Arkansas Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan

Description

How to fill out Authorization To Adopt A Plan For Payment Of Accrued Vacation Benefits To Employees With Company Stock With Copy Of Plan?

Have you been inside a placement the place you need to have files for either business or person purposes almost every working day? There are a lot of lawful papers layouts accessible on the Internet, but locating kinds you can rely isn`t easy. US Legal Forms gives 1000s of type layouts, such as the Arkansas Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan, which can be created to fulfill federal and state specifications.

When you are previously informed about US Legal Forms website and possess your account, just log in. After that, it is possible to acquire the Arkansas Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan web template.

Unless you have an bank account and need to start using US Legal Forms, adopt these measures:

- Obtain the type you need and ensure it is for your proper area/state.

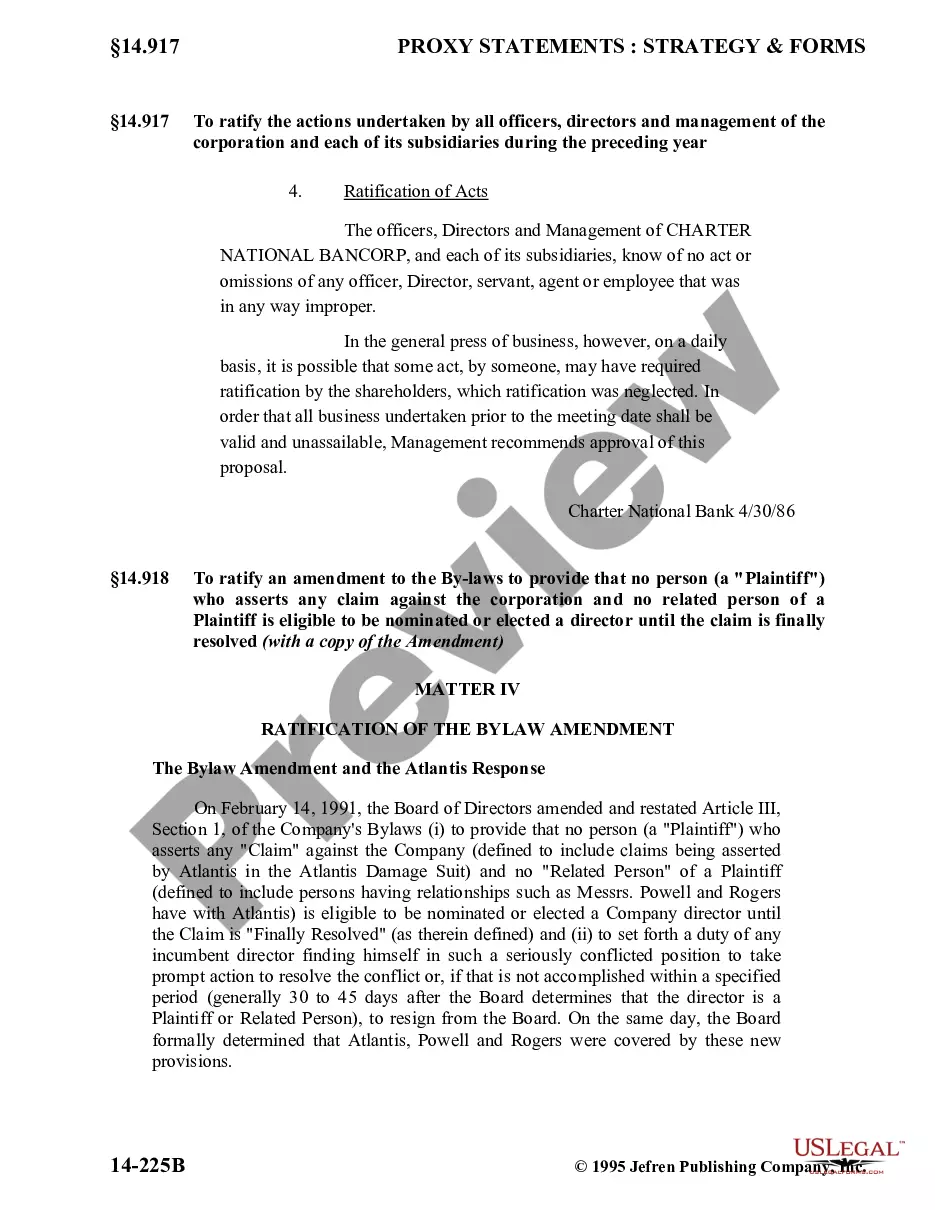

- Take advantage of the Review switch to examine the shape.

- Read the explanation to ensure that you have selected the appropriate type.

- In the event the type isn`t what you`re seeking, make use of the Search area to obtain the type that suits you and specifications.

- Whenever you obtain the proper type, just click Purchase now.

- Select the prices prepare you would like, complete the specified info to produce your bank account, and buy the transaction utilizing your PayPal or charge card.

- Select a practical document file format and acquire your duplicate.

Locate all the papers layouts you might have purchased in the My Forms food selection. You can aquire a extra duplicate of Arkansas Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan anytime, if required. Just click the necessary type to acquire or print out the papers web template.

Use US Legal Forms, the most extensive assortment of lawful forms, to save lots of efforts and stay away from blunders. The assistance gives professionally manufactured lawful papers layouts that you can use for an array of purposes. Create your account on US Legal Forms and begin making your way of life a little easier.

Form popularity

FAQ

In some states, workers forfeit their unused paid time off (PTO) when they separate from the company. In other states, including California, employers must pay out any unused vacation time immediately upon termination.

If your vacation policy states that upon separation, accrued vacation is paid to the employee, by Indiana Labor Laws, it must be paid upon separation. If your policy states that upon separation, accrued vacation is forfeited, the employee, by Indiana Labor Laws, will not be paid.

You and your employer can also arrange how to pay out or cash out accrued vacation time while you are still on the job. These arrangements are often outlined in the employment contract. In some workplaces, it is only an option at the end of a calendar year. In other workplaces, it can happen at any time.

Arkansas does not require PTO payout at separation for vacation time or sick leave unless promised by an employer's contract or policy. No law in Arkansas requires employers to pay out the value of unused accrued paid time off when an employee leaves a company, whether they quit voluntarily, retire, or are terminated.

If a company or corporation terminates the employee, the employee's wages are due by the next regular payday. If the employer fails to make payment within 7 days of the next regular payday then the employer shall owe the employee double the wages due.

No federal or state law in Arkansas requires employers to pay out an employee's accrued vacation, sick leave, or other paid time off (PTO) at the termination of employment.

Even though Washington doesn't have a law requiring PTO payout at termination, employers might be responsible for paying out unused PTO to an employee who leaves the company. If there is a company policy or employment contract that requires it, an employer is required to pay unused PTO to a separating employee.