Arkansas Sample Letter regarding Information for Foreclosures and Bankruptcies

Description

How to fill out Sample Letter Regarding Information For Foreclosures And Bankruptcies?

Are you presently within a position that you need documents for either company or personal functions just about every day? There are plenty of legitimate document templates available on the net, but finding ones you can depend on is not simple. US Legal Forms gives a large number of develop templates, such as the Arkansas Sample Letter regarding Information for Foreclosures and Bankruptcies, which are created to satisfy state and federal needs.

Should you be currently familiar with US Legal Forms website and get a merchant account, just log in. After that, you can acquire the Arkansas Sample Letter regarding Information for Foreclosures and Bankruptcies design.

Unless you provide an account and wish to begin to use US Legal Forms, adopt these measures:

- Get the develop you will need and make sure it is for that appropriate metropolis/county.

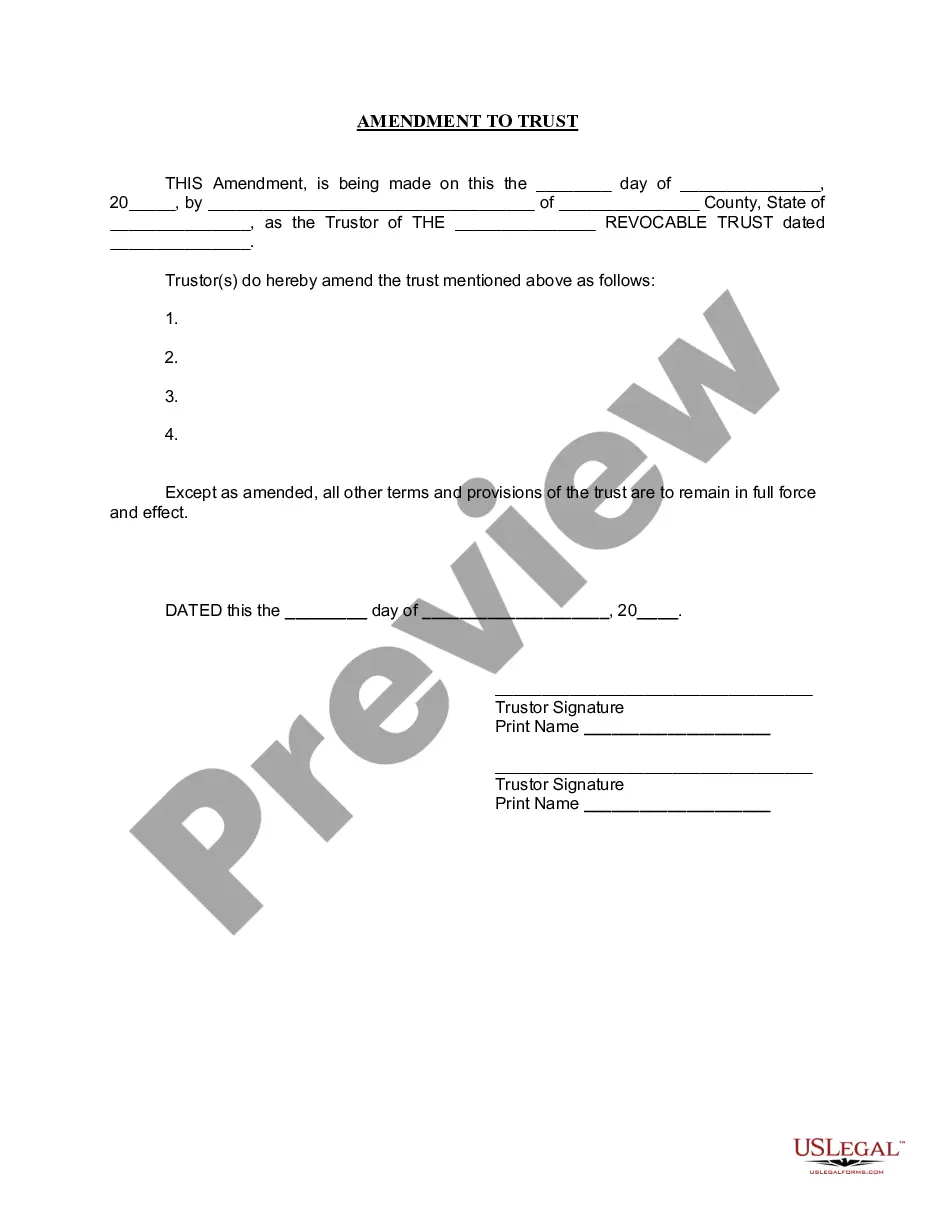

- Make use of the Review option to analyze the form.

- Read the description to ensure that you have chosen the right develop.

- In case the develop is not what you`re looking for, use the Research field to find the develop that meets your needs and needs.

- Whenever you find the appropriate develop, simply click Acquire now.

- Select the prices strategy you need, complete the desired information and facts to produce your account, and purchase your order making use of your PayPal or credit card.

- Pick a convenient data file format and acquire your duplicate.

Locate all of the document templates you might have bought in the My Forms food selection. You can aquire a extra duplicate of Arkansas Sample Letter regarding Information for Foreclosures and Bankruptcies whenever, if possible. Just click the essential develop to acquire or printing the document design.

Use US Legal Forms, by far the most considerable collection of legitimate kinds, in order to save time and stay away from errors. The support gives professionally produced legitimate document templates which can be used for a selection of functions. Make a merchant account on US Legal Forms and initiate making your lifestyle easier.

Form popularity

FAQ

120 days after your missed payment, the bank can begin the formal foreclosure process. There are two types of foreclosure in Arkansas: judicial and non-judicial.

Here are some suggestions for restoring your credit in the wake of foreclosure. Identify the Cause of Your Foreclosure. ... Pay Your Bills on Time. ... Make a Budget and Stick to It. ... Get a Secured Credit Card. ... Keep a Low Credit Utilization Ratio. ... Seek Professional Advice. ... Check Your Credit Scores and Credit Reports Regularly.

You can potentially file for bankruptcy or file a lawsuit against the foreclosing party (the "bank") to possibly stop the foreclosure entirely or at least delay it. If you have a bit more time on your hands, you can apply for a loan modification or another workout option.

Once officially started, a foreclosure in Arkansas usually takes only a few months to complete. Fortunately, most homeowners in Arkansas, and all other states, are entitled to a 120-day preforeclosure period under federal law before the lender can start the process.

Once officially started, a foreclosure in Arkansas usually takes only a few months to complete. Fortunately, most homeowners in Arkansas, and all other states, are entitled to a 120-day preforeclosure period under federal law before the lender can start the process.

Stop the foreclosure by paying off the overdue payments and bring the loan current. pay off the loan to prevent a sale. file for bankruptcy, and. get any excess money after a foreclosure sale.

The home sold through a judicial foreclosure sale can be redeemed by the homeowner within 12 months after the sale.