Arkansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

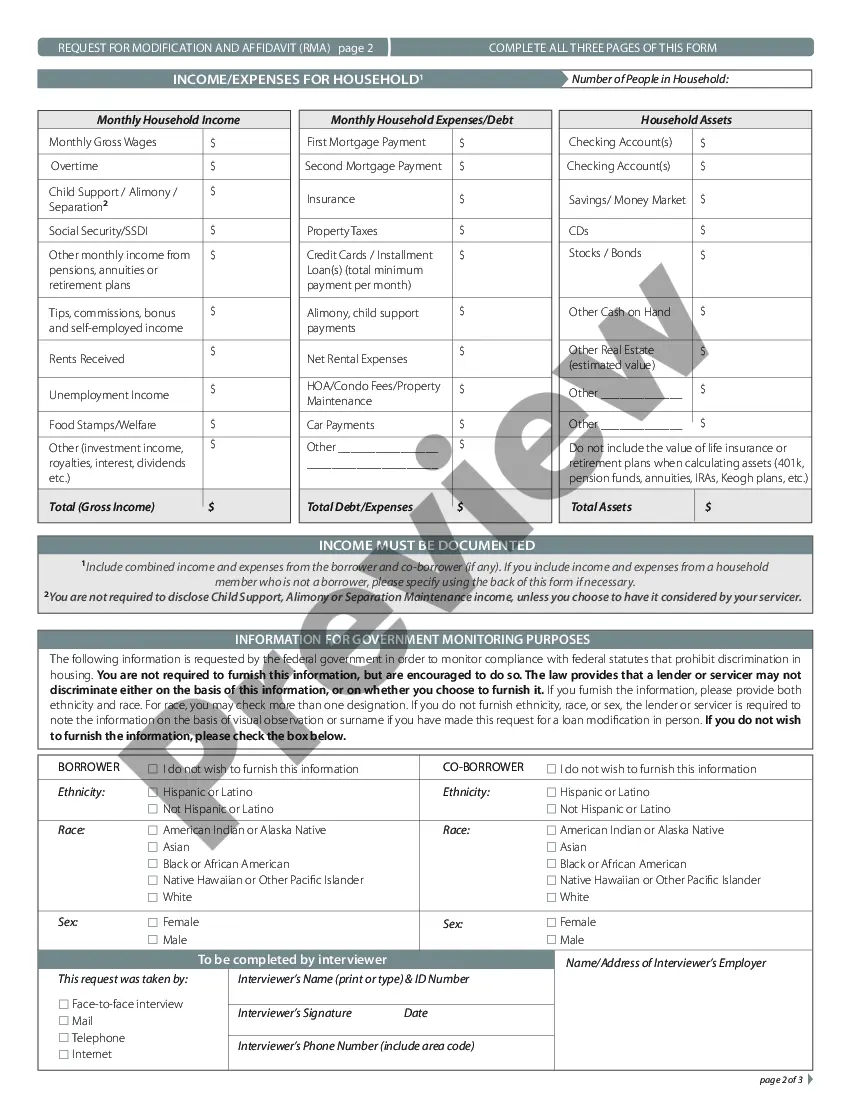

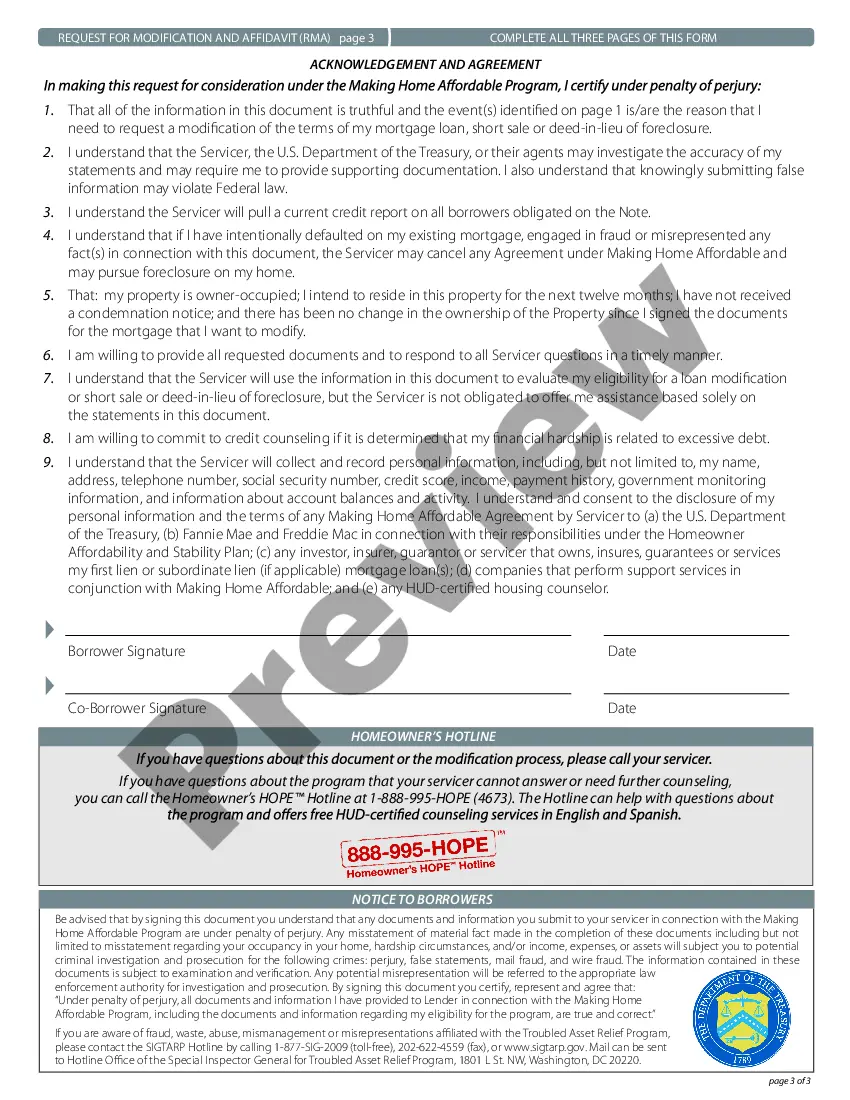

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal template options that you can download or create.

By utilizing the website, you will access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can acquire the latest editions of forms such as the Arkansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP in just a few minutes.

If you already possess a membership, Log In and download the Arkansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously obtained forms within the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Arkansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. Every template you added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, just proceed to the My documents section and click on the form you desire. Gain access to the Arkansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP with US Legal Forms, one of the most extensive libraries of legal document templates available. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- To utilize US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the appropriate form for your city/state.

- Click on the Preview button to review the content of the form.

- Check the form details to confirm you have selected the correct document.

- If the form does not meet your needs, use the Search field at the top of the screen to locate the one that does.

- Once you are satisfied with the form, confirm your selection by clicking on the Buy now button.

- Then, choose your preferred pricing plan and enter your information to register for an account.

Form popularity

FAQ

The HAMP loan modification program, or Home Affordable Modification Program, aims to help homeowners facing financial difficulties to modify their mortgage to make payments more manageable. It provides a structured approach to reduce monthly payments and offers eligibility for a range of home loans. Under the Arkansas Request for Loan Modification RMA, homeowners can access this program and potentially benefit from lower interest rates or an extension of their loan term. Understanding HAMP can equip you with the necessary tools to improve your financial situation.

Requesting a mature modification on your loan under the Arkansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP requires you to engage with your loan servicer directly. Start by preparing a detailed explanation of your financial situation and any changes that have occurred since your last modification. Once you submit your request, it’s essential to follow up regularly to ensure it is processed efficiently. Using uslegalforms can help you to find the right communication templates to assist in this process.

Approval for an Arkansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can vary based on several factors, such as your financial situation and documentation. While some applicants face challenges, many find success by clearly proving their hardship and providing all required paperwork. Staying proactive in communication with your mortgage servicer can also enhance your chances. Remember, every case is unique, which is why understanding your individual circumstances is essential.

