Arkansas Carpentry Services Contract - Self-Employed Independent Contractor

Description

How to fill out Carpentry Services Contract - Self-Employed Independent Contractor?

Are you in a position where you require documentation for various companies or specific objectives almost every working day.

There are numerous legal document templates available online, but finding forms you can trust is not simple.

US Legal Forms provides thousands of form templates, including the Arkansas Carpentry Services Agreement - Self-Employed Independent Contractor, that are designed to satisfy federal and state requirements.

If you locate the right form, click on Purchase now.

Select a payment plan you prefer, complete the necessary information to create your account, and process the payment using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Arkansas Carpentry Services Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/region.

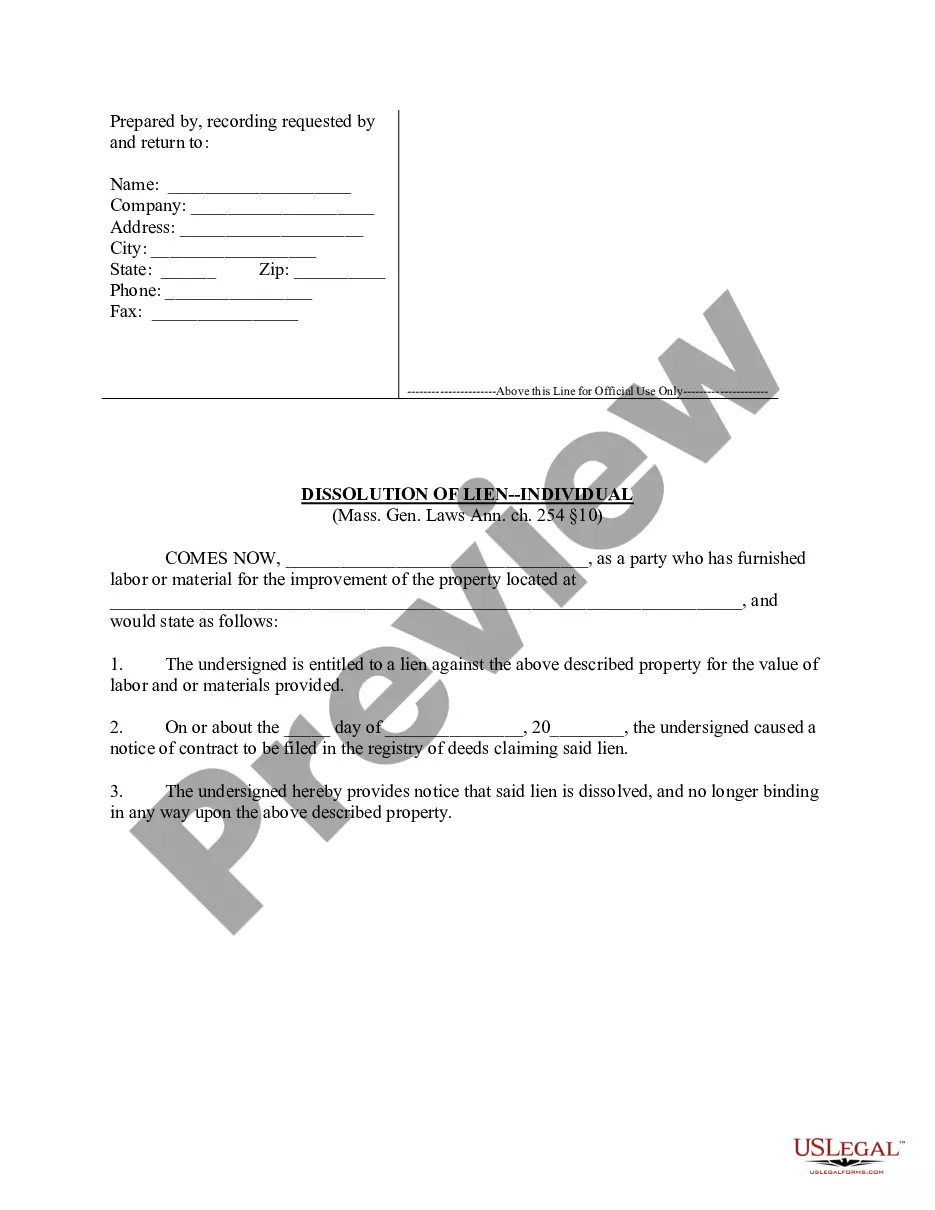

- Utilize the Review button to examine the form.

