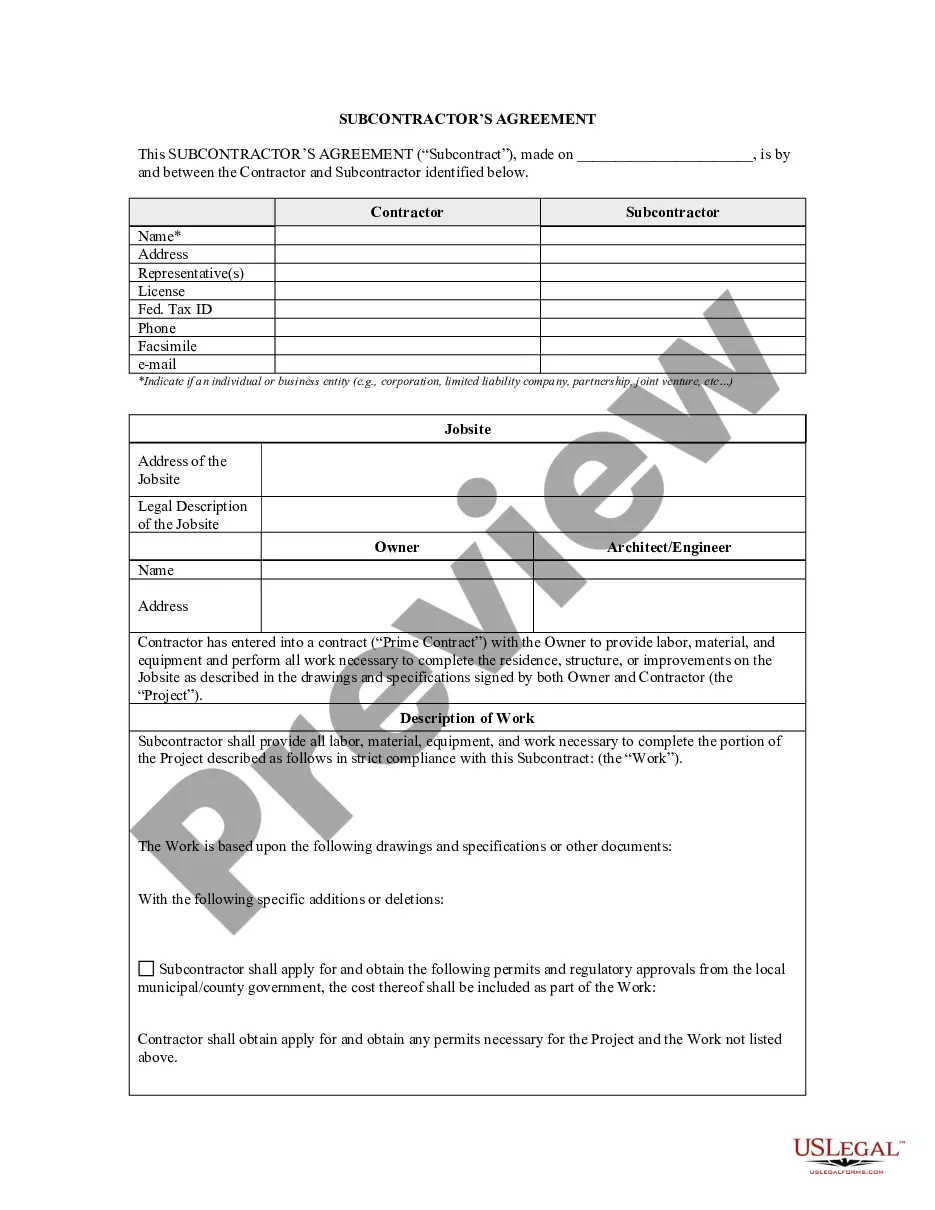

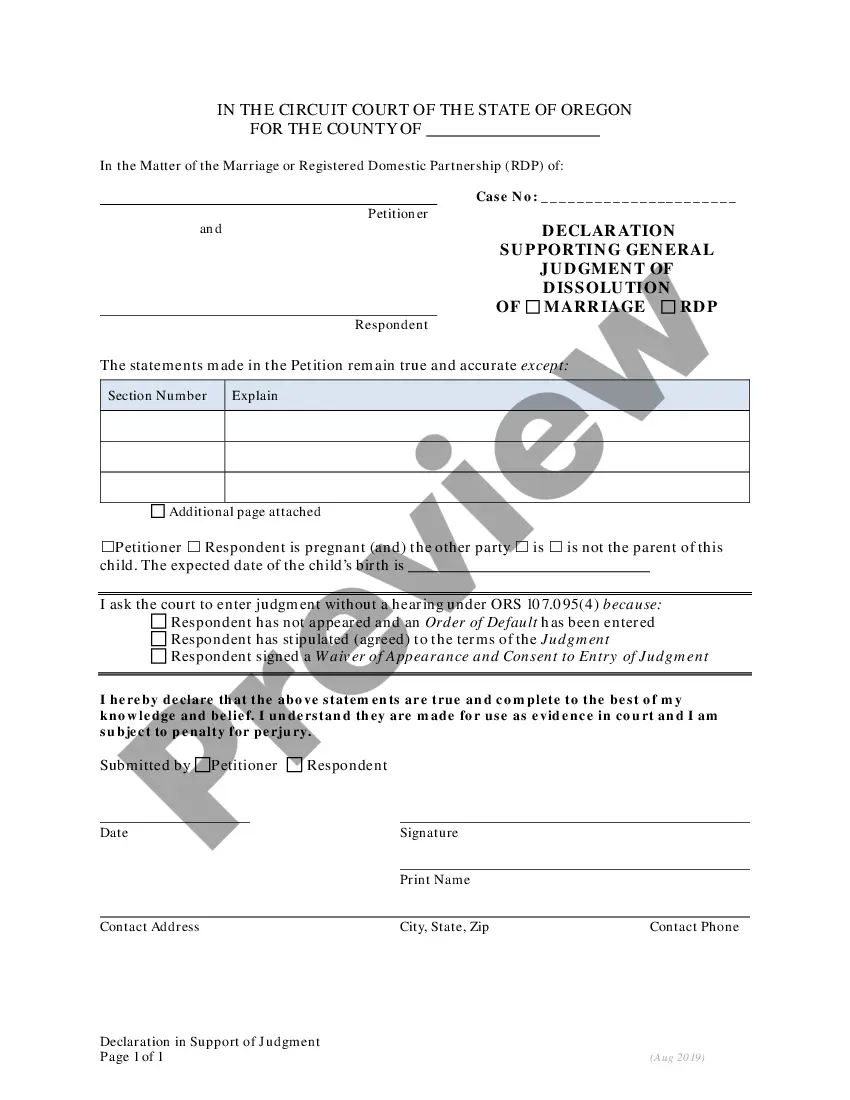

This due diligence workform is used to review property information and title commitments and policies in business transactions.

Arkansas Fee Interest Workform

Description

How to fill out Fee Interest Workform?

If you need to finalize, acquire, or print authentic document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Utilize the site's straightforward and user-friendly search feature to find the documents you need.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Every legal document format you obtain is yours indefinitely.

You will have access to all forms you've downloaded in your account. Check the My documents section to select a form to print or download again.

- To obtain the Arkansas Fee Interest Workform with just a few clicks, use US Legal Forms.

- If you are already a US Legal Forms user, sign in to your account and select the Get button to acquire the Arkansas Fee Interest Workform.

- You can also access forms you previously downloaded in the My documents section of your account.

- For first-time users of US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for your correct state/country.

- Step 2. Use the Preview feature to review the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative forms in the legal document format.

- Step 4. Once you've found the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your credentials to register for the account.

- Step 5. Complete the purchase. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Arkansas Fee Interest Workform.

Form popularity

FAQ

Form AR4 is the Arkansas Non-Resident and Part-Year Resident Income Tax Form. This form enables individuals who do not live in Arkansas for the entire year to report their income earned within the state. If you're navigating the complexities of Arkansas taxes, using the Arkansas Fee Interest Workform can help simplify your filing process.

The AR1000F form is the Arkansas Individual Income Tax Return. It is used to report your income, deductions, and credits to calculate your state tax liability. When filling out your taxes, the Arkansas Fee Interest Workform can help ensure you complete the AR1000F accurately.