Applying for an Arkansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP involves several steps. Begin by contacting your mortgage servicer to express your interest in a loan modification, then gather necessary documents to prove your income and hardship. You will then fill out the required application forms provided by your lender or servicer. If you find this process overwhelming, consider using uslegalforms to access the necessary forms and guidance.

To qualify for an Arkansas Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you generally need to demonstrate a financial hardship. This includes factors such as job loss, reduced income, or unexpected medical expenses. Furthermore, you must occupy the property as your primary residence and it should be a conforming loan, meaning it meets specific government criteria. Ensuring you meet these key requirements can streamline your application process.

HAMP modification refers to the process of altering your mortgage terms under the Home Affordable Modification Program. It typically includes adjustments like reduced monthly payments or lower interest rates to help homeowners remain in their homes. When you file for an Arkansas Request for Loan Modification RMA under HAMP, you lay the groundwork for a more manageable and stable mortgage structure.

As of now, the availability of HAMP remains uncertain well into 2025. However, various loan modification options may still be accessible, depending on your specific circumstances. It is wise to stay informed and consult platforms like UsLegalForms to find the latest updates regarding the Arkansas Request for Loan Modification RMA under the Home Affordable Modification Program HAMP.

Requesting a loan modification means that you are asking your lender to change the terms of your existing mortgage. This can involve reducing your monthly payment, lowering your interest rate, or extending the loan term. By submitting an Arkansas Request for Loan Modification RMA under HAMP, you aim to make your mortgage more affordable and sustainable in the long run.

HAMP stands for the Home Affordable Modification Program, a federal initiative designed to help homeowners struggling to meet their mortgage obligations. This program offers solutions like reduced interest rates and extended loan terms to make payments more affordable. By understanding HAMP, you can explore options through the Arkansas Request for Loan Modification RMA that best suit your financial situation.

Yes, a mortgage loan modification can be a beneficial option for homeowners experiencing financial difficulties. It allows you to adjust your loan terms, potentially lowering your payments and helping you avoid foreclosure. If you are considering this route, the Arkansas Request for Loan Modification RMA under HAMP may provide a solid foundation for your financial recovery.