- Read the description to confirm you have selected the correct document.

- If the form is not what you're looking for, use the Search box to find the form that meets your requirements.

Form popularity

FAQ

Writing an independent contractor agreement requires you to define the scope of work clearly. Include essential sections such as payment terms, deadlines, and confidentiality clauses. It is important to state the relationship between you and your client to avoid potential misunderstandings. For added convenience, explore the templates provided by US Legal Forms, which can streamline your writing process and ensure all necessary components are included.

To fill out an independent contractor form, start by providing your personal information and that of your client. Specify the services you will provide, the payment structure, and deadlines. Always review the terms and conditions included in the form to ensure clarity. You may consider using templates from US Legal Forms, which are designed to meet the requirements of an Arkansas carpentry services contract for self-employed independent contractors.

An independent contractor in Arkansas needs to complete several important documents, including the contractor agreement and any necessary tax forms. Typically, you must provide a W-9 form for tax identification, along with invoices for payments. This paperwork establishes your status as a self-employed independent contractor and protects both you and your clients. US Legal Forms offers a range of resources to assist you in gathering these forms.

Filling out an independent contractor agreement for Arkansas carpentry services involves including both parties' names and contact information. Outline the services to be provided, the payment terms, and the duration of the contract. Additionally, ensure you detail any responsibilities and liabilities. You can use the US Legal Forms platform to find templates that simplify this process.

In Arkansas, you can perform some carpentry work without a contractor's license, but limits exist based on project costs. If your project exceeds a certain dollar amount, you will need to become licensed. It’s important to consult local regulations or an expert to ensure compliance. An Arkansas Carpentry Services Contract - Self-Employed Independent Contractor can assist you in navigating these legalities while outlining the scope of your work.

An independent contractor carpenter is a skilled worker who manages their own carpentry business, handling tasks like building, installation, and repair. This role involves not only craftsmanship but also business management, as you will be responsible for contracts, finances, and client relationships. The Arkansas Carpentry Services Contract - Self-Employed Independent Contractor is essential for outlining your services and clarifying expectations with clients.

Independent contractors need to comply with local and state laws, including obtaining necessary licenses and permits. In Arkansas, specific regulations may apply to carpenters, so knowing what is required ensures you stay compliant. Using an Arkansas Carpentry Services Contract - Self-Employed Independent Contractor can help outline these requirements clearly, protecting both you and your clients.

A carpenter primarily focuses on the craftsmanship of building and repairing structures, including cabinets, furniture, and other wooden items. On the other hand, a contractor manages a project, coordinating different tradespeople, including carpenters, plumbers, and electricians. Understanding the distinction is crucial when creating an Arkansas Carpentry Services Contract - Self-Employed Independent Contractor, as it helps clarify roles and responsibilities.

An independent contractor is someone who provides services to clients while maintaining autonomy over their work. Typically, they control how services are delivered and are responsible for their own taxes, insurance, and licenses. In the context of Arkansas Carpentry Services Contract - Self-Employed Independent Contractor, this means you can define your own schedule and choose your projects without being tied to one specific employer.

To set yourself up as an independent contractor, you first need to clearly define your services, such as Arkansas carpentry services. Next, register your business with the appropriate state and local authorities, and obtain any necessary licenses or permits. It's also essential to create an Arkansas Carpentry Services Contract—Self-Employed Independent Contractor agreement, which outlines the terms of your work, payment details, and duties. Platforms like US Legal Forms can provide you with templates to simplify this process and ensure that you cover all legal aspects.