Arkansas Fax Transmittal Form

Description

How to fill out Fax Transmittal Form?

If you wish to comprehensive, down load, or printing legal document layouts, use US Legal Forms, the greatest selection of legal kinds, that can be found online. Use the site`s simple and hassle-free look for to discover the paperwork you need. Numerous layouts for company and personal uses are categorized by types and suggests, or keywords and phrases. Use US Legal Forms to discover the Arkansas Fax Transmittal Form in just a handful of clicks.

In case you are previously a US Legal Forms customer, log in to the account and then click the Download option to get the Arkansas Fax Transmittal Form. You can also gain access to kinds you in the past downloaded from the My Forms tab of the account.

If you work with US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have selected the shape to the appropriate city/land.

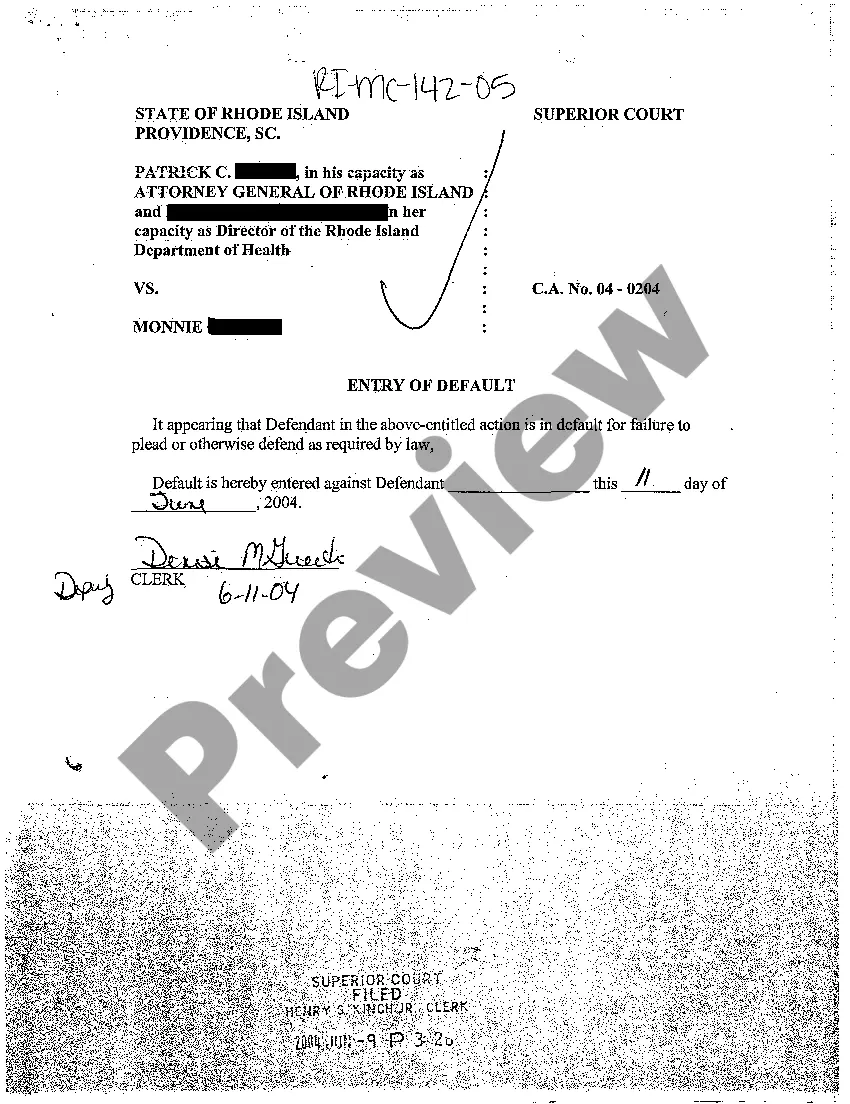

- Step 2. Use the Preview solution to examine the form`s content. Don`t neglect to read the outline.

- Step 3. In case you are unhappy together with the type, use the Search discipline near the top of the monitor to discover other versions of the legal type design.

- Step 4. Upon having located the shape you need, select the Buy now option. Pick the rates strategy you like and add your accreditations to sign up on an account.

- Step 5. Approach the purchase. You may use your credit card or PayPal account to finish the purchase.

- Step 6. Choose the structure of the legal type and down load it on the device.

- Step 7. Complete, modify and printing or indicator the Arkansas Fax Transmittal Form.

Every single legal document design you purchase is the one you have forever. You have acces to each and every type you downloaded within your acccount. Go through the My Forms section and select a type to printing or down load again.

Contend and down load, and printing the Arkansas Fax Transmittal Form with US Legal Forms. There are many specialist and status-distinct kinds you can use to your company or personal needs.

Form popularity

FAQ

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

Just like the federal government, if you earn an income, you must pay income taxes in Arkansas. As a traditional W-2 employee, your Arkansas taxes will be drawn on each payroll automatically. You will see this on your paycheck stub, near or next to the federal taxes.

Employers can register for the UI tax program online using ADWS's EZ Tax Registration system, where they provide their business information and receive an Employer Account Number (EAN).

You may access the Arkansas Taxpayer Access Point (ATAP), .atap.arkansas.gov, for online registration, filing, payment, and for options to manage your Withholding Tax account(s).

If you've run payroll in Arkansas previously, you can find your Withholding Account ID (also called a DFA Account ID) and filing frequency by: Reviewing Payment Vouchers received from the Department of Finance and Administration. Calling the agency at (501) 682-7290.

New Arkansas Employer: Register with the Arkansas Department of Finance and Administration (501)-682-7290 Click here to access the "Register New Business" link. Click the "Register New Business" link to begin the process.

State Tax Forms The Arkansas Department of Finance and Administration distributes Arkansas tax forms and instructions in the following ways: In Person: Arkansas Revenue Office, 206 Southwest Drive, Jonesboro, AR. Phone: Arkansas Revenue Office, 870-932-2716 (Jonesboro) 1-800-882-9275 (Little Rock)

For REFUND RETURN: Arkansas State Income Tax, P.O. Box 1000, Little Rock, AR 72203-1000; For TAX DUE RETURN: Arkansas State Income Tax, P.O. Box 2144, Little Rock, AR 72203-2144; For NO TAX DUE RETURN: Arkansas State Income Tax, P.O. Box 2144, Little Rock, AR 72203-2144.