Arkansas How to Request a Home Affordable Modification Guide

Description

How to fill out How To Request A Home Affordable Modification Guide?

If you need to acquire, obtain, or print authorized document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Employ the site's straightforward and user-friendly search feature to find the documents you require.

A variety of templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to easily access the Arkansas How to Request a Home Affordable Modification Guide within a few clicks.

Every legal document template you acquire is yours indefinitely. You have access to every form you've saved in your account.

Visit the My documents section to select a form to print or download again. Stay proactive and download, and print the Arkansas How to Request a Home Affordable Modification Guide with US Legal Forms. Countless professional and state-specific forms are available for your business or personal needs.

- If you are already a US Legal Forms member, Log In to your account and click the Acquire button to download the Arkansas How to Request a Home Affordable Modification Guide.

- You can also access forms you've previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you've chosen the form for your specific city/state.

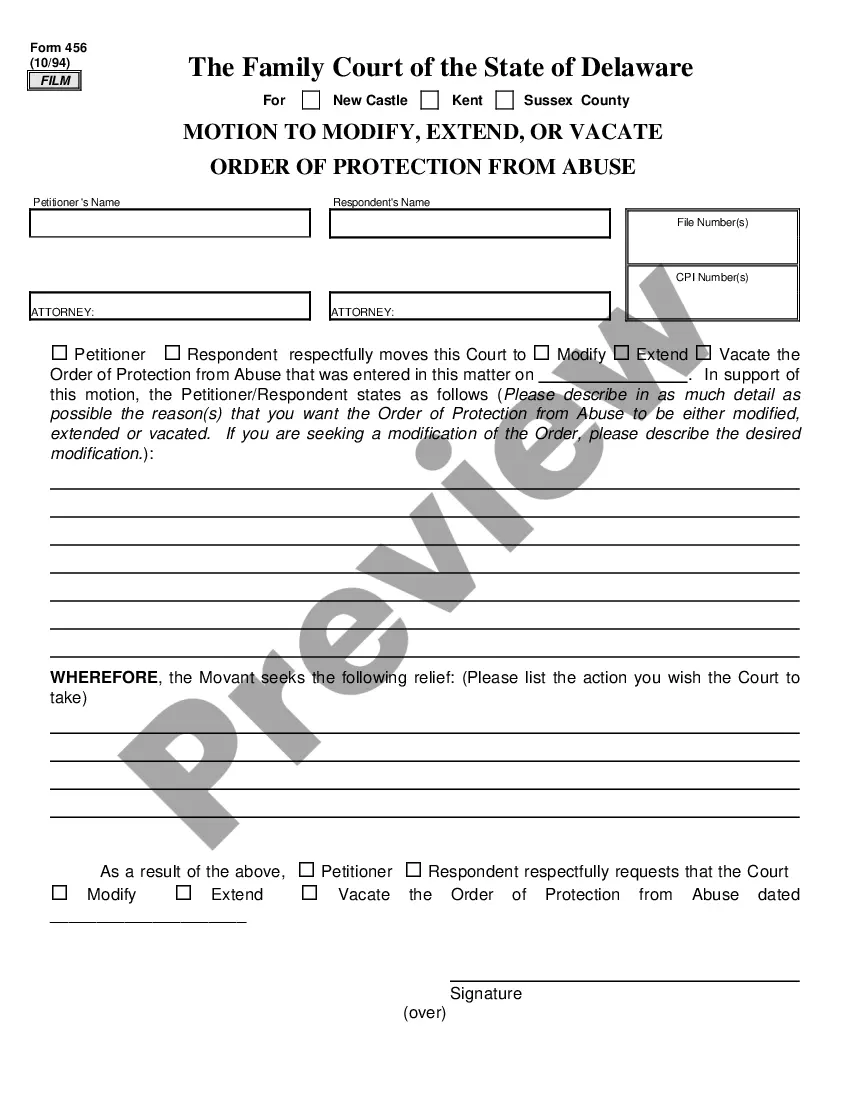

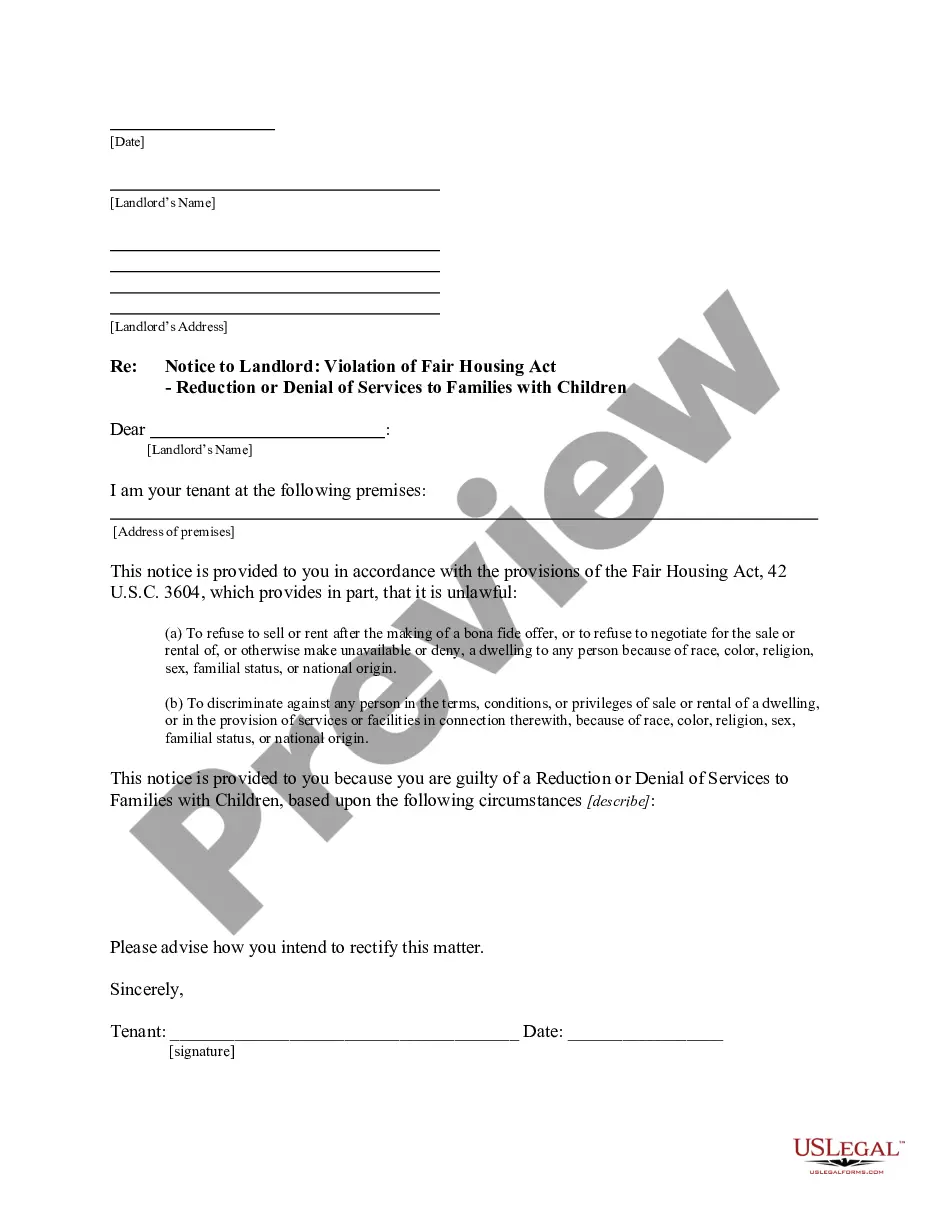

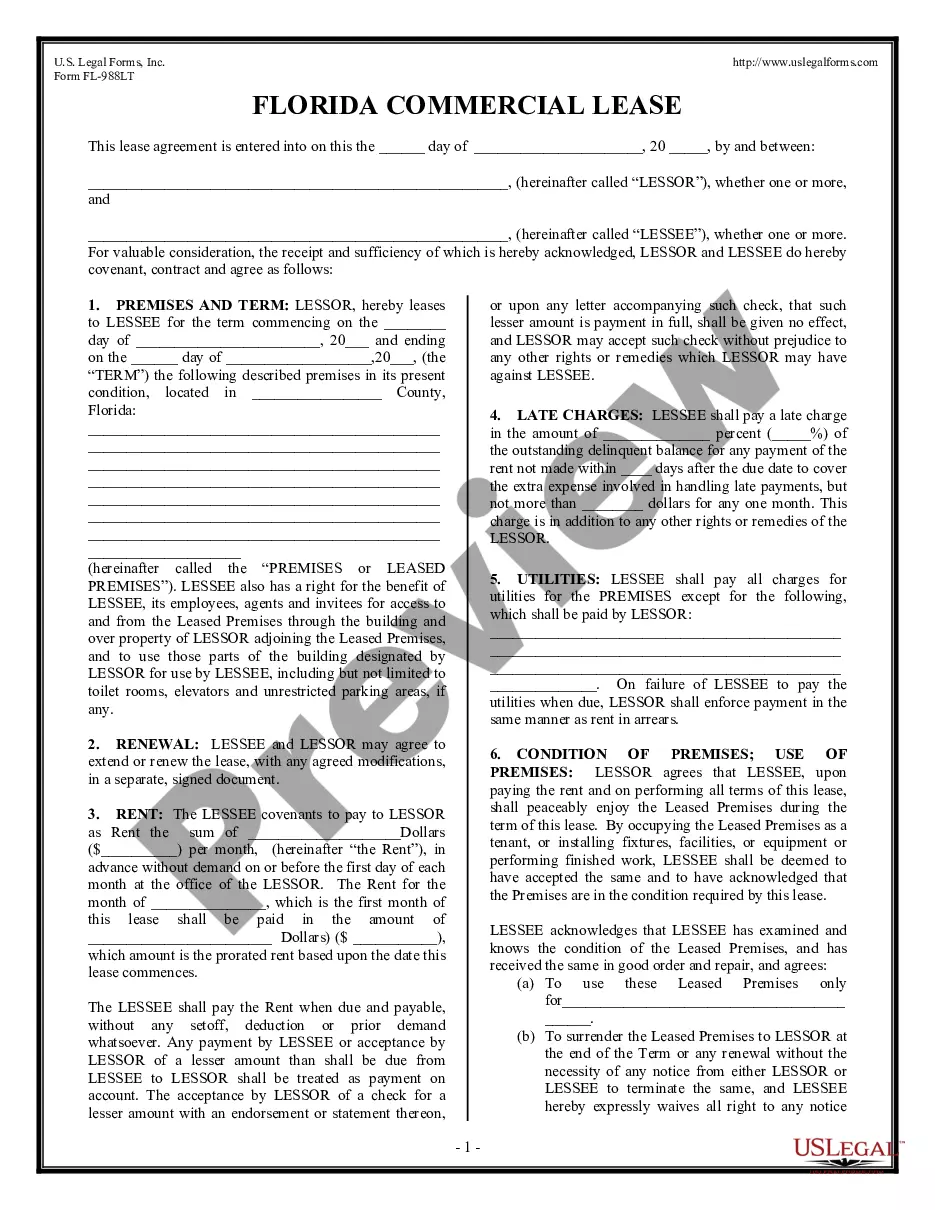

- Step 2. Use the Preview function to view the details of the form, and be sure to read through the description.

- Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the screen to find other versions of the legal form template.

- Step 4. Once you've found the form you need, click the Get now button. Select your preferred pricing plan and enter your credentials to create an account.

