Arkansas Modification of Partnership Agreement to Reorganize Partnership

Description

How to fill out Modification Of Partnership Agreement To Reorganize Partnership?

If you desire to aggregate, procure, or print legitimate document templates, utilize US Legal Forms, the most extensive assortment of legal forms, that are accessible on the web.

Employ the site's user-friendly and convenient search to locate the documents you need.

A selection of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, select the Purchase now button. Choose the payment plan you prefer and provide your credentials to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Utilize US Legal Forms to locate the Arkansas Modification of Partnership Agreement to Reorganize Partnership in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Download button to find the Arkansas Modification of Partnership Agreement to Reorganize Partnership.

- You can also access forms you previously acquired from the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to check the details.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP).

To dissolve your Arkansas LLC, you submit the completed form Articles of Dissolution for Limited Liability Company to the Arkansas Secretary of State, Business and Commercial Services (BCS) by mail or in person. You cannot file articles of dissolution online. Make checks payable to Arkansas Secretary of State.

Types of Partnership 5 Types: General Partnership, Limited Partnership, Limited Liability Partnership, Partnership at Will and Particular PartnershipGeneral Partnership:Limited Partnership:Limited Liability Partnership (L.L.P):Partnership at Will:Particular Partnership:

Types of partnershipsGeneral partnership. A general partnership is the most basic form of partnership.Limited partnership. Limited partnerships (LPs) are formal business entities authorized by the state.Limited liability partnership.Limited liability limited partnership.

The main features of a partnershipProfits and losses are shared equally between the partners;Partners bear unlimited liability for debts and obligations incurred by the partnership.Each partner is an agent for the other(s).Partnerships are assumed to be infinite.More items...?05-Sept-2016

A business partnership agreement is a legally binding document that outlines details about business operations, ownership stake, financials and decision-making. Business partnership agreements, when coupled with other legal entity documents, could limit liability for each partner.

A partnership agreement is a legal document that outlines the management structure of a partnership and the rights, duties, ownership interests and profit shares of the partners. It's not legally required, but highly advisable, to have a partnership agreement to avoid conflicts among partners.

There are 4 steps to follow for changing the partnership deed:Step 1: Take the mutual consent of partners.Step 2: Prepare for making a supplementary partnership deed.Step 3: Executing supplementary partnership deed.Step 4: Do the filing with Registrar of Firm (RoF).

The key differences between them is the partners in each kind of partnership are different for example: in general partnerships they each are responsible for everything that happens with the business, limited partnerships one partner is responsible for the whole business while one is just responsible for the money they

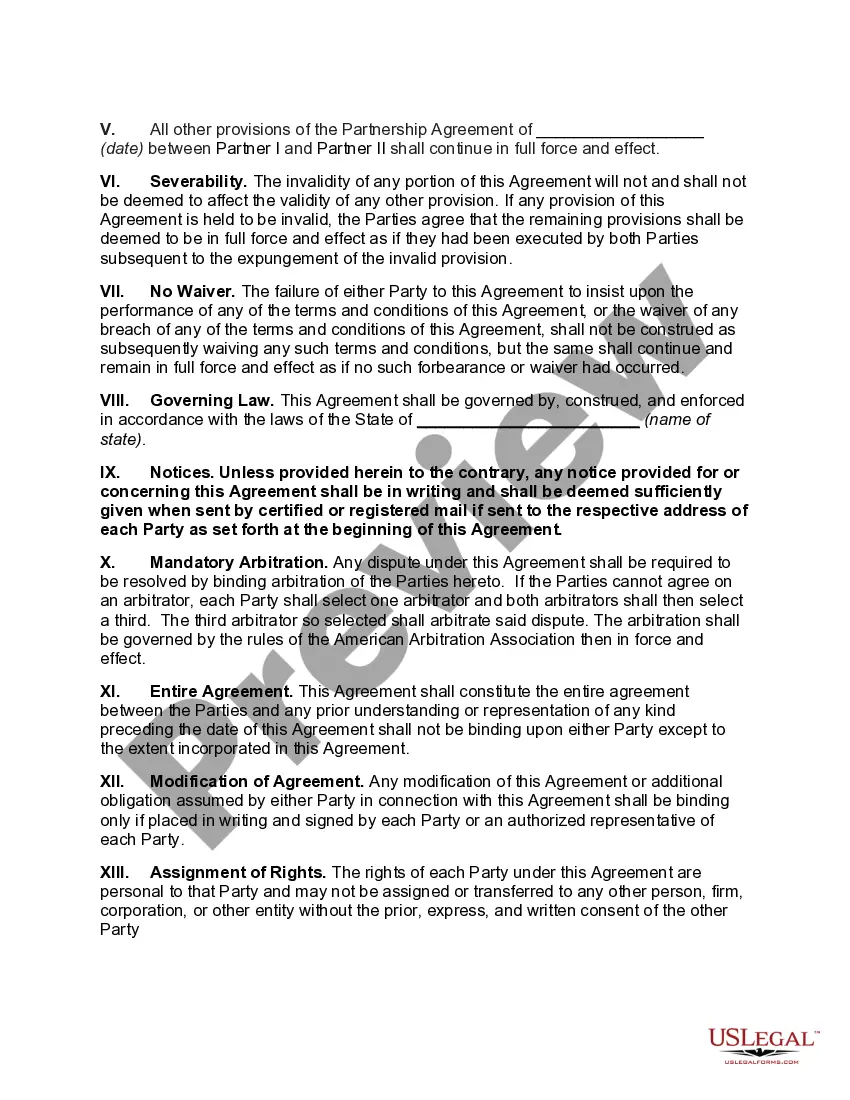

A Partnership Amendment, also called a Partnership Addendum, is used to modify, add, or remove terms in a Partnership Agreement. A Partnership Amendment is usually attached to an existing Partnership Agreement to reflect any changes.