Arkansas Amended Equity Fund Partnership Agreement

Description

How to fill out Amended Equity Fund Partnership Agreement?

Finding the right legitimate papers template can be a have a problem. Naturally, there are a lot of web templates available on the net, but how do you obtain the legitimate form you will need? Take advantage of the US Legal Forms web site. The services offers a large number of web templates, like the Arkansas Amended Equity Fund Partnership Agreement, that you can use for company and personal demands. All of the kinds are examined by specialists and meet federal and state needs.

Should you be currently authorized, log in for your bank account and click the Obtain button to have the Arkansas Amended Equity Fund Partnership Agreement. Make use of your bank account to check with the legitimate kinds you may have purchased earlier. Check out the My Forms tab of your bank account and get an additional version in the papers you will need.

Should you be a fresh end user of US Legal Forms, listed here are simple instructions for you to stick to:

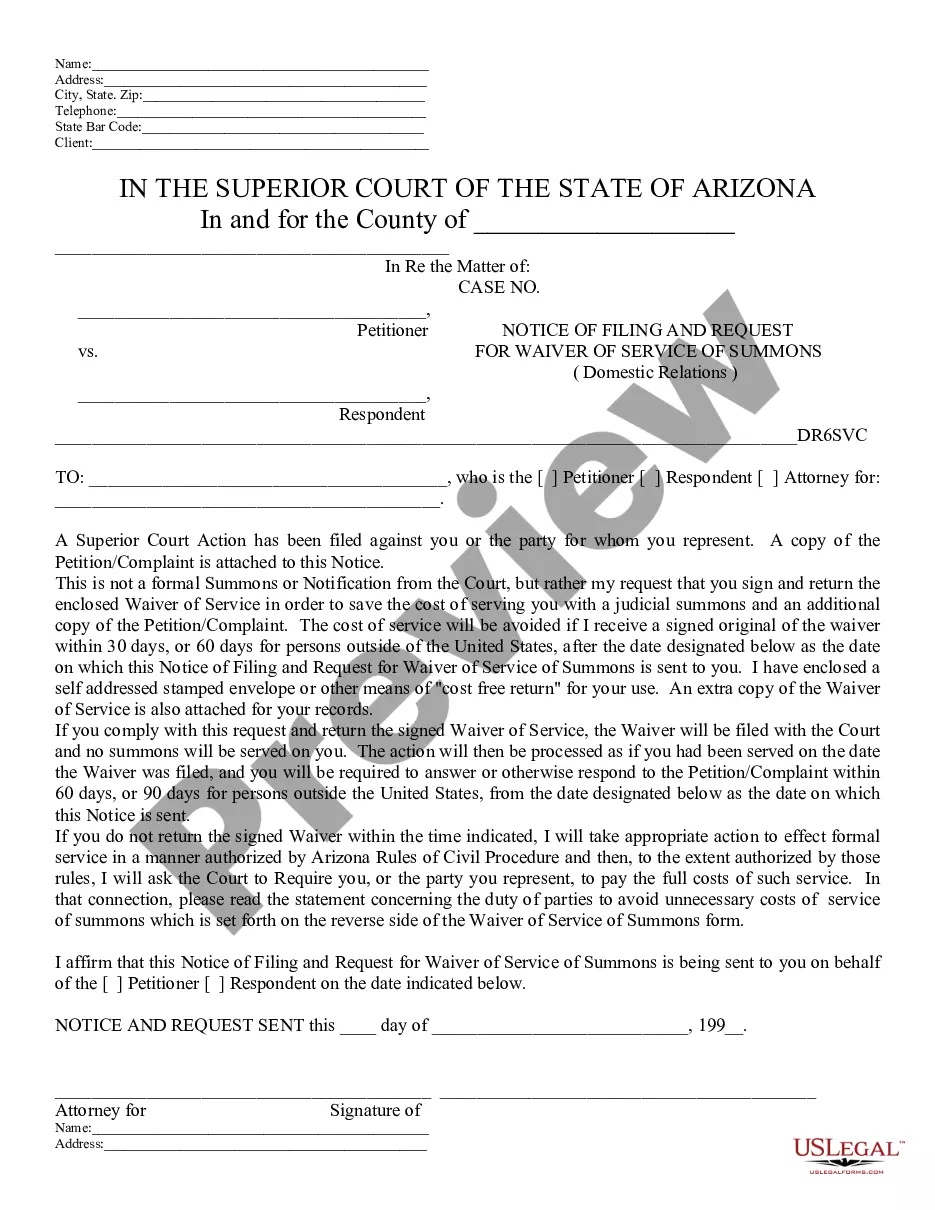

- Very first, make sure you have selected the appropriate form for your town/state. It is possible to examine the form while using Preview button and read the form explanation to ensure this is the best for you.

- In the event the form does not meet your expectations, make use of the Seach discipline to find the appropriate form.

- Once you are sure that the form is proper, click the Acquire now button to have the form.

- Opt for the rates program you would like and enter the essential information. Build your bank account and pay for an order with your PayPal bank account or charge card.

- Select the submit formatting and download the legitimate papers template for your system.

- Total, modify and produce and sign the attained Arkansas Amended Equity Fund Partnership Agreement.

US Legal Forms is the biggest library of legitimate kinds where you can discover various papers web templates. Take advantage of the service to download expertly-created papers that stick to status needs.

Form popularity

FAQ

If you have already filed a federal extension, you do not have to file a state extension. The State of Arkansas will honor an accepted Federal extension and your due date will be one month after the due date of the federal return. This is usually November 15th for annual filers and October 15th for Partnership returns.

Form AR1050 is used to file the income of a partnership. Every domestic or foreign partnership doing business within the State of Arkansas or in receipt of income from Arkansas sources, regardless of amount, must file an AR1050.

If you think you may need more time to prepare your return, you should file for an extension using Form 7004. The due date for your partnership return will be extended until September 15, 2024.

The good news is that because partnerships are pass-through entities, the profits qualify for the deduction that is granted for pass-through business income. So, your deduction is 20% of your share of the partnership's profit.

Arkansas Code Annotated 26-51-919(b)(1)(A) requires a pass-through entity to withhold income tax at the rate of 7% on each nonresident member's share of distributed Arkansas income.

If you are requesting a federal extension, you are most likely going to need a state extension as well, and the procedures that you must follow vary widely from state to state. Nearly all states follow the federal government's lead and allow an automatic six-month extension of time to prepare and file your tax return.

The State of Arkansas grants 180-day extensions to taxpayers who apply properly, which moves the filing deadline to October 15. You do not need to file a separate Arkansas tax extension if you have a valid Federal extension (IRS Form 4868).

General Partnership 15th day of the 3rd month after the close of your tax year.