Statutory Guidelines [Appendix A(4) IRC 468B] regarding special rules for designated settlement funds.

Arkansas Special Rules for Designated Settlement Funds IRS Code 468B

Description

How to fill out Special Rules For Designated Settlement Funds IRS Code 468B?

Are you presently in the placement that you will need papers for both enterprise or individual purposes almost every time? There are tons of legal document themes accessible on the Internet, but locating versions you can depend on is not straightforward. US Legal Forms delivers 1000s of type themes, just like the Arkansas Special Rules for Designated Settlement Funds IRS Code 468B, which are composed to fulfill state and federal needs.

Should you be already knowledgeable about US Legal Forms internet site and get a free account, simply log in. Following that, you can download the Arkansas Special Rules for Designated Settlement Funds IRS Code 468B web template.

Unless you provide an profile and need to begin to use US Legal Forms, follow these steps:

- Discover the type you want and ensure it is for that proper town/county.

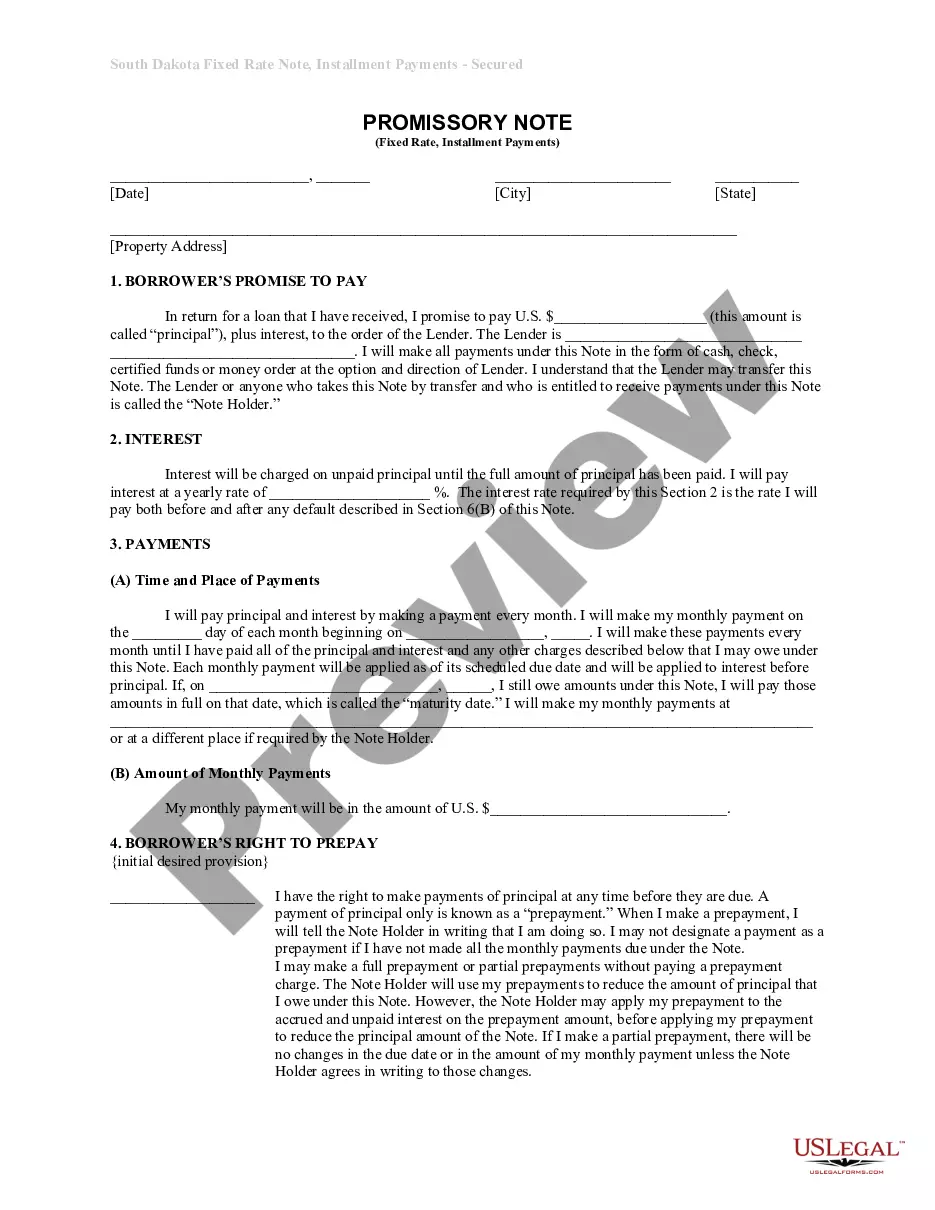

- Make use of the Review switch to analyze the shape.

- Browse the outline to actually have chosen the appropriate type.

- If the type is not what you`re trying to find, make use of the Search discipline to obtain the type that fits your needs and needs.

- Whenever you find the proper type, just click Buy now.

- Choose the prices program you need, complete the necessary information to create your money, and pay for your order using your PayPal or credit card.

- Decide on a hassle-free paper formatting and download your backup.

Find every one of the document themes you have purchased in the My Forms menu. You can obtain a additional backup of Arkansas Special Rules for Designated Settlement Funds IRS Code 468B at any time, if necessary. Just click on the essential type to download or printing the document web template.

Use US Legal Forms, by far the most considerable collection of legal varieties, to conserve time and steer clear of blunders. The support delivers professionally created legal document themes which can be used for a range of purposes. Generate a free account on US Legal Forms and commence producing your way of life easier.

Form popularity

FAQ

§ 1.468B-2 Taxation of qualified settlement funds and related administrative requirements. (a) In general. A qualified settlement fund is a United States person and is subject to tax on its modified gross income for any taxable year at a rate equal to the maximum rate in effect for that taxable year under section 1(e).

Generally, settlement funds and damages received from a lawsuit are taxable income ing to the IRS. Nonetheless, personal injury settlements - specifically those resulting from car accidents or slip and fall incidents - are typically exempt from taxes.

A Qualified Settlement Fund (QSF), also referred to as a 468B Trust, is an exceptionally useful settlement tool that allows time to properly resolve mass tort litigation and other cases involving multiple claimants.

How do law firms establish qualified settlement funds? Be established pursuant to a court order and is subject to continuing jurisdiction of the court (26 CFR § 1.468B(c)). Resolve one or more contested claims arising out of a tort, breach of contract, or violation of law. A trust under applicable state law.

Internal Revenue Code (IRC) § 468B provides for the taxation of designated settlement funds and directs the Department of the Treasury to prescribe regulations providing for the taxation of an escrow account, settlement fund, or similar fund, whether as a grantor trust or otherwise.

A QSF is assigned its own Employer Identification Number from the IRS. A QSF is taxed on its modified gross income[v] (which does not include the initial deposit of money), at a maximum rate of 35%.

A QSF is assigned its own Employer Identification Number from the IRS. A QSF is taxed on its modified gross income[v] (which does not include the initial deposit of money), at a maximum rate of 35%.