Arkansas Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005

Description

How to fill out Chapter 7 Individual Debtors Statement Of Intention - Form 8 - Post 2005?

Are you within a place that you require documents for both organization or personal functions virtually every time? There are plenty of legal record layouts available on the Internet, but finding versions you can depend on is not simple. US Legal Forms provides a huge number of kind layouts, such as the Arkansas Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005, which are composed to satisfy state and federal requirements.

In case you are already knowledgeable about US Legal Forms website and also have a merchant account, just log in. Following that, you may down load the Arkansas Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 template.

Should you not offer an profile and would like to begin using US Legal Forms, abide by these steps:

- Discover the kind you require and ensure it is for the right area/area.

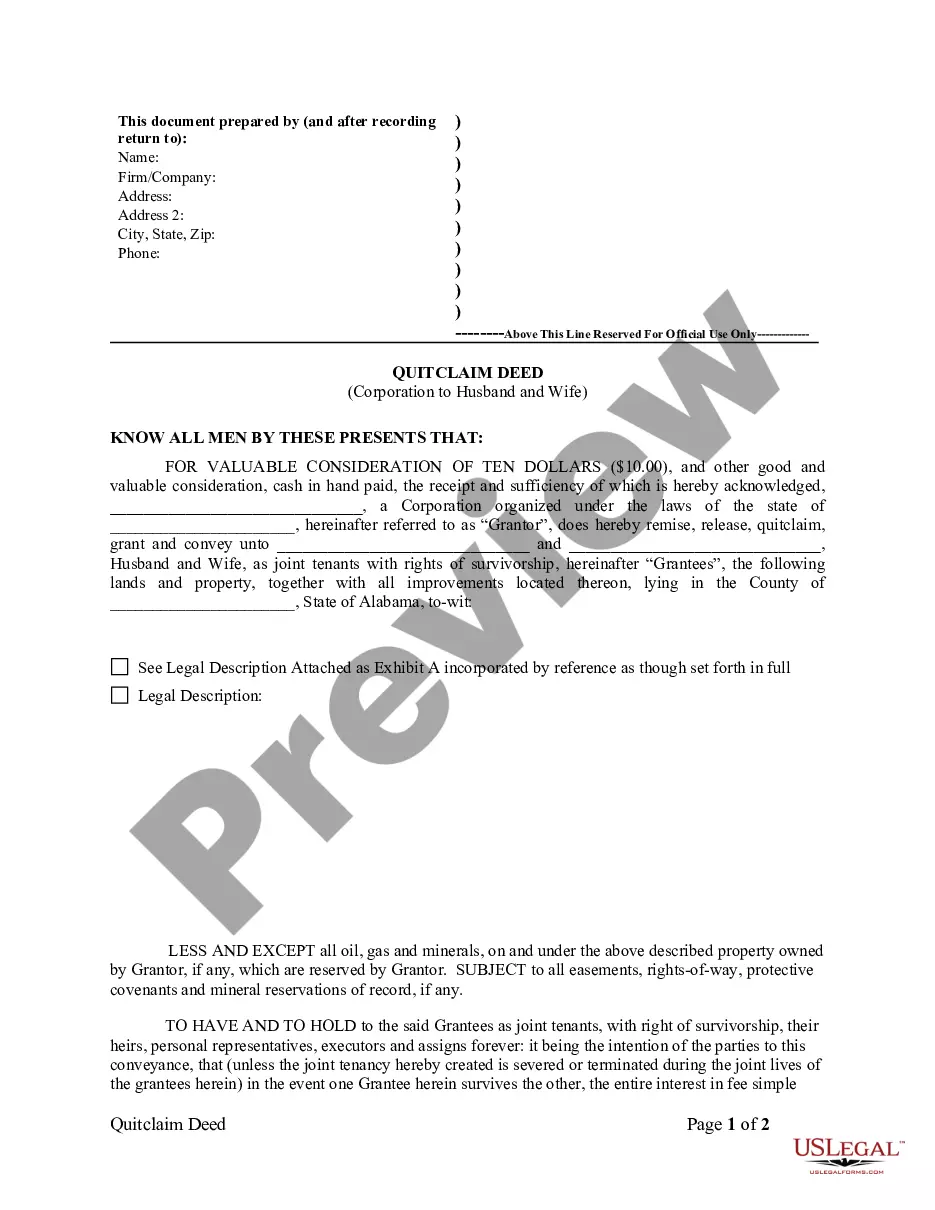

- Use the Preview switch to examine the form.

- Read the outline to actually have chosen the correct kind.

- When the kind is not what you are seeking, make use of the Lookup industry to find the kind that meets your needs and requirements.

- When you discover the right kind, click on Buy now.

- Choose the prices strategy you would like, complete the required details to generate your bank account, and purchase the order making use of your PayPal or Visa or Mastercard.

- Decide on a hassle-free data file format and down load your duplicate.

Discover every one of the record layouts you might have purchased in the My Forms menu. You may get a further duplicate of Arkansas Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 at any time, if necessary. Just click the essential kind to down load or print out the record template.

Use US Legal Forms, the most substantial collection of legal varieties, to save lots of some time and avoid errors. The services provides expertly manufactured legal record layouts that you can use for a variety of functions. Make a merchant account on US Legal Forms and start creating your life easier.

Form popularity

FAQ

In a chapter 7 case, however, a discharge is only available to individual debtors, not to partnerships or corporations. 11 U.S.C. § 727(a)(1). Although an individual chapter 7 case usually results in a discharge of debts, the right to a discharge is not absolute, and some types of debts are not discharged.

Not All Debts Are Discharged Certain debts will remain on your account when you file for Chapter 7 bankruptcy. You will still be responsible for alimony and child support. Tax liens, student loans, and personal injury debts caused by intoxicated drivers are still on the docket, as well.

Filing for Chapter 7 bankruptcy will wipe out your mortgage obligation. Still, if you aren't willing to pay the mortgage, you'll have to give up the home because your lender's right to foreclose doesn't go away when you file for Chapter 7.

Most Chapter 7 bankruptcy cases are no-asset cases. That means the debtors give up nothing to the trustee. The exemption systems permit debtors to retain the means of day-to-day living, free from the claims of their creditors.

When you file for Chapter 7 bankruptcy, you will have to complete a form called the Statement of Intention for Individuals Filing Under Chapter 7. On this form, you tell the court whether you want to keep your secured and leased property?such as your car, boat, or home?or let it go back to the creditor.

In a Chapter 7 bankruptcy you wipe out your debts and get a ?Fresh Start?. Chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. (see Arkansas Exemptions) The trustee sells the assets and pays you, the debtor, any amount exempted.

Examples of nonexempt assets that can be subject to liquidation: Additional home or residential property that is not your primary residence. Investments that are not part of your retirement accounts. An expensive vehicle(s) not covered by bankruptcy exemptions.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.