Arkansas Investment - Grade Bond Optional Redemption (without a Par Call)

Description

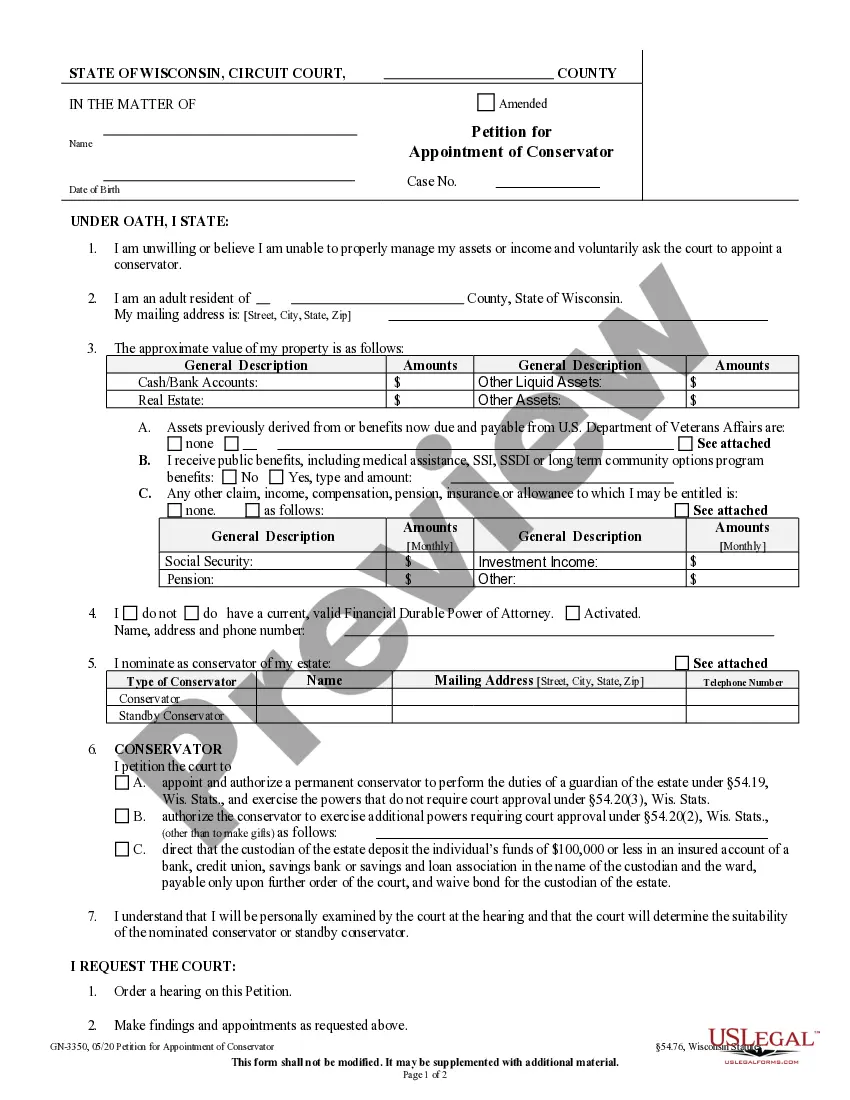

How to fill out Investment - Grade Bond Optional Redemption (without A Par Call)?

Choosing the best lawful document web template might be a have difficulties. Of course, there are a variety of web templates available online, but how can you obtain the lawful form you want? Utilize the US Legal Forms site. The assistance delivers a huge number of web templates, like the Arkansas Investment - Grade Bond Optional Redemption (without a Par Call), which you can use for company and personal needs. Every one of the types are checked by pros and fulfill state and federal requirements.

In case you are currently authorized, log in in your bank account and then click the Obtain key to obtain the Arkansas Investment - Grade Bond Optional Redemption (without a Par Call). Make use of your bank account to appear through the lawful types you may have acquired previously. Check out the My Forms tab of the bank account and acquire one more copy of your document you want.

In case you are a fresh consumer of US Legal Forms, here are simple recommendations so that you can comply with:

- Very first, make sure you have selected the right form for your personal town/county. You may examine the form utilizing the Review key and look at the form information to make sure this is the right one for you.

- When the form does not fulfill your requirements, use the Seach discipline to discover the right form.

- Once you are certain the form is proper, select the Get now key to obtain the form.

- Pick the costs plan you want and type in the necessary information. Make your bank account and pay money for your order with your PayPal bank account or credit card.

- Opt for the file file format and download the lawful document web template in your product.

- Complete, change and print out and sign the attained Arkansas Investment - Grade Bond Optional Redemption (without a Par Call).

US Legal Forms is definitely the biggest catalogue of lawful types that you will find numerous document web templates. Utilize the service to download skillfully-manufactured files that comply with express requirements.

Form popularity

FAQ

Callable or redeemable bonds are bonds that can be redeemed or paid off by the issuer prior to the bonds' maturity date. When an issuer calls its bonds, it pays investors the call price (usually the face value of the bonds) together with accrued interest to date and, at that point, stops making interest payments.

Bond redemption is the process by which a bond issuer repays the principal amount of a bond to the bondholder on the bond's maturity date. When a bond is issued, it has a specified term or maturity date, which is the date when the bond issuer is obligated to pay back the principal amount of the bond to the bondholder. Bond Redemption and Types of Bond Redemption | IndiaBonds indiabonds.com ? news-and-insight ? bond-... indiabonds.com ? news-and-insight ? bond-...

A bond redemption is the full repayment of the principal amount (the amount you invested) and any interest owed to date. What is bond redemption? - Help Centre - Crowdcube crowdcube.com ? en-us ? articles ? 3600006... crowdcube.com ? en-us ? articles ? 3600006...

The date on which a security is due to be redeemed by the borrower. This may be a single date, or a range of dates within which the borrower has discretion to choose when repayment will take place. From: redemption date in A Dictionary of Economics »

Optional Redemption. Allows the issuer, at its option, to redeem the bonds. Many municipal bonds, for example, have optional call features that issuers may exercise after a certain number of years, often 10 years. Sinking Fund Redemption.

Optional Redemption On or after the Par Call Date, the Company may redeem the notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the notes being redeemed plus accrued and unpaid interest thereon to the redemption date.

Bond redemption is the process by which a bond issuer repays the principal amount of a bond to the bondholder on the bond's maturity date. When a bond is issued, it has a specified term or maturity date, which is the date when the bond issuer is obligated to pay back the principal amount of the bond to the bondholder.

In finance, redemption describes the repayment of a fixed-income security?such as a Treasury note, certificate of deposit, or bond?on or before its maturity date. Mutual fund investors can request redemptions for all or part of their shares from their fund manager.

Redemption date. The date on which a bond matures or is redeemed.