Arkansas Self-Employed Paving Services Contract

Description

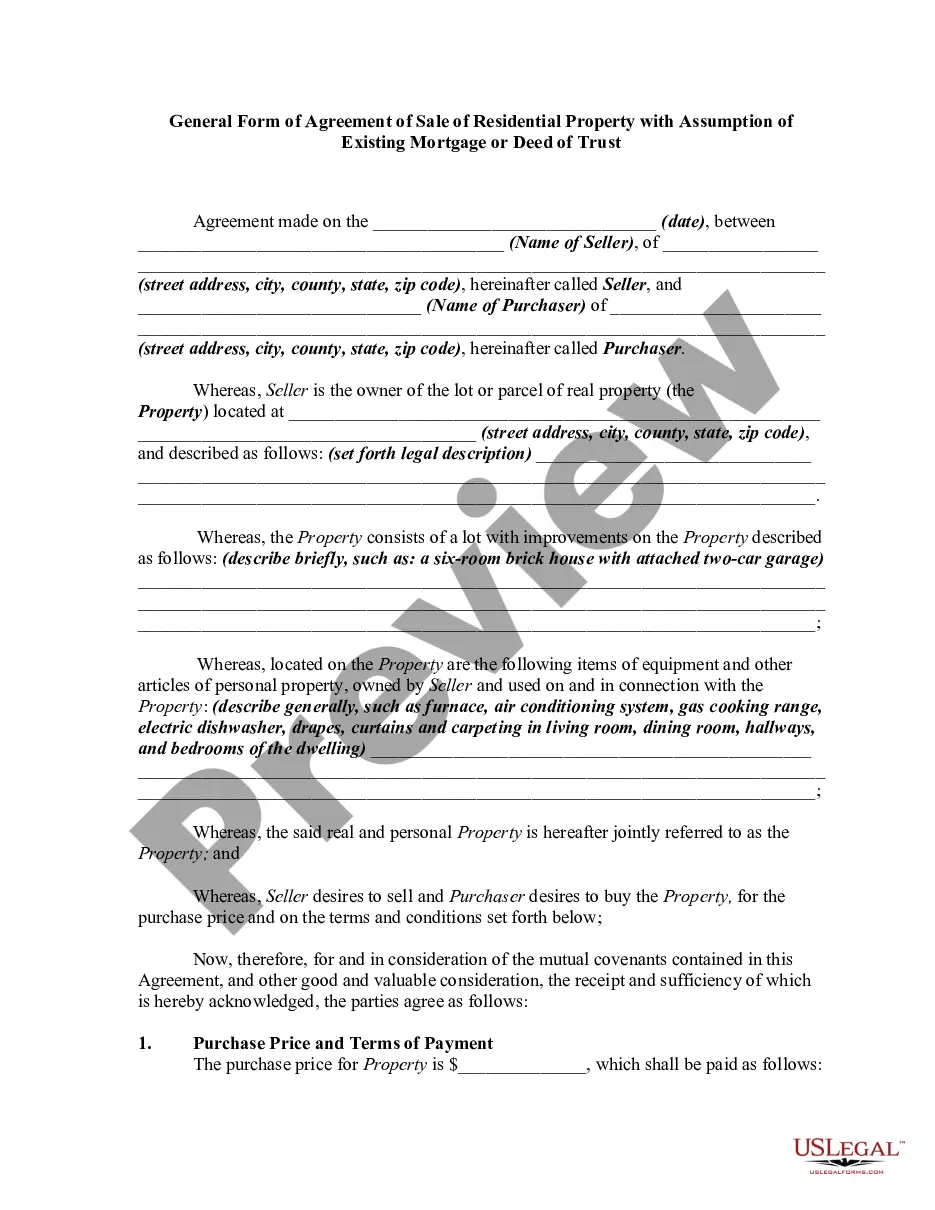

How to fill out Self-Employed Paving Services Contract?

Finding the appropriate genuine document template can be a challenge.

Of course, there are numerous templates available on the internet, but how do you locate the authentic type you need.

Utilize the US Legal Forms website. The service provides thousands of templates, including the Arkansas Self-Employed Paving Services Contract, which can be used for both business and personal purposes.

If the form does not meet your needs, utilize the Search field to find the correct form. Once you are certain the form is correct, click the Buy now button to purchase the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete your purchase using your PayPal account or a Visa or Mastercard. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Arkansas Self-Employed Paving Services Contract. US Legal Forms is the largest repository of legal forms where you can find numerous document templates. Use the service to obtain well-crafted paperwork that complies with state regulations.

- All forms are reviewed by experts and meet state and federal standards.

- If you are currently registered, Log In to your account and click the Download button to obtain the Arkansas Self-Employed Paving Services Contract.

- Use your account to browse through the legal forms you have previously purchased.

- Visit the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/state. You can review the form using the Preview button and read the form description to confirm it is the right one for you.

Form popularity

FAQ

Generally Applicable Law All contractors are deemed to be consumers or users of all tangible personal property including materials, supplies, and equipment used or consumed by them in performing any contract, and the sales of all such property to contractors are taxable sales.

Unlike many other states, California does not tax services unless they are an integral part of a taxable transfer of property.

Some customers are exempt from paying sales tax under Arkansas law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Generally Applicable Law All contractors are deemed to be consumers or users of all tangible personal property including materials, supplies, and equipment used or consumed by them in performing any contract, and the sales of all such property to contractors are taxable sales.

This article answers some of the basic questions regarding sales tax in Arkansas. Arkansas imposes a tax based on the gross receipts from sales. Sales of tangible personal property or services to contractors and sales to consumers or users are generally subject to the gross receipts tax.

Yes, the repair (parts and labor) of farm machinery and equipment is taxable. Is used property taxable? Yes, the sale of used tangible personal property is taxable except as noted in Arkansas Gross Receipts Tax Rules GR-18 and GR-50.

A. No. A home owner does not have to have a license to do his or her own "home improvement" work. However, any contractor you hire to work on the project will need a license if the cost of the work, labor and material, is more than $2,000.

When it comes to sales tax, the general rule of thumb has always been products are taxable, while services are non-taxable. Under that scenario, if your business sells coffee mugs, you should charge sales tax for those products.

Sales and Use TaxThe Arkansas sales tax is 6.5% of the gross receipts from the sales of tangible personal property and certain selected services.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.