Arkansas Agreement for Auditing Services between Accounting Firm and Municipality

Description

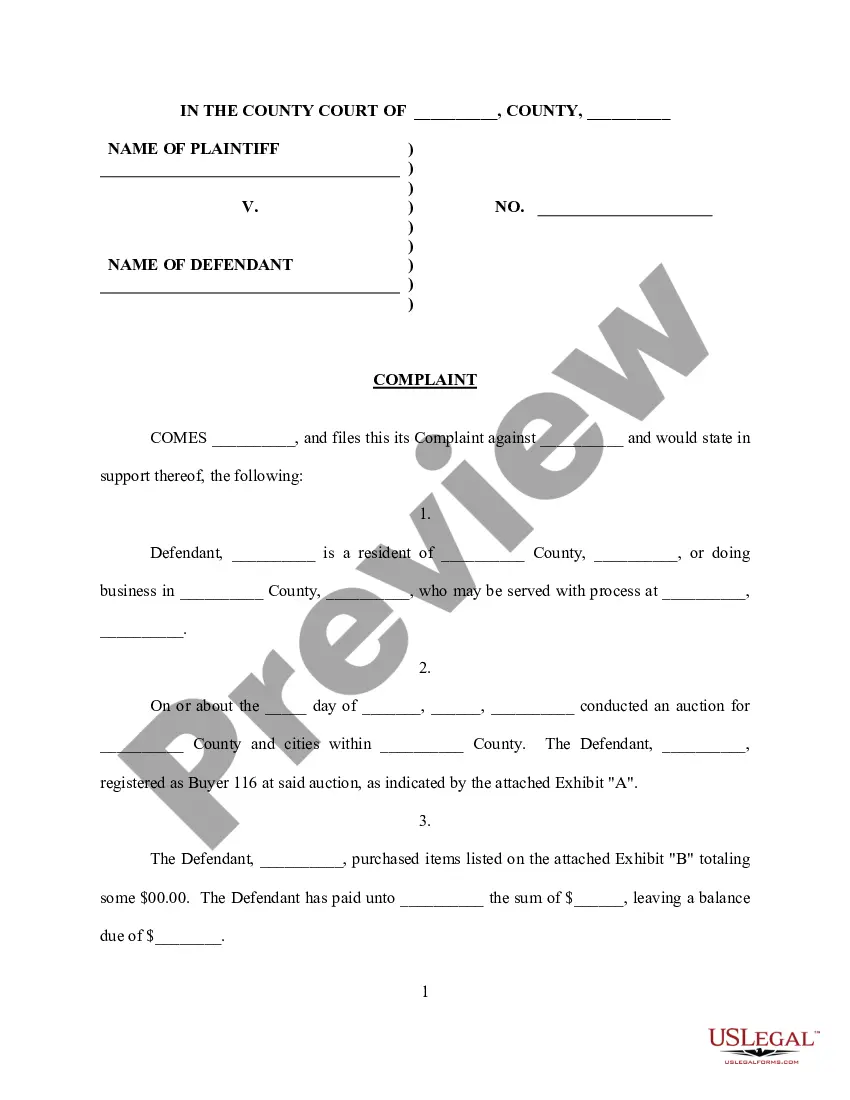

How to fill out Agreement For Auditing Services Between Accounting Firm And Municipality?

US Legal Forms - one of the largest libraries of legitimate forms in America - offers an array of legitimate file templates you can down load or print. Utilizing the web site, you will get 1000s of forms for organization and individual purposes, sorted by classes, says, or keywords.You can get the most up-to-date models of forms just like the Arkansas Agreement for Auditing Services between Accounting Firm and Municipality in seconds.

If you have a subscription, log in and down load Arkansas Agreement for Auditing Services between Accounting Firm and Municipality in the US Legal Forms catalogue. The Down load switch can look on every single kind you see. You gain access to all earlier acquired forms within the My Forms tab of your respective accounts.

In order to use US Legal Forms for the first time, here are straightforward recommendations to help you started out:

- Be sure you have chosen the right kind for your personal city/state. Click on the Review switch to analyze the form`s content. Read the kind explanation to actually have chosen the right kind.

- In case the kind does not match your needs, utilize the Lookup discipline towards the top of the screen to discover the the one that does.

- When you are content with the form, validate your choice by visiting the Acquire now switch. Then, opt for the costs strategy you like and give your accreditations to register to have an accounts.

- Approach the transaction. Make use of your bank card or PayPal accounts to perform the transaction.

- Find the structure and down load the form in your product.

- Make alterations. Fill out, revise and print and indication the acquired Arkansas Agreement for Auditing Services between Accounting Firm and Municipality.

Each and every web template you included in your account does not have an expiry day and is the one you have permanently. So, in order to down load or print one more version, just visit the My Forms area and click on in the kind you want.

Gain access to the Arkansas Agreement for Auditing Services between Accounting Firm and Municipality with US Legal Forms, by far the most substantial catalogue of legitimate file templates. Use 1000s of skilled and status-distinct templates that meet your business or individual needs and needs.

Form popularity

FAQ

The Public Company Accounting Oversight Board (PCAOB) is a non-profit organization that regulates audits of publicly traded companies to minimize audit risk. The PCAOB was established at the same time as the Sarbanes-Oxley Act of 2002 to address the accounting scandals of the late 1990s.

To be independent, the auditor must be intellectually honest; to be recognized as independent, he must be free from any obligation to or interest in the client, its management, or its owners.

For financial institutions, the most common services performed by external auditors that require independence include audits of financial statements, audits of internal control over financial reporting, and attestations on manage- ment's assessment of internal control over financial reporting.

Like accountants, an auditor can work internally for a specific company or for a third party, such as a public accounting firm, to audit various businesses. Additionally, many auditors are employed by government and regulatory bodies, most notably the Internal Revenue Service (IRS).

Specific Prohibited Non-audit Services Bookkeeping. Financial information systems design and implementation. Appraisal or valuation services, fairness opinions, or contribution-in-kind reports. Actuarial services.

An accounting firm is a group of accounting professionals that provides clients with financial management services. These services could include auditing, tax preparation and planning, payroll processing, bookkeeping, and advisory services.

A CPA firm can perform three levels of service on a company's financial statements: compilation, review and audit.

The primary role of an accountant is to handle a variety of tasks including tax preparation, financial planning and audits.

An independent auditor is typically used to avoid conflicts of interest and to ensure the integrity of performing an audit. Independent auditors are often used?or even mandated?to protect shareholders and potential investors from the occasional fraudulent or unrepresentative financial claims made by public companies.

The audit can be conducted internally by employees of the organization or externally by an outside certified public accountant (CPA) firm.