Arkansas Telecommunications Services Agreement

Description

How to fill out Telecommunications Services Agreement?

Are you in a situation where you require documents for various business or personal reasons nearly every workday.

There are numerous legal document templates accessible online, but finding forms you can trust isn’t straightforward.

US Legal Forms offers a vast array of templates, including the Arkansas Telecommunications Services Agreement, that are designed to meet federal and state requirements.

Once you have the correct form, simply click Get now.

Select the payment plan you prefer, complete the necessary information to create your account, and process the order using your PayPal or credit card. Choose a convenient document format and download your copy. Review all of the document templates you have purchased in the My documents menu. You can retrieve an additional copy of the Arkansas Telecommunications Services Agreement at any time if needed. Just follow the necessary steps to download or print the document template. Utilize US Legal Forms, the largest repository of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Arkansas Telecommunications Services Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct region/location.

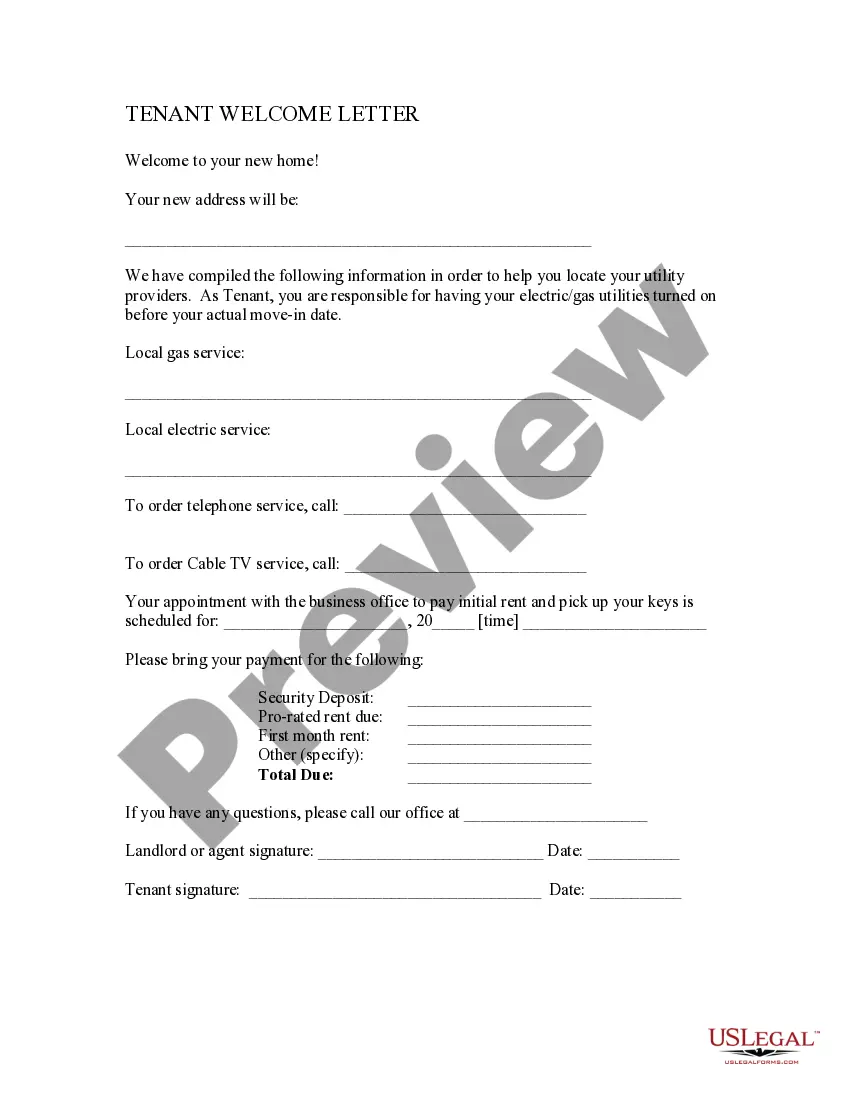

- Use the Review option to scrutinize the form.

- Examine the description to make sure you have selected the right document.

- If the document isn’t what you’re looking for, utilize the Search field to find the form that fits your needs and criteria.

Form popularity

FAQ

While often used interchangeably, a contract is a specific type of agreement that is legally enforceable. A contract must contain clear terms, mutual consent, consideration, and legal purpose. In contrast, agreements may not meet all these criteria and may not hold up in a legal context, particularly in matters like an Arkansas Telecommunications Services Agreement.

Traditional Goods or Services Goods that are subject to sales tax in Arkansas include physical property, like furniture, home appliances, and motor vehicles. Arkansas charges a 1.5% reduced rate on the purchase of groceries.

Some goods are exempt from sales tax under Arkansas law. Examples include prescription drugs, purchases made with food stamps, and some farming equipment.

Yes, the repair (parts and labor) of farm machinery and equipment is taxable. Is used property taxable? Yes, the sale of used tangible personal property is taxable except as noted in Arkansas Gross Receipts Tax Rules GR-18 and GR-50.

Retail sales of tangible items in California are generally subject to sales tax. Examples include furniture, giftware, toys, antiques and clothing. Some labor service and associated costs are subject to sales tax if they are involved in the creation or manufacturing of new personal property.

Some items are exempt from sales and use tax, including:Sales of certain food products for human consumption (many groceries)Sales to the U.S. Government.Sales of prescription medicine and certain medical devices.Sales of items paid for with food stamps.

Additionally, Ark. Code Ann. § 26- 52-304(a)(2) (Repl. 2014) specifically provides that the repair and maintenance of computer equipment or hardware in any form is subject to Arkansas sales tax.

Some customers are exempt from paying sales tax under Arkansas law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Currently, sales of contracts, maintenance agreements, and warranties that involve the future performance of taxable services are subject to Arkansas sales tax. Services performed under those contracts are exempt from sales tax because tax was paid on the warranty agreement.

Traditional Goods or Services Goods that are subject to sales tax in Arkansas include physical property, like furniture, home appliances, and motor vehicles. Arkansas charges a 1.5% reduced rate on the purchase of groceries. Some services in Arkansas are subject to sales tax.