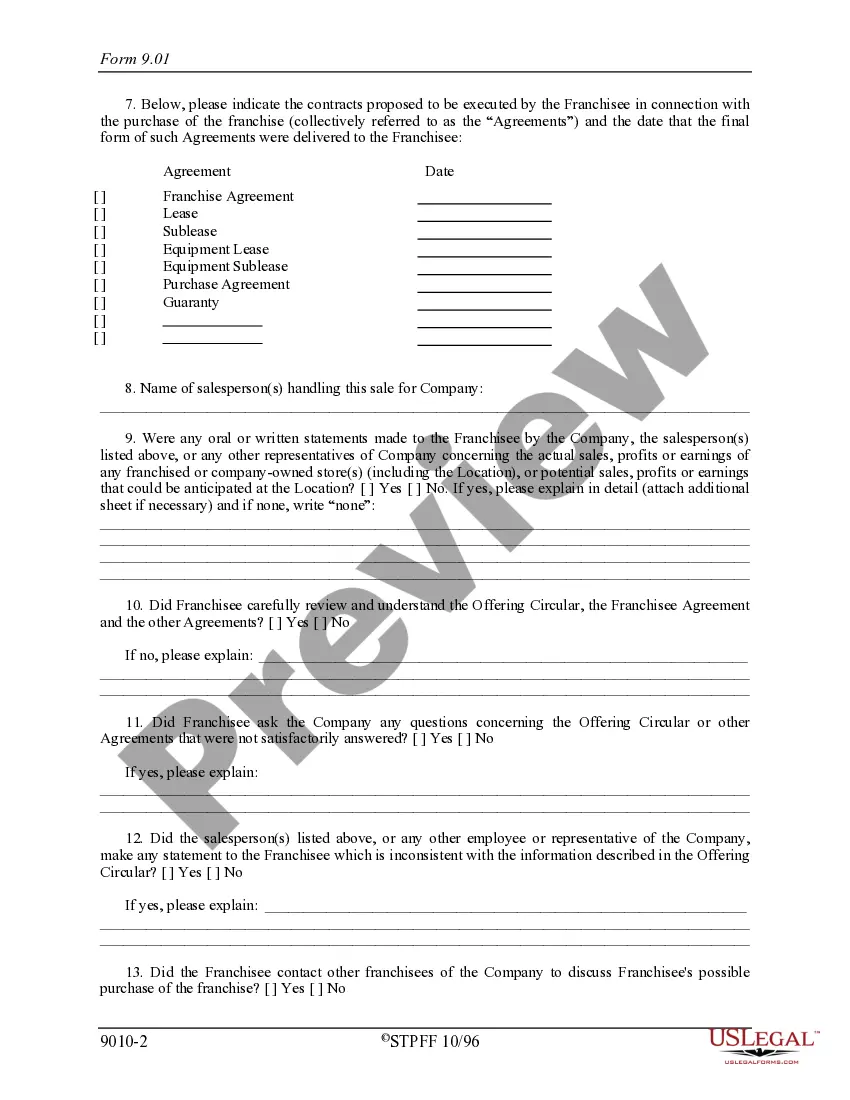

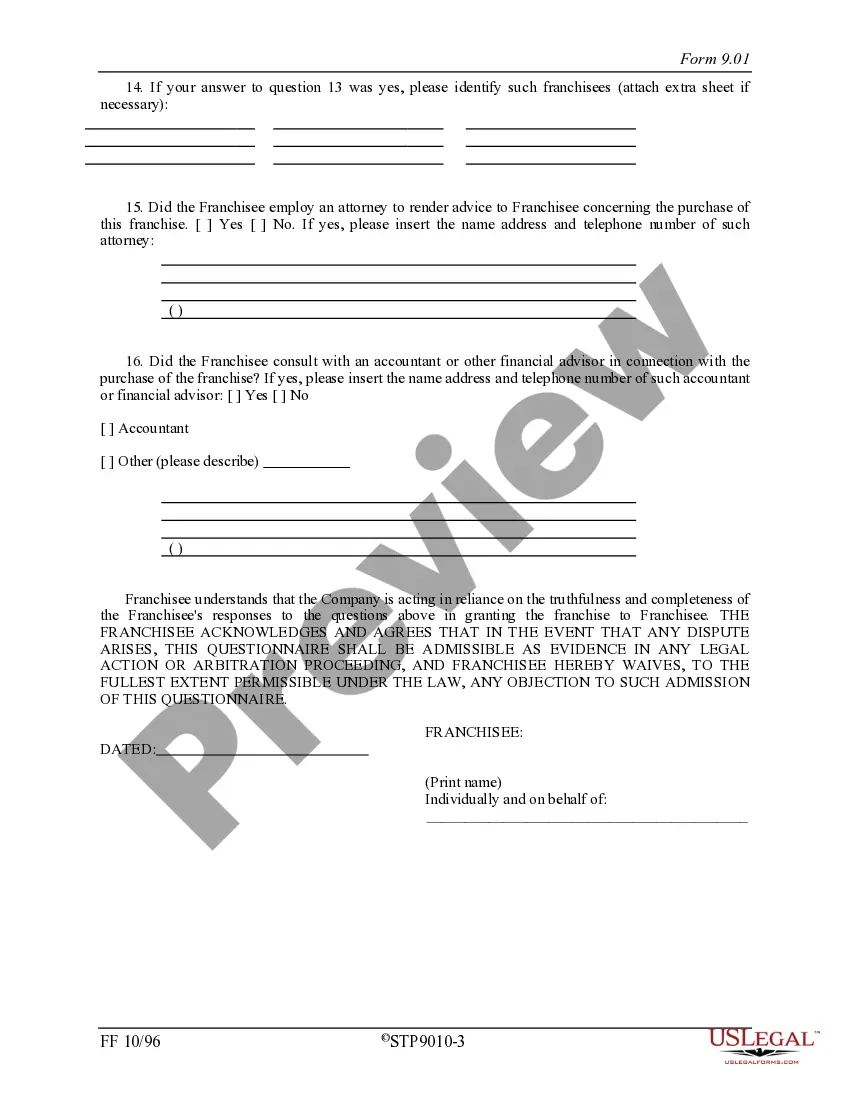

Arkansas Franchisee Closing Questionnaire

Description

How to fill out Franchisee Closing Questionnaire?

US Legal Forms - one of many largest libraries of legitimate varieties in the USA - delivers a variety of legitimate papers templates you can acquire or print out. Utilizing the web site, you can find 1000s of varieties for organization and person purposes, categorized by types, says, or search phrases.You will discover the newest versions of varieties much like the Arkansas Franchisee Closing Questionnaire in seconds.

If you have a monthly subscription, log in and acquire Arkansas Franchisee Closing Questionnaire in the US Legal Forms library. The Acquire button will show up on each and every type you look at. You get access to all in the past downloaded varieties inside the My Forms tab of your accounts.

If you wish to use US Legal Forms for the first time, listed below are simple guidelines to get you started:

- Make sure you have picked the right type to your metropolis/state. Go through the Preview button to check the form`s content material. Look at the type explanation to ensure that you have selected the right type.

- When the type does not fit your specifications, utilize the Look for area near the top of the display to find the one which does.

- Should you be content with the form, confirm your selection by clicking the Get now button. Then, select the prices program you like and supply your accreditations to register for the accounts.

- Procedure the purchase. Use your Visa or Mastercard or PayPal accounts to finish the purchase.

- Choose the format and acquire the form on the product.

- Make modifications. Load, modify and print out and indicator the downloaded Arkansas Franchisee Closing Questionnaire.

Every design you included with your account does not have an expiration time and is also your own property eternally. So, in order to acquire or print out an additional duplicate, just check out the My Forms segment and click on the type you will need.

