Arkansas Partial Shipment Request

Description

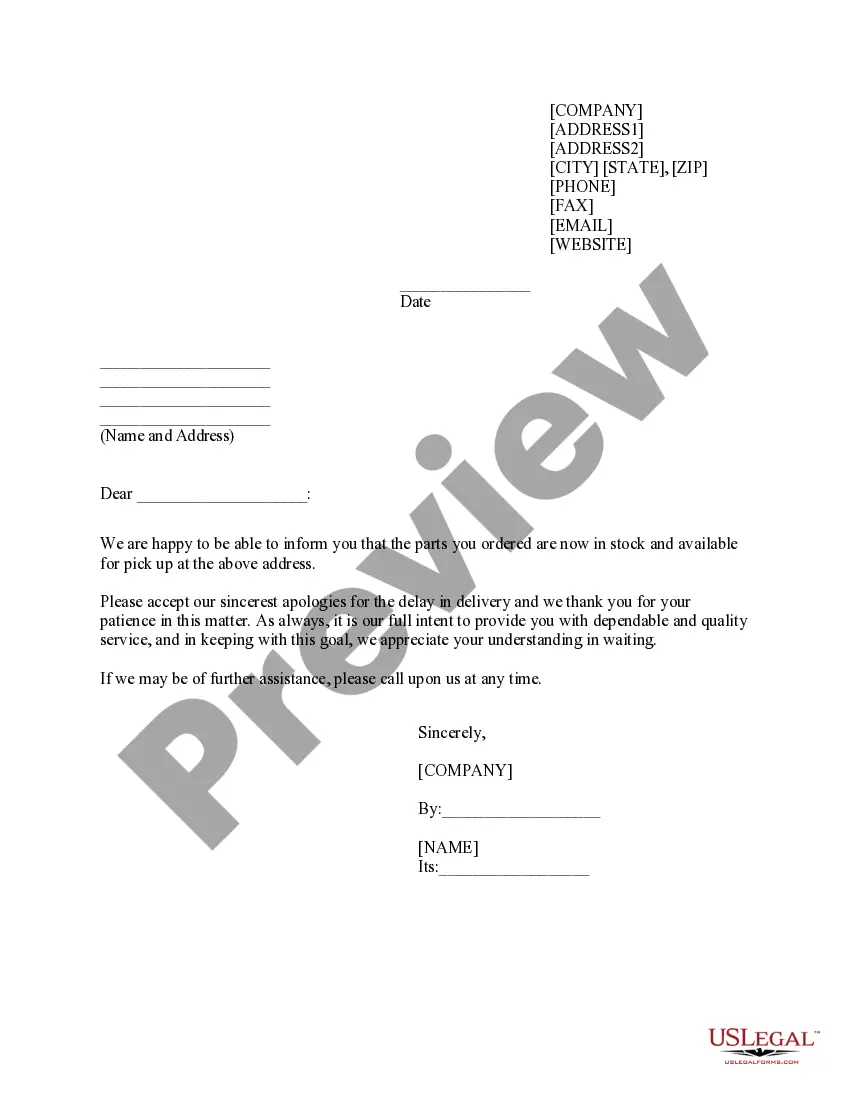

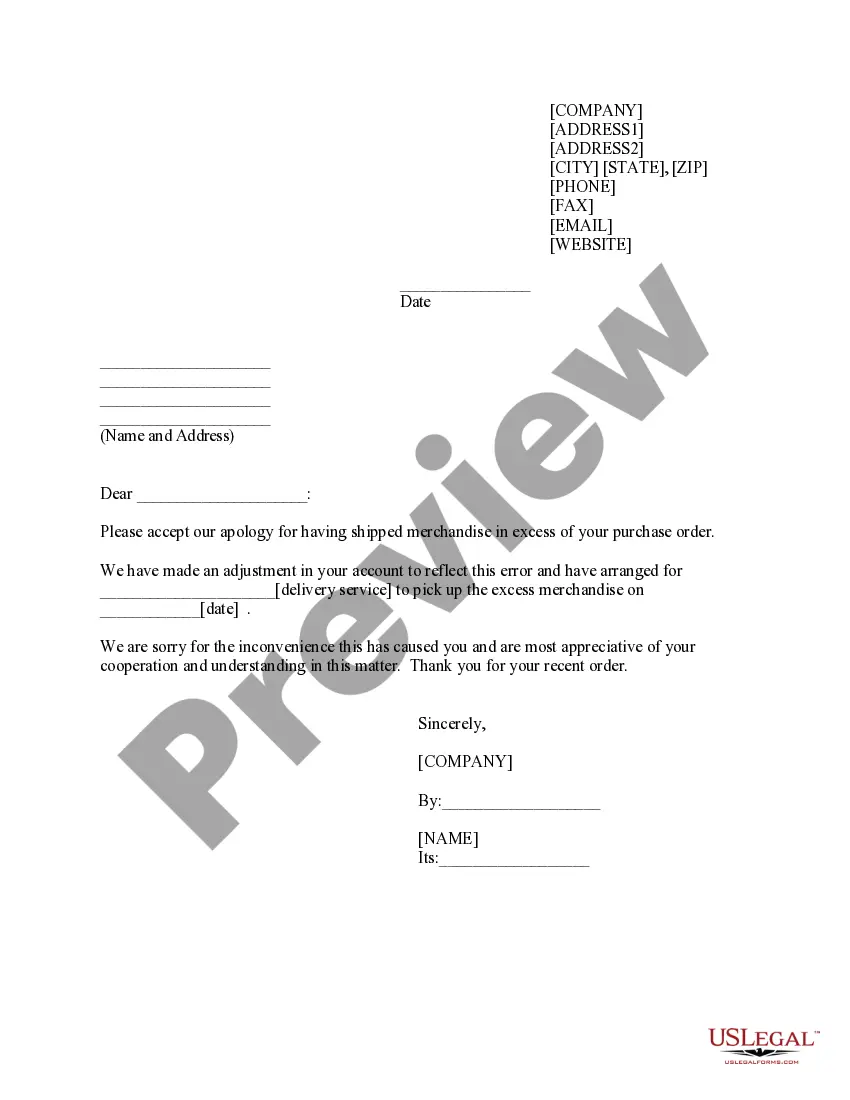

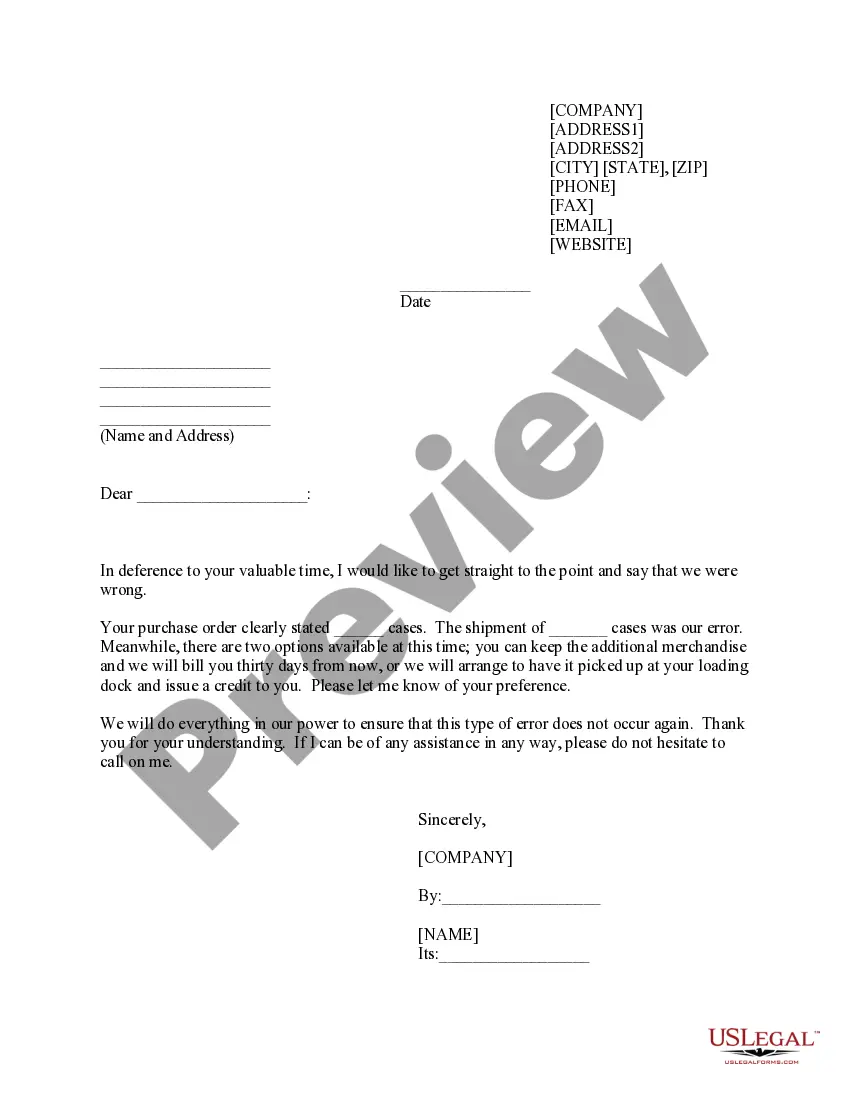

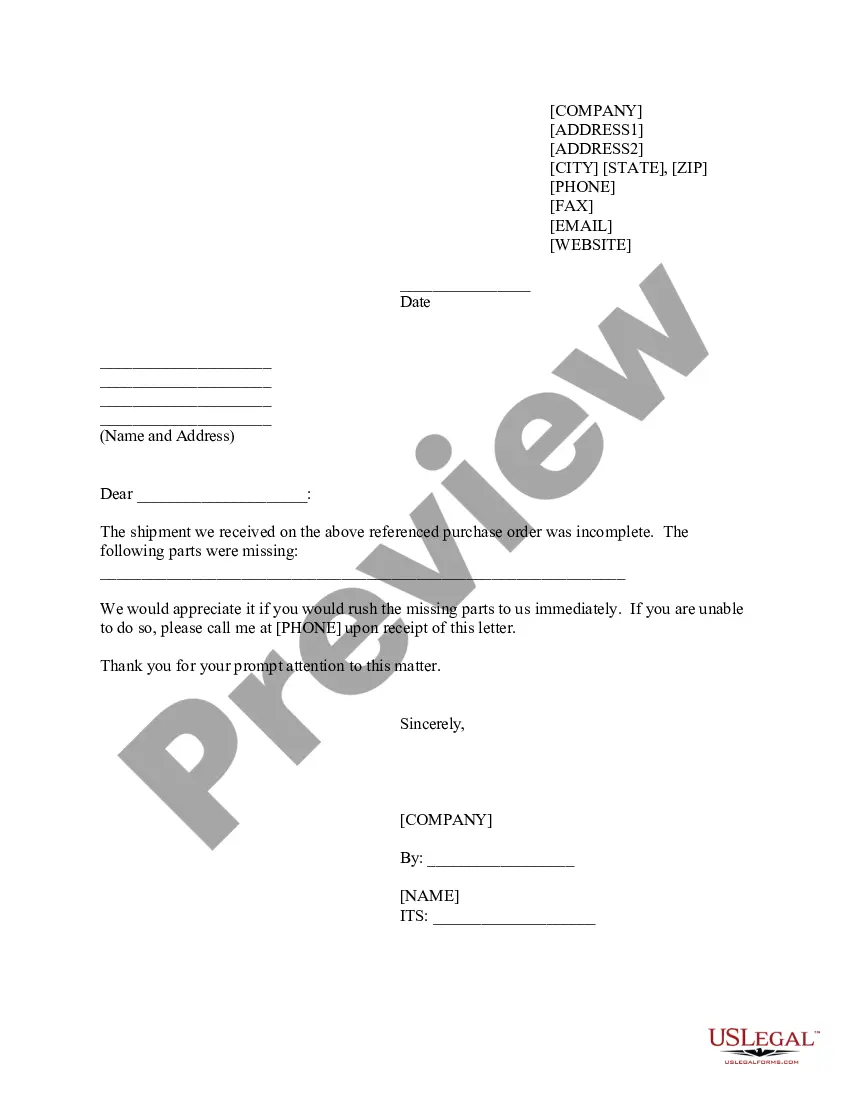

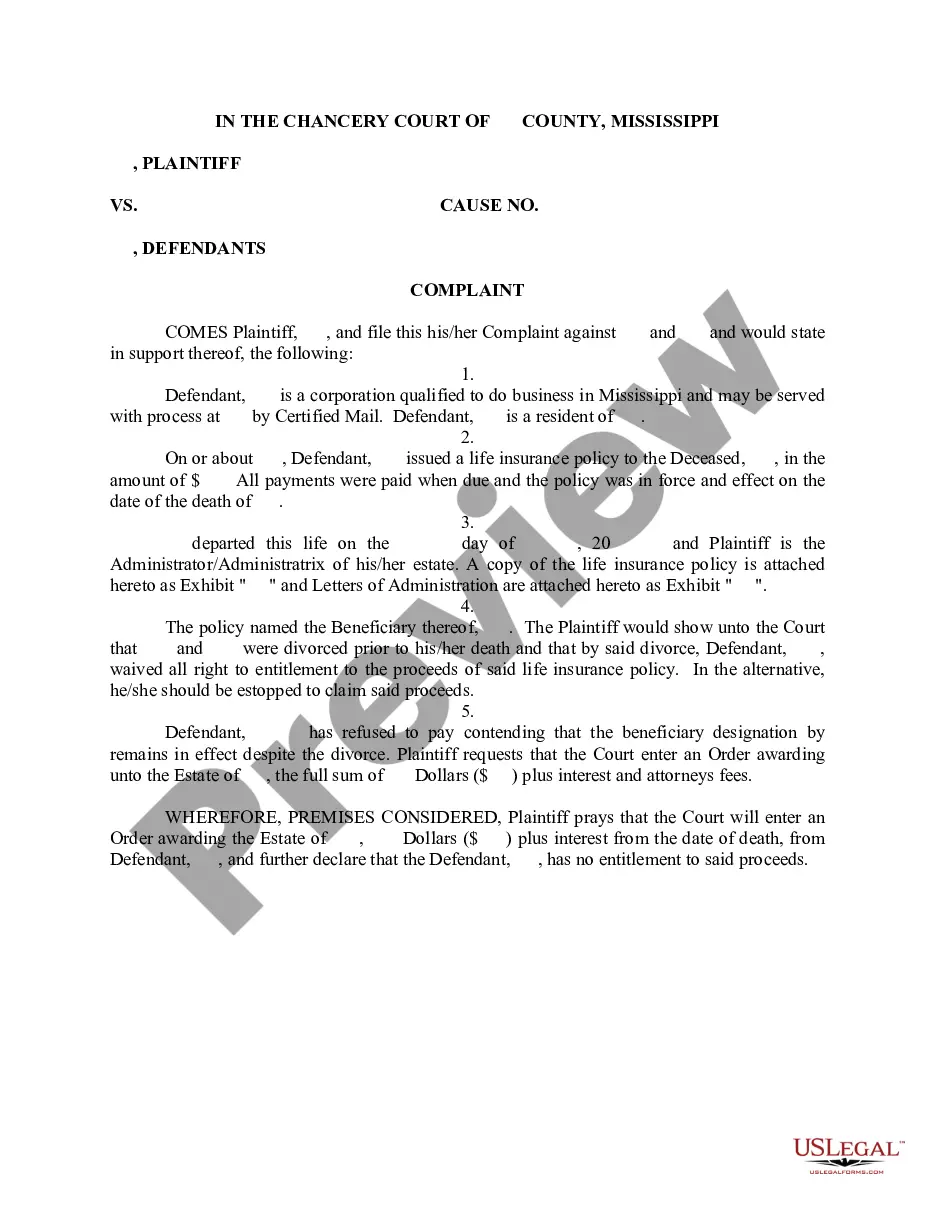

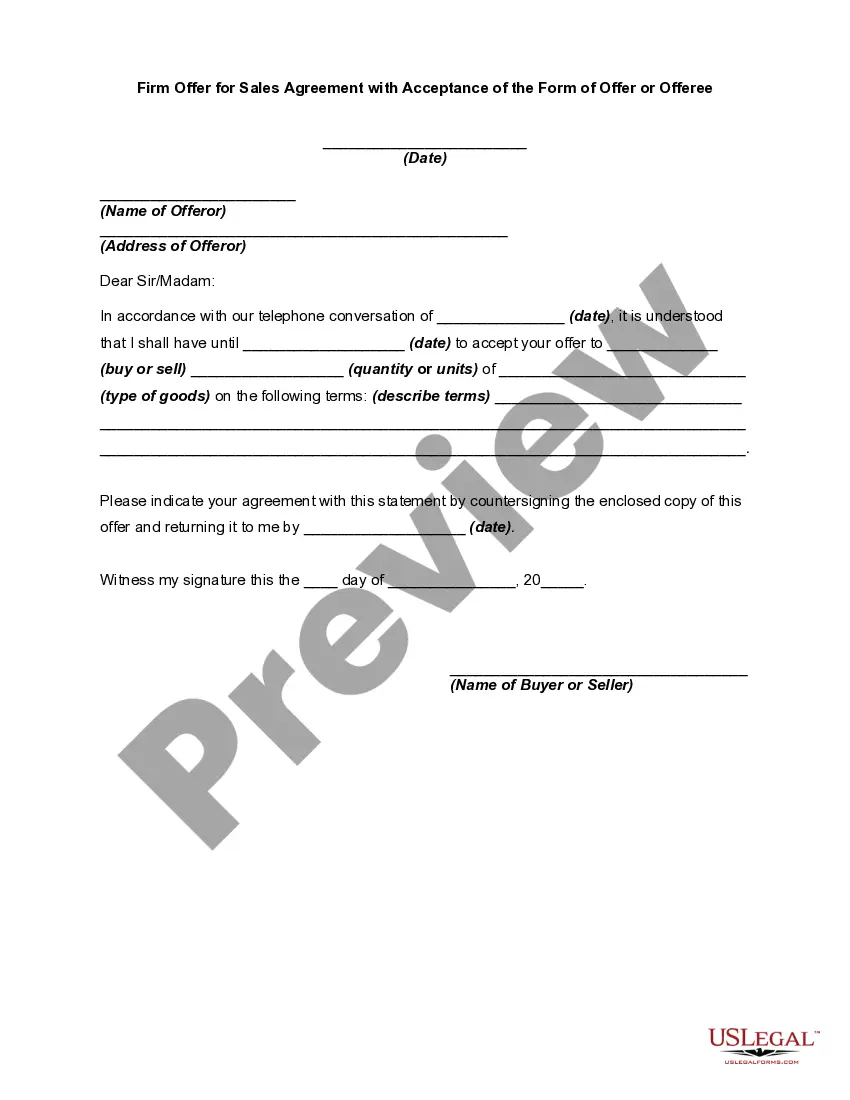

entire amount of an order at the present time but is willing to ship to customer an order if customer reduces the quantity ordered by a certain percentage.

How to fill out Partial Shipment Request?

Have you ever found yourself in a situation where you require documents for both professional or specific purposes almost daily.

There are numerous legal document formats accessible online, but finding reliable versions can be challenging.

