Arkansas Stop Annuity Request

Description

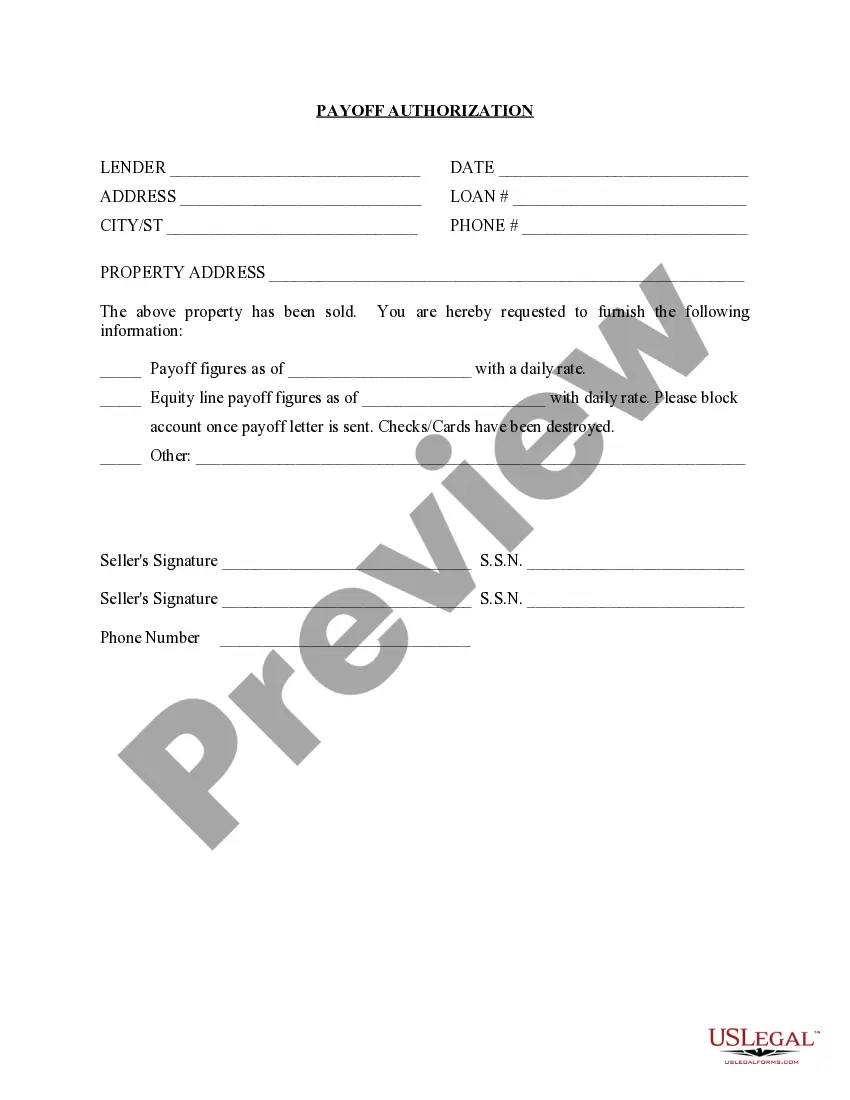

How to fill out Stop Annuity Request?

You might spend hours online trying to locate the legal document template that fulfills the federal and state standards you require.

US Legal Forms offers thousands of legal documents that can be reviewed by specialists.

You can conveniently obtain or print the Arkansas Stop Annuity Request from the services available.

If available, utilize the Review button to browse the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- Next, you can complete, edit, print, or sign the Arkansas Stop Annuity Request.

- Every legal document template you obtain is yours indefinitely.

- To retrieve another copy of any acquired form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the county/city that you select.

- Review the form outline to confirm you have chosen the appropriate document.

Form popularity

FAQ

Arkansas T-drop allows individuals to cease their annuity payments under certain circumstances, primarily involving financial strain or the need for liquidity. Generally, this requires filing an Arkansas Stop Annuity Request and often involves a review process. Understanding this feature can significantly ease your financial burden.

An annuity can be cashed out an annuity at any time before annuitizing the contract. If the annuity is cashed out before the deferred annuity's term has been met, a surrender charge can be applied. Generally, the annuity can be cashed out without a penalty after the term has been completed.

When you surrender an annuity, you will owe, at minimum, income taxes on the taxable amount you receive. These will be due in the year in which you realize the income. In addition to ordinary income tax, you may owe additional taxes imposed by the IRS.

Regardless of your age, you can break an annuity without paying taxes or tax penalties if you decide to roll your annuity proceeds into a new annuity or life insurance contract. The federal tax code includes a provision for the tax-sheltered movement of funds between insurance contracts.

Most annuities offer a surrender-free withdrawal option, available in each contract year. (Your contract year begins the day you sign the annuity contract and ends 364 days later.)

When you surrender an annuity, you will owe, at minimum, income taxes on the taxable amount you receive. These will be due in the year in which you realize the income. In addition to ordinary income tax, you may owe additional taxes imposed by the IRS.

Free Annuity Withdrawal ProvisionsSome, but certainly not all, annuity contracts allow you to withdraw a portion of your funds each year without being subject to surrender charges . You're often granted up to 10% of your total annuity contract value . This is called the free withdrawal provision.

If you decide that you no longer want the annuity within the set time frame, then you can simply cancel the contract without incurring a surrender charge from the insurance company. Think of the free-look period as a get-out-of-jail-free card but with a crucial caveat.

If you decide that you no longer want the annuity within the set time frame, then you can simply cancel the contract without incurring a surrender charge from the insurance company. Think of the free-look period as a get-out-of-jail-free card but with a crucial caveat.

Your annuity contract takes effect on the day that you sign the contract. In most states, you can generally get a refund and cancel the contract at any point during the 10 days immediately following the purchase date.