- Step 5. Complete the payment process. You can use your Visa, MasterCard, or PayPal account to finish the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Arkansas How to Request a Home Affordable Modification Guide.

Form popularity

FAQ

The Home Affordable Modification Program is a federal initiative designed to assist homeowners in need of financial relief by modifying their mortgage terms. Through this program, homeowners can reduce their monthly payments, making it easier to manage their finances. The Arkansas How to Request a Home Affordable Modification Guide offers valuable insights into the application process, eligibility requirements, and the benefits of this program. By exploring this guide, you can navigate the steps to secure a modification successfully.

HAMP stands for the Home Affordable Modification Program. This program was created to help homeowners facing financial difficulties modify their mortgages to make payments more affordable. Understanding HAMP is crucial within the Arkansas How to Request a Home Affordable Modification Guide, as it outlines the benefits of adjusting mortgage terms to avoid foreclosure. By using the guide, you can learn how to qualify for HAMP and apply effectively.

The Down Payment Assistance (DPA) program in Arkansas helps qualified homebuyers secure funding to cover their down payment and closing costs. This program is designed to make homeownership more accessible for individuals and families. By using resources like the Arkansas How to Request a Home Affordable Modification Guide, you can learn how to navigate the application process efficiently and ensure you meet the eligibility requirements.

