New York Federal Consumer Leasing Act Disclosure Form

Description

How to fill out Federal Consumer Leasing Act Disclosure Form?

Are you in a situation where you require documents for either professional or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is not easy.

US Legal Forms provides thousands of template forms, including the New York Federal Consumer Leasing Act Disclosure Form, which is designed to comply with federal and state regulations.

Once you find the appropriate form, click Get now.

Select your preferred payment plan, fill in the required details to create your account, and pay for the order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New York Federal Consumer Leasing Act Disclosure Form template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

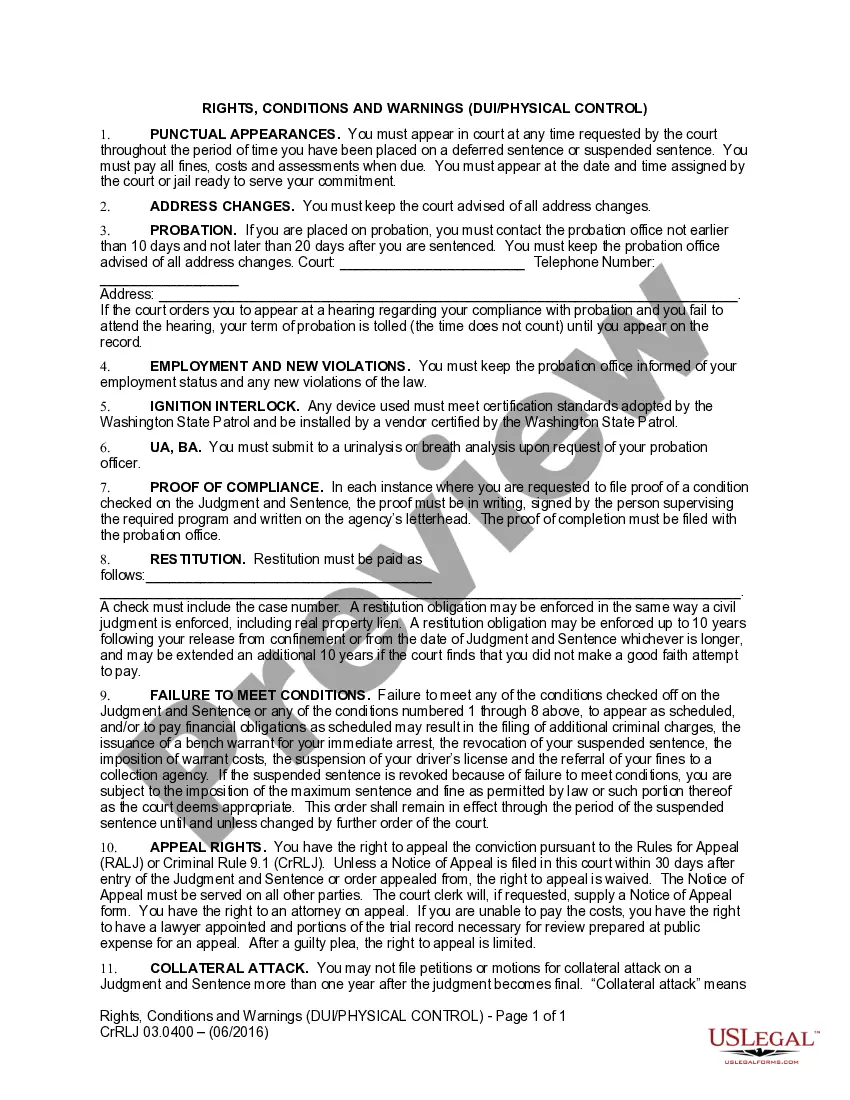

- Use the Preview option to review the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are looking for, utilize the Search feature to find the form that satisfies your needs.

Form popularity

FAQ

Disclosures must be made to the consumer at the time of the leasing transaction, adhering to the requirements set by the New York Federal Consumer Leasing Act Disclosure Form. This means that before the consumer signs a lease, they should receive all pertinent information regarding costs, terms, and conditions. Providing this information upfront helps consumers make informed decisions. You can rely on uslegalforms to ensure that your leasing documents comply with these disclosure requirements.

In New York, lease disposition fees are generally legal but regulated under the New York Federal Consumer Leasing Act Disclosure Form. This document outlines fees that may be charged at the end of a lease, including disposition fees. However, it's essential for consumers to understand their rights and ensure that any fees are clearly disclosed in the lease agreement. Always consult reliable sources or platforms like uslegalforms for accurate information on lease agreements.

The Federal Consumer Leasing Act disclosure provides essential information about the terms and conditions of a lease agreement. This includes details on costs, obligations, and the rights of both the lessee and lessor. It's designed to inform consumers comprehensively, ensuring they are well aware of their commitments under the New York Federal Consumer Leasing Act Disclosure Form.

The Consumer Leasing Act aims to promote transparency in leasing agreements for consumers. It requires clear and comprehensive disclosures, allowing individuals to understand lease terms fully. This act empowers consumers by ensuring they can compare lease offers and avoid hidden fees, creating a fairer leasing environment, particularly regarding the New York Federal Consumer Leasing Act Disclosure Form.

The Consumer Leasing Act mandates that lessors provide specific disclosures to lessees. These disclosures must include essential lease terms, including the obligations of both parties, any fees, and details about the vehicle or asset being leased. It is crucial for consumers, empowering them to make informed decisions, especially when dealing with the New York Federal Consumer Leasing Act Disclosure Form.

A lease disclosure must include vital information related to the terms of the lease agreement. This includes the total payment amount, the duration of the lease, and any fees associated with early termination. Additionally, it should specify the rights and responsibilities of both the lessor and lessee under the New York Federal Consumer Leasing Act Disclosure Form.

A lease disclosure statement is a document that provides key information about a lease agreement, including payment details, terms, and other essential conditions. This statement helps you understand your rights and obligations as a lessee. By reviewing a lease disclosure statement, you can make informed decisions about leasing options. The New York Federal Consumer Leasing Act Disclosure Form serves as an important framework for such statements, ensuring transparency and protection for consumers.

The 90% rule in leasing refers to a guideline that states a lease must have a certain threshold of obligation for it to be considered valid. Specifically, the lease payments and residual values must not exceed 90% of the value of the leased property. Understanding this rule can help you evaluate whether a leasing offer meets legal standards regarding disclosures. When filling out the New York Federal Consumer Leasing Act Disclosure Form, you can verify if the lease complies with this important guideline.

The Federal Consumer Leasing Act is a law that aims to protect consumers who enter into lease agreements for personal property, such as vehicles. It ensures that leasing companies provide clear and concise information about the terms of the lease. By adhering to these requirements, it helps prevent misunderstandings between consumers and lessors, particularly regarding the costs involved. The New York Federal Consumer Leasing Act Disclosure Form is a vital part of this process, as it outlines essential lease details for your clarity.