US Legal Forms offers a vast array of form templates, including the Arkansas Partial Shipment Request, which is designed to comply with state and federal regulations.

Choose a convenient paper format and download your copy.

Access all the document formats you have purchased in the My documents menu. You can retrieve another copy of the Arkansas Partial Shipment Request at any time if needed. Just click on the document you require to download or print the form template. Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and minimize errors. The service provides well-crafted legal document templates that can be adapted for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Arkansas Partial Shipment Request template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the document you require and ensure it corresponds to the correct city/county.

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the appropriate document.

- If the document is not what you need, use the Search section to locate the form that fulfills your needs and requirements.

- Once you find the correct document, click on Get now.

- Select the pricing plan you desire, complete the necessary information to create your account, and process your order using your PayPal or credit card.

Form popularity

FAQ

Calculating Arkansas Car Sales Tax: The sales tax is calculated on the total amount of the sale (less trade-in value). This holds true for private car sales or vehicles purchased from car dealers in Arkansas. The percentage of sales tax charged is generally 6 percent of the total sales price.

Certificate for Developmentally Disabled Individual. INDIVIDUAL INCOME TAX RETURN. This certificate must be completed in its entirety to receive the $500.00 developmentally disabled individual credit. It must be attached to your Individual Income Tax Return the first time the credit is taken.

More about the Arkansas Form AR1000NR Tax Return We last updated Arkansas Form AR1000NR in January 2022 from the Arkansas Department of Revenue. This form is for income earned in tax year 2021, with tax returns due in April 2022.

You must register the vehicle within 30 days of the purchase and pay for state sales tax at the time of registration.

Where do I mail my Arkansas state income tax return? Box 1000, Little Rock, AR 72203-1000; For TAX DUE RETURN: Arkansas State Income Tax, P.O. Box 2144, Little Rock, AR 72203-2144; For NO TAX DUE RETURN: Arkansas State Income Tax, P.O.

Some goods are exempt from sales tax under Arkansas law. Examples include prescription drugs, purchases made with food stamps, and some farming equipment.

The sales tax sits at 6.5% for used vehicles. Arkansans do not have to pay the sales tax on used vehicles that cost fewer than $4,000.

Arkansas Sales Tax on Car Purchases: Arkansas collects a 6.5% state sales tax rate on the purchase of all vehicles which cost more than 4,000 dollars. Vehicles which were purchased at a cost of 4,000 dollars or less are not applicable for state sales tax, and will not be charged.

Form AR1000RC5 "Certificate for Individuals With Developmental Disabilities" - Arkansas.

You can avoid paying sales tax on vehicle transactions in Arkansas if you purchase a used car for less than $4,000.