Applying for a mortgage modification involves several steps, including contacting your lender and gathering financial documents. You must complete an application that outlines your financial status and hardship reasons. The Arkansas How to Request a Home Affordable Modification Guide offers clear instructions on filling out the application and what to expect during the process. Utilizing platforms like UsLegalForms can also simplify this process by providing you with necessary forms and guidance.

The Arkansas Home Assistance Program is designed to provide support to homeowners facing challenges with their mortgage payments. This program offers resources to help families access mortgage modifications and make their payments more affordable. By consulting the Arkansas How to Request a Home Affordable Modification Guide, you can learn how this program works and how it can benefit your financial situation. There is valuable assistance available to you through this initiative.

To qualify for a mortgage modification, you typically need to demonstrate financial hardship, such as loss of income or unexpected expenses. Lenders may also review your payment history and current mortgage terms. The Arkansas How to Request a Home Affordable Modification Guide provides detailed criteria and documents needed to help you assess your eligibility effectively. It's essential to understand these requirements to prepare your application.

Obtaining a mortgage modification can vary in difficulty based on your financial situation and the lender's requirements. Generally, it involves gathering necessary documentation and completing an application that may require thorough financial disclosure. However, by following the Arkansas How to Request a Home Affordable Modification Guide, you can streamline this process and increase your chances of approval. It's crucial to communicate with your lender throughout this process.