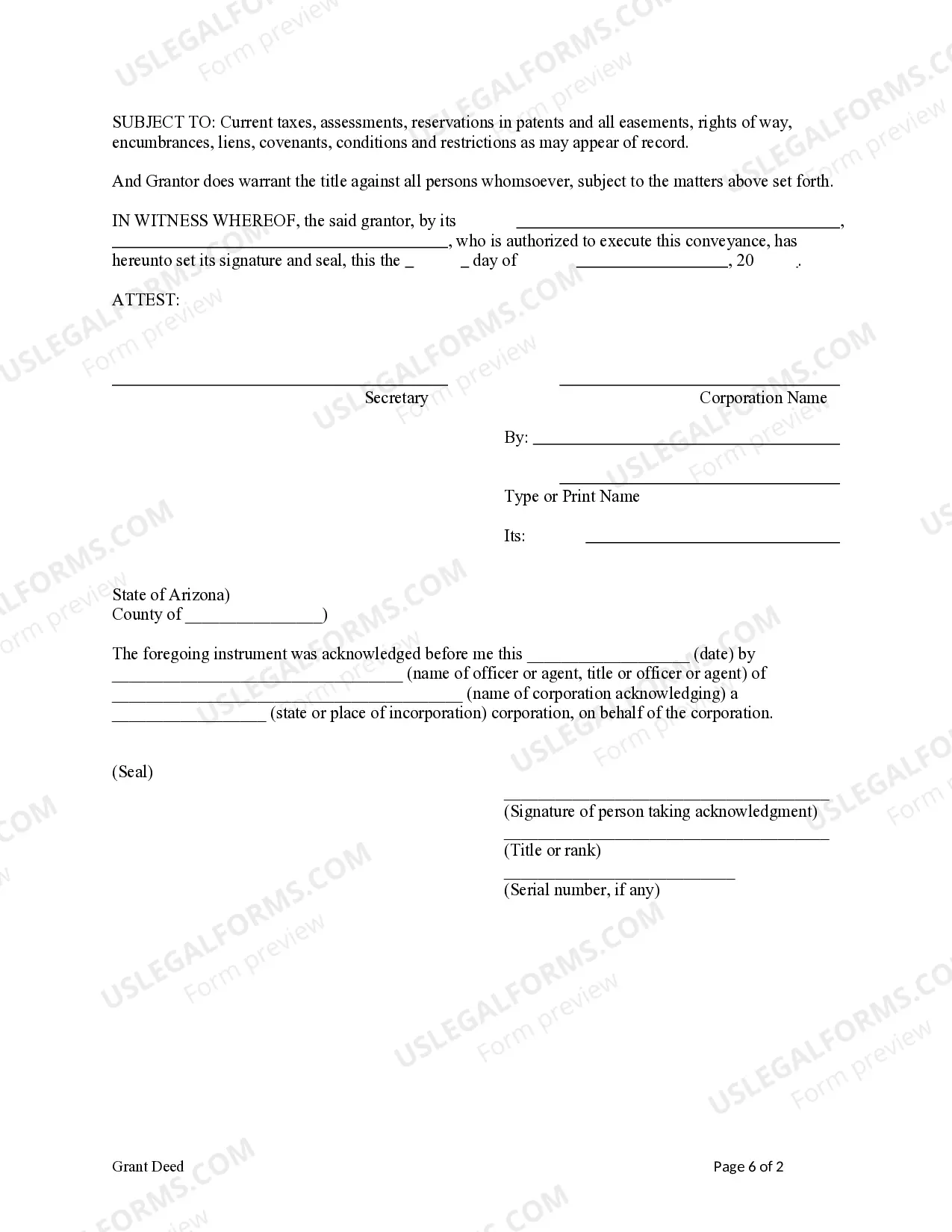

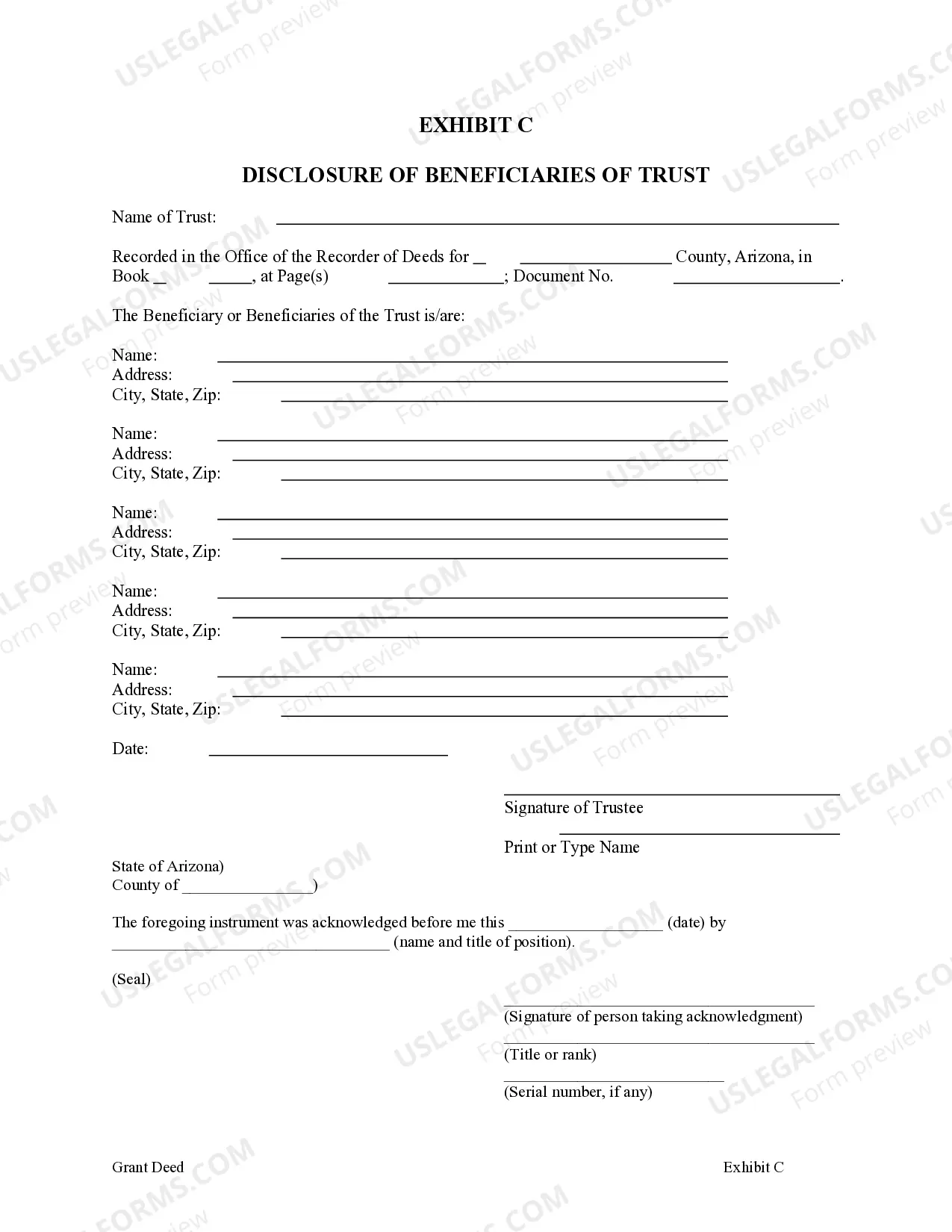

Transferring your property into a trust in Arizona involves creating an Arizona Grant Deed from a Corporation to a Trust. First, consult your trust document to ensure it meets Arizona's legal requirements. After preparing the deed, you will need to sign and notarize it, followed by recording it with the county recorder's office. This ensures the transfer is official and publicly documented.

To transfer property to a trust in Arizona, you will need to execute a new Arizona Grant Deed from a Corporation to a Trust. This document legally conveys ownership from the corporation to the trust. Ensure all necessary legal descriptions and identification details are accurately included. For added convenience, consider using an online platform like US Legal Forms, which offers templates and guidance for completing your deed.

To transfer accounts to a trust, you will typically need to contact your financial institution and provide them with the trust document. This allows the institution to update the ownership of the accounts accordingly. Keep in mind that using an Arizona Grant Deed from a Corporation to a Trust can facilitate asset integration into the trust, ensuring all assets are managed efficiently.

Transferring a deed to a trust in Arizona requires filing a new deed with the county recorder’s office. You must use an Arizona Grant Deed from a Corporation to a Trust to formally transfer ownership. It’s advisable to check the specific requirements with local authorities or seek advice from an attorney to ensure a smooth transfer.

