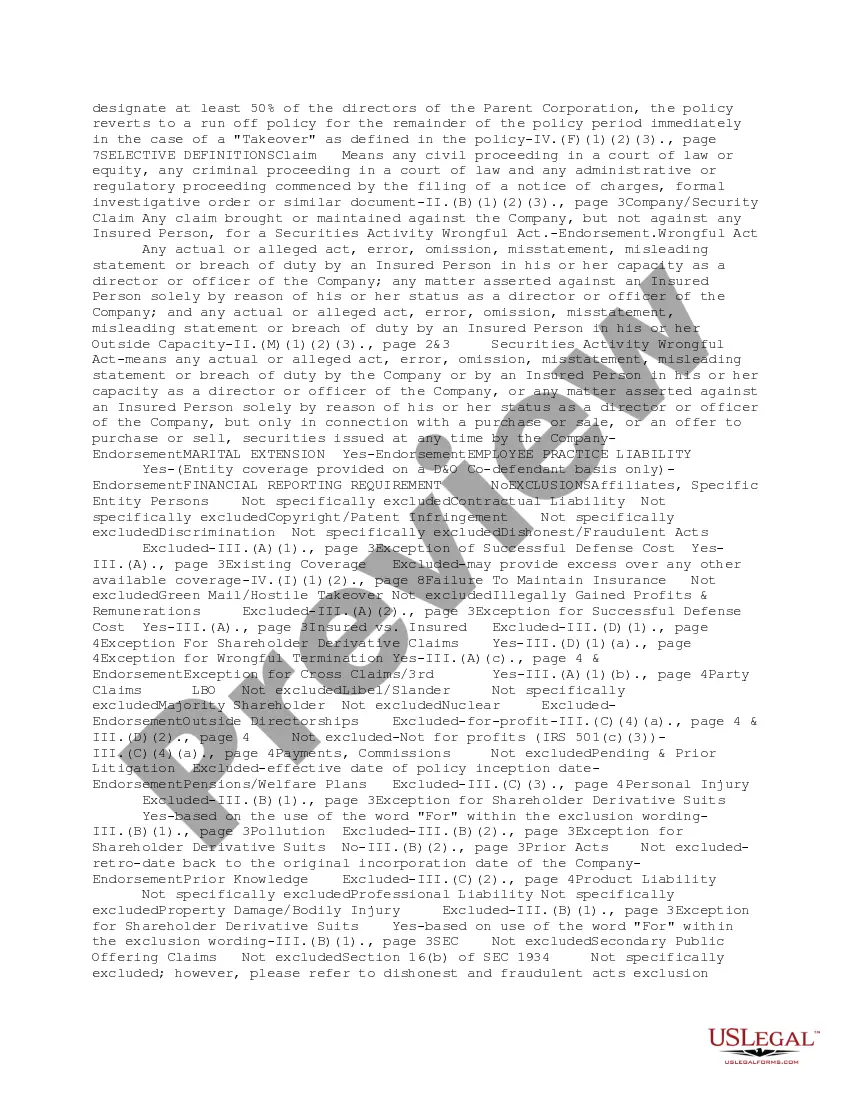

This due diligence worksheet provides detailed information regarding liability insurance for directors and officers in a company regarding business transactions.

