Arkansas Breakdown of Savings for Budget and Emergency Fund

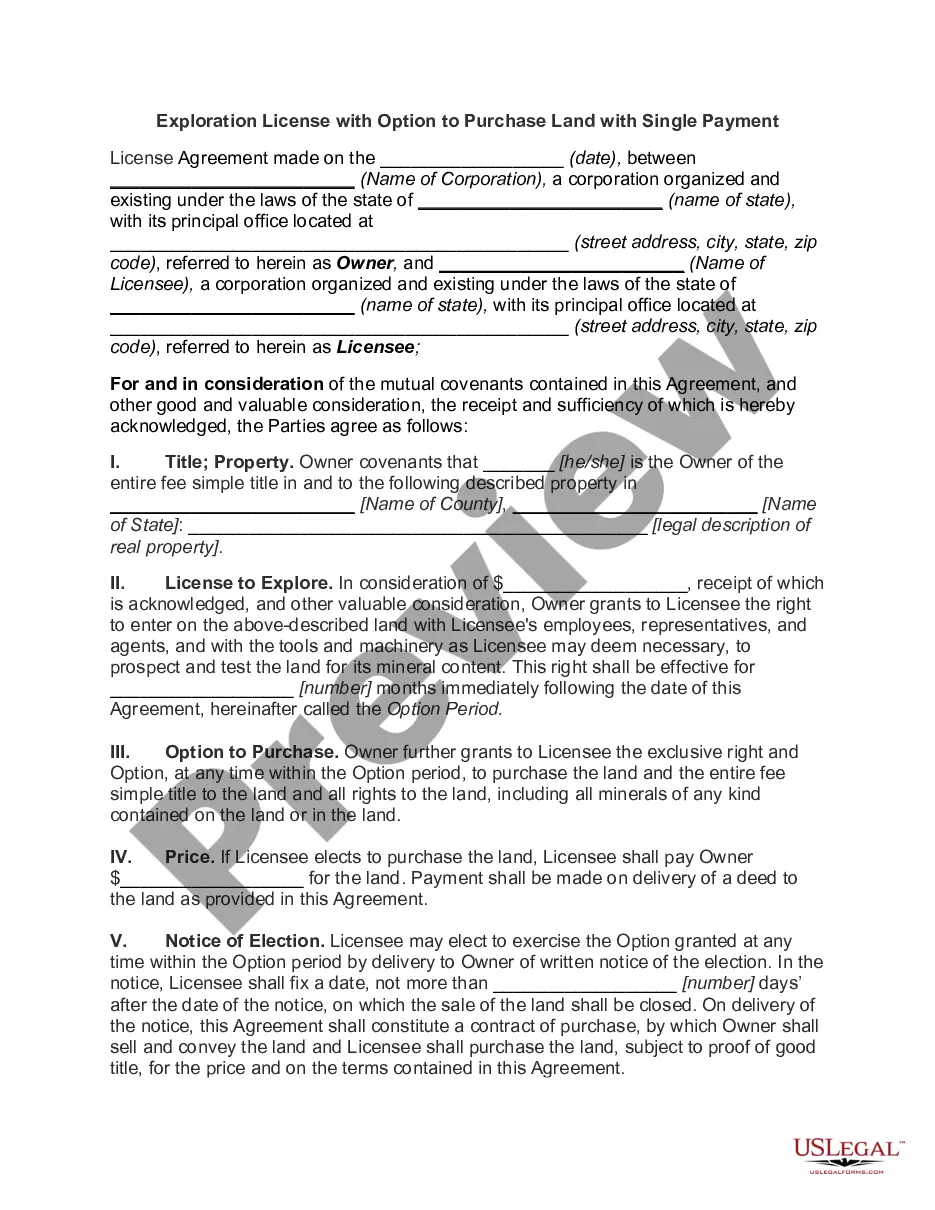

Description

How to fill out Breakdown Of Savings For Budget And Emergency Fund?

Selecting the finest legitimate document template can be quite a challenge.

Naturally, there are numerous templates accessible online, but how do you secure the correct form you need.

Utilize the US Legal Forms website. The platform provides a vast array of templates, including the Arkansas Summary of Savings for Budget and Emergency Fund, which you can use for both business and personal purposes.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Arkansas Summary of Savings for Budget and Emergency Fund.

- Use your account to view the legitimate forms you have previously acquired.

- Navigate to the My documents section of your account to obtain another copy of the document you desire.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

- First, ensure you have selected the correct form for your region/county.

Form popularity

FAQ

Emergency funds can really save the day if you need them, but it can be tough to know how much to save. According to a popular rule of thumb, you should aim for between three and six months' worth of expenses. But in some circumstances, you may want to save up to 12 months' of living expenses.

The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt. By regularly keeping your expenses balanced across these main spending areas, you can put your money to work more efficiently.

Like a retirement fund or college savings fund, an emergency fund is a type of savings fund. The purpose of an emergency fund is to provide enough money to cover high, unexpected costs or to prepare you for a major financial change.

The best place to keep your emergency fund (think three to six months of living expenses) is separate from your regular checking and savings accounts so it can be earmarked for emergencies only.

While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months' worth of expenses.

The rule of thumb is that individuals should have enough in an emergency fund to cover three to six months of living expenses. Add up essential living expenses for one month and multiply that amount by either three or six (this will depend on how much you're most comfortable having in case of emergency).

What is the 50/30/20 rule? The 50/30/20 rule is an easy budgeting method that can help you to manage your money effectively, simply and sustainably. The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt.

It's recommended to have 3-6 months' worth of expenses saved in your emergency fund, to cover your monthly costs if you're out of work. However, if you're currently paying down debt, your emergency fund should be smaller, in the range of $2,500 to $5,000.

Emergency funds can really save the day if you need them, but it can be tough to know how much to save. According to a popular rule of thumb, you should aim for between three and six months' worth of expenses. But in some circumstances, you may want to save up to 12 months' of living expenses.

Bottom line. An emergency fund is the best way to save for unplanned events. It can eliminate the need for taking on credit card debt or taking out a personal loan. Putting your emergency savings in a high-yield savings account allows you to earn interest while you build your nest egg.