Arkansas Cash Flow Statement

Description

How to fill out Cash Flow Statement?

Finding the appropriate authentic document format can be quite a challenge. Naturally, there are numerous templates accessible online, but how can you locate the authentic form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Arkansas Cash Flow Statement, suitable for business and personal purposes. All documents are reviewed by experts and comply with state and federal regulations.

If you are already a member, Log In to your account and then click the Download button to retrieve the Arkansas Cash Flow Statement. Use your account to browse through the legal forms you have previously acquired. Navigate to the My documents section of your account to obtain another copy of the document you need.

Select the file format and download the legal document template to your device. Fill out, modify, print, and sign the downloaded Arkansas Cash Flow Statement. US Legal Forms is the largest collection of legal templates where you can find various document formats. Use the service to download well-designed papers that meet state requirements.

- Firstly, ensure that you have selected the correct form for your city/county.

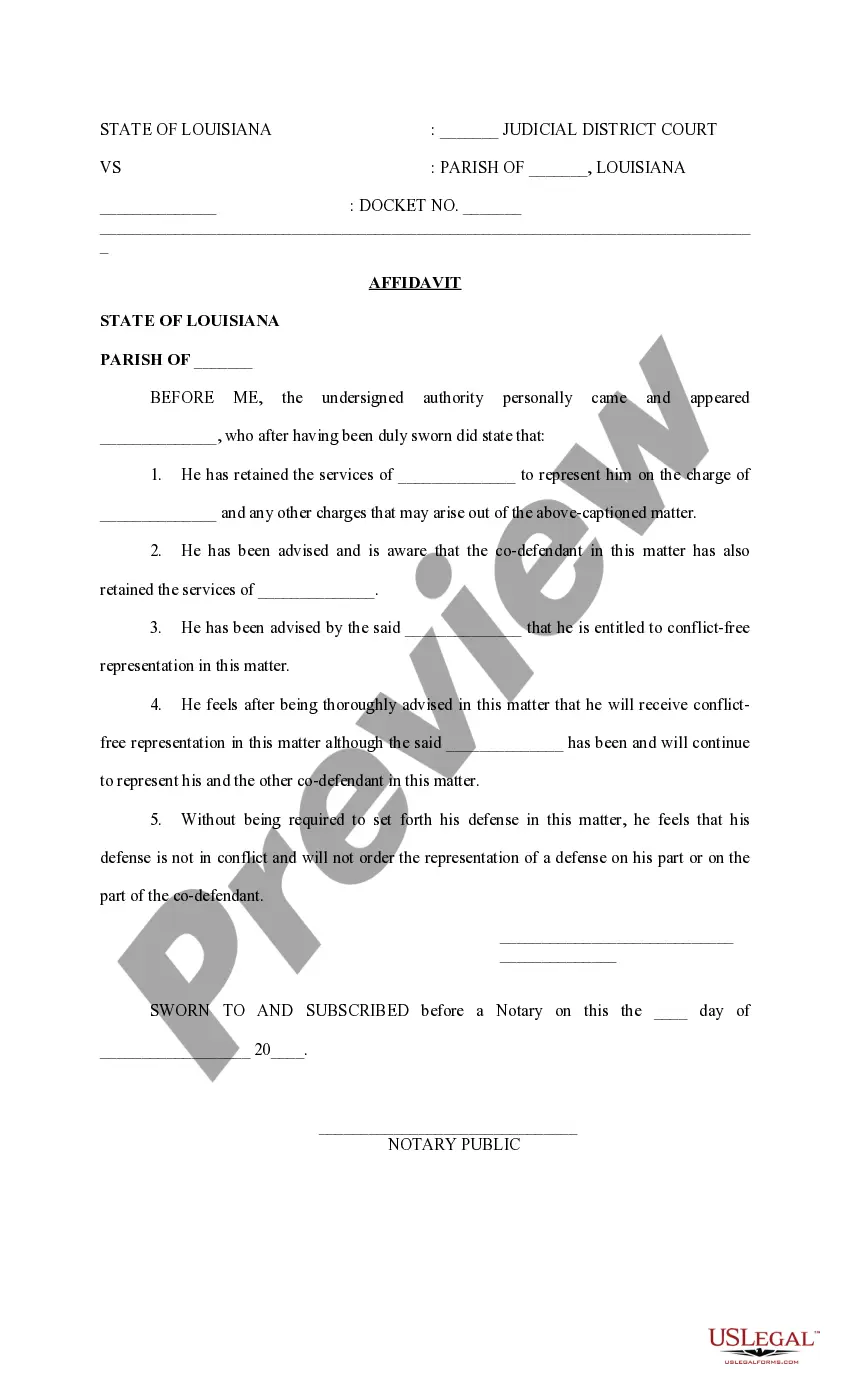

- You can review the document using the Preview button and read the document description to confirm that it is suitable for your needs.

- If the document does not meet your requirements, utilize the Search field to find the appropriate form.

- Once you are certain that the form is suitable, click on the Buy now button to obtain the document.

- Choose the payment plan you desire and enter the necessary information.

- Create your account and complete the purchase using your PayPal account or credit card.

Form popularity

FAQ

The cash flow statement makes adjustments to the information recorded on your income statement, so you see your net cash flowthe precise amount of cash you have on hand for that time period. For example, depreciation is recorded as a monthly expense.

Changes in accounts receivable (AR) on the balance sheet from one accounting period to the next must be reflected in cash flow: If AR decreases, more cash may have entered the company from customers paying off their credit accountsthe amount by which AR has decreased is then added to net earnings.

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows a company receives from its ongoing operations and external investment sources. It also includes all cash outflows that pay for business activities and investments during a given period.

Here are four steps to help you create your own cash flow statement.Start with the Opening Balance.Calculate the Cash Coming in (Sources of Cash)Determine the Cash Going Out (Uses of Cash)Subtract Uses of Cash (Step 3) from your Cash Balance (sum of Steps 1 and 2)An Alternative Method.More items...

Accounts receivable change: An increase in accounts receivable hurts cash flow; a decrease helps cash flow. The accounts receivable asset shows how much money customers who bought products on credit still owe the business; this asset is a promise of cash that the business will receive.

The financial statement of a company consists of a cash flow statement. All companies other than one person company, dormant company and small company come under the applicability of cash flow statements under Companies Act, 2013.

Accounts Receivables and Cash Flows Every business must record all its payables and receivables to measure the company's cash flows. Accounts receivables are part of Cash In vs accounts payable which equates to Cash Out.

Format of a cash flow statement Operational business activities include inventory transactions, interest payments, tax payments, wages to employees, and payments for rent. Any other form of cash flow, such as investments, debts, and dividends are not included in this section.

Impact On Cash Flow A scenario in which a company lends cash in exchange for a note receivable creates a cash outflow on the investing section of the cash flow statement.