Arkansas Directors and Officer Liability Insurance Information Worksheet

Description

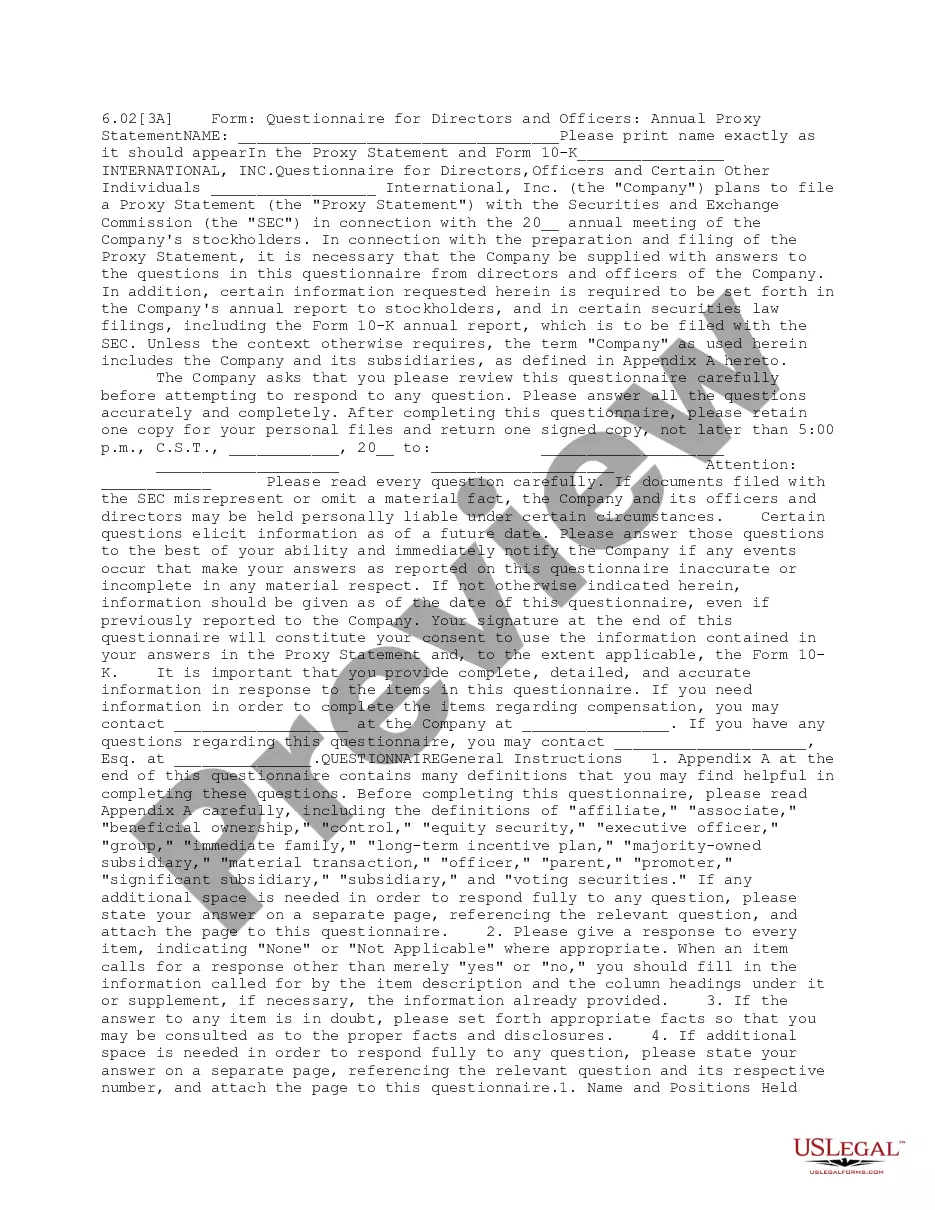

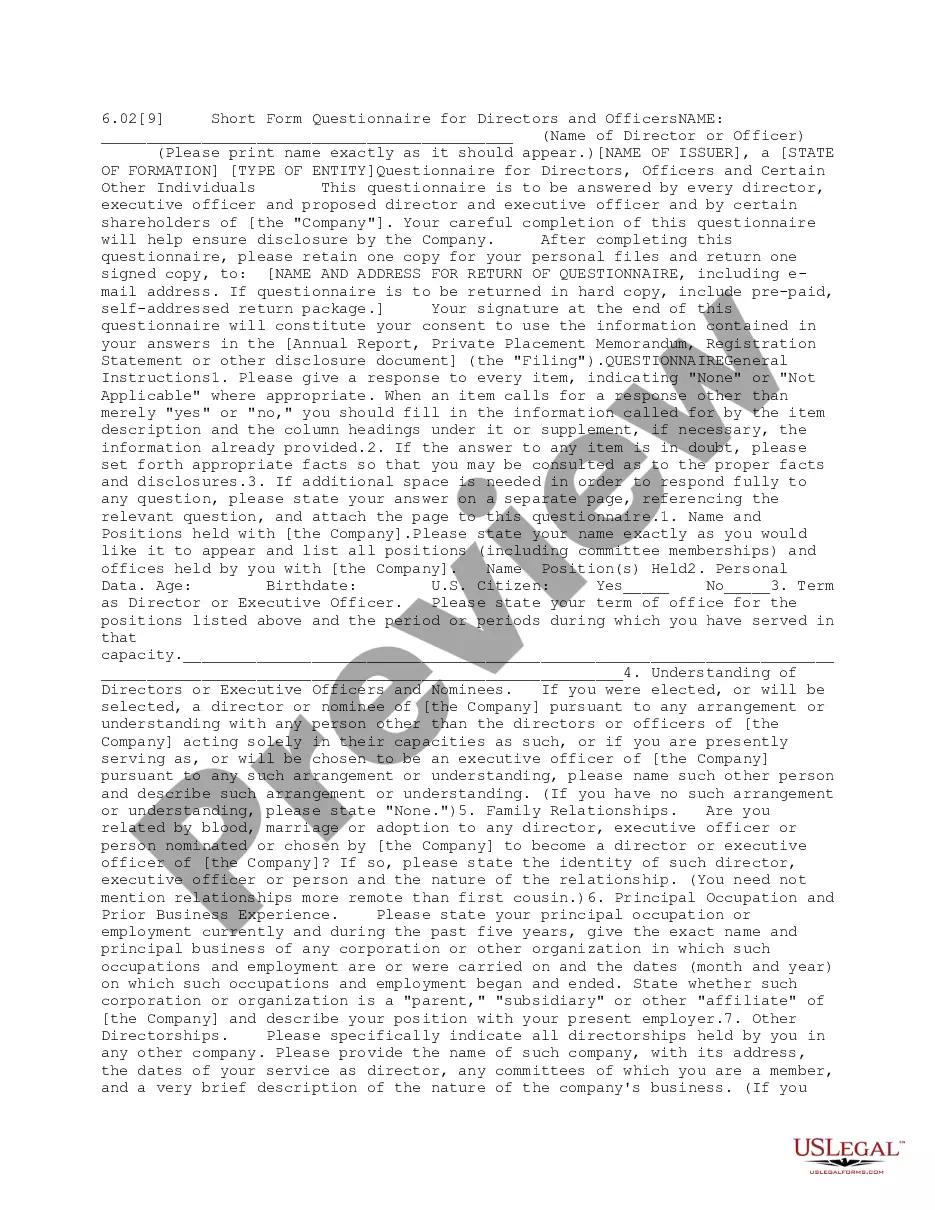

How to fill out Directors And Officer Liability Insurance Information Worksheet?

Are you in an environment where you require documents for both business and personal purposes almost every day.

There are numerous legal document templates accessible online, but finding reliable ones is challenging.

US Legal Forms provides thousands of form templates, including the Arkansas Directors and Officer Liability Insurance Information Worksheet, designed to comply with state and federal regulations.

Once you find the appropriate form, click Purchase now.

Select your preferred payment plan, provide the necessary information to process your payment, and complete the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Arkansas Directors and Officer Liability Insurance Information Worksheet template.

- If you do not have an account and wish to utilize US Legal Forms, follow these instructions.

- Locate the form you require and ensure it corresponds to your specific city/county.

- Utilize the Review feature to examine the form.

- Read the description to confirm that you have chosen the correct form.

- If the form does not meet your needs, use the Search box to find the form that suits your requirements.

Form popularity

FAQ

Key Takeaways. Directors and officers (D&O) liability insurance covers directors and officers or their company or organization if sued (most policies exclude fraud and criminal offenses). D&O insurance claims are paid to cover losses associated with the lawsuit, including legal defense fees.

D&O insurance does cover2026"The type of D&O lawsuits (include) claims of negligence and allegations of mismanagement on behalf of the board; housing discriminatory complaints, usually associated with a denial of a purchase/sublet application involving a designated minority class; employment discrimination, sexual

