Statutory Guidelines [Appendix A(7) IRC 5891] regarding rules for structured settlement factoring transactions.

Arkansas Structured Settlement Factoring Transactions

Description

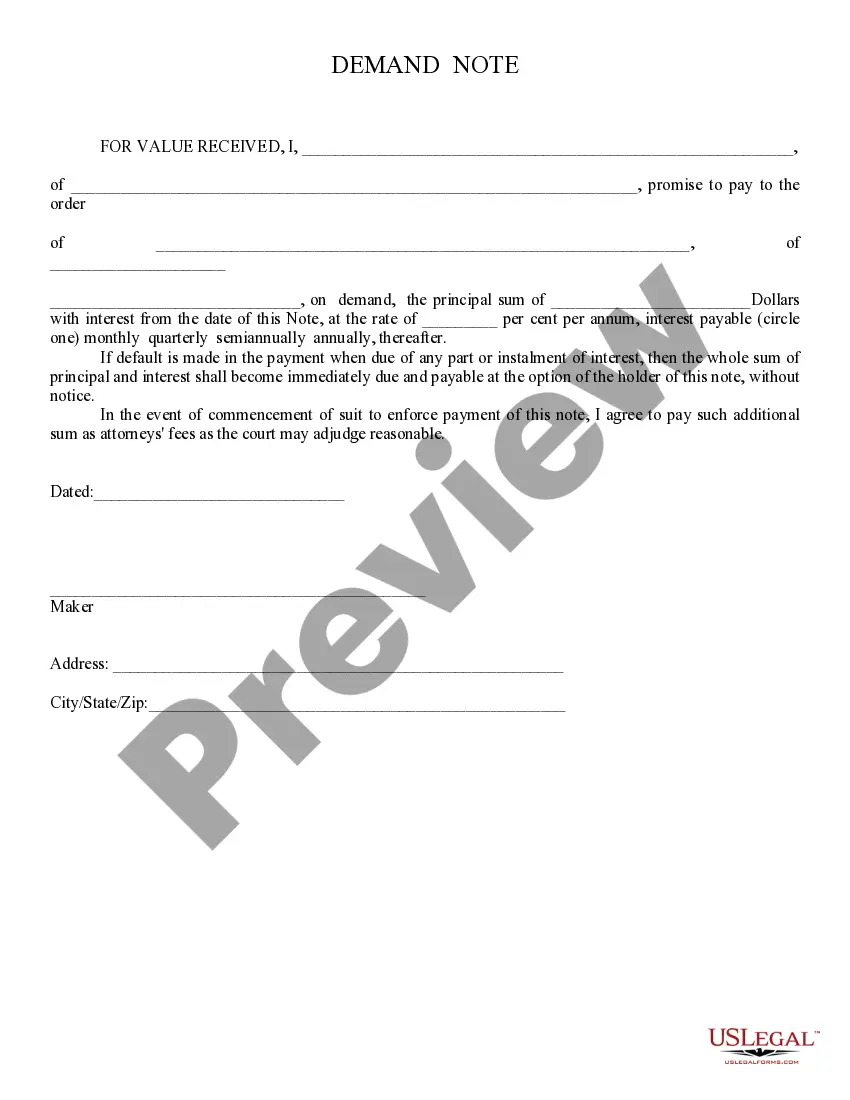

How to fill out Structured Settlement Factoring Transactions?

Choosing the right authorized record format can be a struggle. Of course, there are a lot of layouts accessible on the Internet, but how would you obtain the authorized form you will need? Take advantage of the US Legal Forms website. The service gives 1000s of layouts, for example the Arkansas Structured Settlement Factoring Transactions, which you can use for company and private requires. Every one of the varieties are checked by professionals and satisfy state and federal needs.

Should you be previously listed, log in in your accounts and click the Download option to obtain the Arkansas Structured Settlement Factoring Transactions. Utilize your accounts to look with the authorized varieties you have purchased in the past. Check out the My Forms tab of your accounts and get another backup from the record you will need.

Should you be a new user of US Legal Forms, here are basic instructions that you can follow:

- Initial, ensure you have chosen the proper form for the metropolis/region. You can examine the shape making use of the Preview option and study the shape explanation to make sure it will be the best for you.

- When the form is not going to satisfy your needs, make use of the Seach field to obtain the appropriate form.

- Once you are certain the shape is proper, select the Buy now option to obtain the form.

- Select the prices program you would like and type in the necessary information. Build your accounts and pay for the order making use of your PayPal accounts or bank card.

- Choose the data file file format and obtain the authorized record format in your device.

- Comprehensive, revise and produce and sign the obtained Arkansas Structured Settlement Factoring Transactions.

US Legal Forms may be the biggest local library of authorized varieties that you can find numerous record layouts. Take advantage of the service to obtain skillfully-produced papers that follow status needs.

Form popularity

FAQ

The term ?structured settlement factoring transaction? means a transfer of structured settlement payment rights (including portions of structured settlement payments) made for consideration by means of sale, assignment, pledge, or other form of encumbrance or alienation for consideration. 26 U.S. Code § 5891 - Structured settlement factoring transactions cornell.edu ? uscode ? text cornell.edu ? uscode ? text

Structured settlements can provide long-term monthly payments in workers' compensation/medical malpractice cases. With a structured settlement annuity, there's no risk of outliving the money. Future payments can last for the claimant's lifetime. Structured Settlements: Pros and Cons - FindLaw findlaw.com ? injury ? accident-injury-law findlaw.com ? injury ? accident-injury-law

The Five Steps for Selling a Structured Settlement: Check with a lawyer and local laws to find out if your settlement can be sold. Decide if selling is a good idea, depending on your goals and financial situation. Research quotes and pick a trustworthy company. Attend your court date. How To Sell Your Structured Settlement in 5 Steps - Annuity.org annuity.org ? structured-settlements ? selling annuity.org ? structured-settlements ? selling

Different Types of Structured Settlement Payouts Temporary life annuity. Joint and survivor annuity. Deferred lump-sum. Percentage increase annuity. Step annuities. Structured Settlement Payout Options: Understanding Your Choices annuity.org ? structured-settlements ? payou... annuity.org ? structured-settlements ? payou...

Factoring companies charge a fee when you cash in part or all your structured settlement. It's called a discount rate, which is a percentage deducted from the remaining value of your payments. Discount rates range from 6% to 19% and can go even higher ? although it's possible to negotiate a lower rate.

An alternative to a lump-sum payout, structured settlements are periodic payments typically made to a plaintiff who wins or settles a personal injury lawsuit. Instead of receiving a lump sum of money for damages, the defendant makes a series of scheduled payments to the plaintiff over time.

Cashing in a structured settlement typically requires working with settlement buyers or factoring companies. These companies specialize in buying settlements and providing a lump sum cash payout.

Understanding Structured Settlements These are typically the result of a personal injury, wrongful death lawsuit or another legal claim. The plaintiff agrees to resolve a claim by receiving part or all of a settlement in the form of periodic payments on an agreed schedule, rather than as a single lump sum.