To obtain a trust deed, you will need to create a trust document that outlines the terms and conditions of the trust. This document acts as the foundation for the trust deed. Additionally, legal professionals can help draft the necessary documents and explain the role of an Arizona Grant Deed from a Corporation to a Trust in this process.

Transferring items to a trust involves drafting and executing the proper legal documents. You’ll need to identify the assets and ensure they are titled in the name of the trust. For real estate, you may require an Arizona Grant Deed from a Corporation to a Trust. Consider professional assistance to streamline the process and avoid potential pitfalls.

Yes, a trust can indeed own an LLC in Arizona. When a trust holds an LLC, it provides added legal protection and helps manage assets efficiently. This structure can simplify the transfer of ownership, especially in scenarios involving an Arizona Grant Deed from a Corporation to a Trust. Make sure to consult with legal experts to ensure compliance with Arizona laws.

Transferring a deed to a trust in Arizona typically requires completing a new deed document. You must draft an Arizona Grant Deed from a Corporation to a Trust, specifying the trust as the new owner. Furthermore, once the deed is signed and notarized, it should be filed with the county recorder to complete the transfer process, ensuring the trust protects your assets.

Yes, you can create your own trust in Arizona using various resources available online. There are templates and guides that can help you navigate the process efficiently. However, consider using platforms like uslegalforms for clarity and correctness, especially when introducing complex elements like an Arizona Grant Deed from a Corporation to a Trust.