Gain access to the Arkansas Franchisee Closing Questionnaire with US Legal Forms, one of the most comprehensive library of legitimate papers templates. Use 1000s of specialist and express-distinct templates that meet your company or person requires and specifications.

Form popularity

FAQ

Yes, you can be your own registered agent in Arkansas. With that said, however, after considering the registered agent requirements most business owners elect to hire a registered agent service instead.

Visit . Enter your File number and Federal Tax ID number, click ?Show Available Filings,? then follow the instructions.

In Arkansas, you can establish a sole proprietorship without filing any legal documents with the Arkansas state government.

Contrary to what the name implies, a franchise tax is not a tax imposed on a franchise. Rather, it's charged to corporations, partnerships, and other entities like limited liability corporations (LLCs) that do business within the boundaries of that state.

A.C.A. § 26-54-101 et al., also known as the ?Arkansas Corporate Franchise Tax Act of 1979?, requires all Corporations, LLC's, Banks, and Insurance Companies registered in Arkansas to pay an annual franchise tax.

Arkansas Franchise Tax Report- Due Dates and Fees Arkansas LLCs and corporations without stock will pay a fixed amount for their franchise tax. Corporations with stock, however, will pay 0.3% of their total outstanding capital stock OR $150 ? whichever is greater.

Corporations pay franchise tax if they meet any of the following: Incorporated or organized in California. Qualified or registered to do business in California. Doing business in California, whether or not incorporated, organized, qualified, or registered under California law.

California corporations and S-corps are generally subject CA franchise tax. The California Minimum Franchise Tax of $800 will be automatically calculated for applicable corporate and S-corp returns on CA Form 100, page 2, line 23 or CA Form 100S, page 2, line 21.