D&O liability insurance policy, while it is not mandatory, is an important and integral part of corporate governance, as it protects the directors and officers against personal liabilities and also may ensure relief to the victims of corporate governance breakdowns.

The following are several examples of Management Liability (D&O) claims.Misrepresentation. Directors and officers at a company failed to disclose material facts and provided inaccurate and misleading information to their investors.Credit Fraud.Stolen Corporate Secrets.Recruiting Sales Executives.Investment Agreement.

Directors and officers (D&O) liability insurance protects the personal assets of corporate directors and officers, and their spouses, in the event they are personally sued by employees, vendors, competitors, investors, customers, or other parties, for actual or alleged wrongful acts in managing a company.

The main difference between Directors' and Officers' insurance and Professional indemnity insurance is that Directors and Officers insurance is aimed to provide financial assistance should DIRECTORS and senior OFFICERS of your business named in legal actions which will require legal costs to be covered should a claim

D&O insurance specifically covers members on a board of directors and officers. Professional liability insurance, on the other hand, covers professionals (of nearly any position within a company) that offer specialized services.

Directors and officers (D&O) liability insurance protects the personal assets of corporate directors and officers, and their spouses, in the event they are personally sued by employees, vendors, competitors, investors, customers, or other parties, for actual or alleged wrongful acts in managing a company.

D&O policies include an exclusion for losses related to criminal or deliberately fraudulent activities. Additionally, if an individual insured receives illegal profits or remuneration to which they were not legally entitled, they will not be covered if a lawsuit is brought forward due to this.