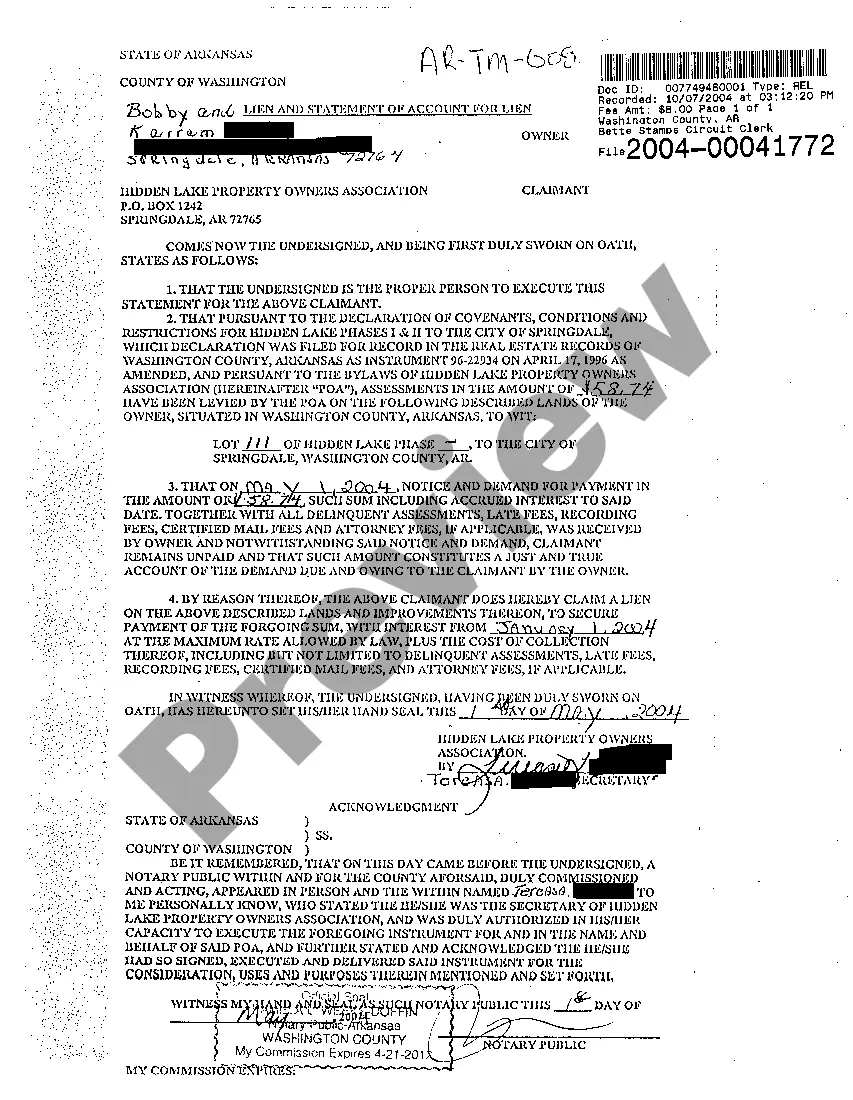

Arkansas Lien and Statement of Account For Lien

Description

How to fill out Arkansas Lien And Statement Of Account For Lien?

Among numerous free and paid samples available online, you cannot be assured of their dependability.

For instance, who developed them or if they are sufficiently qualified to handle what you require them for.

Always remain composed and use US Legal Forms!

Click Buy Now to initiate the purchasing procedure or search for an alternative sample using the Search bar located in the header.

- Obtain Arkansas Lien and Statement of Account For Lien templates crafted by experienced legal professionals and avoid the expensive and lengthy procedure of searching for a lawyer and subsequently compensating them to draft a document for you that you can locate on your own.

- If you possess a subscription, Log In to your account and find the Download button adjacent to the form you’re seeking.

- You will also have access to your previously saved templates in the My documents section.

- If you are using our service for the first time, adhere to the instructions below to acquire your Arkansas Lien and Statement of Account For Lien promptly.

- Ensure that the document you discover is valid in your locality.

- Examine the document by scrolling through the description using the Preview feature.

Form popularity

FAQ

In Arkansas, a lien typically remains on your property for three years unless it is satisfied or released earlier. This duration underlines the importance of addressing any outstanding debts promptly, as an Arkansas Lien and Statement of Account For Lien can affect your credit and property rights. Familiarize yourself with this timeframe to avoid complications in your property ownership. Staying informed can safeguard your financial future.

To place a lien on someone's property in Arkansas, you must first gather necessary documentation and complete a lien statement. After filing the statement with the county clerk's office, you must serve notice to the property owner. This process is vital in establishing your Arkansas Lien and Statement of Account For Lien. For assistance in drafting and filing documents, explore the resources offered by uslegalforms.

A notice of intent to lien in Arkansas is a formal communication sent to the property owner, notifying them of your intention to file a lien if payment is not made. This notice serves as a preliminary step to support your Arkansas Lien and Statement of Account For Lien. By providing this notice, you create awareness and a chance for resolution before legal actions are taken. It is a professional way to protect your interests.

To file a lien in Arkansas, begin by preparing a lien statement that includes specific details about the property, the amount owed, and your contact information. Once the statement is complete, file it with the county clerk's office in the county where the property is located. This process is essential for establishing your Arkansas Lien and Statement of Account For Lien. For guidance or forms, consider using the solutions available at uslegalforms.

In Arkansas, you typically have 120 days to file a lien from the completion of your work or supply of materials. This timeline applies to those wishing to benefit from the Arkansas Lien and Statement of Account For Lien process. To ensure proper protection of your rights, do not let this window pass unnoticed. Prompt action can make a significant difference in your financial outcome.

In Arkansas, a contractor must file a lien within 120 days after the last day of work performed or materials supplied. This timeframe is crucial, as it ensures your claim for payment is recognized under Arkansas law. Failing to file within this period may result in losing the right to enforce the Arkansas Lien and Statement of Account For Lien. Be proactive to protect your interests.

To find a lien on property in Arkansas, start by visiting the county clerk's office where the property is located. You can request access to public records, specifically the Arkansas Lien and Statement of Account For Lien. Additionally, online resources may be available through the local government’s website, allowing you to search for liens more conveniently. If you need assistance, consider using services like US Legal Forms, which offers streamlined access to documents and forms related to liens.

Yes, liens can expire in Arkansas, typically after a specific period unless renewed. Generally, a judgment lien lasts for ten years, after which it may require renewal to remain valid. This expiration offers protection to property owners by providing a clear timeline for resolution. Familiarizing yourself with the Arkansas Lien and Statement of Account For Lien will help you monitor your financial standing and understand when actions need to be taken.

An intent to lien letter in Arkansas serves as a formal notification that a lien may be placed on a property. This letter informs the property owner about the outstanding debt and provides them with an opportunity to settle it before a lien is filed. Receiving this letter is a crucial step in the process and emphasizes the importance of addressing account issues. Utilizing the Arkansas Lien and Statement of Account For Lien can clarify your rights in such situations.

In Arkansas, the statute of limitations on a judgment is typically ten years. This means that once a judgment is obtained, the creditor has ten years to enforce it through collection actions. If the creditor does not act within this time frame, the judgment may become unenforceable. Understanding the Arkansas Lien and Statement of Account For Lien can help you keep track of important deadlines.