Yes, you can e-file your Arkansas state taxes. Many taxpayers find this method to be quicker and more efficient. If you need help with the process, the Arkansas Fee Interest Workform is a great resource, offering guidance on how to e-file and what documents you'll need.

You should send your Arkansas state income tax to the Department of Finance and Administration in Little Rock. Make sure to double-check the address based on your specific tax situation. If you are using the Arkansas Fee Interest Workform, follow the provided mailing instructions for a smooth submission.

You can file the AR1000F either by mailing it to the designated address or electronically, if eligible. Many taxpayers prefer online filing as it can speed up the process. For a seamless experience, consider using the Arkansas Fee Interest Workform, which guides you step-by-step through the required fields.

The address for mailing your federal tax returns depends on your state and whether you are enclosing payment. Generally, you can find the correct mailing address on the IRS official website. If you’re also filing your Arkansas Fee Interest Workform, it’s wise to keep track of both local and federal submission points.

You can mail your AR1000F form to the Department of Finance and Administration in Little Rock. The exact address is provided on the official Arkansas tax website. If you're using the Arkansas Fee Interest Workform, just ensure you check the latest address, as it may change from year to year.

Yes, Arkansas does tax interest income. As a resident, you must report your earned interest on your state tax return. This means you'll include it when completing your Arkansas Fee Interest Workform. Make sure to consider any applicable deductions or credits that may apply to your situation.

Yes, you must report interest income on your Arkansas state tax return. This includes income earned from various financial accounts that generate interest. To ensure proper reporting and compliance, using the Arkansas Fee Interest Workform will provide clarity and help you accurately reflect your financial situation.

Certain forms of income are not included in taxable income in Arkansas, such as qualified scholarships and gifts received. It’s important to understand the distinctions so you can accurately report your financial situation. The Arkansas Fee Interest Workform can assist in categorizing your income effectively to avoid unnecessary taxes.