Arkansas Employee Stock Option Plan of Manugistics Group, Inc.

Description

How to fill out Employee Stock Option Plan Of Manugistics Group, Inc.?

Are you in the position where you will need paperwork for either company or specific purposes virtually every day time? There are a variety of lawful papers themes accessible on the Internet, but discovering kinds you can rely is not easy. US Legal Forms offers thousands of type themes, just like the Arkansas Employee Stock Option Plan of Manugistics Group, Inc., that are written in order to meet state and federal specifications.

Should you be already familiar with US Legal Forms web site and have your account, basically log in. Next, you may download the Arkansas Employee Stock Option Plan of Manugistics Group, Inc. design.

Should you not have an accounts and want to begin using US Legal Forms, follow these steps:

- Find the type you need and ensure it is for your appropriate area/region.

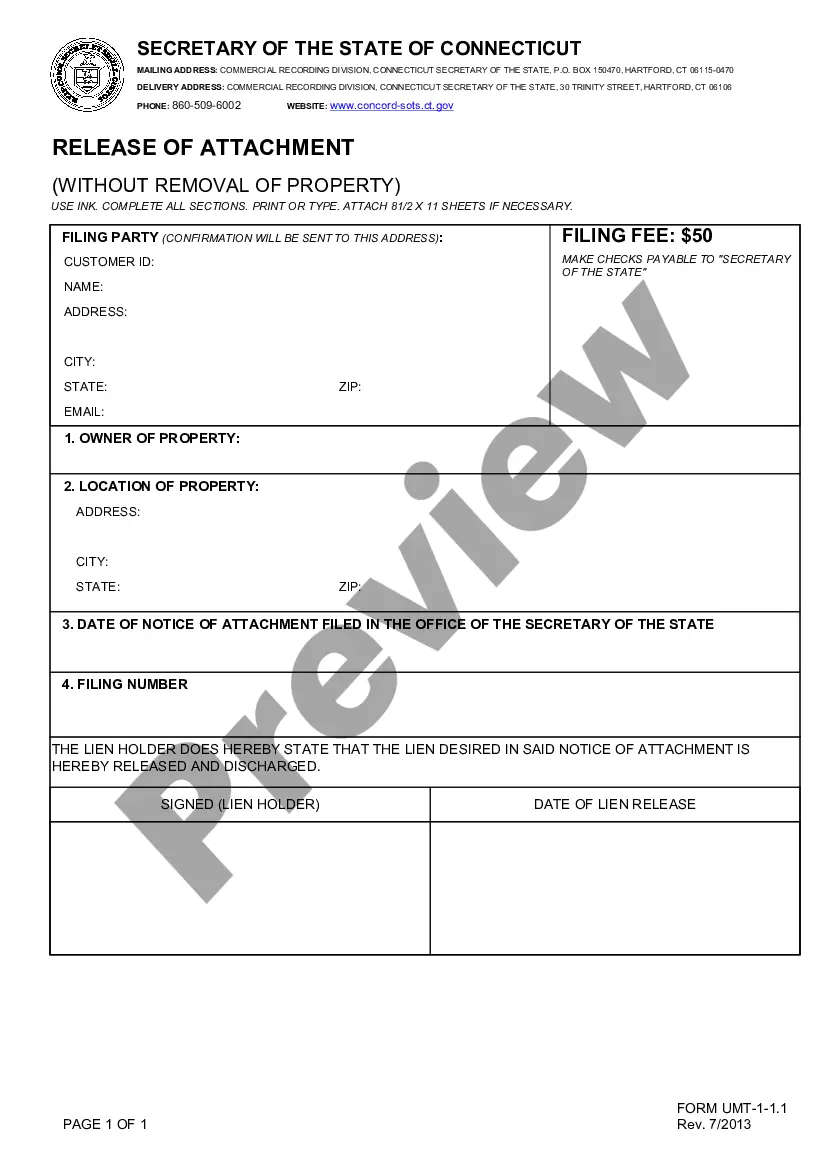

- Use the Review option to examine the form.

- Browse the description to actually have chosen the right type.

- When the type is not what you are looking for, make use of the Lookup field to find the type that meets your requirements and specifications.

- Once you discover the appropriate type, simply click Buy now.

- Choose the costs strategy you would like, fill out the required information to produce your money, and pay money for the order using your PayPal or credit card.

- Decide on a handy document file format and download your duplicate.

Find every one of the papers themes you have bought in the My Forms menus. You can get a further duplicate of Arkansas Employee Stock Option Plan of Manugistics Group, Inc. any time, if required. Just select the required type to download or print the papers design.

Use US Legal Forms, the most substantial assortment of lawful kinds, to save efforts and avoid blunders. The service offers skillfully created lawful papers themes that you can use for a range of purposes. Generate your account on US Legal Forms and begin creating your lifestyle a little easier.

Form popularity

FAQ

Costs to start up an ESOP are substantial, ranging from $15,000 to $100,000 and more. These costs include setting up a trust, which buys and holds ESOP stock. Valuations must remain current. An ESOP can buy only fairly valued stock, best appraised by a qualified appraiser.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.

What is a stock option? A stock option is the opportunity, given by your employer, to purchase a certain number of shares of your company's common stock at a pre-established price, known as the grant price, over a specific period of time, known as the vesting period.

Making ESO Offers Declare the type of stock options employees will receive (ISOs or NSOs). Explain the value in terms of the number of shares rather than the percentage of the company. State that the board must approve all stock option grant amounts before the offer letter becomes valid.

Below are our 10 key steps for creating, building and maintaining an ESPP: Determine the plan's purpose. ... Conduct external and internal research. ... Establish a budget. ... Pick the right components for the company. ... Seek stakeholder buy-in. ... Prepare early for shareholder approval. ... Select a provider. ... Create a robust implementation plan.

An employee stock purchase plan allows you to buy company stock at a bargain price. Discounts usually range from 5% to 15%. For example, if you work and participate in Hilton's ESPP, you can buy Hilton stock at a 15% discount. If Hilton's stock is trading at $130/share, they'll buy it at $110.50/share for you.